Breaking: Peercoin ($PPC) Coin Might Be Gearing For A ReversalPeercoin ( NASDAQ:PPC ) an altcoin created 2012 has since been mute for over 5 years.

Also known as PPC or Peer-to-Peer Coin, the coin was created by Sunny King and his team and launched in August 2012. It is the first blockchain to implement Proof-of-Stake consensus.

The primary inspiration behind the creation of Peercoin was to address a number of perceived shortcomings of Bitcoin, including energy efficiency, security and sustainability, decentralization and long-term viability.

Essentially it was designed as an enhanced replacement for Bitcoin. As such, it was originally forked from Bitcoin and uses the same UTXO style blockchain. However, Peercoin's code was modified to introduce Proof-of-Stake as its primary consensus protocol.

Peercoin's daily price chart depicts a perfectly formed resistant structure, should NASDAQ:PPC break above the $0.36 resistant point, a breakout to the $1 pivot is feasible. Similarly, failure to pull that stunt might negate the assets growth.

Peercoin Price Metric

The Peercoin price today is $0.277113 USD with a 24-hour trading volume of $27,510.89 USD. Peercoin is down 5.39% in the last 24 hours. The current CoinMarketCap ranking is #1053, with a market cap of $8,175,841 USD. It has a circulating supply of 29,503,607 PPC coins and the max. supply is not available.

Peercoin

Peercoin continues to regain the foothold against BitcoinAs described before, Tether fueled Bitcoin bull runs were not good for PPC-BTC ratio. Bitcoin bear markets is when this usually turns around and Peercoin regains ground. This turn-around could also break the multi-year downtrend in PPC-BTC.

Price is now over weekly EMA(100), it has retested it once and has bounce back up.

Next obvious target is 4500-5000 satoshi along that horizontal resistance. Beyond that, retest of May 2021 high between 8000 and 10000 satoshi.

Network hashrate is exploding as well:

pbs.twimg.com

Anyway, fun times for Peercoin bulls.

Peercoin to resume braking the downtrend against BitcoinI believe next move will re-test the weekly EMA100. Just like the last wick up.

It is interesting it wicks so much, but seeing how low the floating supply is it's not surprising at all. Coin is extremely hard to accumulate at these prices, so I expect price level will be rejected by the market.

Spectacular setup herePPC-USD corrected before BTC-USD did and has established the bottom before BTC-USD. This can be see by rising PPC-BTC over the last couple of months.

This chart looks incredibly bullish, and given the 8:1 R:R ratio I'm inclined to take the offered swing.

Peercoin celebrates 10th anniversary later this month.

PEERCOIN PPC USD : MULTI YEAR BULL FLAG 4000% TARGET $11 PEERCOIN PPC is another one of those hidden gems that are in a major bull flag pattern. Peercoin has been around for a while and the team is still active and working on this project. Huge potential here for some massive gains. MACD, RSI, and BBWP are showing a massive move is coming. I think this is a good time to accumulate and hold for the next big run. Great fundamentals and the chart looks great as well. This is not financial advice just my opinion. I have charts on other hidden gems that I have found with some serious reward potential. Check them out. If you find this content useful then please leave me a like and follow me for more updates and analysis. Thank you and good luck out there.

PPC for the winLooks amazing, seeing this re-accumulation here it seems that pump in May was merely a test pump.

I expect next move to land somewhere between $1.8 and $2.5.

Peercoin PPC $2.12 next stopGreat 30% retrace. Lots of momentum here. This is one of the original 6 altcoins dating back to early 2013. A fully diluted supply of 26 million coins, of which we believe 8 million are lost.

The next Peercoin move will be parabolicPeercoin #PPC is one of only 7 cryptos that were around in early 2013. Each cycle it pumps incredibly high. It's one of the laggards as always. This cycle it is heading to $50

7 Altcoins I am Bullish on because of TechFirst off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said, the 7 cryptocurrencies that are altcoins (that I believe are covering a wide variety of sectors) that I think has some strong technological aspects, are what I will be talking about here. For avoidance of conflict of interest, I am not directly associated with the development of any of these. That being said, the 7 altcoins I am bullish on include: ChainLink, Cosmos, Siacoin, Waves, BitTorrent, Pivx, and Peercoin. ChainLink has a really developer friendly smart contract platform, and Cosmos has consensus protocols, and the ability to easily create side-chains. Siacoin has its proof of storage concept. Waves is a next generation decentralized application development platform with its own exchange. BitTorrent I like more as a startup rather than a crypto, but I am betting long on their technologies. Pivx reminds me of a staked variation of Dash. Peercoin is PoW compatible while having PoS for the network security. Peercoin easily can have more real world adaption. If I would be bullish just on the basis of technological aspects, I feel like these 7 altcoins would be on the list.

Peercoin Is Now Ready To Grow (Fib. Targets)We looked at Peercoin (PPCBTC) long-term recently, I will share the trade idea below.

Here we have a closer look at the chart with short-term targets based on Fib. proportions.

PPCBTC broke above EMA50 and MA200 and peaked when it hit EMA200 at 0.00003198, soon after prices started to retrace.

Resistance turned support

After EMA50 (magenta line on the chart) was conquered, prices for PPCBTC moved back down and tested this level as support at ~0.00002500.

EMA50 held and prices are now back above this level and also above MA200 (black line).

What this means is that PPCBTC can easily start to move up from here (green arrow).

Conditionsfor change

If momentum is lost and prices move lower, the red arrow comes into play. Right now we are looking bullish, so we aim at the Fib. targets next.

Thanks a lot for reading.

Namaste.

--

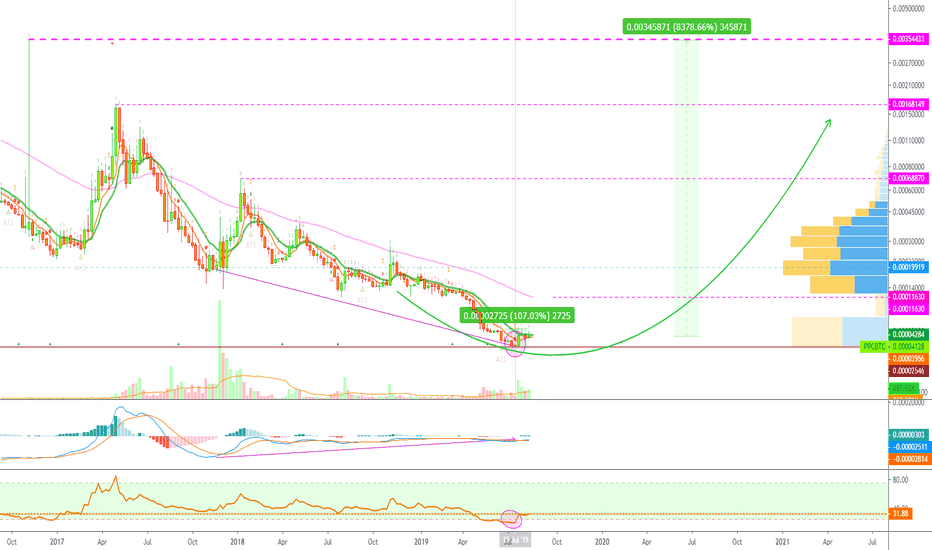

Peercoin Awakens | Full Chart W/ Long-Term Targets (12,000%+ PP)

Peercoin Awakens | Full Chart W/ Long-Term Targets (12,000%+ PP)Peercoin (PPCBTC) is starting to wake up after a new all-time low and years of bear action... Let's take a look.

Let's start with the long-term chart, here we have the ATL sitting at 0.00001950:

Over 12,000 potential profits from current prices to our ATH (we are using Nov. 2016 peak prices as all-time high).

Consolidating since July 2019.

The RSI just made a nice jump and is really bullish (we are bullish above 40 on the weekly timeframe).

Prices are trading above EMA10.

When we look at the daily timeframe, we can find more bullish signals... Peercoin (PPCBTC) Daily (D)

MA200 conquered yesterday.

Trading volume starting to increase.

New uptrend forming.

Bullish MACD.

Peercoin is very likely to start growing long-term... Remember to have a plan/strategy in place before buying anything if you decide to trade.

Thanks a lot for reading.

Namaste.

Peercoin Hits Bottom | Up to 8300% PProfits To All-Time HighPeercoin (PPCBTC), one of the first cryptocurrency projects to launch and also a classic, hit a new all-time low on the week of the 15th of July and started to print some bullish signals... Let's take a look:

After hitting a new ATL, PPCBTC printed the "Morning star" pattern. This is a bullish pattern and holds additional strength here as we are looking at the weekly time frame.

Together with this new low and the bullish candlestick pattern, we can see a massive increase in trading volume and a huge 100%+ bounce.

Long-term bullish divergence, since late 2017, can be spotted on the MACD (purple arrow).

The RSI hit massively oversold and its lowest ever.

The profits potential for PPCBTC from the current price (0.00004128) to Novembers '16 peak price, is a massive 8300%+.

Just reaching EMA50 (0.00011630) from the current price, which can be easily achieved, can generate a generous 181% gains.

As you can see, Peercoin has been available for trading on Bittrex since April 2014. Good for long-term hold and to diversify.

Any questions?

Feel free to use the comments section below...

It will be my pleasure to answer any questions.

Namaste.

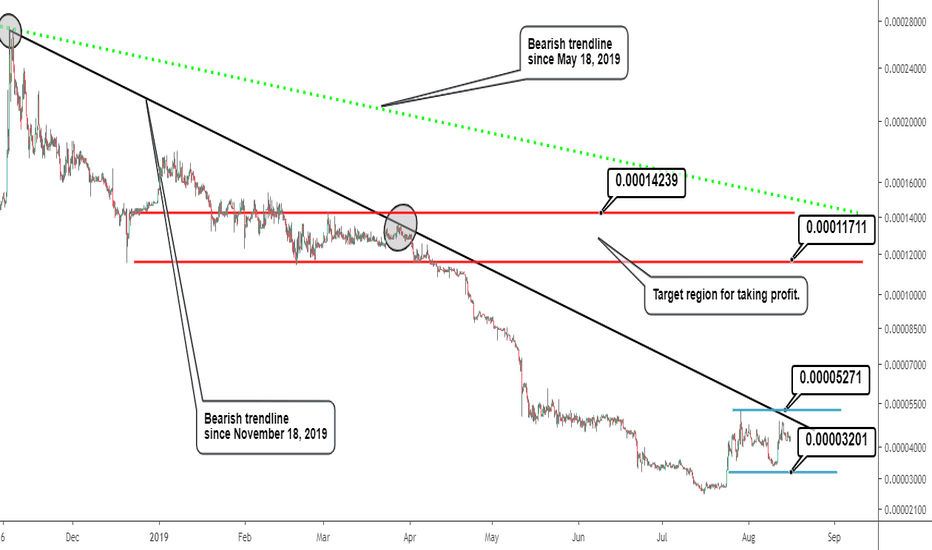

Peercoin Intraday Timeframe Analysis. Bullish OpportunityConclusion for today's Peercoin (PPCBTC) analysis: A close above ~~0.00011711 implies resumption of bullish momentum in Peercoin.

Peercoin analysis for today is carried out on a 6 hour timeframe chart using a log scale. Historical data going as far back as November 2018 till current date is shown on the chart with the major downward trend. Two major trendlines are plotted on the chart. Bearish trendline from November 2018 closest to price action and the bearish trendline since May 2018.

The latter trendline is close to a major resistance zone in Peercoin that is expected to present a challenge to any bullish swing that develops. Price low achieved on July 16, 2019 was followed by a bullish swing upwards after which Peercoin has traded in a sideways (ranging) environment.

A break above the bearish trendline since November of 2018 increases the chance of the current bullish swing making progress, while a close below ~0.00002646 implies the resumption of the existing bearish trend.

Strategies for going long include buying as soon as price retraces to ~0.00003201 or buying as soon as price breaks above ~0.00005271. Minimum profit target for either scenario is the lower boundary of resistance at ~0.00011711.

Peercoin Bullish Opportunity: Daily Timeframe AnalysisConclusion for today’s Peercoin price analysis: A retracement back to 0.32 or 0.24 is expected in Peercoin prior to the resumption of bullish momentum.

Peercoin price analysis for today is carried out on a Daily timeframe using a log scale. A price peak of 9.00 on January 13, 2018 (not shown here) was followed by a dominant bearish move trend that seems to have terminated at a price low of 0.20 on July 17, 2019.

The aforementioned bottom reached was followed by a rally and the 20 Day moving average is also indicated on the chart for perspective. Bullish momentum currently has hit a target for price between 0.41 and 0.44 that is marked on the chart as immediate resistance.

A break above 0.44 implies higher prices in Peercoin with 0.51 and 0.63 offering price levels for possible termination of bullish momentum. It is also important to keep in mind the long term bearish trendline since February 2018. Price has not broken and/or closed above it.

This region coincides with the 0.51 target for Peercoin and therefore can be expected to pose a challenge to the current bullish move from July 17, 2019.

Support levels anticipated in case of price retracement from the 0.41 price level includes 0.32 and 0.24. A consolidation in price at either level that is confirmed by momentum will provide opportunity to join the current bullish trend from the July 17, 2019 price low.

A trading opportunity to buy in PPCBTCTechnical analysis:

. PEERCOIN/BITCOIN is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 50.

. The price downtrend in the daily chart and the RSI downtrend are broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. Price is in the support zone (0.00013300 to 0.00011550), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (0.00013300)

Ending of entry zone (0.00011550)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00017960

TP2= @ 0.00021130

TP3= @ 0.00025085

TP4= @ 0.00029140

TP5= @ 0.00033495

TP6= @ 0.00038600

TP7= @ 0.00047070

TP8= @ 0.00069000

TP9= Free

PPC-BTC Long Trade PlanCommodity : PEER COIN

Trade Type : LONG

Trading Against : BITCOIN

Entries : Double-UP Entries throughout the Buy Zone

Profit Taking : 25% at each TP point

Profit Locking : Move SL to break even once TP1 is hit, to TP1 once TP2 hits, to TP2 once TP3 hits and so on

Duration - 1-2 weeks

Investment in trade : 5% of the total Trading Balance.

Prospective Profit : 11.34% to 25.74%

Prospective Loss : 9.27%

RRR : SL to TP1 is 1.22, SL to TP2 is 1.98 and SL to TP3 is 2.78

Buy Zone/TPs/SL price points are marked in the chart as follows

Greens - Profit Targets (TPs)

Blue - Buy Zone (Entries)

Red - Stop Loss (SL)

PPC: $1 Short Growth PotentialPeercoin recently had a steep negative correlation along with the rest of the crypto market. It also sustained some higher difficulty targets and different updates regarding its block time and block reward infrastructure. Currently looked at as a hybrid coin, PPC has some profit growth potential given its market history. A potential $1 price target is likely to happen in the upcoming weeks.