Peak

PEAK in place for longer term reversalThis is based on my dowsing work and there's some alignment with Martin Armstrong's cycles, though he would wait for the close of February.

Regardless, I'm basing this idea on my dowsing work, which indicates this as a lower high of an important and longer term peak in in GLD, /GC and even miners (see post on GOLD).

Where it stops, I don't know, but give yourself plenty of time. If it takes out the prior peak, I'd say I'm wrong.

Elevator action to come?Based on my dowsing method, the guidance is that TLT has made a peak for a bigger reversal. 2 symmetry resistances have held today and the idea is wrong with a close above those levels.

I'll update this idea with a target after the move down.

It's interesting that this idea is in alignment with the GLD idea, which makes me wonder if indexes are going to finally get it together. I think TLT and GLD are easier trades than indexes, however.

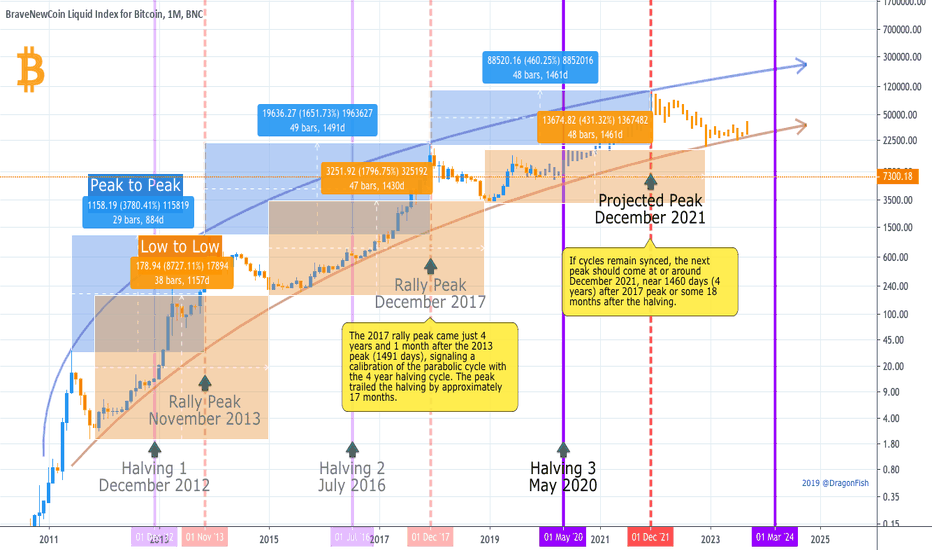

Timing the Peak of the Next BTC Bull RunWhen will Bitcoin reach the peak of its next parabolic advance? Probably at roughly the same time it did in the last rally. This seems straight forward enough, but other trend analysis on this platform has variously projected the next bitcoin price peak from sometime just after the third halving in May 2020 all the way to sometime in 2023. While the earlier prediction is highly unlikely, the extended prediction is supported by the fact that, peak to peak, the third bull run of 2017 was much more extended (1491 days) than the previous bull run (884 days). Therefore, we may assume that subsequent parabolic moves will also play out over longer and longer time frames.

However, the simplest answer is probably the best in this case. If we consider that the halvings are roughly 4 years apart, it is notable that the third peak came just over 4 years after the second peak. This suggests that in fact the peaks have become calibrated to the halvings and that the next all time high will come near the 4 year mark (or day 1460) as well. Bitcoin is unique in that the stock to flow ratio can be very precisely projected, unlike any other traditional market, making this rough prediction of the timing possible.

This probably doesn’t help us predict price discovery, however. Government regulation, current events, technological disruption, etc., etc., all affect market sentiment and make it nearly impossible to guess where the price will go. That said, we do know that the halvings will become more and more priced into market valuations in the future as the market gains a greater awareness of the halving algorithm, and this process has probably already started. Futures markets (CME & Bakkt) will also act as tempering forces on BTC volatility (apparently the intention when futures trading was launched on CME in 2017). And as the value of BTC has become more tagged to store-of-value than currency utility, volatility and price discovery have naturally been tamed (relatively), a process that will also continue. This is to say that conservative predictions may fall closer to the mark. On the other hand, the mere fact that flow is dramatically cut after each halving as demand continues to grow gives BTC bulls a lot of hope.

Whatever the peak of the next parabolic rally, it is likely to be tied closely to the halving cycle and stock-to-flow models, and trend lines will probably remain inside the general channel indicated by history. In other words, we're probably not going to the moon, but we are still holding the best performing asset ever seen.

Hopefully these observations aren’t too obvious. They are just meant to help us all keep our eyes on the big picture as we hodl into the future.

DF

Exact Price and Date for Peak of next Bitcoin Bull RunUsing my charting method I show you what I think is the exact date and price bitcoin will peak in our next bull run, as well as the date and price when we will put in our next bottom. I also cover the upcoming BTC halving on may 25th 2020 (halvings are represented by the vertical yellow lines) and show prices throughout the next bull market cycle. Visit my website If you would like to have access to the shareable version of this chart. I also have a video of me giving my technical analysis while creating this chart from scratch.

(website link is in my profile details)

INGN Selling Short Earns Higher Profits FasterThe Inogen Inc. chart shows that it takes much longer to reach a Peak new All-Time High. However, a Topping Formation or Business Bear Downtrend occurs much faster. There is triple or quadruple the points profit in half the time when selling short a stock as compared to buying it going long in the market. This stock is now at a support level and is no longer a viable sell short candidate.

Ethan Allen Earnings - Testing my model - All Point 2 Jan28 PeakTESTING... TESTING...

Using my momentum trending theory/method using ETH earnings (eue-tu-wb)., i am tweaking short term model to try predict earnings

The hourly momentum model predicts a major pivot point in momentum to the downside in the price.

The 5 minute model predicts the same on multiple different waves.

brschultz aka markettimer777

Apple (AAPL) Has Probably Plateaued I'm doing this main chart using the log scale because it makes it so obvious that growth is slowing down. We just got rejected hard off the resistance that has held us since the 80's! We're also in a giant rising wedge, and are JUST touching the bottom of it right at this very moment (actually, I'm being generous with my line. In truth, we've broken down already). Now, I don't think Apple will disappear. That's not what this analysis is about. As I've mentioned recently, I think many tech stocks have plateaued. Some may continue higher eventually, but Apple most likely will not grow much. Why? I think the world's population has peaked, and people's interest in technology has also peaked. People who speculated on Apple have also walked out with massive profits. Just look at that graph! In my opinion, and I know it's controversial, there is no reason for Apple to continue to grow at an astronomical rate. As you can see, growth has clearly reached a point that it cannot sustain and it will likely flatline, or experience a long period of slow growth. Their tech has simply become a part of our daily lives. It's almost part of our biology at this point. Why speculate on it anymore? I argue that by becoming so valuable, it has actually set the stage for its own demise. I don't know if this makes any sense to you. By demise I mean stagnation, basically.

Anyway, where Apple flatlines is anyone's guess. We have some possibilities on this chart (green zones). It could be fairly near current prices (in the $80-100 area). Or it could be in the $50 zone. That seems more likely to me, given the size of the tech bubble.

I think people will continue to use Apple products every day, so I don't see it really falling off a cliff permanently. It's also dropped pretty substantially from it's all-time-high already. As I mentioned in my DJI analysis, I was pretty sure it would not be able to sustain above the $1 Trillion market cap. I was surprised that it held up there as long as it did, to be honest. A lot of people out there will keep on harping about investing and how everyone should still hold Apple stock in their portfolio. I do not think there is much upside anymore. It might EVENTUALLY gain back a good amount of what it's lost since the ATH, but I doubt it'll reach beyond $1 Trillion again. This is just my view, though. I could be totally wrong. I just have a feeling about it though.

I am not a professional financial advisor, and this is not financial advice.

-Victor Cobra

Potential H&S bottom on Cloud Peakbull case for coal stocks, with rising exports/rising gas prices/cold winter forecast.... May '19 target of ~$7 at the neckline

DJI - Peak Momentum Experiment The chart above is for an experiment based on peak linear regression.

The two main support zone above were established by analyzing historical movements based on regressional trends.

The 16k zone represents the possible standard deviation zone, while the one below represents the regressional mean to the peak.

The Peak Momentum indicator below establishes momentum based on linear regression calculations.

As you can see it is showing the DJI momentum has currently peaked and a small bear div has formed.

However this does not mean that we could no form an additional higher high.

The RMRO indicator above, is there to measure the average true range.

Generally speaking the price almost always returns to the mean. While doing so, the price usually follows suit.

Therefore, based on the first crossover on the RMRO, it leads me to believe at bear minimum we should have some consolidation.

I hope of all enjoy this little experiment over the next several months or maybe even years.

If you have any questions, please feel free to leave a comment!

Riding the Bitcoin Diamond Train w/ BottomFinder - 581% profit!Bottom & Top Finder v2.5 When using BF for swing trading on 15m or lower timeframes, it is best to enter on the strong bottom, and ignore the medium and weak signals.

As you can see the past few weeks on BCD has been VERY profitable. A total of over 581% was possible if you entered on every strong signal. A few bottom signals did not register a strong sell signal, but profit was still possible from all entry points. After all, this is mathematics, not a crystal ball time machine!

If you notice my profit claims are not inflated as I am not using the low/high wicks as guides, but rather actually attainable order prices. If you are an experienced trader, the medium signals can also be used if you are seeing confirmation for the move by other indicators as well. This would have enabled you to make several more very profitable trades.

Join us on telegram to chat! We provide market signals and information freely. We have 3 trial spots left this week for BottomFinder.

Amazon - In an exponential rally. Next target seen at 1,862It should be clear to everyone, that Amazon is in an exponential rise and they even ever ends well (just remember the last one we saw in Bitcoin).

The indicators shows a negative divergence relative to the price movement indicating that this rally is loosing strength and the potential upside is becoming limited. The next possible target for wave 5/ of 5 is seen at 1,862, but exponential rallies has a way of exceeding even the most optimistic, so I wouldn't be overly surprised to see an extension closer to 2,177, before wave 5/ of 5 peaks.

However, all warning lights has started flashing, so keep your stop tight.

Bitmex XBTUSD BottomFinder Swing Trades for JuneBottomFinder just signaled a bottom for the Perpetual Dollar Swap. Where will it go from here?

As you can see using the 5 min time frame to swing trade, the indicator selected many profitable trades in a sideways market. When in a downtrend or uncertain sideways trend, you should buy on the strong signal and sell on the weak signal.

BullFilter is our other indicator showing longer term trend strength. Join us on telegram to chat! We have 3 trial spots left this week for BottomFinder.

BottomFinder Indicator DCR May Trades - Killed it!BottomFinder has been nailing profitable trades on DCR for the past month. There was only 1 unprofitable signal during the last 30+ days! Multiple signals before large pumps and respectable profits in the downtrend as well!

With no buy signal generated yet, I would (short term) hold off on buying in the current market. Once the next strong buy is signaled, you can expect a 3-7% rebound (let TopFinder signal when to sell).

Stop losing satoshies on bad entry/exit timing. Let BottomFinder do the heavy lifting for you!

Like, Follow & send a PM for trial access. 3 Trial slots now open as of 1:15PM EST 6-4-18

BTCUSD: Lower High Formation In Progress. Watching For 7335.BTCUSD update: This market is in a slow grind right into a resistance area. As I wrote earlier on S.C., it may look inviting, but only if you want trouble.

The 7896 resistance defines the bearish reversal zone which price is just under. If price is going to fake out, it is most likely to do so near this area.

The more attractive area is the 7335 to 7213 minor support which is the .618 area relative to the current bullish swing. We don't know if price is going to retrace back here, but if it does, we will be looking for bullish reversal candles.

In summary, just because price is moving slowly higher does not make it any safer to enter. Let the market present a sensible opportunity. The worst thing you can do is force a trade. We have been reiterating this idea over and over again over the series of new articles that have been coming out. Wait it out, a more attractive reward/risk opportunity will eventually appear.

BottomFinder Indicator May Litecoin trades.With only 1 unprofitable trade for the entire month. Stop wasting your time and satoshies on bad entry/exit timing.

As you can see BottomFinder caught the huge early May pump and was still able to make solid profits riding the dump as well!

A weak bottom signal was just generated on the one hour timeframe, so a further drop maybe in store short term. In the next few days the price should rebound 2-5% just wait for the top finding signal to let you know when to exit!

Like, Follow & send a PM for trial access. 5 Trial spots now open as of 3:15PM EST 5-31-18