Paysafe

PSFE Paysafe Limited Options Ahead of EarningsIf you haven`t bought PSFE before the previous earnings:

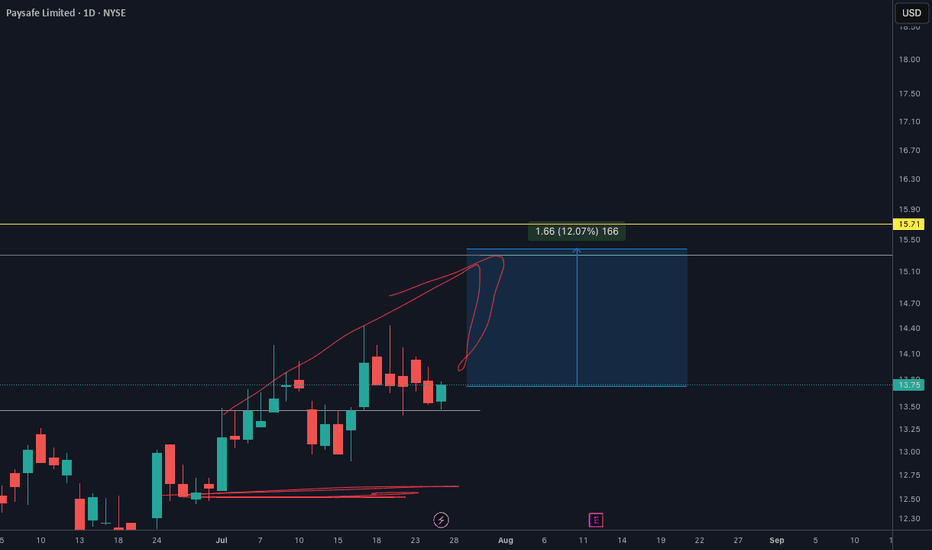

Then analyzing the options chain and the chart patterns of PSFE Paysafe Limited prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-5-17,

for a premium of approximately $1.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PSFE Paysafe Limited Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PSFE Paysafe Limited prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $0.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

PaySafe (NYSE: $PSFE) Continues To Trade Well Below IPO Price 💎Paysafe Limited provides digital commerce solutions to online businesses, SMB merchants, and consumers through its Paysafe Network worldwide. It offers digital wallet solutions under the Skrill and NETELLER brands, which enable users to upload, store, withdraw, and pay funds and APMs from a virtual account; Knect, a Skrill-related loyalty program; Net+Prepaid Mastercard, a companion product enabling NETELLER digital wallet active users to access and use stored funds anywhere that Mastercard card products are accepted; rapid transfer solutions; and issuing services for prepaid, virtual, and private label cards on behalf of its merchant customers. The company also provides eCash solutions, such as Paysafecash, a bill payment eCash solution that allow users to shop online and then pay offline in cash to finalize the transaction; paysafecard, a prepaid eCash solution; and paysafecard prepaid Mastercard that can be linked to a digital paysafecard account and used to make purchases. In addition, it offers integrated processing solutions, including a range of PCI-compliant payment acceptance and transaction processing solutions for merchants and integrated service providers comprising merchant acquiring, transaction processing, online solutions, gateway solutions, fraud and risk management tools, data and analytics, POS systems and merchant financing solutions, as well as support services for independent distribution partners. Paysafe Limited is based in Hamilton, Bermuda.

PaySafe (PSFE) looking for $6 and weekly oversold before reverseDescending wedge is showing more downside. Been a significant range for awhile now and weak price action is showing confirmation that this wants to head lower. I hope I'm wrong but would set buys for around $6. Think this is a great long term stock that has been unnecessarily beat up and manipulated. I think we see a solid bounce once weekly RSI is oversold and we approach bottom of the triangle. Long hold for me, i.e. 4-5 years.

Paysafe Limited LONG positionPaysafe Limited is an integrated payments platform. The company enables businesses and consumers to connect and transact in payment processing, digital wallet, and online cash solutions.

A decreasing trend of Paysafe can be seen since January. As we can see, there is a bullish confirmation indicated by MACD. Moreover, RSI shows an increasing movement. The price of stock hit a lower boundary of Keltner channel. Therefore, long position is recommended.

Position: LONG

Stop-loss: $ 8.6

Entry range: $ 8.79- $ 9.37

Target I: $ 10.62

Target II: $ 12.27

Target III: $ 13.96

NO FINANCIAL ADVICE

PSFE [Long]Paysafe Limited appears to be taking step 1 in a series of steps it must take to reverse the long downtrend it has been in most of the year.

The price is currently battling at the .236 fibonacci area from the previous swing high around $13. If bulls cannot hold above the .236 of this swing, then that means much more downside is likely.

Keep in mind, that when you have capitulation below the .236 followed by a run up back ABOVE it, it is usually very difficult for bears to force price action back below it and sustain it for long. In otherwords, breaking back above the .236 is the point of no return for bears.

An area I am most often a fan of for placing large position longs, PSFE currently above the .236 fib may be the setup many traders have been waiting on.

If this trade is taken, stop losses just below $10.63 would be advised ($10.58, $10.55, etc.)

Paysafe Falling WedgePaysafe is relatively new to the public market after being SPAC'd public end of March.

This company has been around for a while now as a private company and at one point was a public firm.

I like this stock, has a few big names as clients: $COIN, $RBLX, $DKNG

I think it'll be a slow burn, so I hold shares.

Falling Wedge pattern with earnings report May 11th.

You could wait until after earnings to see how it is, but I think we'll see a breakout of this pattern due to earnings.

By the way, if you have information about $PSFE, feel free to comment.

Paysafe Payout Round 2! 🤑BFT was a big winner last time we played a breakout on the January 27th write up and we were able to capitalize on a 26% move. BFT has spent the last month in a bearish downfall from $18 —> $12 when the market was selling off with uncertainty. Looking at BFT’s chart we sold off to $12.51 this past Friday but managed to rally with the market and close at $14.93. After hours trading saw price action close at $15.09 Friday afternoon so we will have to see where BFT opens at this Monday morning 3/8. Paysafe’s merger with BFT has the vote scheduled for March 23rd so we can see some bigger volume coming into BFT these next few weeks. I have been holding July calls since the end of January including averaging down this week and adding of shares. I will be looking to add April $15 or $17.5 calls for a momentum play.

Chart:

HVN & Fib ext: BFT has a HVN in the area highlighted from $14.50 to $15.88. This also coincides with the 38.2% & 23.6% fib extensions outlined in white. BFT over $16.32 can confirm a breakout back to the highs.

EMA’s : The Daily EMA clouds are all converging at the $15.40-$15.88 lvls which will serve as a strong resistance area. Price action closing over $16.32 lvl can trigger a bigger run.

Plan : $16.32 lvl break with volume accumulation, enter April calls. I expect $17.50 to serve as a resistance lvl and I will watch to see how it behaves there.

*Big believer in the Fintech sector and I think Paysafe has the opportunity to easily break the $20 price range. Ultimately this momentum play in the short term will be affected by the overall market sentiment. Tech has been very weak the past two weeks and although futures and market sentiment has been a little more bullish due to Friday’s closing I am still hesitant and will be playing smaller. If the tech sector gets hot again watch out for BFT to run into its merger as it gains more attention.

BFT Long Opportunity! Paysafe will payoutToday we saw a strong bearish move in SPX, its biggest since October. Accompanying this was a strong sell off in a wide variety of sectors. This can definitely be the beginning of a bigger correction but that also means there is plenty of stocks that will be touching prices we haven't seen in a long time. The SPAC movement lost some momeuntum the past few days with the WSB short squeezes and market pandemonium that ensued. However, I think that top SPACs will have the attention turned to them sooner rather than later. BFT is one of those. I will not dive into BFT and its merger with Paysafe but leave that up to your own DD but, I will post a link below that is informative. I was put on to this specific stock by Mr. Aaron so shouts out to you.

BFT is currently on a 25% sell off from its ATHs just three days ago, reaching the 19.54 lvl. The most intriguing part about it was today's massive volume compared to the previous 4 days (20 million vs 8, 14, and 8 respectively). Looking at the short volume from today's action almost 2 million of that was short volume. Today's action showed a significant decrease in the short volume ratio which is something to be aware of as we note this 25% sell off the past few days.

For more details about BFT and its merger with Paysafe check out this link www.nasdaq.com

Chart:

Today we had a huge gap down and subsequent sell off. I suspect many shorts taking profits as we enter levels of stronger support. We are currently sitting at a HVN at the $14.73 range. Watch to see what BFT does tomorrow and Friday (1/28 & 1/29). I am overall looking to add BFT to my portfolio because I believe Paysafe is a foundation of the payment processing sector.

4h RSI: 28.62

4h MACD: significant bearish momentum

Volume: The key for a bottom --> consolidation --> bounce here will be the volume. It will tell us when a reversal is likely. We are touching the POC on daily chart.

Plan: Depending on price action tomorrow I would like to enter the trade in the 14.40-15.27 range. If we continue to sell off I am eyeing the 14-13.65 lvl of support for another entry. Ideally we want to consolidate at this 15 lvl for the next few days. We are still early on this stock and I am eyeing this for a longer term hold.

BFT Foley Trasimene huge upside potential!This can be big: Foley SPAC in merger talks with Blackstone's Paysafe - Bloomberg News

Nov 6 (Reuters) - A blank-check company set up by veteran investor Bill Foley is in talks to merge with online payments firm Paysafe Group Ltd, which is backed by Blackstone Group Inc BX and CVC Capital Partners!

The report, citing people with knowledge of the matter, said Foley Trasimene Acquisition Corp II BFT .U has begun talks with investors to raise more than $1 billion in new equity to support the merger, which would create a company valued at more than $10 billion. (Reuters)