PBF

PBF Energy (PBF) - Strategic Partnership and Growth Analysis! 🚀📈 Key Points:

Partnership: PBF Energy recently formed a 50/50 partnership with a division of global energy giant ENI.

Biorefinery Project: The collaboration is focused on supporting the financing of a biorefinery project.

Growth Driver: The biorefinery project is expected to be a significant growth driver for PBF Energy in the coming years.

Capacity Increase: The partnership is set to increase PBF's refining capacity and facilitate entry into key markets.

🔍 Analysis:

Strengths: The collaboration leverages complementary strengths and expertise from both companies.

Market Entry: Entry into key markets aligns with PBF Energy's growth goals.

Macroeconomic Factors: Positive indicators include strong demand for refined products and ongoing geopolitical tensions.

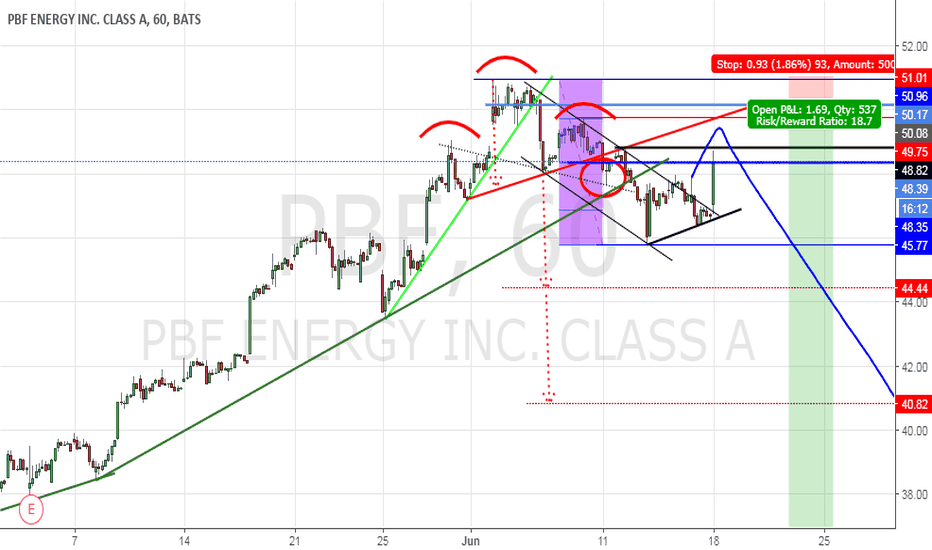

📉🎯 Trading Strategy:

Entry Range: Consider entry above the $41.00-$42.00 range.

Upside Target: Set an upside target in the $72.00-$74.00 range.

Analysis Consideration: Factor in macroeconomic trends and monitor developments in the biorefinery project.

🔄📈 Note: Stay updated on company announcements and market dynamics for informed trading decisions. 🚀💡 #PBF #EnergyStock #TradingAnalysis 🛢️📌

$PBF: Bullish trend continuation$PBF is a stock that trends very smoothly, in the daily and weekly timeframe and historically has given us a lot of good trades over the years. It has a low risk buy setup here, so it's worth playing it (also present in $CL_F, so you can trade either of the two, in my case I''m long oil futures but not $PBF yet).

Best of luck!

Cheers,

Ivan Labrie.

PBF Energy Inc Triangle BreakoutThe idea here is about PBF Energy Inc:

PBF Energy, Inc. engages in the operation of a petroleum refiner and supplies unbranded transportation fuels, heating oil; petrochemical feed stocks, lubricants, and other petroleum products in the United States. It operates through the following segments: Refining and Logistics. The Refining segment refines crude oil and other feed stocks into petroleum products. The Logistics segment owns, leases, operates, develops, and acquires crude oil and refined petroleum products terminals, pipelines, storage facilities, and logistics assets.

My view is bullish (Swing trade) for the below observed technical factors.

Points as per TA on a weekly & daily Chart:

1.Contracting or Symmetrical Triangle breakout on a weekly & daily chart at the time of publishing as per below:

2. Double Bottom formation under process at the time of publishing as per below:

3. Bearish Navarro 200 harmonic pattern CD leg in progress at the time of publishing as per below:

4. Trading way above 20 & 200 EMA on a weekly & daily chart.

5. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on weekly chart is Strong for an upward momentum at the time of publishing. However, Kumo twist on daily chart is weak & kumo breakout and kumo twist is neutral on monthly chart at the time of publishing.

6. RSI is at 58.59 on a weekly Chart and 61.02 on daily chart at the time of publishing.

7. MACD above signal line on daily chart & below signal line and converging on a weekly chart.

8. Hull Moving average is sell on daily & monthly and other moving averages are strong buy. However, weekly Hull Moving average & other moving averages on monthly chart is a strong buy.

9. ADX (Average directional index ) trend strength is at 14.37 on a weekly and 24.83 on a daily chart which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) Projected Target: provided in the chart as per double bottom & Bearish Deep Crab harmonic pattern. Trend is flat at the time of publishing.

Target: Provided in chart for double bottom & bearish Navarro 200.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

#PBF: Weekly uptrend, increasing demand amid driving seasonI like the setup in $PBF here, 35% upside at least from here vs a 14% downside risk. I'll keep an eye on the target zone, as this could move even higher over time, until the forecasted rally duration pans out. We had some great trades in this stock since the March 2020 bottom, last weekly signal panned out perfectly before, I think it will perform once again.

Best of luck,

Ivan Labrie.

MPC: Long term uptrend signal$MPC has an excellent long term uptrend signal at play here. If not long you should average in over 3 days at least, risking a drop to 43.42, or 3 daily average ranges down. Targets are 89.66 and potentially up to 143.09 in the long run, to be hit by or before Q4 2019.

My mentor, Tim West has been adamant about $MPC's strengt, and so far he's been right. This stock has shown relative strength, selling off less than its peers and rallying more and with lower volatility, indicating that there are some big players involved, buying in the background.

Fundamentals are great for this company, and valuation is compelling, so it's a really low risk trade.

I'd reccomend holding this and $PBF for exposure in this sector.

Good luck,

Ivan Labrie.

PBF: Excellent 'Time at Mode' signalsPBF is tracing a downtrend, sadly, since it didn't bottom at the recent low...I had to take a loss on my recent entries, and I'll wait for it to hit the lower targets to reenter. My idea is perhaps to short put options at the target, and either get assigned, or get profit from the premium on expiry. Either way, it's a great trade if we take the long side.

Fundamentals are good, and this is a good addition to any portfolio, we just need to time a good entry here and let it ride. The yield is worth it.

Good luck,

Ivan Labrie.

Portfolio update: I'm long a few thingsThis is how my equity portfolio looks on the long side -plus a stake in $RVLT-. I also have shorts in $NVDA and $NFLX, which -if we consider that $CEF and $TLT are pretty much like shorting the market-makes my portfolio 51% long, 1% in cash and the rest 'short'.

I'll hold this for the time being, watching the developments here onwards.

Good luck,

Ivan Labrie.

Global update: I'm out of most equity positions for nowExcept for $NVDA short and $RVLT long. You can see how these fared against $SPY this year.

I'm anticipating a breakdown in $NVDA, and maybe some kind of correction in $SPY, which would give us a lot of great opportunities next year, so, for now, I take my modest profits in equities home for the year and let these two running.

I'm in BTCCNY, RVLT, NVDA short, USDSEK, USDTRY, USDNOK, EURUSD short, USDJPY for the time being, and will look to reenter my other positions next year.

Cheers,

Ivan Labrie.

PBF: In an uptrend, buy dipsI'm looking to reenter PBF at support near the 27.55 mark. I've highlighted my recent trades in the chart, showing my exits and reentries. I'm adept at working like this instead of holding during corrections. I anticipate the turns based on price action around key levels, and the application of Tim West's 'self contrarian' signals that we use to time exits in good profits, or trail stops and add to positions.

What we do is constantly asessing our own emotions regarding our positions, specially the winning ones, since this gives us a great edge in finding good profit taking zones, and determining when to reenter positions.

I'd reccomend buying a position gradually near the 27.55 mark, starting as soon as Monday would be ok, but ideally the correction will last until December 14th which is what I estimate.

I'd reccomend opening a 7% size position if we hit 27.55, and you can look to add once in profit confirming the rally. Entering over a week would be better.

Good luck,

Ivan Labrie.

PSX: Warren Buffet's callThis stock is acting great (and similarly to $PBF and $MPC, it's a great long term play, with immediate entry parameters).

If not long the stock you can look to get long on either, dips to support, price moving above the previous daily close or a new daily high. As long as it stays above the light blue box, it's highly likely accelerating to the upside, and heading to 84.53 in the short term.

Good luck!

Ivan Labrie.

PBF: Potential long term long zone and daily swing tradePBF has a nice bullish setup in the daily chart. After an extended decline, it's likely to move back up to meet the weekly downtrend mode after the time projected in the weekly expired right at the bottom. Daily charts are setting up as bullish with RgMov making a new high ahead of price, and a potential Time at mode uptrend signal about to confirm if the next daily bar stays above 22.70 until the close. In any event, probability of a move up is considerable, and specially backed by rising crude, SPY, and the recent shortage of fuel in South America, which greatly benefits U.S. refiners like PBF.

Long term longs can be established at these levels, risking a specific percentage weight in your portfolio, or perhaps you can take the technical setup here and go long risking either 3 times the daily ATR (I reccomend this) or risking a drop under 22.70 after Monday's close (if this level isn't retested).

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance0.25% on such information.

PBF: Interesting long in the makingPBF has broken the inside downtrend line, forming a mode after rallying above earnings resistance.

Free cash flow has turned positive recently, and the stock looks to be accumulated and ready to rally very soon.

The dividend yield is quite attractive and I think we can see some nice upside in due time intil FCF yield is low again.

Look to enter longs at market, specially if the day turns up tomorrow, keeping stops under 31, or using 3 times the ATR value for them.

PBF might benefit indirectly from the rising crude oil price, but it's a company that can do well even while crude is falling, which makes it an attractive stock to go long on dips.

Good luck if taking this trade.

If interested in my professional trading signals, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers,

Ivan Labrie.