How To : Chart Formations Critical Second Top & Bottom Entry Hi Traders and Investors

This video is a follow up from my previous posting dealing with shifts of momentum.

This time we are looking to add an additional synergy - the second touch in a chart formation - which can be found in Double Tops, Double Bottoms and head shoulder formations. Correctly using the second touch on the chart formations has allowed me to avoid many mistakes in my evaluating my trades and I hope that it will help you in evaluating your trades.

When you look at the Double Top and Double Bottom chart formations, you will notice that high frequency trading and algorithms trading will often create the formation of a second top to the same level as the first top or slightly higher by taking stops pilling at the first top . At this point, you want to wait for the synergies to come into play and use your tools to look for a shift in momentum on the 2nd top touch see video.

Waiting for the shift in momentum to occurs after the second touch, is a critical piece of of information that will prevent you from taking trades that are likely to be stopped out on the first test.

Hope it helps have a great week end

Marc

Patterns

#BTC/USDT 1D UPDATE BY Trader_SL #BTC/USD Chart Update

2022/04/13

1D TIME FRAME

As you see in the chart, BTC is trading inside a rising channel and currently sitting at the lower level of the channel. In the past scenarios, we have seen BTC bounce many times after hitting the lower level of this channel also we can see Bitcoin now is with hidden bullish divergence So I'm expecting a bounce in the market from this level and making another Higher low.

If any daily candle closes below this channel then this scenario becomes invalidated. Let's see. I'll update you.

This is not a piece of financial advice.

Do hit the like button if you like it and share your charts in the comments section.

Thank you!

XAUUSD Overall Bullish

Good Afternoon traders we are looking for the massive pennant formation to continue to the upside.

Will be looking to add additional positions around g 1940-1942, looking for gold to move into the 60's and potentially the 80's depending on how we see it react once reaching 1960.

As always trade proper RR live to trade another day. Let's make some money guys.

Thank you for watching.

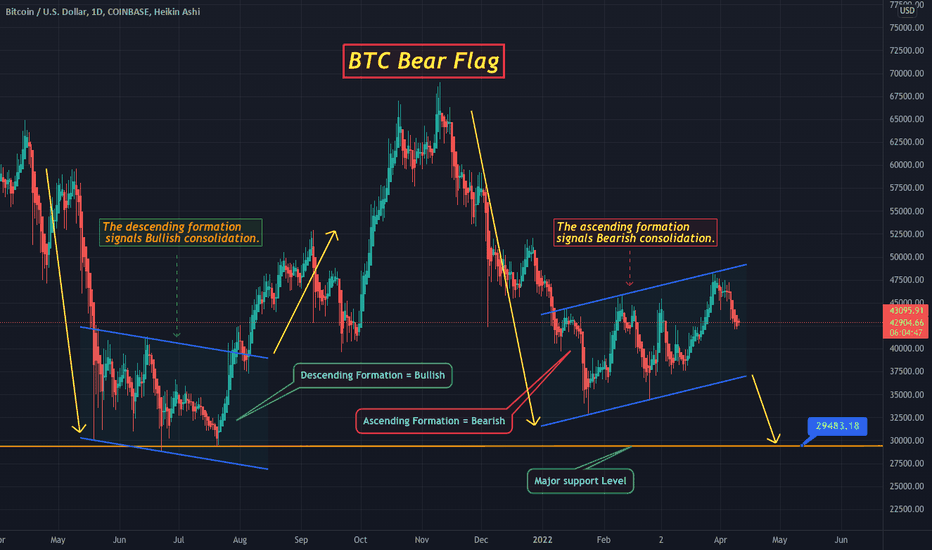

Bitcoin Bear Flag - What this means for Bitcoin's Future...Hello Traders,

Today I will be discussing the formation of a Bear Flag and what this means for Bitcoin.

- As you can see on the chart BTC has been consolidating in an "Ascending" parallel channel since January.

1) An ascending formation is typically a Bearish signal.

2) In conjunction with the downtrend from the highs at $69K in November, this creates a bear flag.

- Now I'm sure some of you may be wondering... Well BTC consolidated last year in a channel before the massive pump to $69K, so won't Bitcoin do the same this time? - The answer is no.

- Last year Bitcoin consolidated in a "Descending" channel which is typically Bullish.

- As expected BTC pumped coming out of that Bullish consolidation.

- This time BTC has created a Bear Flag and has a much higher probability of continuing lower before hitting previous ATH's.

So what does this mean for BTC? Here are the 3 possibilities I see playing out..

1) (Highest Probability) BTC retests the $36K support level

2) (Medium Probability) BTC retests the $29K support level

3) (Lowest Probability) BTC retest the $20K support level.

I want to emphasize... Patterns have a certain probability of playing out. Bear flags have a relatively high probability of playing out and BTC has formed a textbook Bear Flag. This means the probability of BTC breaking down and even hitting $20K are still relatively high. Sometimes you have to zoom out and look at the bigger picture. I'm sure a lot of you will be discouraged by this, but think of how incredible it would be to accumulate BTC back at $20K!?

Good luck everyone and happy trading!

BTC for funThis is the same chart I posted earlier

I've watch more times like this that I can count, I thought it might be fun to see if I could predict how it would move.. (there's no doubt that the chart will have inaccuracies)

This chart isn't in any way to be taken very seriously or traded around.. Just seeing how accurate I can get, and posting this publicly gives me added pressure....

Good luck and best regards

The BTC Bart Sucks - We have better things to do with our timeDid you have been there the BART (Simpson pattern) of course bitcoin isn't new to the game on this pattern, probably as old as time itself (not scientific, don't sweat me chart champions :)

... ultimately it's the "Gartley Classic 22" pattern.. You end back where you started... if I wasn't trading with sinful amounts of leverage I wouldn't care at all..

(really care with leverage either-- other than I have to pay constant focused attention to what's happening)

XABCD Pattern, Short trader with good probabilityThis pattern indicated that the NZD/JPY could drop nicely this week, looking at the daily chart, and it could bring some decent profits.

But of course, this is just basic technical analysis.. 100% accurate, detailed, and precise trades are forever available to our wonderful clients.

We will update the idea on our blog's analysis section so we can help you remove stress and risk from it :)

Trading by yourself carries a ton of risk, it's best to leave it to professionals to handle the risk for you.

Bank nifty long position Hi Everyone... Hope you all are doing good....

So let's talk about today's trade as you all know from last few days market gives us a gap up opening and after opening market moves in a short range....

So how we have to work in banknifty let's see...

Conditions...

1. There is a strong resistance at the level of 36600 so if banknifty break this level and give us closing above the level then go for the CE and the tragets are 36800, 37000 and the last one is 37300

2. If banknifty breaks the previous day low which is 36300 then go for the PE and the target is 36100, 36000 and the last one is 35800

Hope you all are understand the levels and please follow and like for daily updates.

GBPUSD : STRONG BULLISH MOVE

Hello traders.

GBPUSD had created a beautiful M structure previously and now has retested (Retraced to) the neckline of the M structure and shown above.

Rejection of the necklines, shows a clear and strong indication of continuing bullish movement.

Short your positions from MO day session opening and hold it for a long period of time with Targeted price 1.27555

Bitcoin Bearish Gartley: Will it Reject 48.2?So far, this bearish gartley harmonic has been accurate to the relative tee. I assume now, we reject around the 48k area, and push further back down to retest trend... This to me, would confirm a bear market for quite some time 6-12 months is possible. If we look at VWAP and Daily/Weekly/Monthly supply levels, we should reject.

We will find out soon.

If you haven't longed I would not enter any trades here. If you are looking for an entry. I would short if we reject of the 48k level, and reclaim the D3 Supply lows... thats where I would enter a short.

Patience Pays

Daily forecast on a WC daily forecast on a WC!

i see this as a good risk to take given the confluences of the higher time frame not breaking that high, so their is a likelihood of price moving back to the upside. given the structure and the price action on the higher time frame i can see a last leg forming to an ascending structure. an entry can be made out on the 4H in the form of a larger flag, its just a matter of pulling that trigger at the right moment for me now. a risk of 1% will be executed if the criteria is met to my trading plan, if im stopped out im happy with the position in this frame of mind - given the potential this move has to the upside.

Education Post: Double TopBTC has been bearish over the last week or so, but why? On the chart you can see I've attached a photo of a double top pattern, which is exactly what BTC has formed and played out the last couple of days. There's not much to say about this pattern as it's self explanatory. Looking at patterns is a really good way to predict future price movement as you can see this pattern played out exactly like the photo. You can google these patterns as there are loads of them.

Now looking at the chart there's not a lot we can use to infer where BTC will move next, however the RSI is becoming oversold on D1 and is moving towards its support line. I'm looking for a small bounce here but I'll need to do some more analysis tomorrow which I will share.

Hope this post helped:)

Trade safely

UDATE on Triangle Pattern From Feb3Hello Traders Here IS The Triangle Pattern From FEB 3 That Has Indeed Formed. IF You Took The Buy From The Last Data Point Of The Triangle Before The Break You Would Have Caught bout 150 PIPS OFF That Trade. Currently Price Is Testing Off The Completed Triangle So BUY! BUY! BUY! You Can Set Your TP At The Original TP Or You Can Hold From The Break/Retest To However Many Pips There Are From The Top Of The Triangle To The Bottom Of The Triangle ( This Is Around Where The Breakout Will complete Its Self. Just observe its movement overtime to see this play out.This is how patterns work). If YOU ENJOYED THE PATTERN AND TO SEE IT PLAY OUT PLEASE LET ME KNOW IN YOUR THOUGHTS IN THE COMMENTS AND LIKE AND FOLLOW IF YOU DONT MIND :) ENJOY!