Parallel Channel

Gold can continue moving up inside the upward channelHello traders, I want share with you my opinion about Gold. At the beginning of the chart, the price started to grow from the buyer zone between 2865–2880 points, entering the first upward channel, where it formed higher highs and higher lows. After multiple rejections from the resistance line, the price made a correction and exited the channel, but the overall bullish impulse remained intact. Following a brief consolidation in the support area between 3000–3015 points, GOLD launched another strong move upward, securing a position above the current support level at 3000. This zone has proven to be strong support and marked the beginning of a new upward channel. Currently, the price is trading confidently inside this second upward channel. After a minor correction to the midline, GOLD continued its upward trajectory. I expect a short-term pullback, but as long as the support holds, the bullish trend is likely to continue. My main scenario assumes that GOLD will stay within the channel and move toward TP1, which is set at 3135 points. Given the bullish structure, solid reaction from support, and clear upward momentum, I remain bullish and anticipate further growth. Please share this idea with your friends and click Boost 🚀

GOLD - Price can bounce up from pennant to $3100 pointsHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Price sometimes declined inside the falling channel, where it broke support level and fell to the channel's support line.

Then it turned around and rose to support area, some time traded near and later continued to move up.

Gold broke $2935 level again and soon exited from channel also, after which continued to grow in pennant.

In pennant, price reached $3055 level, which coincides with resistance area and tried to break it, but failed.

After this, price corrected to support line of pennant and then started to grow, and now it trades near $3055 level.

In my mind, Gold can bounce up from support line of pennant to $3100, breaking resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

MEWUSDT → False breakout of resistance after distributionBINANCE:MEWUSDT.P in the distribution phase is testing a strong resistance and liquidity zone against which it makes a false breakout.

Regarding the current situation, we should pay attention to several key levels - support and upper resistance. A retest of 0.00300 - 0.00312 is possible, the target of which could be another liquidity zone, before MEW continues its fall according to the current local and global trend, which have a common direction on the background of weak bitcoin and weak cryptocurrency market.

Resistance levels: 0.002793, 0.003, 0.00312

Support levels: 0.002696

The key support area plays the role of 0.002696, which are trying to contain the market. Below this line is a free zone and there are no levels that can prevent the movement. Thus, the breakdown and consolidation of the price under 0.026969 can provoke a strong impulse towards the zones of interest 0.00222, 0.002

Regards R. Linda!

LAYERUSDT → Far retest of key resistance at 1.400BINANCE:LAYERUSDT.P is forming a realization within the uptrend. The coin is stronger than the market, but the initial reaction to the strong resistance at 1.400 may be in the form of a false breakout and a pullback to 1.275 or 0.5 fibo

Since the opening of the session, LAYERUSDT has passed the daily ATR, but after reaching the resistance, the coin may not have the potential to continue rising. Liquidity above the 1.400 level may hold this area and prevent the coin from breaking through this zone the first time around.

Bitcoin is testing trend resistance at this time and could likely form a rebound or a continuation of the decline, which could affect altcoins accordingly!

Resistance levels: 1.400

Support levels: 1.2932, 1.2747, 0.5 fibo

BUT ! Everything depends on the price reaction at 1.400. A sharp and distributive approach with 90% probability will end in a false breakout and correction to the mentioned targets.

But, if LAYER starts to slow down and consolidate in front of the level, an attempt of breakout and struggle above 1.400 is possible and further movement will depend on it.

Regards R. Linda!

Google Wave Analysis – 28 March 2025

- Google broke key support level 160.00

- Likely to fall to support level 147.30

Google recently broke the key support level 160.00 (which has been reversing the price from September, as can be seen from the daily Google chart below).

The breakout of the support level 160.00 accelerated the active impulse waves iii and 1 – both of which belong to the extended downward impulse wave (1) from last month.

Google can be expected to fall to the next support level 147.30 (a former multi-month low from last September).

Gold Wave Analysis – 28 March 2025

- Gold broke resistance level 3050.00

- Likely to rise to resistance level 3100.00

Gold rising steadily after breaking above the key resistance level 3050.00 (which reversed the price earlier this month).

The breakout of the resistance level 3050.00 accelerated the active impulse wave 5 of the higher impulse wave (3) from November.

Given the clear daily uptrend, Gold can be expected to rise to the next resistance level 3100.00 (target for the completion of the active impulse wave (3)).

US Equities Fall Amid Inflationary Pressures and Trade TensionsUS equities closed the week with significant losses, reversing the gains recorded during the previous week. The S&P 500 and Nasdaq dropped more than 1%, reflecting a clear deterioration in market sentiment amid multiple adverse factors.

The bearish session unfolded in an environment dominated by worrying signs of inflationary pressures, particularly the Personal Consumption Expenditures (PCE) Price Index, a key gauge followed by the Federal Reserve (FED). The core PCE posted a monthly increase of 0.4%, the largest gain since January 2024, exceeding market expectations. On an annual basis, this measure accelerated to a concerning 2.8%, signaling persistent inflationary pressure that could complicate future monetary policy decisions by the FED.

At the same time, soft data has continued to deteriorate significantly, adding uncertainty regarding the resilience of hard data. The University of Michigan consumer sentiment index fell to 57, its lowest level since November 2022, due to negative expectations regarding personal finances, unemployment, and inflation. In fact, two-thirds of consumers anticipate a rise in the unemployment rate, reflecting a level of concern not seen since the 2009 financial crisis.

Much of this uncertainty has been fueled by recent policies implemented by the Trump administration, particularly government spending cuts and aggressive trade policies. The latest move came with the announcement of 25% tariffs on imported cars and auto parts, effective April 3. This measure triggered an immediate negative reaction in both local and international markets, anticipating higher costs for US consumers and potential trade retaliation from key partners such as the European Union, Canada, China, Japan, and South Korea.

At the sector level, discretionary consumer goods were the most affected on Friday, while utilities showed relative resilience. This uneven performance supports the case for a defensive market, reflecting a growing risk aversion among investors.

The combination of inflationary pressures, economic slowdown, and rising trade tensions creates a challenging environment for equities. Overall, current conditions point toward a concerning scenario with signs of stagflation: low economic growth coupled with persistent inflation and a rapidly deteriorating economic sentiment.

In conclusion, it will be key to closely monitor the evolution of hard economic data as well as the international response to US trade policies. The big question in the coming months is whether the current fragility in economic sentiment will ultimately translate into hard economic indicators, decisively impacting equities.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Euro can exit from pennant and rebound up from support areaHello traders, I want share with you my opinion about Euro. The price was previously trading inside an upward channel, where it consistently rebounded from the support line and moved toward the resistance line. After a final bounce from the lower boundary, EUR made a strong breakout and exited the channel, triggering a powerful bullish impulse. This move brought the price directly to the current support level at 1.0745, which overlaps with the support area. After reaching the local high, the price turned around and entered a correction phase, forming an upward pennant pattern. Inside this structure, we can see how EUR respected both the resistance line and the rising support line of the pennant. Recently, the price rebounded from the support line again, showing signs of strength near the support area, and is now consolidating at the edge of the pennant. This setup often signals an upcoming breakout. I expect the price to break above the resistance line of the pennant and continue its bullish move toward TP1, which is set at 1.0950 points. Please share this idea with your friends and click Boost 🚀

DOGEUSDT valid breakout to the upside As we can see price broke channel resistance and now only after a valid retest here we can expect heavy pump start but we should consider it that we are now in a short-term bear market so price can fall more here to our major buy zones which are mentioned on the chart with green zones and then start of pump.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

GBPAUD what's next ! GBPAUD is trading inside an ascending parallel channel, the price action shows a neutral short term trend, but the major trend is bullish, price is clearly trading above the 200 EMA, my setup is wait for price to touch resistance line of the channel to catch the next correction, let me know in the comments bellow what do you think for this pair, your thoughts is important, if you like my idea don't forget to boost it.

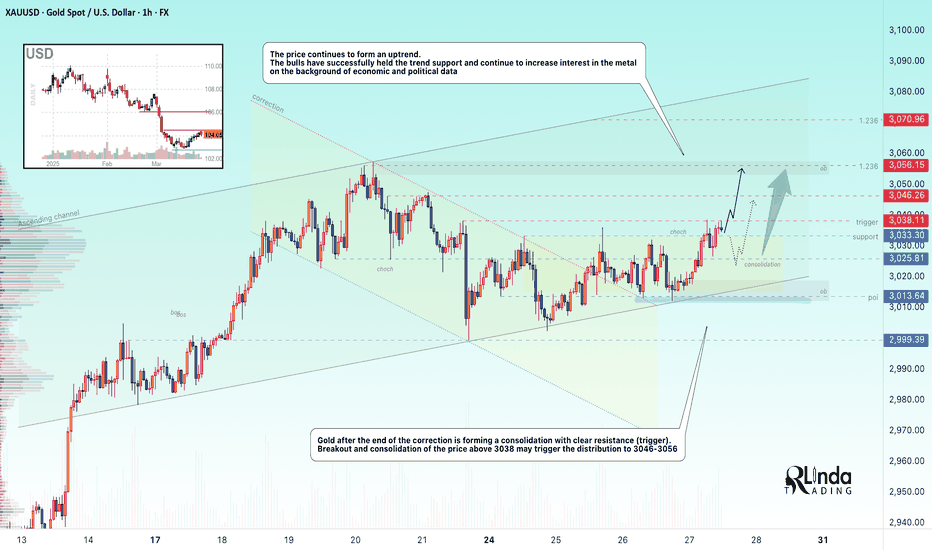

GOLD → Consolidation forms a trigger. Rally?FX:XAUUSD continues to rise amid weakening dollar demand due to Trump's imposition of new tariffs. GDP and Initial Jobless Claims ahead

Gold is further supported by renewed concerns about a slowdown in the US economy due to trade duties. However, growth beyond ATH remains questionable due to geopolitical nuances.

The market focus shifts to macroeconomic data: the final US GDP for the fourth quarter and jobless claims will be released today. Also the attention will be drawn to the speeches of the Fed representatives, who earlier made it clear that they are in no hurry to cut rates due to inflation risks caused by Trump's tariff policy

Resistance levels: 3038, 3046, 3056

Support levels: 3033, 3025

The strong resistance is 3038. Breakdown and price consolidation above this level will provoke continuation of growth (there is a chance of ATH retest). But, since there is news ahead, gold may test the zone of interest and liquidity 3030-3025 before further growth.

Regards R. Linda!

Is Bitcoin slowly forming a top? What to expect from the market About a week ago, I posted that the recent uptick in BTC (and the broader crypto market) was as a result of Bears taking profits and that the market will dip lower once this correction runs its duration. Well, so far, my prediction is still on track and we can expect prices to climb higher over the next few days (maybe even a week from when this is published).

I believe that that mini rally (black path) within the larger uptrend (green path) has enough juice for one more leg before it pulls back. Once that happens, price might stall around that area and then push higher, setting the stage for the final leg of the larger upswing.

I personally don't like trading matket correction unless they're on the weekly or monthly chart. However, I will keep monitoring price until my prediction plays out.

What are your predictions for Bitcoin's short term price? Let me know in the comments section below.

Make sure you follow me to get future updates as they unfold.

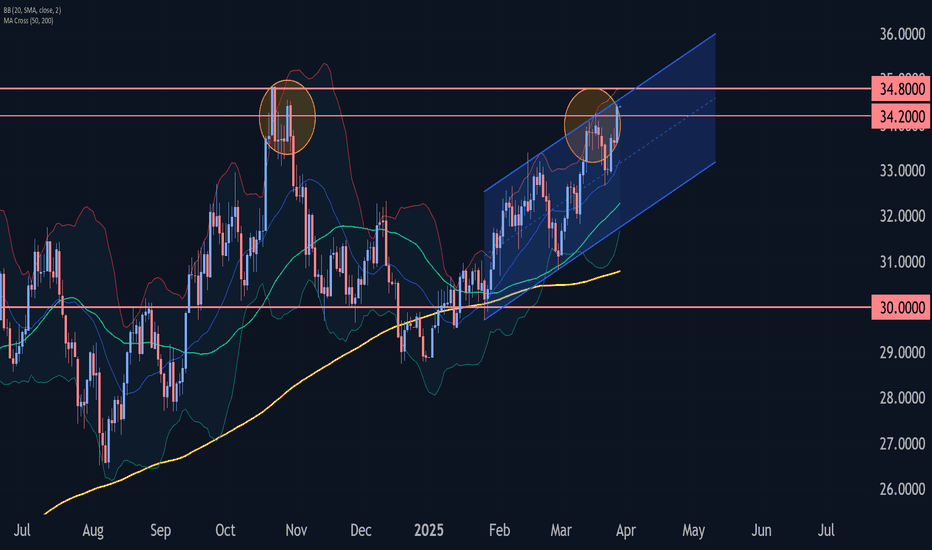

Silver Wave Analysis – 27 March 2025

- Silver broke resistance area

- Likely to rise to resistance level 34.80

Silver recently broke the resistance area between the key resistance level 34.20 (top of the previous impulse wave i) and the resistance trendline of the daily up channel from January.

The breakout of this resistance area accelerated the active impulse wave iii of the higher impulse waves 3 and (C).

Given the clear daily uptrend, Silver can be expected to rise to the next resistance level 34.80 (former multi-month high from October) – from where the downward correction is likely.

Bitcoin - Why is everyone wrong + Magic Moving AverageWe have so many warning signs that Bitcoin is going to crash significantly in 2025/2026. One of them is this magic 20-weekly moving average. As we can see, the price always respects this dynamic level, and if the price falls below it, it triggers a sell signal. On the other side, if the price rises above it, it triggers a buy signal. The price is currently below it, so this is a bearish signal.

The next bad signal is this Elliott Impulse wave. What we can see here is a perfect textbook impulse wave that has been completed. If you are an Elliott Wave trader, you already see that this is a big problem. After such a wave is complete, we are always looking for an ABC correction with a fibonacci retracement tool. Use only these 3 Fibo levels, others do not work properly! Specifically, 0.618 FIB, 0.500 and 0.382 FIB. Bitcoin loves the 0.618 FIB, so there is a pretty huge chance of going down to 32k. But expect a very strong bounce from the 0.382 FIB as well, which is at 52k. Set up your buy orders here, and thank me later!

What we can also see on the chart is an unfilled Fair Value Gap (FVG) between 34k and 28k. Often the price loves to come back and test these important price actions. This is a great buying confluence with the 0.618 FIB because the FVG is inside this Fibo level.

The last thing I want to talk about is this huge blue ascending channel on the weekly chart. This is a representation of this whole uptrend (bull market). You may say that Bitcoin is bullish until this channel holds, yeah, but what we do here is we predict future price action and give you technical analysis. I am giving you this information in advance so you can prepare for the future!

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

EURUSD - Potential Reversal Zones and ScenariosThis 4-hour chart of EURUSD highlights potential Fair Value Gaps (FVGs) that could act as strong areas of support and possible reversal zones. Price action is currently trending within a descending channel, with three possible bullish scenarios outlined:

1. A breakout from the upper boundary of the channel leading to an immediate bullish move.

2. A retracement into the first FVG zone, followed by a reversal upward.

3. A deeper retracement into the second FVG, aligned with the 0.618-0.65 Fibonacci retracement level, before a strong bullish rebound.

Keep an eye on these levels for high-probability trade setups. Patience is key!

NASDAQ INDEX (US100): Bullish Reversal Confirmed?!

I see 2 very strong bullish reversal confirmation on US100 on a daily.

First the market violated a resistance line of a falling channel.

Then, a neckline of a cup & handle pattern was broken.

Both breakouts indicate the strength of the buyers.

We can expect a growth at least to 20300 resistance.

❤️Please, support my work with like, thank you!❤️

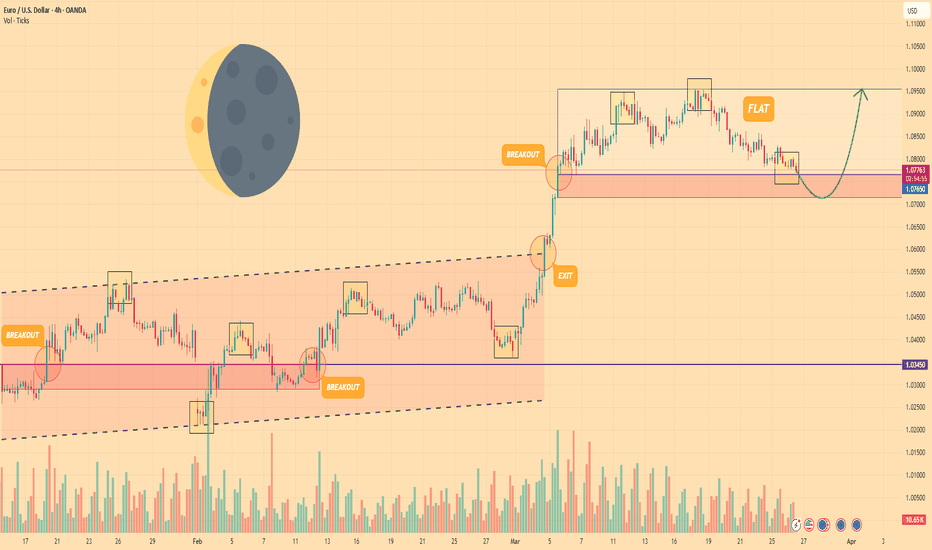

EURO - Price can correct to support area and rise to $1.0955Hi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago price started to grow inside a rising channel, where it broke the $1.0345 level and then it reached the resistance line.

Next, price made correction to support line of channel and then it quickly reached $1.0345 level and broke it again.

After this, price continued to grow in the channel, and later, it exited from it and rose to $1.0765 level.

Soon, price broke this level and started to trades inside flat, where it reached top part of flat and some time traded near.

Then it started to decline, so, now I expect that Euro can bounce up from support area and rise to $1.0955 points.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

DOLLAR INDEX (DXY): Strong Bullish Sentiment

As I predicted yesterday, Dollar Index continued growing.

Analyzing the intraday price action today,

we can see that the market established a nice rising channel on a 4H.

I think that the Index will keep rising within a channel and will reach 105.0 level soon.

❤️Please, support my work with like, thank you!❤️

GBPUSD → Correction to the liquidity zone. Waiting for a FBFX:GBPUSD gets a negative CPI report in the early session and tests key support, but failing to reach the liquidity area a rebound is formed. The pair is in consolidation...

The CPI report provoked a small liquidation in the market, within the framework of which the price tested one of the key supports at 1.2886, but the price did not enter the liquidity area, i.e. technically the chances to return to this area are quite high.

A correction to the imbalance zone is being formed, from which the decline may continue. In the short term I am interested in 1.2868, which can still hold the market and form a bullish impulse.

Resistance levels: 1.2926

Support levels: 1.2886, 1.2868, 1.2811

False break of the global range support at 1.2868 may trigger a rebound to 1.2926. I do not exclude a deeper correction to the support from D1, for example to 1.2811 from which, against the background of the bull market, we can wait for an upward correction.

Regards R. Linda!