Gold (XAU/USD) Breakout & Retest Trade Setup - Bullish Move!Gold (XAU/USD) has successfully broken out of the consolidation zone after a strong rally. The price action recently tested the previous resistance level, which is now acting as new support.

Trade Setup:

Entry: Price has retested the breakout zone and is showing signs of bullish momentum.

Support: The previous resistance area (now turned support) is holding well.

Stop Loss: Placed just below the support at $3,034.562 to manage risk.

Target: A potential upside move towards the $3,055 zone, which aligns with the next key resistance level.

This setup follows a breakout-retest continuation pattern, a classic technical strategy where price revisits a breakout level before resuming the trend. If bullish momentum continues, we can expect a move towards the projected target.

📌 Key Levels to Watch:

Support: $3,034.562

Resistance/Target: $3,055

Current Price: $3,039.925

💡 Risk-to-Reward Ratio: Favorable, as the stop loss is placed strategically below support.

⚠️ Disclaimer : This is not financial advice. Always manage your risk and use proper risk management techniques.

What are your thoughts on this setup? Will Gold push higher or face rejection? Let me know in the comments! 🚀💬

Parallel Channel

GBPAUD Wave Analysis – 18 March 2025- GBPAUD reversed from the support zone

- Likely to rise to resistance level 2.060

GBPAUD currency pair recently reversed from the support area between the support level 2.0290 (former multi-month resistance from December) and the 38.2% Fibonacci correction of the upward impulse from February.

The upward reversal from this support zone stopped the previous short-term ABC correction 4.

Given the strong multi-month uptrend, GBPAUD currency pair can be expected to rise to the next resistance level 2.060 (which reversed the previous upward impulse wave 3).

GBPUSD Wave Analysis – 18 March 2025

- GBPUSD reversed from support zone

- Likely to rise to resistance level 1.3050

GBPUSD currency pair recently reversed from the support zone between the support level 1.2900 and the upper trendline of the daily up channel from January.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Bullish Engulfing - which continued the active impulse wave (C).

Given the strongly bullish sterling sentiment, GBPUSD currency pair can be expected to rise to the next resistance level 1.3050 (the former monthly high from November).

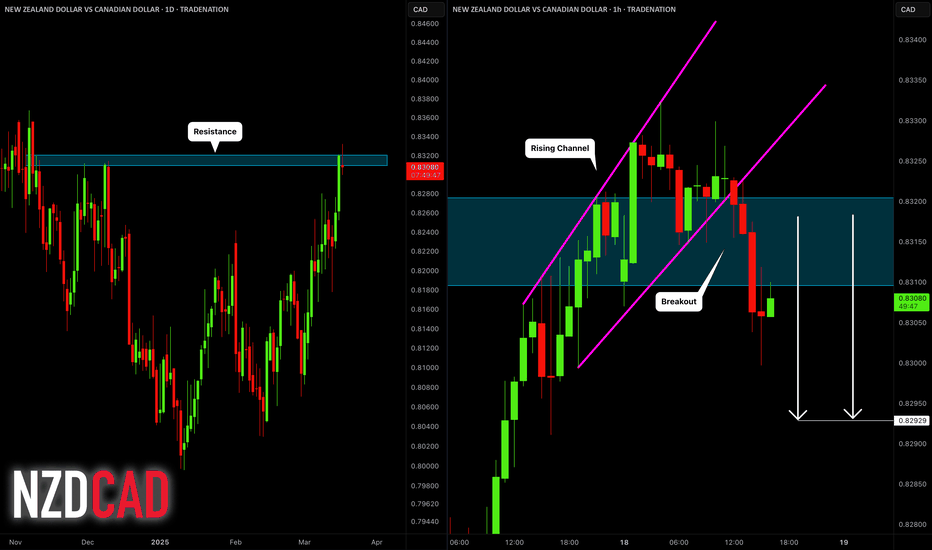

NZDCAD: Bearish After the News?! 🇳🇿🇨🇦

NZDCAD turned bearish after a release of Canadian Inflation data.

The price retraced from a key daily resistance and broke

a support line of a rising parallel channel on an hourly time frame.

The market may drop at least to 0.8293

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Euro will rebound from support area and continue to move upHello traders, I want share with you my opinion about Euro. This chart illustrates how the price entered an upward channel and immediately broke below the 1.0500 support level. After trading for some time within the buyer zone, it dropped to the support line. Following this move, the Euro reversed and started climbing, eventually reaching the 1.0500 level again, breaking above it, and making a retest. The price then continued to rise and later reached the current support level, which coincided with the support area and the channel's trend line, where it traded for a while. Soon after, the Euro broke through the 1.0805 level and remained within the support area for an extended period before climbing to 1.0945. At that point, it reversed and started declining. The Euro quickly dropped to the support line of the channel and then bounced back up. However, it recently fell again to the support line of the channel, where it has been gradually moving higher since. Given this setup, I expect the Euro to decline to the support area before rebounding and continuing its upward movement within the channel. Based on this, my TP is set at 1.1150. Please share this idea with your friends and click Boost 🚀

GOLD - Price can correct to support area and then continue growHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

A few moments ago price started to grow inside a rising channel, where it so long rose near support line and reached $2845 level.

Then Gold broke this level, exited from channel and started to trades inside flat, where it at once made retest.

After this movement, Gold started to grow and later grew to top part of flat, which coincided with $2955 level.

Price some time traded near this level and then corrected to support area, after which started to grow.

Gold rose to $2955 level and broke it, thereby exiting from flat too and then it continued to move up next.

Possibly, Gold can fall to the support area, correcting, and then continue to rise to $3040

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Bitcoin (BTC/USD) Potential Breakout from the Downtrend Channel!Bitcoin is currently trading inside a descending channel, with price consolidating in a small range. A breakout from this zone could trigger a strong bullish move toward the upper boundary of the channel.

🔹 Key Observations:

BTC is trading within a well-defined downward channel.

Current Consolidation: A small range has formed, suggesting a potential buildup before a breakout.

Target Projection: If price breaks out, we could see a move toward the 90,790 level, aligning with the upper trendline.

📈 Bullish Scenario:

A breakout above the consolidation area may lead to a push toward 90,790.

Confirmation of strength will be needed above resistance levels.

🔻 Bearish Risk:

If rejection happens at resistance, BTC may continue downward within the channel.

💡 Key Levels to Watch:

Resistance Target: 90,790

Current Support: 82,500

Will BTC break out of the downtrend, or will the channel continue to hold? Let’s discuss below! 📊🔥

HelenP. I Gold will continue to move up in upward channelHi folks today I'm prepared for you Gold analytics. Looking at the chart, we can see that the price entered the channel and began moving higher along the trend line. Soon, it climbed to Support 2, which aligned with the support zone, broke this level, retested it, and then continued its upward movement. Later, Gold reached Support 1, which also coincided with a support zone. Shortly after, it broke this level as well, reaching the resistance line of the channel before making a correction to another support zone. The price traded around this area for some time before making a corrective move below Support 1, even briefly breaking the trend line in a false breakout. However, it quickly resumed its upward movement within the channel. Gold then broke through Support 1 again, retested it, and rebounded from the support zone. Based on the current structure, I expect XAU/USD to make a corrective move toward the trend line before continuing its growth inside the upward channel. Given this scenario, my goal is set at 3070 points. If you like my analytics you may support me with your like/comment ❤️

Gold (XAU/USD) Sell-Off Continues | Bearish Target insightGold Spot (XAU/USD) indicates a potential continuation of the current downtrend.

🔹 Sell Limit at 3082: A significant level where a sell order was placed, marking the start of the recent decline.

🔹 Strong Downtrend: After rejecting the 3082 level, gold has been making lower highs and lower lows, confirming bearish momentum.

🔹 Support & Target Zone: Price is approaching a key support area near 2880-2900, which aligns with the marked target level.

📉 Bearish Outlook:

If the price breaks below the current support, further downside is expected.

A potential bounce could occur at the target zone before a trend reversal.

💡 Key Levels to Watch:

Resistance: 3082

Support/Target: 2880-2900

Traders should monitor price action at support to determine if further downside is likely or if buyers step in for a potential reversal.

What’s your outlook on gold? Will the bearish trend continue? 📉💰

Orbs to provide a 20x?Welcome back dearest reader!

Today we will analyse another project called Orbs. Looking at their website the fundamentals look great! But other than that, the chart also looks fantastic!

When looking at past performance its clear orbs has been in a massive flag formation since march 2021, it has broken out in october 2023 and has just now touched a very important support zone! Expecting upside momentum from here untill august.

Target: 0.40$

Stoploss: 0.0145$

NASDAQ INDEX (US100): Important Breakout I spotted a great example of a bullish reversal on 📈US100.

The index formed a double bottom pattern on a 4-hour chart and broke and closed above a resistance line of a descending channel.

There is a positive response on retesting the key support level based on a broken neckline.

It is expected that the index will continue to rise towards the 20,000 / 20180 levels.

OMUSDT → Paranormal behavior. Rally readinessBINANCE:OMUSDT as a whole looks stronger than the market. After a strong rally a correction in the format of a bearish wedge is formed, subsequently the price broke the resistance and is trying to consolidate above the key support

Against the background of a weak market OM coin has good prospects as technically someone is interested in this project and the coin as a whole behaves strongly and looks stronger than the market.

A breakout of the bearish wedge (consolidation pattern within the correction) is forming. If the bulls keep the coin above the previously broken figure resistance and above the base of the 6.752 reversal pattern, the growth may continue in the short to medium term

Resistance levels: 7.39, 7.98

Support levels: 6.752, 6.51

One of the few coins that is rising while bitcoin is falling. Focus on the previously mentioned support levels, as well as on the local resistance 7.05, the break of which may provoke a prolongation of growth

Regards R. Linda!

GBPUSD → Consolidation after a trend breakout. Long-Squeeze?FX:GBPUSD may test the local support amid the pre-news correction of the DOLLAR. Traders are waiting for inflation data, high volatility is possible

The fundamnetal situation is predisposed in favor of the pound sterling, which has an advantage on the back of the falling dollar, which is likely to take a medium-term position on the back of the Trump administration.

Technically, GBPUSD is consolidating above the key support zone of 1.286 - 1.280 below which a huge pool of liquidity has formed which could be tested before the trend continues.

Important news ahead. Traders are waiting for CPI data. High volatility is possible

Resistance levels: 1.2938 (trigger)

Support levels: 1.2868, 1.281, 1.2728

Bulls may be aggressive and keep the price from correcting downwards. In this case, price consolidation above 1.2938 could be a good entry point for the continuation of growth. But because of the upcoming news, I would prefer to wait for a retest of the liquidity zone 1.2868 - 1.281 before taking action to open a position.

Regards R. Linda!

NZDJPY → Attempting to change the downtrendFX:NZDJPY is trying to get out of the downtrend by breaking the channel resistance. Against the background of local strengthening of the dollar, the currency pair has all chances.

Technically, buyers are starting to gain momentum and support the market, it can be seen on the background of locally growing minmiums, which gradually leads to the breakout of the channel resistance. The trigger in our case is the resistance 85.240 - a key level that divides the market into 2 planes.

If the bulls are able to consolidate above 85.240, an impulse to 86.13, then 86.88 may be formed in the short-term.

Support levels: 84.500, 84.00

Resistance levels: 85.240, 86.13

Initial testing of the trigger may end in a small pullback due to liquidity formed above. The pullback may be directed towards the previously broken channel resistance. But the emphasis is on price consolidation above 85.240, as this will be a prerequisite that the bulls are holding the market in the moment and are ready to keep going up.

Regards R. Linda!