A Double Bottoms Pattern!The double bottoms pattern is a common chart pattern used in technical analysis, including scalping strategies. It is a bullish reversal pattern that can signal a potential trend reversal from a downtrend to an uptrend.

- In scalping, traders aim to take advantage of short-term price movements and generate quick

profits. The double bottoms pattern can be used to identify potential buying opportunities for

scalpers. Here's a general description of the pattern:

- Downtrend: The price is in a downtrend and reaches a low point, forming the first bottom

(low).

- Reversal: After the first bottom, the price bounces back up but fails to sustain an upward

movement, leading to a minor pullback.

- Second bottom: The price then declines again, but this time it does not reach the previous

low. Instead, it forms a second bottom, which is typically higher than the first one.

- Confirmation: Once the second bottom is formed, traders look for confirmation signals to

enter a long (buy) position. This may include a breakout above a resistance level, a bullish

candlestick pattern, or an increase in trading volume.

- Target: The target for the trade is often set by measuring the distance between the bottoms

and adding it to the breakout point. This provides an estimate of the potential upside move.

- It's important to note that scalping strategies often rely on quick trades and small price

movements. Therefore, it's crucial to incorporate additional technical indicators, such as

momentum oscillators or moving averages, to enhance the accuracy of the signals and

manage risk effectively.

Remember, before implementing any trading strategy, including scalping, it's advisable to thoroughly backtest and practice it in a simulated or demo environment to gain confidence and refine your approach. Additionally, risk management and proper position sizing are essential aspects to consider in scalping or any trading activity.

Patternception

XMRUSDT wants the necklineThe price is testing the supply zone on 178$ where the market created an important daily resistance on the 0.5 Fibonacci level.

On the 4h Timeframe the price created the W pattern and we can find the neckline on 150$.

How approach it?

If the price is going to lose the support on 160$, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

ETHUSDT is testing the weekly support The price bounced to 0.618 Fibonacci level on the daily timeframe (2900) and now the market is testing the previous daily support case for new resistance.

on 4h Timeframe, the price created two M patterns and the price is testing the second neckline above the 3100

How to approach?

IF the price is going to lose the weekly support and retest it as new resistance According to Plancton's strategy , we can set a nice order

Be aware to False breakout

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

Candle FormationThis post is not a trading idea, but for our learning together.

1. False Break

In general, many of us know that the false break is when the price breaks through the Resistance/Support area but the candle fails to close outside that area. When this happens the candle will create a wick.

However, a false break can also mean the candle has successfully closed outside the S/R area, but in the next candle the candle reverses direction again.

As in the example on the left side, there are several examples of candle formations that indicate a false break.

When this candle formation is formed we can enter the next candle with a stop loss above the previous candle (sell) or below the previous candle (buy).

2. Inside Bar & engulfing Candle

For inside bars, it is very good to use for a fairly strong trend. i.e. when the price has no clear correction or pullback.

for entry using this candle formation can be seen on the chart.

As for the Engulfing Candle, it can be used when a trend occurs and the price forms a pullback or correction. When the price pulls back, look for this candle formation to enter as a trend continuation.

AUDJPY Fibonacci ClusterThe price formed 2 harmonic patterns in the support area.

In this complete pattern, there are several Fibonacci levels that coincide with the support area.

So that it is possible to become a cluster as an area reversal.

If the price stays above this level, it will go to 38.2 and 61.8 level as default targets for the harmonic pattern

EURUSD False BreakOn the H4 Time frame, the price initially seemed to break support.

However, the price has tried to fight several times.

Currently price make a strong movement and create a large candle.

If the H4 candle closes with a large candle, then we can buy on the next candle.

On H4 and H1 we also have a bullish divergent which is an indication of a strengthening.

USDCHF Bulish ContinuationCurrently the price is forming a falling wedge as a bullish pattern.

And this will be a trigger for a bullish continuation.

After previously forming a bullish shark pattern and double bottom.

The previous high or 100% point CD is the final target for the shark pattern and also becomes a complete ABCD.

get ready to take buy position when the price breaks this falling wedge

CADCHF Shark 224 CADCHF completed Bearish Shark pattern at level 224

then the price forms a double top as a reversal pattern and breaks the neckline

the price is currently making a correction into neckline.

we can take the sell when the price breaks this correction area with profit targets at the level of 50, 61.8 and 100 percent of CD leg

GBPUSD Sell AreaIn last week's trading, GBPUSD fell quite strong and we need to wait for the price to pullback before another sell.

At the beginning of this week, the price made some upside movement.

The sell area is the S/R area, 50% retracement of the total swing and 61.8% of last week's swing.

This area will hold the price to go up even more.

- For aggressive entry, you can set a sell limit in that area.

- And for conservative entry, you can wait for rejection in that area and wait for correction on a smaller timeframe

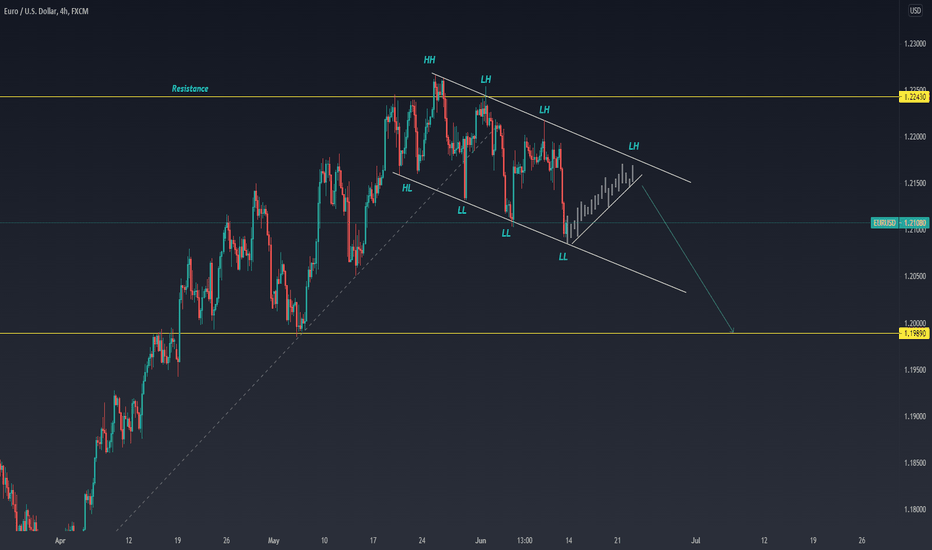

EURUSD AnalysisEURUSD fell quite strongly on Friday' and break its support and form a new low .

In the previous movement the price declined after touching the resistance area.

Then the price broke through its up-trendline and formed a lower low.

We can expect the price to make some correction first before another downside movement.

sell can be done after the price breaks the correction area and targeting the next support/yellow line.

AUDCAD Daily ABCDOn the daily chart the price completed the ABCD Pattern in the support area.

From here we look for opportunities for a bounce from support.

Currently the price is still correcting and we can wait for the price to break this correction area

before deciding to buy.

we are also have a bullish divergent on MACD.

If the price manages to get out of this correction channel, then the opportunity to go up is very open

AUDUSD Sell SetupPrice retesting weekly resistance area, then reverses and breaks the trendline.

RSI also shows a bearish divergent.

However, the price is currently testing the support which is the neckline area of the potential head and shoulders pattern.

From this level the price may react by bouncing back.

We can sell when the price is testing the grey area which has the potential to become the right shoulder