Patience

Imminent Position Formulation - Daily Interval - DXFHello Fellow Successful Traders,

The stock (DXF) has had a significant amount of consolidation throughout that previous years. Utilizing various technical approaches, as well as fundamental observations, the stock will (soon more or less) experience volatile PA (Price Action) Levels. Be diligent and consider the prevalent (adverse) risks associated with emotional trades. Wait for a Proper Entry Moment (and do not be greedy).

Resistance Level 2 - (7.00 - 7.30) 30 cent interval

Resistance Level 1 - (4.85 - 4.15) 30 cent interval

Key Price Zone (KPZ) - (3.70 - 4.00) 30 cent interval

Support Level 1 - (1.65 - 1.90) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Plan)***

-LionGate

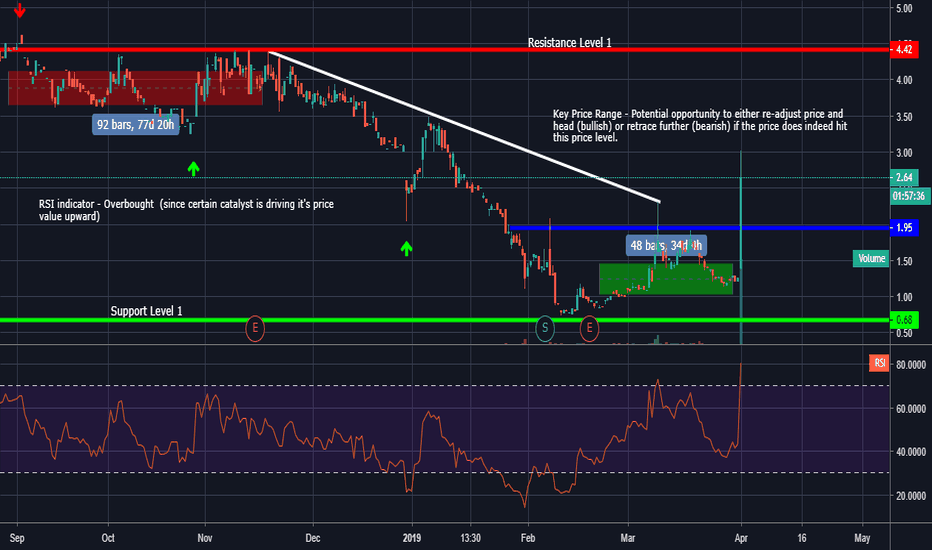

Trend Transfer Imminent - 4hr Interval - JCSHello Fellow Traders,

The stock (JCS) manifests a current (or within the next few days) opportunity to transfer towards northward (bullish) trajectory. Considering that the stock has contested previous (all time lows), there is correction imminent.

Resistance Level 2 - (4.65 - 4.85) 20 cent interval

Resistance Level 1 - (3.15 - 3.45) 30 cent interval

Key Price Zone - (2.85 - 3.15) 30 cent interval

Support Level 1 - (1.95 - 2.15) 20 cent interval

Furthermore, acknowledge that the stock (JCS) has gained historical data within the last few months. (Presenting an opportunity to solidify positions to come in the near future).

-LionGate

Position Formulating - 45min Interval - SPIHello Fellow Traders,

The stock (SPI) appears to be experiencing a sudden surge of PA (Price Action). However, the current price is attempting to infiltrate Support Level 1. (Wait For Correction, and Enter the Market Accordingly).

Resistance Level 1 - (7.15 - 7.45) 30 cent interval

Key Price Zone (KPZ) - (5.10 - 5.35) 25 cent interval

Support Level 1 - (3.60 - 3.85) 25 cent interval

Support Level 2 - (0.65 - 90) 25 cent interval

Not Investment Advice. For Educational Analytical Purposes Only. (Be Conscientious and Stick To Your Itinerary)***

-LionGate

Long Position Aggregating - 45min Interval - USDCADHello Fellow Traders,

The current pair (USDCAD) appears to be forming a viable setup for a long (bullish) position within the next few days (2 - 3). Be considerate of the RSI readings, as there a correction may be prevalent prior to the setup.

Resistance Level 2 - (1.34515 - 1.34545) 30 pip interval

Resistance Level 1 - (1.33740 - 1.33765) 25 pip interval

Blue Horizontal Line (KPZ) - (1.33525 - 1.33555) 30 pip interval

Support Level 1 - (1.32955 - 1.32980) 25 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Long position (Short Term) - 45min Interval - AUDJPYHello Fellow Traders,

The currency pair (AUDJPY) is preparing for an imminent correction within the previous penetration of (KPZ). This position is arguably solely for a temporary periodical plan. As the overall trend of the pair (AUDJPY) is a negative direction.

Resistance Level 1 - (79.455 - 79.480) 25 pip interval

Blue Horizontal Line (KPZ) - (79.240 - 79.270) 30 pip interval

Support Level 1 - (79.010 - 79.040) 30 pip interval

Support Level 2 - (78.495 - 78.520) 25 pip interval

Furthermore, the imminent correction may non-the-less penetrate Resistance Level 1. (Wait For Confirmation, Patience is Vital)

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Potential Position Forming - Daily Interval - XSPAHello Everyone,

The Stock (XSPA) appears to have been consolidating for more than a seven-month time frame. Indicating strong breakout patterns may be in the process within the upcoming months. The RSI is presenting an oversold threshold, which could imply a potential long (bullish) position for the short term (4hr, 1hr, and so on). The stock has been in the "oversold" category on Friday (3/29).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Position Formation - 45m Interval - SIRIHello Everyone,

The stock (SIRI) has quite a significant uproar in (bullish) demand, as there still appears to be room for more upward momentum throughout the next couple of days.

Resistance Level 1 - (6.05 - 6.25) 20 pip interval

Blue Horizontal Line - (5.75 - 6.00) 25 pip interval

Support Level 1 - (5.45 - 5.70) 25 pip interval

PA - (5.70 - 5.85) 15 pip interval, after price influx (bull)

Furthermore, consider the current RSI level (Almost overbought threshold). Further analysis and patience of market movement may be necessary for proper judgment.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Potential Breakout Opportunity - 4hr - AUDUSDHello Everyone,

The currency (AUDUSD) has been on a negative (bearish) trend for quite a time length. A transfer in trend (direction) is imminent soon. (or a correction within a few days times). Further analysis and patience is necessary before entering a position. (Wait for confirmation or infiltrated S/R Levels)

Resistance Level 3 - (0.72940 - 0.72965) 25 pip interval

Resistance Level 2 - (0.72070 - 0.072100) 30 pip interval

Resistance Level 1 - (0.71690 - 0.71715) 25 pip interval

Blue Horizontal Line (KPZ) - (0.71150 - 0.71175) 25 pip interval

Support Level 1 - (0.70520 - 0.70550) 30 pip interval

Support Level 2 - (0.70015 - 0.70040 25 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Long Position (Trend Transfer) - Daily Interval -EURUSDHello Everyone,

The currency pair (EURUSD) has manifested a rejection (failed infiltration) at Support Level 1. Since this instance, the pair will continue to an upward momentum until Resistance Level 1.

Resistance Level 1 - (1.18125 - 1.18155) - 30 pip interval

Key Price Zone (KPZ) - (1.14410 - 1.14440) 30 pip interval

Support Level 1 - (1.11780 - 1.11810) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Principles)***

-LionGate

Correction Imminent - 4hr Interval - ABILHello Fellow Traders,

The stock (ABIL) PA (Price Action) is exposed to a trend transfer within the next few days. Consider the previous uproars (bullish) in momentum. Further analysis and consideration is necessary prior to entering the market.

Resistance Level 2 - (14.40 - 14.65) 25 cent interval

Resistance Level 1 - (7.95 - 8.20) 25 cent interval

Blue Horizontal Line (KPZ) - (2.80 - 3.10) 30 cent interval

Support Level 1 (Significant Aide) - (1.40 - 1.65) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Principles)***

-LionGate

Trend Transfer - 45min Interval - EURCHFHello Everyone,

The currency pair (EURCHF) appears to be shifting trend direction as numerous buyers (bulls) are entering the market. (Be cautious of a false reversal, wait for confirmation).

Resistance Level 2 - (1.12550 - 1.12580) 30 pip interval

Resistance Level 1 - (1.12185 - 1.1215) 30 pip interval

Blue Horizontal Line (KPZ) - (1.12105 - 12.130) 25 pip interval

Support Level 1 - (1.11610 - 1.11640) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Potential Trend Continuation - 45min Interval - GTXIHello Fellow Traders,

The stock (GTXI) presents a subtle and "non-movement" position within the (4hr + intervals). In the 45min, however, the stock appears to be pulling northward (bullish) for a further continuation from previous average highs.

Resistance Level 2 - (2.45 - 2.65) 20 cent interval

Resistance Level 1 - (1.60 - 1.85) 25 cent interval

Blue Horizontal Line (KPZ) - (1.35 - 1.60) 25 cent interval

Support Level 1 - (0.95 - 1.20) 25 cent interval

Support Level 2 - (0.70 - 1.00) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Volatile Past - 4hr Interval - ADMAHello Everyone,

The stock (ADMA) PA (Price Action) has been nothing but (IMO) an eye opener. As numerous traders were seeking to short the stock at price intervals (4.10 -4.15), there was another (bullish) penetration in the stock's trading average. This certainly is lesson for anyone interested or keen on investing in the stock market. (Avoid sporadic price fluctuations, be diligent and considerate of market catalysts)

Resistance Level 2 - (6.80 - 7.10) 30 cent interval

Resistance Level 1 - (5.80 - 6.10) 30 cent interval

Blue Horizontal Line (KPZ) - (4.30 - 4.55) 25 cent interval

Support Level 1 - (1.90 - 2.20) 30 cent interval

Furthermore, risk management is pivotal when attempting to trade such a stock. (Do not let impulsive actions wipe-out your account).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Plan)***

-LionGate

Consolidation Taking Place - 30min - LINUFHello Everyone,

The stock (LINUF) has begun to consolidate at PA (Price Action) levels (0.037020 - 0.012578), which can be quite a discrepancy in value. There does not appear to be any (solidified) S/R levels that can implicate a viable position at this moment in time (IMO). Further analysis and patience is ideal within any trading strategy.

Resistance Level 3 - (0.131140 - 0.121170) .000030 cent interval

Resistance Level 2 - (0.099750 - 0.099790) 0.000040 cent interval

Resistance Level 1 - (0.039650 - 0.039680) 0.000030 cent intveral

Blue Horizon Line (KPZ) - (0.023985 - 0.023105) 0.000020 cent interval

Support Level 1 - (0.009920 -0.009950) 0.000030 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Position Formation - 4hr Interval - USDCADHello Everyone,

The currency pair (USDCAD) throughout the past week consolidated and then gained traction towards a downward (bearish) identity. A reversal or further consolidation may be imminent. Be cautious and let market action take place (Support Level 1 or Resistance 1).

Resistance Level 1 - (1.34680 - 1.34730) 50 pip interval

Blue Horizontal Line - (1.33200 -1.33250) 50 pip interval

Support Level 1 - (1.32430 - 1.32480) 50 pip interval

Support Level 2 - (1.31100 - 1.31150) 50 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Plan)***

-LionGate

Current Consolidation - Daily Interval - ONTXHello Everyone,

The stock (ONTX) began price consolidation after a tremendous push north (Bullish). As of currently PA is immensely volatile and I advise caution when longing or shorting this stock.

Resistance Level 3 - (11.15 - 11.35) 20 cent interval

Resistance Level 2 - (5.90 - 6.15) 25 cent interval

Resistance Level 1 - (4.70 - 495) 25 cent interval

Blue Horizontal Line (KPZ) - (3.35 - 3.65) 30 cent interval

Support Level 1 - (1.55 - 1.80) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Potential Short Position - 4h Interval - PULMHello Everyone,

The stock (PULM) experienced rapid growth (bull) within today's market. Considering the current sporadic momentum upwards, there is none-the-less an opportunity to short the stock till price consolidation.

Resistance Level 1 - (4.30 - 4.50) 20 pip interval

Blue Horizontal Line - (1.80 - 2.10) 30 pip interval

Support Level 1 - (0.50 - 0.80) 30 pip interval

Furthermore, (PULM)'s Net Income: -18.056M which can be quite alarming, as their return on assets is negative as well (-1.1653). If they can revitalize the negative totals (into positive), there still may be hope for them in the coming months and year.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Potential Correction - 4hr Interval - ADXSHello Everyone,

The stock (ADXS) has none-the-less presented an immense amount of volatility within the last few days (2). The overall trend of the stock, however, is pulling downwards (Bearish) towards territory that hasn’t been contest since (2009).

Resistance Level 2 - (14.70 - 15.00) 30 cent interval

Resistance Level 1 - (10.75 - 11.00) 25 cent interval

Blue Horizontal Line - (8.00 - 8.30 ) 30 cent interval

Support Level 1 - (2.55 - 2.80) 25 cent interval

Furthermore, this is highly sporadic stock and should be handled with immense caution. (Wait for PA confirmation prior to entering a position)

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Principles)***

-LionGate

Position Developing - 45min Interval - CELHello Everyone,

The stock (CEL) has appearing to garner a modest amount of upward momentum. In the very least, PA is either attempting to consolidate at current price levels or formulate a breakout position. (Let Market Action Take Place and Then Form Your Decision).

Resistance Level 1 - (7.45 - 7.75) 30 cent interval

Blue Horizontal Line - (4.25 - 4. 55) 30 cent interval

Support Level 1 - (5.30 - 5.55) 25 cent interval

Support Level 2 - (3.40 - 3.70) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Reversal Impending - 4hr Interval -VUZIHello Everyone,

The stock (VUZI) appears to have endured a significant amount of sellers over consuming buyers (bearish market). In this regard, an immediate (or within the next formation) reversal may be in order to either consolidate at current PA (Price Action) level or breakout to lower lows (or higher highs). Further is always necessary prior to trading transfers

Resistance Level 3 - (7.15 - 7.45) 30 cent interval

Resistance Level 2 - (5.25 - 5.65) 40 cent interval

Resistance Level 1 - (3.70 - 4.10) 30 cent interval

Blue Horizontal Line - (3.15 - 3.35) 20 cent interval

Support Level 1 - (2.45 - 2.75) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Position Formation - 4hr Interval - EURJPYHello Everyone,

Currency Pair (EURJPY) appears to be forming various potential setups within the upcoming weeks.

Blue Horizontal Line - (125.475 - 125.525) 50 pip interval

Resistance Level 1 - (126.185-126.235) 50 pip interval

Resistance Level 2 - (126.750 - 126.800) 50 pip interval

Resistance Level 3 - (127.475 - 127.525) 50 pip interval

PA (Price Action) - (124.700 - 124.850) 150 pip interval

Furthermore, the resistance levels represent possible formations if the (blue horizontal line) is coupled (broken). Which can provide further bullish momentum to hit Levels (1-3). As for the current price action, let the market run its intended course and then wait for confirmation at (blue horizontal line).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Reversal Imminent - 45min Interval - EURUSDHello Everyone,

The currency pair (EURUSD) has been on a (bearish) trend since (March 20th -21st). Considering the present PA at Support Level 1, there is a plausible opportunity to believe that the pair will be in an uptrend (or consolidation) within the next few days. Wait for further price confirmation. The PA has broken numerous consolidation levels to further progress downwards (March 25th -26th, March 28th - April 1st).

Resistance Level 1 - (1.13915 - 1.13945) 30 pip interval

Support Level 1 - (1.11890 - 1.11920) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Diligent and Stick To Your Trading Plan)***

-LionGate