I Think I Should Just Trade This SetupI Think I Should Just Trade This Setup

So long story short, I just:

0. Assess whether price has Seeked Liquidity, or Rebalanced Fair Value to get a clue of current price intention.

1. Wait for Overextended Price (Bearish or Bullish), Higher TF = Better

2. Wait for 4HR up to 15min Divergence + Oversold/Overbought, at least 2 TF with same divergence

3. On 15min, plot your FVA (PDA must be respected).

4. Look for your FVG entry once price has left the FVA.

5. Target nPOCs that align with divergence + price action direction (ex. npoc below price + bearish div + premium array respected + bearish orderflow leg)

I've been winning "random" trades like this, no TradingView needed, just MT5, and has saved my funded account from imminent death lol. But here's how, if I looked back on those trades, I entered.

I mean, this makes sense. Combine Price Action(PDA + FVA Respected) with Volume Momentum.

Oh, and just to add. I think nPOCs from previous sessions give a good clue about where price wants to go.

For example, npoc below price + bearish div & overbought + premium array respected + bearish orderflow leg = target nPOC.

I might have to track tradingview entries to see if this actually works.

PDA

The opportunity to earn money on the vib exit pumpIn the coming days, against the background of the beginning pullback in the market, oversold coins from the delisting announcement may become very interesting for speculators, since for strong altcoins that have shown good growth this month, the probability of falling within the rollback prevails, and the threat of assigning the monitoring tag in the second half of the week hangs over weak coins. Today, there was not enough volatility in the market for the breakdown of vib wing and pda due to the lack of futures on them. After the stock market closes over the weekend, there is a possibility of a stable payback of these instruments with major breakouts. There is also a possibility of growth impulses at the beginning of the new week, especially from Tuesday evening to Wednesday, as part of a pullback on the current monthly candle, and on May 1st, a new monthly candle. Against the background of the beginning of the sales period, there is a possibility of disruptions tonight and from Sunday to Tuesday. Vib is in an extremely oversold position, and therefore a slight additional drawdown is possible. If the price approaches 0.01, there will be a good opportunity to buy, which will bring up to 150% profit even with weak dynamics and a retest of 0.025. An additional drawdown of up to 0.5 is possible for wing, and up to 0.00600-750 for pda. With sufficient volatility, there is a chance of growth up to 0.050-75 for vib, 2.5-3.5 for wing and 0.021-25 for pda.

Working with coins from the delisting announcement is extremely dangerous due to high volatility, but it can be extremely profitable, which we observed during the pumps of the previous delisting and the example of alpaca.

In the second half of the week, after assigning the monitoring tag, I will select coins without the tag that are insured against delisting.

The possibility of continuing the VIB trendYesterday, an attempt was made to turn the weekly candle into a bullish one and change the trend. The momentum is very volatile with a local breakout, breakdown of the previously formed trend line and resistance of 0.035. These are signals for an attempt to continue the trend. Within the framework of the bullish market sentiment of this week, a reversal of the daily candle is possible today with a further transition with sufficient volatility and holding of the bullish weekly candle. Coins from the delisted list remain a very interesting tool for speculators until the monitoring tag is assigned to new coins.

The end of seasonal growth, reducing work positionsThe seasonal growth cycle is ending this week. For most of the market, the sales cycle begins on Sunday. In the new week, we can still expect pumps for the turn of the month for individual coins. From Sunday to Tuesday, the probability of a market drawdown prevails as part of a pullback on the current weekly candle and shadow rendering for the new week. For coins that have already attempted to turn the month around, the probability of stable sales until the end of May already prevails from this week. From Tuesday to May 7-9 or 11-12, there will still be a flat period, when, with a general market pullback, individual coins may show growth, then the probability of a return of ether to 1500-1600 prevails, with a possible reversal and drawdown of the altcoin market. Today and tomorrow, I recommend reducing positions on coins, especially those that have shown good growth, in order to avoid drawdowns in the new month.

In the first half of the new week, growth impulses for coins that have not yet attempted to turn the current monthly candle into a bullish one are more likely. In particular, pumping is possible using vib wing and pda, which are awaiting delisting. For coins without the monitoring tag, it is better to make further purchases after the announcement of the tag assignment in the new week, because after the rollback from Sunday to Tuesday, coins can lose up to 50% additionally in the second half of the week if the tag is assigned. I will collect the list of coins for work in May after the announcement of the tag assignment.

A new growth opportunity for VIBVIB is preparing a new growth momentum today. As I wrote in previous reviews, finding a token below the 0.035 level is appropriate when the ether is below 1500, even if there is a monitoring tag. At the moment, the breakdown is more likely caused by panic sales on tag assignment. However, the assignment of the tag was obviously already worked out by the price when it fell below the 0.075 support. At the moment, I expect to enter the more appropriate 0.050-75 zone, corresponding to both the current market position and the tag. The opportunity for a refund will appear as soon as the indicators stop extinguishing sales, which has already happened on small timeframes. That is, today and tomorrow there is a high probability of a weekly candle reversal above the key support of 0.0350–375, and in the case of a daily or weekly candle opening higher, attempts to grow to 0.075-100 are likely, which is the main non-closed retest zone after the January impulse and is highly likely to be worked out. A retest of 0.035-50 from the current level will bring up to 100%+ profit.

Growth to 150-250% by pda in the coming week.As I wrote earlier, April is the most powerful seasonal growth period in the first half of the year. The first half of the month was under selling pressure against the background of the continuation of the trend of the previous month and quarter, but as we approach the middle of the month, the activity of buyers is likely to begin to increase and from the second half of this week we can expect breakouts in coins with a subsequent trend. To date, coins with the monitoring tag that are not included in the delisting announcement have a high probability of growth, because They are the most oversold due to concerns related to the announcement, but now they have time to wait for the next announcement. Wing was the first to react, and it retains the probability of a new wave of up to 50%+ this month. But today I want to focus on the pda, where the main goal is to retest the range of 0.021-25 at least and attempt a test of 0.035-50 with sufficient volatility. Even with growth towards the immediate goal, the profit will be up to 150%+. VIB and alpaca have similar potential.

More interesting assets for speculators are only the coins from the delisting announcement, because due to the minimal capitalization, even a small influx of buyers gives a large percentage of growth. In this regard, before the actual delisting, there is a possibility of powerful exit pumps this week, as it already was on vidt. In particular, according to uft, the momentum may reach several x's by the end of the week. Cream and troy have less potential, but they can also show profitable growth impulses in the event of increased customer activity in the market. I would like to note that uft and troy have very high non-closed targets on the retest of 0.21-25 and 0.0031-35, which may lead to growth after delisting from binance at the expense of other exchanges.

Consolidating the UFT trendApril is the month of the strongest seasonal growth in the first half of the year. In the first half of the month, the probability of purchase disruptions prevails against the background of the negative closing of the last quarter, however, as we approach the middle of the month, the probability of a stable bullish trend with a sharp reversal for individual coins will begin to increase.

Today I want to once again draw your attention to uft, which gave you two waves of 40-50% each and good opportunities to slip up. Unfortunately, we did not see a stable reversal on the quarterly candle due to the negative overall market dynamics and the falling altcoin index. However, the new quarter opened above the strong 0.075 support, which provides an opportunity for a hike to 0.15 and a stable trend. Purchases from the current 0.05 level can bring up to 3-5X in the absence of delisting and the beginning of a trend.Also, in the second wave, a breakout signal is left, and in the case of an exit above 0.11 from the third wave, there is a high probability of a trend to retest 0.21-25 with intermediate resistance at 0.150-175. A similar pattern has already worked out last week on a smaller timeframe.

Vib troy pda alpaca voxel cream can also show powerful growth impulses among coins with the monitoring tag and fio pivx bifi among coins without the tag. Coins with the monitoring tag often show good dynamics in the second half of the week due to the low probability of delisting. In the first half, it is worth keeping a stop loss close to the price in case of delisting until noon.

New opportunities for earning money on VIPTo date, we have come close to a change in the quarter and a high probability of increased volatility. The second half of the monthly candle on ether opened in the negative zone, which gives a signal to hold sales until the end of the quarter. However, in recent days, individual coins have the opportunity to work out their accumulated potential with a bullish reversal of the monthly candle. VIB is currently the most oversold coin without the monitoring tag. Against the background of the pinbar of the last monthly candle, there were few buyers this month, but technical buy signals were left up to a 0.1 retest even with the current market position.

In an optimistic scenario, today's daily candle may turn bullish with continued purchases until the end of the quarter. Negative statistics on the United States today may contribute to this. In the case of a reversal in the current quarter, the target may be a local breakout and retest of the trend line formed by the previous breakdown.

With less volatility and strong statistics coming out in the US today, the probability of a rebound from the retest of past hows in the range of 0.110-125 and a transition to a flat near the key long-term level of 0.075 +-15 prevails. In this case, the start of purchases may be delayed until the opening of a new quarter, or the next announcement on the assignment of the monitoring tag.

The main long-term support is 0.035, a hike below which is possible only under extraordinary circumstances with the withdrawal of ether by 1,500, the dominance of alcoins by 7.5% or the assignment of the monitoring tag. Given the current oversold conditions and high targets, assigning the tag will only give a temporary departure below 0.035 with further growth to 0.075, similar to vidt.

In addition to vib, among coins without the monitoring tag, so far I am considering only pda with a possible new wave of growth, especially if the tag is not assigned in the new month.

The coins that already have the monitoring tag are the most oversold on binance, due to which they have shown good growth impulses in the last two weeks against the background of attempts to reverse the quarter. Before the next delisting announcement, there is time for new waves to reverse the current quarter under an optimistic scenario, as vidt shows, and a pullback already in the new quarterly candle. The most interesting scalping companies among this group today are uft troy alpaca with a growth potential of up to 100%+ and cream nuls with a possible growth of up to 50%+.

PDA ( SPOT)BINANCE:PDAUSDT

PDA / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

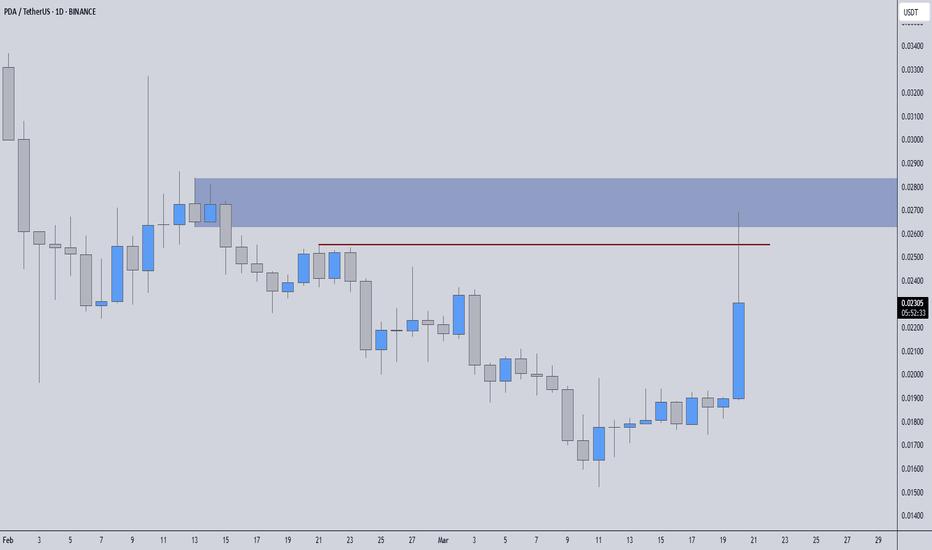

PDAUSDT(PlayDapp) Updated till 21-03-25PDAUSDT(PlayDapp) Daily timeframe range. PA is in its lowest low zone. if PA dont have devs backup it solely depends on market maker thats just sad. thats how it creates new low. recent resistance at 0.02288 if there is a retest it will happen above it.

PDAUSDT – Liquidity Grab & Rejection! Watching for Shorts🚨 PDAUSDT – Liquidity Grab & Rejection! Watching for Shorts 🚨

“Classic move—liquidity swept, rejection confirmed. Now, we hunt for the breakdown!”

🔥 Key Insights:

✅ Liquidity Cleared – No more excuses for price to push higher.

✅ Resistance Holding Strong – Sellers stepping in, rejection in play.

✅ LTF Breakdown = Entry Signal – We wait for structure, not emotions.

💡 The Game Plan:

Monitor 1H Downward Breakouts – Confirmed weakness = sniper short entries.

CDV & Volume Profile Must Align – Smart money must support the move.

Retest of Broken Support = Ideal Short – Precision matters, no chasing.

“Patience wins. If the structure confirms, we pull the trigger—clean & calculated!” 🚨🔥📉

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

A new opportunity to attempt a pullback on the quarterly candleToday, a new opportunity for market growth has emerged, and I want to consider it. First of all, I want to emphasize the discrepancy in fundamental factors. The crypt was brought down against the background of a trigger that I paid attention to first of all – wti oil went below 71 and at the opening of the new week, the crypt immediately reacted, in anticipation of a drawdown of the foreign exchange market and the growth of the dollar following oil. However, the subsequent mass of negative statistics on the United States completely offset the impact of oil and the euro went above 1.050 and even 75, which so far strengthens purchases. As a result, the crypto market remains in an oversold position relative to other markets.

Given the picture and binance's aggressive measures to keep the market at the bottom, the situation looks like another giveaway game. The Amers tried to bring down the market by selling oil. Against this background, ether opened the month below 2250, which gives a technical signal for sales up to 1900. At the same time, binance was not against helping to delay the pullback of the quarterly candle as close as possible to its close, which would open a new quarter above 2250 or 2500, giving a signal to maintain purchases. Such a picture and the negative opening of the month reduce the goals that we can achieve from above this quarter, we are no longer talking about 3,500 on the air. However, if the altcoin index goes from 8.5% to 10-11, according to my expectations, the ground will be sufficient for coin breakouts.

And so, after the sales in the first half of the month, against the background of the bearish last candle and the opening of this month below 2250, this week it is worth preparing for a new attempt to roll back the quarter, which will begin with the reversal of the month as it passes its middle. This week, there is a high probability of breakouts of similar rare pros or burger on many oversold coins.

First of all, it is worth noting uft vidt alpaca, which binance artificially pushed below the technically relevant market levels by assigning the tag monitoring. Given the assignment of the tag, it is worth calculating the upper limit of the flat at 0.25 for uft, 0.025 for vidt and 0.15 for alpaca. From attempts to test these levels, it is more reliable to reduce positions and move lower on the next market drawdown. There is a high probability that, under the pressure of the new tag, these instruments will flatten from marked loyalties to these resistances until the fall and reach higher targets only by the end of the year. In my opinion, there is also a high probability that the monitoring tag was added temporarily to create profitable entry points for large investors and reset the hamsters, since the tokens were trading with fairly good dynamics and futures were added to them at the end of the year for a specific purpose. The picture resembles manipulations with pros. These tokens are now in the most oversold position and are very interesting to work with, because in case of rollbacks they will give up to 50-100%+ growth.

Among the coins with the monitoring tag, I also consider troy and cream to work, but they are now inferior in growth potential by up to 50%. It should be borne in mind that, depending on the activity of buyers, troy can test the left technical signal at 0.0032-35 and repeat the pros pattern. There is no such goal for cream. The combo can also show up to 30-50% growth, but it is in a less oversold position and there is a possibility of testing supports at 0.100-125 and subsequent growth with the main resistance at 0.25. I am not considering other coins with the monitoring tag in the current market picture yet. I would like to remind you that there has been no delisting so far this month, and in the first half of the week before lunch, it is worth keeping a short stop at the current coin price with the tag monitoring in case of delisting.

After changing the frequency of operations with the monitoring tag from quarterly to monthly, coins without the tag are in danger of a double collapse. First on tag assignment, then in the case of delisting. We were finally prevented from identifying more reliable instruments among those that were oversold and had accumulated great potential for a rebound. After assigning a tag to more than fifty coins over the summer at such a pace, I think binance will start removing the tag for over-traded coins at the bottom, where we again lose the opportunity to determine which coins can fail in this case. However, based on indirect signs of past volatility and the addition of futures, I suspect that the tag may be removed from coins such as alpaca uft vidt pros ctxc combo troy aergo.

Among coins without the monitoring tag, vib still stands out strongly, according to which there is a high probability of an exit attempt to 0.1+. Until next month and the new assignment of the tag, the monitoring token is reliable, which can lead to a sharp influx of buyers at the turn of the quarter. Relative to the market, it is also in the zone of extreme oversold conditions, and at the current price of ether, the range of 0.075-90 is more appropriate for vib. Purchases are still rather sluggish under the pressure of indicators and a pullback after the breakdown of last month, but in the near future there is a high probability of leveling off into the specified range at least. In a negative scenario, without steady growth under market pressure this month and the assignment of monitoring in the new one, the token has nowhere to fall, which also makes investments from the current position quite reliable.

In addition to vib, among coins without the monitoring tag that are reliable until the new month, pda stands out strongly with a growth potential of up to 80%+. In case of general market growth, I also consider voxel farm og wing to scalping. For voxel and farm, there is a probability of a drawdown of up to 25-30% in the event of a negative market and the departure of ether to 1900, but with market growth, impulses of up to 30-40% are likely from current levels. According to wing and og, emission data from different sources began to diverge, which could lead to a drawdown to 1.5 and 2.5, respectively, with a negative market and falling ether. If the market grows from current levels, growth waves of up to 30-40% are also likely.

A new wave of VIB growthToday, another opportunity has formed for vib, which once again showed the best dynamics in January with a breakdown of 90%+. The year for the token opened quite positively above 0.0975, which gives a signal to consolidate above 0.01 in the future. The last impulse was given by the collapse of the last peaks, which gives a signal for at least a retest of strong resistance at 0.105, consolidation above which ensures an increase in volatility up to 0.15-25, especially considering the strong signal for a collapse left before the new year. At the moment, the price has traded near the long-term support of 0.055-625, a hike below which is likely only in the case of serious force majeure with a drop in ether by 1500-1750, bitcoin by 75k, or the assignment of the monitoring tag to the token (I expect the next tag changes in early April).

Given the successful opening of the second half of the quarter above the interim support at 0.06 and the time reserve before the possible assignment of the tag, there is a high probability of a repeat attempt to reverse the quarter. It is highly likely that we will see a strong resistance test at 0.075 by the end of the week with a likely breakdown, given the significantly higher final targets. If a new week opens above 0.075, there is a chance of stable support for purchases with breakouts at 0.0925, 0.105 and higher. To date, the token is the most oversold on binance and has the greatest growth potential of up to 100%+ among coins without the monitoring tag. There is also a possibility of adding futures, in which case growth up to 0.25 will not take long. In case of a fall below the 0.0550-625 support, a return to the retest of this resistance up to 0.075 is almost guaranteed, given the current oversold conditions, which makes investments quite reliable.

At the moment, the token is well suited for storing funds in an average amount along with og uft pda vidt.

Resumption of sales on the market before the end of the monthTo date, the market has passed an important boundary in the middle of the quarter, and therefore it is time to make another review of the prospects. Unfortunately, with a good opening of the year, there continues to be a deterrence of purchases in the market and the maintenance of the medium-term correction that has begun. The previous plan worked out according to the least volatile scenario with an increase in purchases only by the middle of the quarter. However, the activity of buyers was not enough even to open the second half of the quarter above 2750. Large investors are selective with investments and are in no hurry. With this picture, the probability of holding sales until the end of this month prevails, but the opening level of the quarter will play a role in the new monthly candle, on the basis of which I expect a good bull run on altcoins for the retest of the opening of the year along with ether aimed at 3250+.

There is no obvious sales signal, so I think the flat will remain quite technical. This week, I expect purchases to remain until the weekly candle closes. In the first days of the new week, it is also likely that purchases will continue based on the inertia of the current week, but from Tuesday to Wednesday, the probability of resuming sales to draw the second bottom on the daily chart around 2600 AETHER and resuming purchases as we approach the new month prevails. The main task of the bulls will be to keep the price above 2500 until the end of the month, which will be enough to turn the quarter around. There is still a possibility of a smooth release of ether above 3000 this month, however, the probability of this at the current opening of the second half of the month is rather weak in my opinion. Significant factors with a sharp drop in the dollar should contribute to this.

With the current picture of coins showing good growth, the probability of a pullback to the second bottom from the nearest resistances prevails. In particular, for alpaca from 0.175-190 or for OG from 4.75-90. Also, the probability of a pullback prevails for combo and slf, which is likely to make it possible to re-borrow more profitably with further higher levels in the medium term.

First of all, in the remaining time until the middle of the new week, I am considering coins that have not yet shown good growth, such as vib uft pda vidt ast with possible breakouts of up to 50%+ in the coming days. I can also show growth impulses for coins with the monitoring tag, which often give growth last on weekends. The most oversold among them are vite troy amb cream.

Stable purchases on OGFollowing the alpaca testing, OG is ready to give a similar picture with an attempt to overtake the previous impulse. The previous impulse has already rechecked the opening level of the year with a local overlap, which opens the way for a test of levels 6 and 7.5. With the current market and the continuing likelihood of a new general drawdown, we are unlikely to see a hike above 6 on the first attempt. On the eve of passing through the middle of the quarter in the next two or three days, there is a high probability of a breakdown attempt of 5 with a stable continuation of the trend until the end of the month. With a more negative market, the volatility of the token may not be sufficient for a breakdown, in which case the probability of smooth growth prevails until the end of the month with a chance to open a new monthly candle above 5.

In the medium term, the token remains a reliable tool for storing funds, as the year opened above the 4.75 support near the key level for volatility growth of 5. Such an opening gives a flat signal for a retest of loyals due to an opening below 5, but also an exit to the 5-7.5 range in the medium term due to an opening above 4.75. Full-time support for a reversal With the current market, it is 3.5, from which there is a probability of a trend up to 7.5+ before the summer. There is a possibility of a test of a lower level of 2.5, but this will happen only in an extremely negative market with a drawdown of bitcoin by 75k or ether by 1500-1750. In this scenario, the token is likely to remain fairly stable and will give a smaller drawdown relative to the rest of the altcoin market, providing an excellent opportunity for topping up.

Along with og, vidt vib PDAs occupy an interesting position, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca and og, is so far a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

UFT are preparing for a trend reversalFollowing the alpaca testing, OG is ready to give a similar picture with an attempt to overtake the previous impulse. The previous impulse has already rechecked the opening level of the year with a local overlap, which opens the way for a test of levels 6 and 7.5. With the current market and the continuing likelihood of a new general drawdown, we are unlikely to see a hike above 6 on the first attempt. On the eve of passing through the middle of the quarter in the next two or three days, there is a high probability of a breakdown attempt of 5 with a stable continuation of the trend until the end of the month. With a more negative market, the volatility of the token may not be sufficient for a breakdown, in which case the probability of smooth growth prevails until the end of the month with a chance to open a new monthly candle above 5.

In the medium term, the token remains a reliable tool for storing funds, as the year opened above the 4.75 support near the key level for volatility growth of 5. Such an opening gives a flat signal for a retest of loyals due to an opening below 5, but also an exit to the 5-7.5 range in the medium term due to an opening above 4.75. Full-time support for a reversal With the current market, it is 3.5, from which there is a probability of a trend up to 7.5+ before the summer. There is a possibility of a test of a lower level of 2.5, but this will happen only in an extremely negative market with a drawdown of bitcoin by 75k or ether by 1500-1750. In this scenario, the token is likely to remain fairly stable and will give a smaller drawdown relative to the rest of the altcoin market, providing an excellent opportunity for topping up.

Along with og, vidt vib PDAs occupy an interesting position, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca and og, is so far a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

Pullback to the second bottom on ALPACAAs we approach the middle of the quarter, there is an increase in purchases of altcoins, in preparation for which I recommended purchases in the second half of last week. To date, I have pleasantly shown the alpaca token, on the example of which I want to consider further scenarios for the development of events.

The token has opened an annual candle above the key level of 0.15, which gives a signal for a hike to the levels 0.25-35-50 . However, the market has been overbought since last year and there is still a possibility of further drawdown of the tops up to 75k and below for bitcoin. In this regard, a reliable scenario for altcoins is so far only a retest of the opening of the year with a further pullback to draw the second bottom, from where we can expect a more confident trend towards a reversal of the annual candle. In particular, for alpaca, the probability of a rollback prevails with an attempt to reverse the month again before closing the monthly candle. If a new monthly candle opens below 0.15 and, moreover, 0.14, growth may linger until the second half of March.

Today, a more interesting position is occupied by og vidt vib PDAs, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca, so far is a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

Today, determining the future direction of the marketTo date, we have passed the middle of the month, and I want to review the market situation. First of all, it is worth noting that the second half of the month opened below 3250 on the air, which gives a signal for new attempts to break 3000. That is, the predominance of altcoin sales remains until the end of the month. Due to this market situation today and tomorrow, there is a high probability of an impulse to 2900. Yesterday's growth wave is only a retest of the last resistance and an opportunity for buyers to exit. Today, statistics on the United States will play an important role. With negative data, it will be possible to hold 3250 until the end of the week, compensate for sales and reach above 3500. With strong statistics, sales are likely to be extremely aggressive and continue into the new week.

Bitcoin opened the second half of the month more positively, above 95k but below 97.5, which so far gives a signal to keep the flat in the range of 92.5 - 97.5 with new attempts to exit above 100k. According to the overall picture, the altcoin dominance index is likely to fall by the end of the month, up to 9% in a negative scenario, in order to maintain bitcoin and open a new month above 100k.

With the continuing negative picture on the market, most altcoins continue to move synchronously with the altcoin index and ether, waiting for further market dynamics to be determined. If 3150-3250 is held on ether and negative statistics for the United States are released today, we can expect new impulses for individual coins as part of an attempt to turn the monthly candle into a bullish one. The most oversold cream pda ast alpaca vidt bifi coins can show good impulses. Pivx slf uft wing pros have also returned to strong supports, which can also give major rebounds. Over the weekend, there is also a high probability of new impulses for coins with the monitoring tag due to the lack of delisting. First of all, the interests of vite and hard.

By default, deletions from binance loans were alerted this week. The binance opportunity is trying to bring down the price in this way.

#PDAUSDT Getting Ready for a Massive Breakout or Not? Key LevelsYello, Paradisers! Can #PlayDapp bulls get enough momentum for a bullish breakout or not? Let's look at the latest analysis of #PDAUSDT and see what's happening:

💎#PDA is trading within a descending channel formation, showing a clear downtrend structure that has persisted for months. While the price is testing key levels, the next move will determine whether the #PlayDapp breaks free from its bearish grip or continues its downward slide.

💎The immediate focus is on the $0.067 resistance zone, which aligns with the channel’s upper boundary. A decisive breakout above this level would signal the start of a trend reversal, opening the door for a move toward the major resistance zone at $0.126. Such a breakout would likely bring renewed bullish sentiment and attract new buyers.

💎However, if #PDAUSDT fails to break above $0.067, the $0.045 support zone will become crucial. This zone has consistently acted as strong support and a bounce from here could allow bulls to regroup for another attempt at breaking resistance. Failure to hold will send it to the $0.037 demand level.

💎If the #PDAUSD closes below $0.037 on the daily chart, it would confirm a bearish breakdown, invalidating any bullish recovery. In this scenario, we could see a continuation of the downtrend toward lower levels, potentially testing $0.025 or below, which would further reinforce bearish sentiment.

#PDA/USDT#PDA

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 0.0400

We have an uptrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 0.0506

First target 0.0700

Second target 0.0864

Third target 0.1050

PDAUSDT 1DPDA ~ 1D

#PDA Make purchases gradually after successfully breaking through this descending resistance line

PDAUSDT 1DPDA ~ 1D

#PDA Reached the current low and waited to break this resistance line.

Very attractive to place a buy here, with a minimum target of 20%+

Will #PDAUSDT Surge or Stumble? Crucial Levels to Watch NowYello, Paradisers! Are you ready for the next big move of the #PDA? Let's dive into the critical analysis for #PDAUSDT and explore the potential outcomes:

💎Currently, #PDA is navigating a pivotal demand zone, hinting at a possible bullish surge. The token has been on a descending resistance trend, but recent price action within the $0.052-$0.057 range shows promising momentum.

💎This zone is essential for sustaining any bullish movement. If #PlayDapp can hold its ground, we could see a push towards the significant resistance level at $0.087.

💎But what if GETTEX:PDA can't sustain above the Bullish Order Block at $0.062? In that scenario, we should prepare for a retest of the lower support between $0.052 and $0.057. A successful bounce here could set the stage for a strong bullish reversal, possibly leading to a breakout above this major support area.

💎However, caution is key. If #PDAUSDT loses momentum and drops below the previous low, it would negate the bullish setup and potentially trigger a substantial price decline.

Keep your eyes on the charts, and don't let market noise distract you.

MyCryptoParadise

iFeel the success🌴