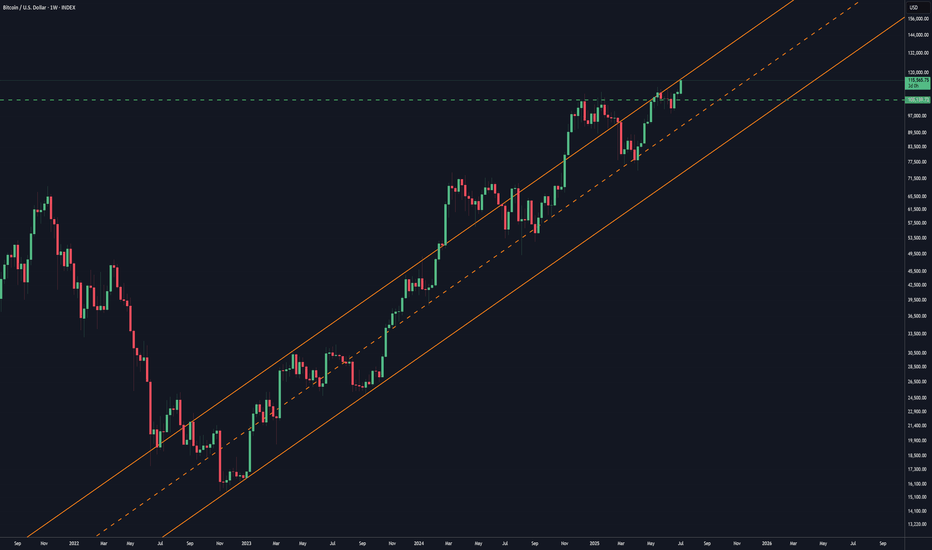

BITCOIN - Price can go into correction after reaching new ATHHi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

Bitcoin spent weeks confined to a tight falling channel, carving out a series of lower highs and lower lows as sellers maintained full control of the market.

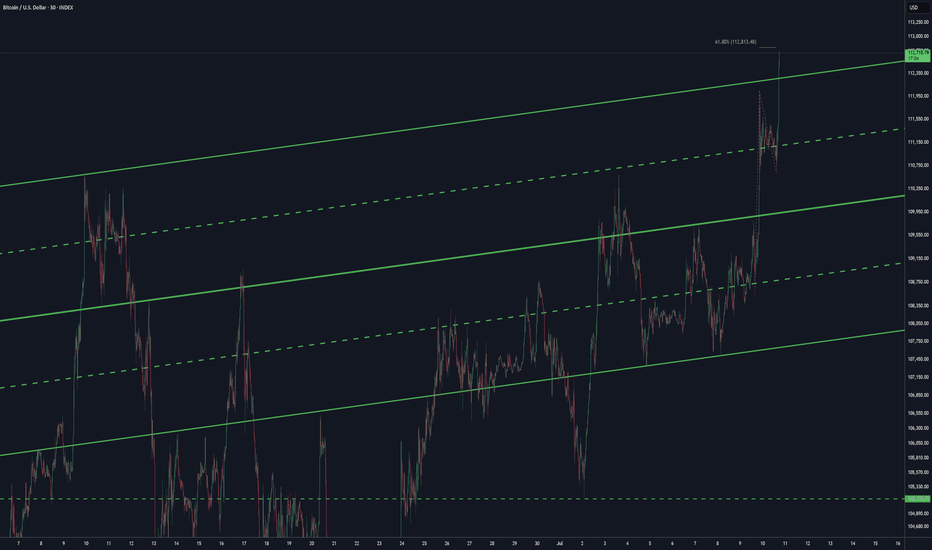

The breakout above $110300 ignited a powerful rally, propelling BTC into an ascending wedge formation and driving price sharply higher toward a fresh all-time high at $118800.

Once the ATH was reached, selling pressure reasserted itself, halting further upside and triggering a loss of bullish momentum.

This lightning-fast climb to $118800 appears to have drained buyer enthusiasm.

Key support now resides around $110300 - $111700, backed by the wedge base.

Given the exhaustion of buyers and the clear wedge resistance, I anticipate BTC to retrace toward the $112000 area following its recent surge.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Parallel Channel

SILVER (XAGUSD): Correction is Over?!

It looks like Silver has finally completed a consolidation within

a wide horizontal parallel channel on a daily.

A new higher high formation today indicates coming growth.

Because if its Friday, I suggest looking for trend-following buy from Monday.

Let the market close above the underlined resistance to let it set a Higher Close

as well.

Look for buying after a pullback, aiming at 38.0 as the first goal.

❤️Please, support my work with like, thank you!❤️

GOLD → Distribution. There is potential for growth to 3450–3500FX:XAUUSD breaks through consolidation resistance and forms a distribution pattern. A breakout of 3345-3358 could lead to another rally amid high economic risks...

Gold is rising for the third day in a row amid growing concerns about new tariffs announced by Trump. He threatened to impose tariffs on Canada and most of its trading partners, as well as the EU. Despite the strengthening of the dollar, demand for gold remains strong due to uncertainty and expectations for US inflation data next week. Investors are cautious ahead of CPI and the Fed's possible response

The correlation between gold and the dollar is declining, with gold rising due to geopolitical reasons amid high economic risks.

If the bulls keep the price above 3300-3345, the market could be extremely positive for 3400-3500.

Resistance levels: 3345, 3358

Support levels: 3330, 3308

Gold has broken through the resistance of the “triangle” consolidation pattern and is forming a distribution phase towards the zone of interest 3345 - 3358, from which a small correction may form before growth. Since 3345 is an intermediate level, the focus is on 3358. I do not rule out the possibility of a long squeeze of the support levels 3330, the triangle support, and 3310 before the growth continues.

Best regards, R. Linda!

Altcoins Market Cap: We on the Verge of a 5T Exposion!Hey crypto traders! Let’s dive into this monthly chart of the Altcoins Market Cap. You won’t believe what’s brewing!

We’re currently approaching a critical channel support at 200B, a level that might act as a springboard for massive rally — check out the jumps from channel support in 2019 and 2023! Each time the market cap hit this support, it skyrocketed, and now we’re at that pivotal moment again.

The chart projects a jaw-dropping target of $5T within the next 24 months if history repeats itself!

The price action shows we’re testing the lower boundary of this ascending channel, with the market cap sitting around 239.65B. A bounce here could send altcoins on a parabolic run, potentially hitting 5T by mid-2026. But if support fails, we might see a dip toward 100B — let’s keep an eye out!

Key Levels to Watch:

Support: 175B (channel support)

Resistance: 1.55T, 5T (projected target)

Breakdown Risk: 100B

Are altcoins about to explode to 5T, or will we see a deeper correction? Drop your thoughts below!

PS take a look at others vs. btc price action here:

EURUSD - Bears Are on the MoveHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURUSD has been overall bearish trading within the falling wedge pattern marked in red. And it is currently retesting the upper bound of the wedge.

Moreover, the blue zone is a strong structure.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and structure.

📚 As per my trading style:

As #EURUSD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Another channel resistanceThere is of course this quite significant channel that forms the base of this entire move, and also frames back further in time. After all was said and done, this wouldn't be surprising if it contained the price as it has done previously. Not to say it can't be sustained above it, because it certainly doesn't rule anything out, but it's there nonetheless.

Bitcoin dominance chart ready to dump?Bitcoin dominance aka the btc.d chart has been in these 2 rising channels now for a long long tie, after ust recently being rejected down fro the top trendline of the neon yellow channel, there seems to be an opportunity here for it to potentially head down to retest the bottom trendline of that channel as well. If this occurs this could lead to an altcoin season. Price is right now combating the 50ma(in orange) and trying to maintain it as support. If this moving average flips to solidified resistance that greatly increases the chances of price going down to retest that bottom yellow trendline. Being that both of these channels are rising channels probability favors price action eventually breaking down from them instead of up so I have arbitrarily placed the measure move break down target of the yellow channel in a random spot below roughly where price could break down from the channel were it to be rejected strongly enough here by the 50ma. It’s retested this bottom trendline multiple times in the past and has always found away to avoid the breakdown thus far though so a breakdown there is definitely not guaranteed if it does retest the trendline, but even heading back down to retest the trendline in the first place may provide enough momentum for an alt season *not financial advice*

Add-onsAs far as break outs go, this might be all it goes but I'd like to see it get a bit technical and hit that first level at the 618 before retesting the channel. If it can hold up there and maybe flush a bit out, then for me it's an adding opportunity. It might be the last chance we see these prices. It can always be wrong, but that's what stops are for on trading funds.

Break of downward sloping channel LongNike has swept liquidity and is now showing a strong bounce to the upside.

Although I didn’t manage to enter the initial long, I am monitoring for a break above the current downward-sloping channel. A clean breakout followed by a retest would provide a more reliable entry point. I’m not aiming to catch the absolute bottom—I’d rather wait for confirmation of trend reversal.

A move above the monthly level at 79.46 would be an additional sign of strength and increase conviction in the long setup.

There is still significant overhead resistance, particularly around the point of control aligned with the anchored VWAP near 92.50. That area would be my first target. However, if momentum continues, there is potential for a move towards the 122 level.

After breaking support level, Euro can continue to fallHello traders, I want share with you my opinion about Euro. After forming an ascending channel, the price steadily moved higher and reached a local range area near 1.1850 points. However, once it entered this zone, the momentum faded. The market started showing signs of distribution, and we saw multiple attempts to push higher being rejected. This range acted as a cap, preventing further growth. Now, the price has pulled back and is trading near the current support level at 1.1700, which also coincides with the support area. This zone has already been tested several times, and each bounce has been weaker than the previous one. That suggests growing pressure from sellers. Looking at the broader structure, the price exited the previous triangle formation with an upward move, but now that impulse has exhausted. The rising wedge is also broken. Based on the behavior at resistance and the weakness around the current support, I expect a breakdown from the range and further decline toward TP 1 at 1.1500 points. If bearish pressure continues, the price could eventually reach the major buyer zone around 1.1345 - 1.1300 points. Given the weakening momentum, retests of support, and lack of bullish continuation, I remain bearish and anticipate a continuation of the downtrend. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

GOLD - Price can bounce down from resistance line of channelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Gold broke out of its long-term rising channel and hit $3390 resistance level before momentum definitively stalled.

That failure marked a shift in control, as sellers forced price into a falling channel, establishing lower highs and lower lows.

Price fell to support level, after whcih it turned around and bounced up to resistance line of falling channel.

Now, Gold tests the upper boundary of the falling channel near $3318, where each bounce has been capped by declining volume.

Key support lies in the $3250 - $3235 area, aligned with multiple prior demand tests and the former rising-channel floor.

I expect Gold to reverse from the channel resistance and slide toward $3235, decisively breaking below the $3250 level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

HelenP. I Bitcoin can continue to fall and break support levelHi folks today I'm prepared for you Bitcoin analytics. If we look at the chart, we can see that Bitcoin has been trading inside a well-defined upward channel. The price recently touched the upper boundary of this channel for the second time and formed a clear reaction, indicating strong resistance. After this, BTCUSD started to pull back from the resistance zone around 110300 - 109800 points. At the moment, it is trading slightly above this support area, but momentum is already shifting downward. Given this structure, I believe Bitcoin is likely to continue its decline and break below the support zone. The previous upward impulse has already lost steam, and there are no signs of strong buying activity around the current levels. The next logical target in this scenario is the lower boundary of the channel, near the 107500 level, where the trend line acts as dynamic support. This level has historically served as a rebound point, and I expect it to do so again. My current idea is short, aiming for a move down toward the trend line. If BTCUSD breaks through the first support and confirms the weakness, the price could fall quickly and test the next support area around 105600 - 105000 points. But for now, I will be watching the 107500 level closely. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Aussie: Still Growing!

CAPITALCOM:AUDUSD

The bullish momentum continues after our last successful AUDUSD setup, and a move toward the 0.65900 resistance area looks probable now.

🪙 My Trading Plan:

🔼 BUY Stop: 0.65648

❌ Stop Loss: 0.65320

✅ Take Profit: 0.65965

💡 Why am I buying here?

✅ Price broke recent resistance at 0.65500, activating buy trades.

✅ RSI confirm ongoing bullish momentum 📊.

📰 Fundamental Situation:

🏦 RBA Rate Decision Supports AUD

The Reserve Bank of Australia (RBA) surprised markets by holding rates steady at 3.85% 🏛️, diverging from expectations of a cut. This cautious stance reflects the RBA’s preference to wait for clearer signs of slowing inflation 📉 before adjusting policy further.

Governor Michele Bullock emphasized that inflation risks remain persistent ⚠️, driven by high labor costs and weak productivity, possibly requiring a longer period of restrictive policy ⏳. Deputy Governor Andrew Hauser noted the bank is closely monitoring global risks 🌐, especially US tariff developments, underscoring sensitivity to global headwinds that could impact trade and growth 📦.

🌎 Trade Tensions in Focus:

President Trump ruled out extending tariff deadlines beyond August 1 ⛔, announcing new duties:

🔹 50% on copper 🪙

🔹 Potential 200% on pharmaceuticals 💊

🔹 10% on goods from BRICS 🌐

These moves are likely to intensify global trade tensions ⚔️, potentially impacting commodity flows and inflation, which the RBA and markets will continue to monitor closely.

#BTCEUR #1D (Binance) Bull-flag breakout and retestBitcoin looks very good for bullish continuation after regaining 50MA support on daily, against the Euro.

⚡️⚡️ #BTC/EUR ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 12.0%

Entry Targets:

1) 93017.86

Take-Profit Targets:

1) 108422.28

Stop Targets:

1) 85296.36

Published By: @Zblaba

CRYPTOCAP:BTC BINANCE:BTCEUR #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +16.6%

Possible Loss= -8.3%

Estimated Gaintime= 1-2 months

MarketBreakdown | EURUSD, DOLLAR INDEX, BITCOIN, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

The price started a correctional movement after it updated

a high the first of July.

The market formed a bullish flag pattern.

Your next trend-following bullish signal will be a breakout and a daily

candle close above its resistance.

2️⃣ Dollar Index #DXY daily time frame 💵

The market corrects in a bearish flag pattern.

I see a test of a significant horizontal resistance cluster now.

Your signal to see will be a bearish violation of a support

of the flag and a daily candle close below.

3️⃣ #BITCOIN #BTCUSD daily time frame

Though the price managed to update the All-Time High

yesterday, the market did not manage to close above

a current major resistance.

I believe that we will see another attempt of the market to breakthrough.

Your bullish confirmation will be a daily candle close above the underlined resistance.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The price reached an important confluence demand zone

based on a rising trend line and a horizontal key structures support.

Probabilities will be high to see a bullish movement from that.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US Jobless Claims: Why They Matter for EURUSD 🇺🇸FOREXCOM:EURUSD

📈 US Jobless Claims: Why They Matter for EURUSD 🇺🇸💼

While Trump’s tariff policies ⚔️ remain in focus, it’s important not to overlook today’s economic calendar 🗓️, with Initial Jobless Claims taking the spotlight.

🧐 What are Jobless Claims?

Initial Jobless Claims 📑 measure the number of people filing for state unemployment insurance for the first time. Released weekly by the US Department of Labor 🏛️, it’s a key indicator of the health of the US labor market 💪.

Why does it matter?

A strong labor market typically supports the US dollar 💵, as it reduces the likelihood of immediate Fed rate cuts 🕰️, while higher claims suggest a weakening economy, which could pressure the dollar lower.

📊 Latest Figures:

🔹 Previous: 233K

🔹 Forecast: 235K

Last week, claims fell from 237K to 233K, highlighting continued labor market resilience. If today’s data beats expectations (lower claims), the USD may strengthen 🛡️, potentially pushing EURUSD below 1.1700. Conversely, higher claims could weaken the USD ⚠️, lifting EURUSD above 1.1800.

💡 Trade Idea:

BUY EURUSD at 1.17300

❌ Stop Loss: 1.17600

✅ Take Profit: 1.16500

While the US labor market remains strong, technical factors and broader fundamentals can confirm a strong EURUSD reversal, keeping bearish opportunities in play.

🚀 Stay tuned for live reactions after the data drops!

💬 Support this post if you find it useful! 🔔

XRPUSDT → Resistance ahead. Correction before growthBINANCE:XRPUSDT is rising after breaking through consolidation resistance. Bitcoin's rally supported the overall market momentum, but a new resistance zone lies ahead...

Bitcoin is testing its ATH and updating it, but is facing pressure and forming a false breakout. A correction in the flagship coin could trigger a correction in XRP, but if Bitcoin continues to storm the 112K area without a pullback, followed by a breakout, the market could find support and continue to rise.

After XRP broke through resistance, the coin entered a distribution phase and is testing an important resistance zone of 2.4488 - 2.4772. The inability to continue growth, a false breakout, and price consolidation in the selling zone could trigger a correction.

Resistance levels: 2.4488, 2.4772, 2.6524

Support levels: 2.3587, 2.3375, 2.2455

Despite breaking through resistance, XRP is still in a local downtrend. Pressure on the market is still present. The formation of a false breakout will indicate that growth is limited for now. However, if the price consolidates above 2.4772 and begins to break out of the local structure, we can expect growth to continue.

Best regards, R. Linda!

BITCOIN → Market manipulation. Chance for growth to 110KBINANCE:BTCUSDT , as part of a correction triggered by negative news from the US regarding tariffs, is testing liquidity in the support zone. There is a chance of recovery to 110K.

Bitcoin is reacting with a decline to fundamentally negative data on tariffs from Trump. Technically, the price is facing support and forming a false breakdown, the purpose of which was to capture liquidity. This could lead to a recovery within consolidation in an uptrend, but again, there are conditions...

Countries that have received notification of tariffs are responding positively to cooperation (if this trend continues, Bitcoin could receive a local bullish driver).

The market perceives this as positive, and after liquidity is captured, the price could recover to the resistance of the trading range.

Resistance levels: 108230, 109690

Support levels: 107500, 106500

Bulls are trying to hold the local interim bottom at 107500. There is a reaction to the false breakdown of support. The focus is on 108230; if the market can break through this level, we will have a chance to grow to 110K.

Best regards, R. Linda!

Mastercard Could Face ResistanceMastercard fell hard in June on the threat of stablecoin competition. Now, after a rebound, some traders may expect another push to the downside.

The first pattern on today’s chart is the selloff that began on June 13 when the Wall Street Journal reported that major retailers were considering stablecoins as an alternative to credit-card payment systems. Another drop came the following week after the U.S. Senate passed the GENIUS Act regulating stablecoins.

The stock recovered in the second half of June but it halted at the post-drop closing high of $569.45. Has new resistance emerged?

Third, prices could be stalling at the 50-day simple moving average. The 8-day exponential moving average (EMA) is additionally below the 21-day EMA. Those signals may reflect weakening intermediate- and short-term trends.

Fourth, stochastics have reached an overbought condition.

Finally, this month’s lower high could potentially represent the start of a new falling channel. Such a pattern could make investors expect a lower low closer to $500.

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

DYDX Breakout from Falling Wedge | Targeting $1.60+# DYDX Breakout from Falling Wedge | Targeting $1.60+

📈 **DYDX/USDT Analysis – Daily Timeframe**

DYDX has just broken out of a falling wedge pattern – a classic bullish reversal formation – after holding a strong support zone around **$0.50**. This zone has acted as a reliable demand area for several months.

---

🔍 **Technical Highlights:**

- ✅ Falling wedge breakout confirmed with daily candle close above resistance

- 🟢 Strong support at $0.50–$0.52

- ⚠️ Horizontal resistance at $0.75 may act as a short-term barrier

- 🚀 Potential rally toward major resistance at **$1.60–$1.70** (target zone)

---

🎯 **Profit Targets:**

- First Target: **$0.75**

- Final Target: **$1.60 – $1.70**

❌ **Invalidation (Stop-loss idea):**

- If price breaks below $0.48 with volume, the bullish scenario may be invalidated.

---

📊 This setup is based on breakout structure and potential trend reversal. If volume confirms, this could be the beginning of a new mid-term uptrend.

💬 Let me know what you think about this setup! Would love to hear your feedback.

CRUDE OIL (WTI): Will It Rise More?

Quick update for my yesterday's analysis for WTI Crude Oil.

As I predicted yesterday, the price went up to the target.

We got one more strong bullish confirmation after a New York

session opening:

the price violated a resistance of a horizontal range on a 4H time frame.

I think that the market may rise even more and reach 69.25 level.

❤️Please, support my work with like, thank you!❤️

GBPUSD - Macro Trend Continues!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red. And it is currently retesting the lower bound of the channel.

Moreover, the green zone is a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and structure.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD → Readiness to test the local bottomFX:XAUUSD is under pressure from the rising dollar and uncertainty, breaking through support levels, which opens up a corridor for the market to fall to 3255 - 3246

The price of gold is consolidating around $3300 after falling more than 1% amid expectations of the Fed minutes and news about tariffs.

Investors remain cautious: the dollar is supported by hopes for US trade deals, while the threat of new tariffs from August 1 is holding back gold's growth.

Weak inflation data in China did not support the metal, while expectations that the Fed will not rush to cut rates due to inflationary pressure from tariffs are also limiting interest in gold. Traders are waiting for the Fed minutes and new statements from Trump to determine the further direction.

Technically, the market looks weak (on D1, the price closed below the key level of 3300 on Tuesday) and there is a chance of a further decline.

Resistance levels: 3300, 3311

Support levels: 3295, 3255, 3246

Consolidation below 3295-3300 could trigger a further decline to 3255, from which the market could react with a correction.

Buying can be considered if gold reverses the short scenario, manages to strengthen to 3311, and consolidates above this level. At the moment, the price is in the selling zone...

Best regards, R. Linda!