Community ideas

Entry Psychology Hey guys, Ray here, and I just entered a trade here.

Doesn't matter buy or sell,

or what currency your trading.

We all enter the market and none of us can ever know the "perfect price".

Therefore, our Stop Loss is inadvertently a key factor in our entries, lot sizes, and psychology.

In this video I explain what I mean...

Please comment if you found this insightful!

BTC EMA TRADING STRATEGYIn this video, I show you guys how I trade using the higher timeframe 12,21 EMA bands to find entries on 1min timeframe and capture the bigger trend with tight SL and huge R/R.

Benefits

1. Tight invalidation, leading to Massive winners

2. Entry and SL is based on pure Market structure.

3. Price first apporach

Gann Trading Strategy: Understanding Gann Price CyclesGann Trading Strategy: Understanding Gann Price Cycles.

Gann Trading Strategy with a deep dive into Gann Price Cycles and candle range averaging to forecast upcoming highs and lows. Learn how to apply Gann's time and price principles, predict market turning points, and enhance your trading accuracy.

Gann Price Cycles: Understanding Market Movements with Precision

- Gann Price Cycles are a fundamental concept in W.D. Gann's trading methodology, used to predict market highs and lows based on historical price movements and time cycles. Gann believed that markets move in predictable cycles, influenced by both price and time relationships. By studying these cycles, traders can anticipate future turning points with greater accuracy.

Key Principles of Gann Price Cycles:

1. Repeating Market Patterns – Price movements follow specific cyclical patterns that repeat over time. Identifying these patterns helps traders forecast future price swings.

2. Time and Price Symmetry – Gann emphasized that time and price must be in balance. When a market completes a significant time cycle, it often results in a reversal or acceleration of trend.

3. Natural Market Rhythms – Just like planetary cycles, financial markets move through predictable 360-degree price cycles, based on Gann’s Square of Nine and Gann Angles.

4. Averaging Price Ranges – By analyzing historical price ranges and averaging them, traders can estimate the next high or low in the market.

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Gann Trading Strategy | Predict Market Highs & Lows with Gann.Gann Trading Strategy | Predict Market Highs & Lows with Gann Trading Strategy

In this video we will unlock historical secrets of Sacred Geometry and how they apply to financial markets through W.D. Gann's Time & Price concepts. This video explores the deep connection between natural mathematical principles, the Golden Ratio (0.618), Fibonacci levels, and market structure—all rooted in ancient sacred geometry used in art, architecture, and astronomy.

Markets are not random; they follow universal laws found in nature, human anatomy, and celestial movements. Gann discovered that time and price cycles repeat in predictable patterns, allowing traders to anticipate reversals with precision. This video will guide you through how to use these ancient principles in modern trading.

What You'll Learn in This Video:

✅ Understanding Gann’s Time & Price Geometry – The foundation of market movements

✅ Golden Ratio & Fibonacci Trading – How 0.618, 0.786, and 1.618 shape market trends

✅ The ABCD Pattern in Trading – How to use structured price action setups.

Discover the hidden connections between Sacred Geometry, W.D. Gann’s Time & Price principles, and financial markets in this powerful Gann trading lesson. Markets are not random; they move according to natural laws, mathematical ratios, and planetary cycles—the same principles found in ancient architecture, astronomy, and human biology. Gann’s work revealed that time and price must synchronize for major market reversals, and by understanding these patterns, traders can anticipate key turning points with accuracy. This lesson will dive deep into Gann’s geometric approach, the Golden Ratio (0.618), Fibonacci levels, and structured price action setups, all of which play a crucial role in market movements.

Hidden Forces: Decoding Buyer & Seller Activity on ChartsTotal Volume vs. Volume Delta: The total volume on the chart includes both buys and sells, making it less useful for analysis. Volume Delta, however, shows whether buyers or sellers dominated within a candle.

A green Delta candle means more aggressive retail buying; a red one means more retail selling. This helps analyze market sentiment beyond price movement.

Price & Delta Relationships:

1. Price and Delta move together → Organic movement, likely driven by retail.

2. Delta moves, but price doesn’t → Retail is heavily biased in one direction, absorbing limit orders. Possible smart money trap.

3. Price moves, but Delta doesn’t → Retail didn’t participate in the move. Lack of belief or failed market-making attempt.

4. Price moves against Delta → Strong indication of market manipulation. Large players using aggressive strategies against retail.

Market Manipulation & Smart Money:

* Whales leverage retail psychology and order flow to position themselves.

* Retail often gets caught in fake moves, unknowingly providing liquidity to big players.

Final Thought: By analyzing Delta and price movement together, we can spot hidden large buyers and sellers and understand market dynamics beyond surface-level price action.

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

How To Properly Read Open Interest (OI) Identify Trends $VARAIn crypto, especially when trading shit coins, measure OI on BTC, ETH, and any other asset that has futures up against whatever you are trading.

Most importantly identify positive or negative correlation between the asset pair and TRADE accordingly.

i.e. if you are measuring OI for USDX or DXY know that it will have negative correlation toward your risk asset whatever it is.

Open Interest and Volume ARE NOT THE SAME THING!

Volume is the measure of contracts settled in a trading session (hourly, daily, monthly, etc.)

Open interest (or OI for short) is the total number of contracts still outstanding.

OI and order wall size are correlated.

OI is charted.

Increasing OI means an increase in liquidity i.e. open contracts.

Decreasing OI means that there is a decrease in liquidity i.e. liquidity is leaving the market either cash or asset.

Open Interest can help you identify trend shifts. Use it along with order flow the compliment each other.

OI Rising - Market trends up - Volume increasing - Trend will continue

OI Falling - Market trends up - Volume decreasing - Trend will turn bullish

OI Rising - Market trends down - Volume rising - Strong bearish continuation

OI Falling - Market trends down - Volume falling - Bearish bias is lessening

Notice in the above simplified examples that volume MUST be paired with OI to be useful.

One might mistake that volume on it's own can be used to judge trends.

Open interest will increase as more traders enter the market which means often that money is coming into the market.

OI will decrease as traders exit the market or as contracts are closed. This means that money is leaving the market i.e. less buyers

Gann Astro Trading Course | Gann Trading StrategyGann Astro Trading Course | Free Lesson. Gann Astro Trading | Gann Time Cycles | Gann Financial Astrology. Gann Trading Strategy - Gann Trading Course

TOPIC OF THIS VIDEO - Gann Astro Trading Course | Free Lesson

🎯 Unlock the Market’s Hidden Code with W.D. Gann’s Strategies!

What if market movements weren’t random — but followed a precise, predictable blueprint? In this powerful breakdown, we dive into the groundbreaking methods of W.D. Gann, revealing how price, time, and planetary positions create a hidden pattern behind market highs and lows.

Gann’s revolutionary idea was that time and price vibrate together — making them interchangeable. By converting prices into planetary longitudes, tracking time cycles, and applying market geometry, you can uncover the market’s natural rhythm and predict turning points with remarkable accuracy. This video unveils the core of Gann’s strategy, giving you the tools to anticipate price moves before they happen.

---------------------------------------------------------------------------------------------------------------------

📌 What You’ll Learn in This Video:

✅Gann Square of 9 Explained – Understand how this iconic tool aligns price and time with planetary degrees to identify key turning points.

✅Price to Longitude Conversion – Learn how to convert market prices into planetary longitudes to uncover hidden reversal points.

✅ Time and Price Interchangeability – Discover how Gann’s theory of time-price equality helps predict trend shifts.

✅ The 10% Decimal Shift Rule – A powerful trick to reveal harmonic price levels by shifting the decimal point.

✅ Market Geometry: The Blueprint of Price Movements – Explore Gann’s geometric approach using circles, squares, and hexagons to map market pivots.

✅ Planetary Cycles and Longitudes – See how planetary movements — like Saturn’s retrograde and Mars' heliocentric positions — influence price action.

✅ Harmonic Degrees and Price Reactions – Find out why 10, 15, and other degree increments often mark critical spike reversal areas.

✅ Equilibrium Principle – Learn how Gann's "squared out" price and time cycles lead to powerful reversal setups.

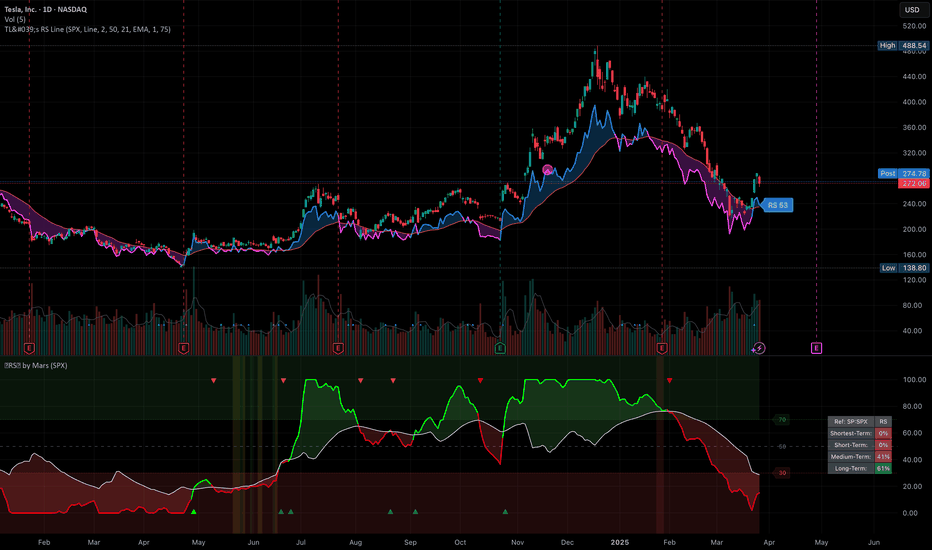

✅ Real Case Studies: Tesla & IBM Analysis – Watch Gann’s techniques in action as we analyze historical charts to uncover price pivots and reversal dates.

market geometry and harmonic degrees.

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading

[How to] Properly analyzing relative equal levels with orderflow🔑 This is a basic principle and idea overview of why price will behave a certain way around levels where double lows or highs are. Also reviewing what is called Low Resistance Liquidity. This happens when multiple levels are stacked going lower or higher without a stop hunt.

Share this with your trading partner 💪🏽

2025 ICT Mentorship: Premium & Discount Price Delivery Intro2025 ICT Mentorship: Lecture 4_Premium & Discount Price Delivery Intro

Greetings Traders!

In this video, we dive into the fundamental concept of Premium and Discount Price Delivery—a crucial aspect of smart money trading that helps us understand how institutions approach the market with precision and efficiency.

Understanding Currency Pairs

Before we explore premium and discount dynamics, it's essential to grasp the basics of currency pairs. A currency pair, like EUR/USD or GBP/USD, represents the value of one currency against another. For example, EUR/USD shows how many U.S. dollars (the quote currency) are needed to purchase one euro (the base currency). Just like any other tradable asset, currency pairs fluctuate in value due to various economic and market factors.

Trading Is Part of Everyday Life

Believe it or not, everyone in the world is a trader. Whether you're buying groceries at a store or negotiating for goods and services, you're participating in trading activities daily. Some people aim to purchase items at a discount, while others can afford to pay a premium—it’s simply part of life.

However, banks and financial institutions take trading to another level. They don’t just trade haphazardly—they operate with extreme precision, aiming to make high-quality investments by executing trades at premium prices and targeting discount levels. This strategic approach allows them to capitalize on market inefficiencies and ensure profitable outcomes.

Why Premium and Discount Matter?

The concept of premium and discount price delivery is foundational for understanding how the market moves. By recognizing where the market is trading at a premium (overvalued) versus a discount (undervalued), traders can make more informed decisions and align their strategies with institutional order flow.

Stay tuned as we break down how to identify these zones on a chart and how to incorporate them into your trading strategy. Make sure to like, subscribe, and turn on notifications so you never miss an update!

Happy Trading,

The_Architect

What happens if you give a TikTok trader a billion dollars?In this video, I covered the topic of accumulation and distribution of large positions.

I explained why big market players prefer using limit orders when building and offloading their positions.

I also talked about how retail traders — who I often call TikTok traders — tend to rely on market orders, and why the price is more likely to move against the masses of TikTok traders.

Understanding this is crucial when analyzing what’s really going on "under the hood" of the market. I’ll dive deeper into this in my upcoming posts.

So don’t miss out! Subscribe!