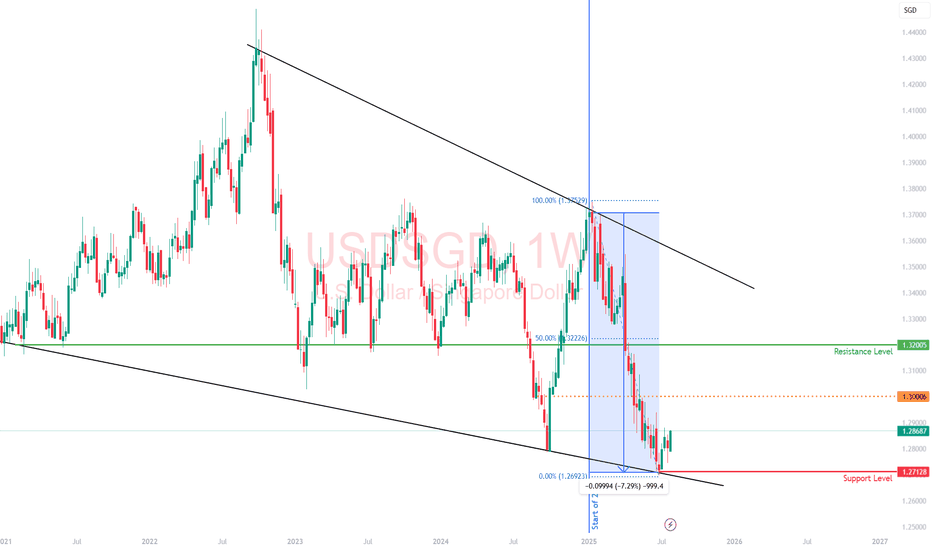

Singapore Dollar: Asia’s Quiet Safe Haven with Eyes on ParityThe Singapore dollar has quietly emerged as one of the strongest performers in Asia, gaining over 7% against the US dollar this year.

While much of the FX world fixates on the yen or franc in times of uncertainty, the SGD is carving out a niche as a regional safe-haven, driven not by size or liquidity, but by credibility.

The strength in the SGD isn’t just about USD weakness. Singapore's macro fundamentals

budget surpluses,

robust reserves, and

deep-rooted investor confidence

offer a kind of quiet strength that traders tend to overlook until it becomes obvious.

This makes the SGD a compelling hedge against both regional turmoil and global dollar decay.

As more global capital looks for stable homes outside of the traditional, Singapore’s financial system and currency are set to benefit.

The idea of SGD hitting parity with the USD, once dismissed as unrealistic, is now getting serious attention.

Analysts have suggested that it could happen within five years, but I wouldn’t be surprised if it comes sooner!

The greenback’s structural issues of twin deficits, political gridlock, and de-dollarization headwinds are no longer theoretical.

That said, liquidity is still a constraint. The SGD makes up just 2% of global FX turnover, and the MAS actively manages the currency to avoid excessive volatility.

This means that while the long-term trend favors SGD appreciation, traders betting on a rapid sprint to parity may be left waiting.

In my view, the SGD is one of the most underappreciated macro trades in FX.

Parity

Euro Back to Parity?The possibility of EUR/USD reaching parity remains a realistic scenario under current macroeconomic and geopolitical conditions.

1. Diverging Monetary Policies

In light of Tump 2.0 and the potential impact of increasing inflation due to the introduction of tariffs, the Federal Reserve is seen to be backing down on its path to keep cutting rates.

On the current plans for only 2 rate cuts in 2025, elevated U.S. interest rates could continue to bolster the U.S. dollar, as higher yields attract foreign investment, increasing demand for USD.

On the other hand, the European Central Bank (ECB) faces mounting pressure to ease its policy stance.

The Eurozone economy has shown signs of stagnation, with Germany, the region's economic engine, teetering on the brink of recession.

A dovish ECB weakens the euro relative to the dollar, contributing to downside pressure on EUR/USD.

2. Weakening Eurozone Economy

The U.S. economy has remained relatively resilient, supported by robust labor markets and consumer spending.

Conversely, the Eurozone has struggled with sluggish growth and energy dependence, leaving it more vulnerable to external shocks.

3. Geopolitical Risks

The ongoing effects of the Russia-Ukraine war continue to strain Europe’s energy sector.

While the region has reduced its reliance on Russian natural gas, high energy prices remain a structural challenge, eroding business competitiveness and consumer purchasing power.

Heightened geopolitical tensions globally have fueled risk-off sentiment, benefiting the safe-haven U.S. dollar.

4. Technical Analysis

EUR/USD has been trading in a downward trend since October 2024, after reaching a peak of 1.12.

Should the pair break below the round number level of 1.02 (and 61.8% Fibonacci retracement level from the longer term) the path to parity becomes increasingly plausible, with 1.00 serving as the next major psychological support.

The 50-day moving average remains below the 200-day moving average, forming a " death cross " pattern, which indicates bearish momentum. Additionally, the TSRI MACD crossover indicates continued selling pressure but room for further downside.

Conclusion

The conditions are aligned for EUR/USD to reach parity.

While short-term volatility and market sentiment may delay this move, the structural drivers of dollar strength and euro weakness remain firmly in place.

EURUSD D1 BEARISH, RETURN TO PARITY ?Lot of confluence factors indicate that EUR is going to give way to USD

COT Delta = black line dropping hard, Institutions are heavily short

YIELD Differential = green/red line, nosedive lower

LIQUIDITY Differential = orange line = FED more restrictive than ECB ?

GAPS = Next Weekly gap is 150 pips lower @ 1.01 = Yearly S1

PIVOTS = Price below Yearly PP, heading for Yearly S1 @ 1.0050 = GAP Low

FUNDAMENTALS = USD beats EUR on pretty much all metrics

ECONOMICS = Germany, the EU-powerhouse, in multi-year recession

POLITICS = Trust is fading, most EU-countries (will) vote for change

Looking for a drop in price to 1.01, probably return to parity before spring

Will History Repeat as Major Currencies Dance Toward Parity?In a dramatic shift that has captured the attention of global financial markets, the euro-dollar relationship stands at a historic crossroads, with leading institutions forecasting potential parity by 2025. This seismic development, triggered by Donald Trump's November election victory and amplified by mounting geopolitical tensions, signals more than just a currency fluctuation—it represents a fundamental realignment of global financial power dynamics.

The confluence of diverging monetary policies between the U.S. and Europe and persistent economic challenges in Germany's industrial heartland has created a perfect storm in currency markets. European policymakers face the delicate task of maintaining supportive measures. At the same time, their American counterparts adopt a more cautious stance, setting the stage for what could become a defining moment in modern financial history.

This potential currency convergence carries implications far beyond trading desks. It challenges traditional assumptions about economic power structures and reevaluates global investment strategies. As geopolitical tensions escalate and economic indicators paint an increasingly complex picture, market participants must navigate a landscape where historical precedents offer limited guidance. The journey toward potential parity serves as a compelling reminder that in today's interconnected financial world, currency movements reflect not just economic fundamentals but the broader forces reshaping our global order.

Conclusion

The current landscape presents unprecedented challenges for the EUR/USD pair, driven by economic fundamentals and geopolitical tensions. One significant concern is the potential release of sensitive footage from Israel (by the Israeli National Security Agency (NSA) from Hamas body cameras, containing graphic atrocities from the October 7th incident.), which could threaten European stability. These developments go beyond simple market dynamics and have the potential to reshape the social and political fabric of Europe.

Market professionals emphasize the importance of adaptable strategies and the vigilant monitoring of key indicators. Investors must prepare for increased volatility while maintaining strong risk management frameworks. The pressure on the euro-dollar relationship is likely to persist, making strategic positioning and careful market analysis more crucial than ever in navigating these turbulent waters.

Eurozone PMI Contracts Amid Geopolitical TensionsThe Eurozone's PMI dropped to 48.1 in November, indicating contraction, with the services sector hit hardest. Simultaneously, the EUR/USD falls to $1.03327, nearing parity with the US dollar. This drop is further highlighted by the dollar index reaching over 107.5, its highest in two years, fueled by strong US economic data and safe-haven demand amid global uncertainties. The Eurozone faces heightened vulnerabilities due to geopolitical tensions, contrasting the robust US economic indicators.

As traders eye potential parity in the EUR/USD, it's crucial to consider geopolitical developments and economic indicators. Understanding these dynamics can aid in gauging market movements and potential trading opportunities.

For those trading forex, it's important to manage risks, as leverage magnifies both profits and losses. Be informed: stay updated with economic events, and consider using resources like tastyfx’s YouTube channel for strategy development. Always trade with caution, as past performance is not indicative of future results.

Polkadot Price Prediction 2024hello dear trader and investors

New app

Polkadot for Begginers

Credentials hold in Google & Apple Cloud

Easy sending DOT & Stables to friends/family

Not just a wallet, easy staking with 1 click

Any wallet can connect to this app for easy payments

Payment in 1Mil+ brands in the USA

34 countries in few months with another 1+ Mil shops

Up to 20% cashback in Dot after payment with the app

Huuuuuuge!!!

What’s New With Polkadot?

A crucial development driving Polkadot’s growth is the ink! 3.0 upgrade by Parity Technologies. This upgrade significantly enhances the platform’s smart contract creation, fostering more intricate programming logic.

Technological Enhancements: One key factor underpinning Polkadot’s potential is Parity Technologies’ recent 3.0 upgrade of its ink! programming language.

Strategic Collaborations: Polkadot’s integration with Lido for liquid staking on the Moonbeam and Moonriver platforms is another crucial aspect of its fundamental analysis. Hot from Polkadot Decoded

EURUSD: Bearish Bat with MACD Bearish DivergenceWe have an Intraday Bearish Bat on the Euro with Bearish PPO Confirmation and MACD Bearish Divergence.

Earlier today, the Euro Doubled Bottomed at $1.05 and has since been on the rise, but so far it has only managed to come back up towards the moving averages and move up to complete a Bearish Bat. Now it is showing multiple signs of coming back down, and if it does, I don't think $1.05 will hold but that it will instead break and make its way towards $1.035. I think we will continue this trend until the Euro Is Back Below A Dollar.

A determined ECB could see the EURUSD climbThe EURUSD trades significantly higher, bouncing from the 0.9740 support level to approach the parity level again.

Although the price is currently consolidating below the 0.9950 interim resistance level, the EURUSD is likely to continue trading higher.

Look for the price to break above the 0.9950 and 1.00 price area to signal a stronger move higher, with the next key resistance level at 1.0085.

This move higher could also be driven by the sentiment conveyed by the ECB that it will raise rates to deliver the 2% inflation target.

Tue 1st November 2022 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. Enjoy the day all. Cheers. Jim

EUR/CHF almost back to parity; Flag targetJuly 5th was the last time that EUR/CHF traded at 1.0000. The pair traded lower in an orderly channel until the pair broke above it on August 29th near 0.9629. EUR/CHF then hugged the top trendline of the channel, while still moving lower, making a local low at 0.9409. Since then, the pair has been moving higher in a flag formation. On October 13th, EUR/CHF broke out of the flag pattern. The target for a flag pattern is the height of the flagpole, added to the breakout point of the flag. In this case, the target is near 1.0015.

EUR/CHF has been moving higher 10 of the last 11 trading days, including today. If price is to make it to target, the first resistance is the 50% retracement level from the highs of June 9th to the lows of September 26th at 0.9962. Above there, resistance is at the psychological round number level of 1.0000. If price makes it to the target and continues higher, the next resistance level is the 61.8% Fibonacci retracement level at 1.0092.

However, notice the RSI has just moved into overbought territory, indicating that EUR/CHF may be ready for a correction. If the pair does correct, the first support level is the low from October 12th at 0.9644 and then the September 26th lows at 0.9409. If EUR/CHF breaks below, there is no support until the lows from January 2015 when the SNB dropped the 1.2000 peg to the Euro, near 0.8630!

If EUR/CHF can’t make it above parity, watch the RSI. If it is still in overbought territory, the pair can fall to 0.9644 quickly!

Tue 11th October 2022 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. Enjoy the day all. Cheers. Jim

Fri 16th September 2022 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. I'm just keeping the Stop fairly tight and at the same level as the other Sell trades that are still open. Enjoy the day all. Cheers. Jim

EURUSD: Gains should be limited!EURUSD

Intraday - We look to Sell at 0.9992 (stop at 1.0042)

The medium term bias remains bearish. We are assessed to be in a corrective mode higher. Reverse trend line resistance comes in at 0.9995. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 0.9881 and 0.9850

Resistance: 1.0000 / 1.0325 / 1.0800

Support: 0.9880 / 0.9800 / 0.9700

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Thu 1st September 2022 EUR/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Buy. Still have 4x partial Sell trades on this pair so they do give me some protection for this high risk Buy trade. Enjoy the day all. Cheers. Jim

How long will EUR/USD parity last? After the EURUSD reached and broke below parity, an analysis of the situation is in order.

Last week, the euro failed to close above 1.0320 and the 50-Day Moving Average, presenting a potential bull trap and setting up the opportunity for short sellers, as illustrated by the orange circle.

Although the pair broke below the parity on August 22, a decent pullback is on the table, as investors become uncomfortable with the unusual valuation of the pair. One only has to look back to July 14, to witness the pullback in the EUR/USD after an intraday probing of the parity level.

Bears should remember that we might still be in the middle of a downward leg. So, the medium-term decline may extend to new depths. 0.9900 has already been tested and rejected but a more granular look at the candles might be necessary at this point.

The intraday battle

The EUR/USD spent most of its time consolidating below parity, organizing near 0.9930, before the London opening and strong European data was released.

On the hourly chart, you can see the first of the two big blue candles forming after consumer confidence in the Euro Area rose by 2.1 points in August, from a record low of -27 in July. Consumer confidence was expected to slide further into negative territory, so the upwards revision came as a surprise to the markets.

Two subsequent hourly candle wicks broke above parity to test the staying power of a below-parity EUR/USD. For now, Support is building below 0.9960. In the short term, the market might need to work a lot to take out buyers at 0.9900.

Will the GBP be the next to hit parity with the USD?After the euro made a once in 20 years slide to parity with the US dollar, one might also ask: will the British pound be the next to cross parity with the American dollar?

The GBPUSD pair has been consistently in a downtrend since last year. Traders and investors are now on their watch as technical indicators may show signs of a possible move towards the parity target.

One of the most used indicators to determine the trend and price movements is the Supertrend Indicator. This indicator is widely used for trading markets and provides buy and sell signals in a trending market. As the name suggests, this indicator acts like a moving average or a MACD. A very simplistic way to use this indicator is to buy whenever the price closes above the green line and sell if the price closes below the red line considering the current market trend.

On the daily chart, we can see that the GBPUSD made a rebound at around 1.1800 after it made a fresh 2022 low.

With the use of Supertrend and a 200 EMA period, we can identify that the price is still in favor of moving further down. The indicator gave the initial sell signal last month for a continuation to the downside; since then, the price has tumbled even further. With this information, we might expect the price to continue moving down and possibly hit the parity target. However, if the indicator flips to green, a possible pullback to the upside before continuing further down may also happen in the short or mid-term. If this happens, traders may want to wait for the indicator to give a sell signal before taking a position.

Is that the bottom on EURUSD?The main questions that we get right now are if that's the bottom and are we going to see a reversal.

The downtrend is really strong and we're expecting to see a breakout of the 1,0000 level.

Right now, we're in a pullback and we would expect to have more selling opportunities once it ends.

Such opportunities would be if price manages to push higher to around 1,0150 and it then reverses.

The targets will be again a retest of the lows and also a possible breakout.

Therefore, the trend is still valid and we should see a new lower low!

Is it time for a pullback on EURUSD?Like we said yesterday, the strong psychological number of 1,000 is suitable for a possible pullback.

As of right now, it hasn't gained momentum yet and it's still possible to see a further push down and price trying to break below the parity level.

In case of price bouncing back up, we could wait for 1,0150 and then look to enter short again!

EUR-USD Parity! Buy!

Hello,Traders!

EUR-USD is trading in a strong downtrend

And the pair has almost reached PARITY

So despite my strong bearish bias

I think that we will see at least a local rebound

From the 1.00000 level on EUR-USD

Because If thats not a round level

I don't know what is...

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!