LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

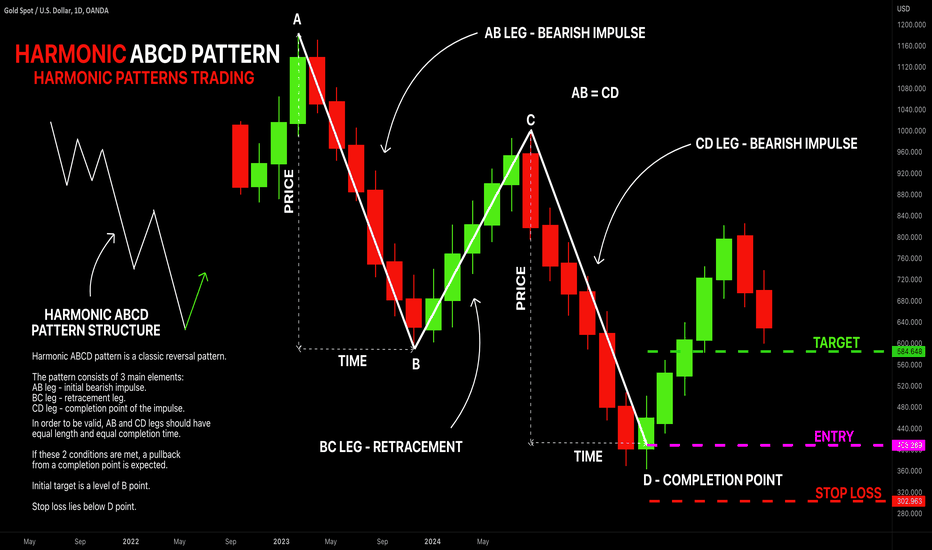

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Patterntrading

BITCOIN TECHNICAL ANALYSIS IN THE LONG TERM (SHOCKING REVEAL)The total evaluation for BTC chart is bearish. Please be mindful of your risk management as we are, despite the momentum of the bearflag or rising wedge, is still magnanimously bearish overall. This corresponds very well with my NASDAQ chart that you can see in my profile. I am thinking that even if we push up for one last market maker fake out, 26,200$ is the final fake out WITH RESPECT to the monthly resistance trendline. Question is, can this be broken? Absolutely, however until then we have to stick with what we have displayed in our computers telling how bearish the market is.

Do not forget to like, follow, share and comment so I would know what you think! Thank you everyone. :)

POLKADOT PERSONAL ANALYSIS IN THE LONG TERM (SHOCKING REVEAL)The total evaluation for DOT asset is bearish . Please be mindful of your risk management when it comes to buying at certain level. It is truly key to recognize designated levels at which volume and trading activity can be found, I have already provided you with the volume profile on the left to assess your judgement. The green line as it shows is a representation of market structure activity that truly respects the descending triangle , however any move significant enough to breakout and confirm its stand outside of this is more than welcome. Hey, no one wants crypto dead you know! However, until then, I will short every rally in accordance with the November 2021 trendline and descending triangle trendline.

You may save this chart for future reference. Bookmark it! Do not forget to like, share and comment :D -- Come back here again when it plays in our favor or not!

TMD - STOCK - LONG - ASCENDING TRIANGLETITAN MEDICAL INC. STOCK displays an ascending triangle pattern. Entry is at the breakout of the pattern make sure this coincides with a volume increase to verify breakout.

Exit is shown in the chart (Flag).

Trading opportunity for RVNUSDT RavencoinBased on technical factors there is a Long position in :

📊 RVNUSDT Ravencoin

🔵 Long Now 0.03616

🧯 Stop loss 0.03130

🏹 Target 1 0.04200

🏹 Target 2 0.04800

🏹 Target 3 0.05600

💸Capital : 1%

We hope it is profitable for you ❤️

Please support our activity with your likes👍 and comments📝

ETHEREUM - 2000 or 700?COINBASE:ETHUSD seems to be in the final stages of this correction.

It mightve already topped out if we look at the Monthly AI or there could be one more high up towards 2000 to complete multiple patterns and the 382 from the April 3 High.

Weekly AI has a High/Low late on the 9th of August. Keep an eye out for this to play out. If we are at a high then we will look for short opportunities and if its a low we will look for longs.

A different look at the market. I hope this helps. Enjoy the week. 👍👍

ETHUSDTHello my dear friends

I'm not very familiar with harmonic patterns, but according to price action, the price should enter a very quick correction.

It must be released from this state of compression.

If we want to look at the chart from a different point of view, it seems that if the price range of $1,655.52 is completely consumed and the first target of the pattern is hit, by observing the loss limit, we can reach the specified range (1,726.24 $) enter into the transaction.

We would be happy to hear your comments

BITCOIN - Possible Top Saturday??COINBASE:BTCUSD is still edging higher with now real confiction. Im thinking we are coming to the end of this rally.

If we take a look at the AI for this week then we could see this have one more rally into Sat evening or has the high already been made just shy of 25k?

There are a lot of unfinished patterns just above 26k with multiple ABCDs and the 61.8% level from the May 31 high @ 26700.

Some things to watch over the coming days. Enjoy the day. 👍👍

Learn Ascending Triangle | Classic Price Action Pattern 📚

Hey traders,

In this educational video, I will teach you how to identify an ascending triangle.

We will discuss the structure and the bias of this patter

and how to apply that in analysis.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

ETH - Change in Trend Window.COINBASE:ETHUSD Is in a CIT Window which could see it reverse into this evening.

There is also a smaller pattern completing between 1680 - 1700.

Lets see if we can get a reaction here.

This is the set up we look for, A rally into the expected CIT window with a pattern.

I hope this helps. Enjoy the day. 👍👍

Possible next move in SPXHi everyone.

Today I'm gonna talk about SPX. In this moments the price have 2 posibilitties:

Option A: We have a double bottom pattern and the price will go to the level of pattern and then we need to wait a intentional canddle who confirms the change pattern. In this point it's good enter to long (more risk)

Option B: The price will go to te resistance and then will fall to the support (here we can enter with a short). In the support we need to wait if the price will go down or bounce to the resistance again

(good opportunity to enter long)

Thanks for read this and leave me a comments or questions and if you like this analysis, follow me.

See you soon !

EURCAD Growth to Resistance 150+ PipsWelcome back! Let me know your thoughts in the comments!

**EURCAD - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Brian & Kenya Horton, BK Forex Academy

BTC - Correction Day??COINBASE:BTCUSD looks to be headed for a correction today.

10:30 & 18:30 are critical turn points if we rally into these times then we should see some selling.

Ideal scenario would see us back down to 22k over the next couple of days.

Also Major planetary event this weekend which could change things.

I hope this helps.

Enjoy the day. 👍👍

Trading opportunity on DOTUSDT PolkadotBased on technical factors there is a Long position in :

📊 DOTUSDT Polkadot

🔵 Long Now 6.69

🧯 Stop loss 5.90

🏹 Target 1 7.50

🏹 Target 2 8.40

🏹 Target 3 9.25

💸Capital : 1%

We hope it is profitable for you ❤️

Please support our activity with your likes👍 and comments📝

ETH heading strong resistance and good support levelshello all

i think we breakout from a range area and surpass the 1280 resistance.

now we reach 1650 resistance and the market react to it.

so i think we have a pullback to 1300 area and after that toward 1650 again

and repeatedly react to 1650 resistance and after that will go for 2000 resistance.

also maybe we have a 50% correction of this impulse wave that shows the 1300 level too.

Etherum has good fundamentals according to merge upgrade.so this targets are reachable

in coming months.

share me your opinion in comments.