Range setup for 20th April, Things to know before Opening BellMarket Opening: Expecting GapDown to upward;

Overall Structure: Downtrend;

Sentiments: Neutral (49%);

Market Mood(FGI): 64% Greed, keeping patience is suggested before looking for fresh opportunities.

PCR: 0.41 Bearish , IVP:60%;

Target: 17050, 17250, 17400, 17600;

Stoploss: 16800, 16600, 16500, 16350;

---

*P.S: Identify the B/S zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Papertrading

Range setup for 19th April, Things to know before Opening BellMarket Opening: Partial gapup/Flat;

Overall Structure: Downtrend;

Sentiments: Neutral (46%);

Market Mood(FGI): 66% Greed, keeping patience is suggested before looking for fresh opportunities.

PCR: 0.47 Bearish , IVP:52%;

Target: 17350, 17450, 17550, 17650;

Stoploss: 17000, 16900, 16750, 16600;

Decision: Ignore Fresh Buying until breakout above 17350 and may take rejection at 17450 whereas if breakdown then sell below 17000 till 16850.

Suggesting for short-covering and ignore long positions.

---

*P.S: Identify the B/S zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range setup for 18th April, Things to know before Opening BellMarket Opening: Gapup to downward/Gapdown;

Overall Structure: Downtrend;

Sentiments: Neutral (45%);

Market Mood(FGI): 70% Extreme Greed, likely to be turned down;

PCR: 0.54 Bearish, IVP:29%;

Target: 17600, 17800, 17900, 18000;

Stoploss: 17350, 17250, 17150, 17000;

---

*P.S: Identify the B/S zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range setup for 6th April, Things to know before Opening BellMarket Opening: Flat Negative/Partial Gap down;

Overall Structure: Uprange; Market may take a breath

Sentiments: Neutral (47%);

Market Mood(FGI): 81% Extreme Greed, likely to be turned down;

PCR: 0.92 Neutral, IVP:46%; (indecisive)

Target: 18150, 18250, 18450, 18600;

Stoploss: 17800, 17700, 17600, 17450;

Decision: Sell Below 17850 OR Buy Above 18150 at openings.

Observed Tripple Top, whereas Holding for a Breakdown at 17900.

Probability of pullback to retest at 17600-500.

---

*P.S: Identify the B/S zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range setup for 5th April, Things to know before Opening BellMarket Opening: Flat Positive/Partial Gap down;

Overall Structure: Uptrend;

Sentiments: Neutral (47%);

Market Mood(FGI): 87% Extreme Greed, likely to be turned down;

PCR: 1.27 Bullish , IVP:46%;

Target: 18150, 18250, 18450, 18600;

Stoploss: 17900, 17800, 17600, 17450;

Entry Decision: Buy Above 18150 or Sell Below 17900 (Suggesting to go trend side).

Market maybe turn down after spending time(range) at upper level, OR Probability of pullback directly to retest at 17600.

---

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range setup for 4th April, Things to know before Opening BellMarket Opening: Flat Positive/Partial Gap;

Overall Structure: Uptrend;

Sentiments: Neutral (45%);

Market Mood(FGI): 80% Extreme Greed, likely to be turned down;

PCR: 1.19 Bullish, IVP:35%;

Target: 17800, 17900, 18100, 18200;

Stoploss: 17600, 17400, 17200, 17000;

Entry Decision: Buy Above 17800 or Sell Below 17550 (Suggesting to go trend side).

Market maybe turn down at 18000-18100 crucial level, OR Probability of pullback to retest at 17600.

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range Setup for 1st April, Things to know before Opening Bell!Market Opening: Negative/Gap down;

Overall Structure: Neutral;

Sentiments: Neutral; Wait for Breakdown

Market Mood(FGI): 70% Extreme Greed, likely to be turned down;

Target: 17555, 17660, 17770, 17900;

Stoploss: 17335, 17250, 17150, 17050;

Entry Decision: No Fresh entry on Sell side; Probabilities of Breakdown;

Suggesting Buy above 17555, Sell Below 17335;

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

2503-Nifty Range setup, Things to know before opening bellMarket Opening: Indecisive; Expecting an upward move;

Overall Structure: Neutral; Expecting a Breakout;

Sentiments: Neutral;

Market Mood(FGI): 68% Greed, likely to be turned down;

Resistance: 17320, 17440, 17600;

Support: 17120, 17000, 16900;

Decision: Go with uptrend if given breakout towards key level,

OR Market may fall down towards strong key support(17000-16900)

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range Setup for 24 March, Things to know before opening Bell.Market Opening: Flat/Gapdown;

Overall Structure: Bearish/Down trend;

Sentiments: Neutral;

Market Mood(FGI): 66% Greed, likely to be turned down;

Resistance: 17350, 17440, 17600, 17770;

Support: 17100, 17000, 16900;

Entry Decision: Wait for breakout and buy on Deep at a key level. If Breakout fails, take a directional trade of sell side.

Probability of Short selling, Expecting a breakout at mid market;

Market in low volatility.

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range setup for 23 March; Things to know before Opening Bell.Market Opening: Flat/Partial gapup;

Overall Structure: Uptrend;

Sentiments: Neutral; Wait for Breakout

Market Mood(FGI): 57% Greed, likely to be turned down;

Resistance: 17350, 17450, 17600;

Support: 17200, 17100, 17000;

Entry Decision: Buy Above 17350, Sell Below 17200 ;

Probability of Short covering, Expecting an uprange market ;

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate. This strategy is for knowledge purposes only & is subjected to market risk.

Range Setup for March 22; Things to know before Opening BellMarket Opening: Flat/Partial gapup;

Overall Structure: Uptrend;

Sentiments: Neutral;

Market Mood(FGI): 49% Fear, likely to be turned up;

Levels:

Resistance: 17350, 17450, 17585;

Support: 17100, 16930, 16755;

Decision: Buy Above 17330, Sell Below 17100 ;

Probability of Short sell, Trend may fall down to retest at a key level;

Expecting an Up to Downward and may break out at mid-day market;

--------------------------------------------------

*P.S: Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate.

Strategies for knowledge purposes only & are subjected to market risk.

Range Setup for 21st March; Things to know before Opening BellMarket Opening: Gap Up;

Overall Structure: Uptrend;

Sentiments: Neutral, Partial Positive;

Market Mood(FGI): 40% Fear, likely to be turned up;

Decision: Buy Above 17400, Sell Below 17260 ;

With a huge gapup, market may fall down to retest at a key level;

Levels:

Markup/Resistance: 17400, 17450, 17600;

Markdown/Support: 17250, 17150, 17000;

--------------------------------------------------

P.S: *Identify the zone, Follow the trend direction, Trade after trend confirmation.

We rigorously tested the strategy and is 88.6% accurate.

**Strategies for knowledge purpose only & are subjected to market risk.

#Verdiction

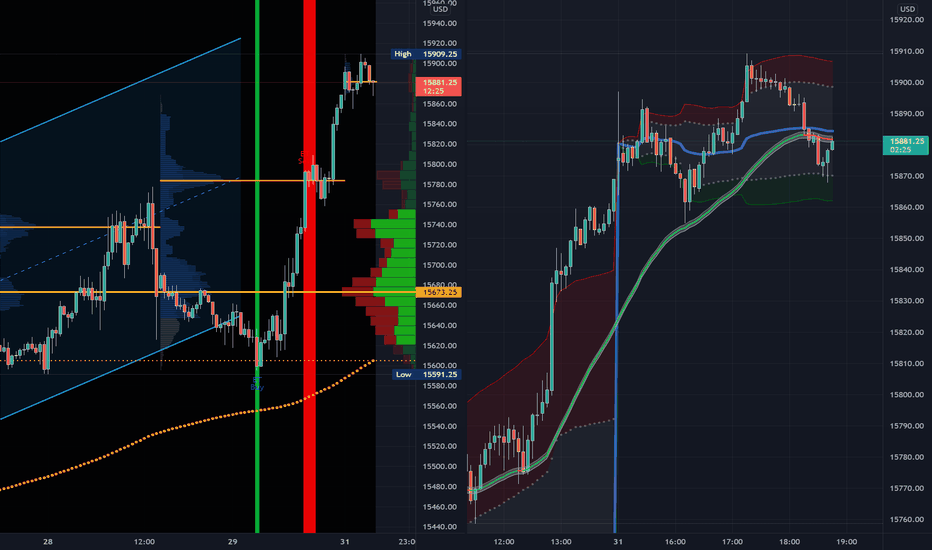

Tutorial | How To Get Real-time Futures Data Into TradingViewWhen you create an account on TradingView, you're pretty much set for realtime stock, forex, and crypto data. Want to know the price of Bitcoin or Apple? No problem. But futures data is a different animal. In this tutorial I demonstrate how to use a demo account from one of the integrated futures brokers to get futures quotes so that you can practice trading the futures markets using the trading features on TradingView.

Paper Trading on TradingView: 3 Simple StepsI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

If you are brand new to trading and haven’t yet used a paper trading simulator, you should.

Some people won’t use a paper trading simulator when they are first getting started because they don’t feel like it’s an accurate representation of the real markets.

They’re right to an extent. You’re not risking real money, so you’re not going to experience the emotions that come along with it just trading in a simulator.

Even with that said, I’m still a huge fan of trading simulators. Think about it, when pilots are training, before they are able to actually fly, they spend hours and hours on the ground training in a simulator.

Why Should I Paper Trade?

There are two main reasons I want to show you how to use TradingView paper trading as a stock market simulator.

1) You want to test your trading strategy. A solid trading strategy has three elements to it:

- Knowing what to trade. Are you trading stocks or options?

- Knowing when to enter.

- Knowing when to exit, at either a profit or a loss.

These are the main elements of any solid trading strategy, and it doesn’t matter what strategy you’re trading.

It could be a strategy like the PowerX Strategy or The Wheel, it doesn’t really matter.

You want to make sure that the strategy actually works which is why you want to test it to make sure that you understand the rules so that you’re not making any mistakes.

If you are making mistakes, it’s better to find out when you’re not risking real money.

2) The second reason why you should trade on a simulator first? To gain confidence.

Whenever you have a new strategy, you might be wondering if it actually works right?

This is why when you use a simulator to test your strategy and you see that it works, you get more confidence because now you get some actual numbers.

So you will know your winning percentage, your average profit, your average loss, and other important numbers.

Setting Up TradingView To Paper Trade

TradingView is a free tool that you can use as a simulator, and you may already be familiar with it already. I use it a lot.

So here is a step by step walk-through for how you can use TradingView as a simulator.

1) Step one. You need to connect paper trading, and in order to do this, you go to the “Trading Panel” tab at the bottom.

Once you bring it up, you can choose your broker and log into your brokerage account.

On the very left side, you see “Paper Trading.” Click that.

2) Step two. You want to reset your account. You might be wondering,

“Why should I reset my account? I haven’t done anything yet.”

This is because your account will start you off with $100,000 by default.

This may be a fun fantasy, but maybe not exactly your trading account size.

It is very important that you mirror the size of your paper trading account with your real trading account.

So, therefore, you click on the gear icon that will show on the right-hand side, and then in the dropdown menu, you see “Reset Paper Trading Account.”

Once you click that, it will prompt you to input your desired starting balance.

So if you are planning to start with $10,000 in your real trading account, start with $10,000 in your paper trading account.

If you are starting out with an account of $20,000, enter that instead.

You get the idea. Then just hit “Reset.”

3) Step three. You will have to adjust a few settings and before I walk you through an actual order.

Right mouse click anywhere on the screen in your charts.

In the menu, you will see the fourth item down is “Trade.”

Go ahead and click on “Trade” then click on “Create New Order.”

When you click on Create New Order, you have an order ticket appearing on the right-hand side of your chart.

You will also see a gear icon.

Click the icon to change the settings, and these are the settings that I personally use, so I highly recommend these.

- Uncheck “Show Order Price In Ticks.”

- Check “Show Quantity In US Dollar Risk”

- Uncheck “Show Quantity In Percent Risk.”

- Check “Show TP/SL Inputs In USD,” (that’s Target Profit & Stop Loss).

- Uncheck “Show TP/SL Inputs In %.”

OK, so this is the basic settings in order to use the simulator.

Now let me show you exactly how to use it in conjunction with the PowerX Optimizer.

Using TradingView With The PowerX Optimizer

The PowerX Optimizer is a tool that I personally use to scan for stocks to trade.

When the stocks come up on the list I quickly go through the list and I’ll look for stocks that have no gaps, good upside/downside trend-ability, and I want to see a nice P&L chart.

Let’s pretend the PXO pulled up the stock PLUG as a recommended stock, and use it as an example.

Now, remember what I said about how a trading strategy should tell you three things.

It should tell you what to trade when to enter, and when to exit. This is exactly what PowerX Optimizer does.

Now here is how to use TradingView’s paper trading simulator in conjunction with PowerX Optimizer.

The PowerX Optimizer will show you how many stocks to trade based on your account size, when we want to enter, and when we want to exit.

What you want to do in TradingView to fill in the quantity and where exactly we want to enter.

And according to PowerX Optimizer, we want to buy, but we don’t want to buy it at the market price, we want to buy it when it reaches the “Buy To Open” price in the data window on the upper right.

Let’s just use the price of $18.89 as a place holder for this example.

Let’s also assume it suggests buying 55 shares based on the account size.

And then we can also specify our profit target and our stop loss.

Now PowerX Optimizer will give you a the profit target in the “Data Window,” lets say for $26.63.

We can then also specify a stop loss, and PowerX Optimizer tells us when to get out of this position with a loss.

For this let’s use $15.26.

So according to the PowerX Optimizer, with our $10,000 account, we would risk $199, almost $200 trying to make $425.

So our risk-reward ratio, as you can see here in PowerX Optimizer is 1:2.13, also seen in the “Data Window.”

So then all you need to do is click on “Buy Nasdaq” after you’ve entered all this in TradingView.

Remember, this is not being executed as your broker.

This is a simulator. So you don’t make and you don’t lose any money.

This is for testing your trading strategy and gaining confidence.

So let’s just say buy and you see the order is sent right now.

Once the order is placed you will now have one position and two orders in the market.

Those orders are a sell limit order for our profit target, and a sell stop order for our stop loss.

So as you can see, it is super easy to use this simulator here in conjunction with PowerX Optimizer.

You can now change the orders that you do have in the market here, so you can change them to a different price by clicking the little edit sign you will see on the right hand side.

So you see exactly what you have right now, what you bought, you have the working orders, you have the filled orders here and now, if you would change any working orders, for example, if you want to change your stop loss, you just click on the edit here and change it to any value that you want.

By the way, the right way to move your stop loss is always closer to your entry price, never away. Never, ever give a trade more room, it usually ends in disaster.

Summary

So this is how this trading simulator works. First of all, why do you need a simulator?

It is just to first test your trading strategy to see if you understand the rules, and to see if the trading strategy works.

Finding all this out will gain your confidence, all with no risk.

You can set up your TradingView account for paper trading in three easy steps:

1) You connect the paper trading account.

2) You reset it to the account size that you are planning to trade.

3) You modify the order settings.

Very simple. Then you just pick any stock that you want.

The best thing is, is it’s free.

I highly recommend that you do this. You literally have nothing to lose.

Easily will Surpass $120, Mark my Words!First off, please don't take this seriously or as financial advice. As always, this is on an opinion based basis. That being said, I been following this since it was $48, and then I saw it hit $52.40 at noon. I knew this was going to blow up. Nikola has been blowing up. One of the biggest bull runs ever I seen for EVs. Now it closed at $73.27, and post market already grew by $14. The support is definitely there. I was originally going to say it will hit $100. It looks like it can surpass now even $120 quite soon.

I Paper Traded these 8 Stocks since May 8th: $11.454K Profit SimFirst off, please don't take anything I say as financial advice or seriously. As always, this is on an opinion based basis. That being said, the stocks I paper traded off of a total of 10 trades with 11.45% profit off $100k simulated were: ETSY, TSLA, OSTK, DELL, NVDA, JD, NET, and FVRR. This was done to show I know how to also do a conservative trading strategy for holds rather than day trading or penny stock buy and sell, or other risky positions I am usually good at. That being said, I am not making a recommendation as of now on all of these stocks. Tesla I am pretty bullish on, as well as most of them, however the reason they did so decent is I was focusing on a Covid19 related time period. This is just a demonstration to show that you can still make good money while many markets are bearish. 100% of the simulated trades were profitable.

Been watching NVDA: Next Target $330First off, please don't take anything I say seriously or as financial advice. As always, this is on opinion based basis. That being said, let me get into a few of my insights. For the last few days of watching Nvidia and looking at the current market spread, I feel like for a small bullish expectancy, is at least realistic. It will likely pass the $330 price threshold within days, a week or so at most (though expected way sooner). I am not sure though about the earnings call, which is why I am mostly mutual on either shortening it or doing your own research before doing a hold after May 19th. This stock has been having stable growth overall however.

I Made $3371.85 Paper Trading Tesla in 1 DayFirst off, please don't take anything I say seriously or as financial advice. As always, this is on opinion based basis. That being said, let me get into a few of my thoughts. I made $3371.85 paper trading Tesla in one day, and the profit turn over acquitted to $26.55 per share. If Tradingview allowed me to lower the amount of money used for paper trading, I would have started off with $5000 and showed how you can make at minimal sometimes $200/day day trading Tesla if you know what you are doing. Add compound interest and multiple trades and you can obviously perform WAY better. Not to say this is financial advice or anything like that, but on hypothetical performance if you followed the same thing past trendlines it would have likely yielded similar results with well thought out buy and sells.