PELNSE:PEL

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

PEL

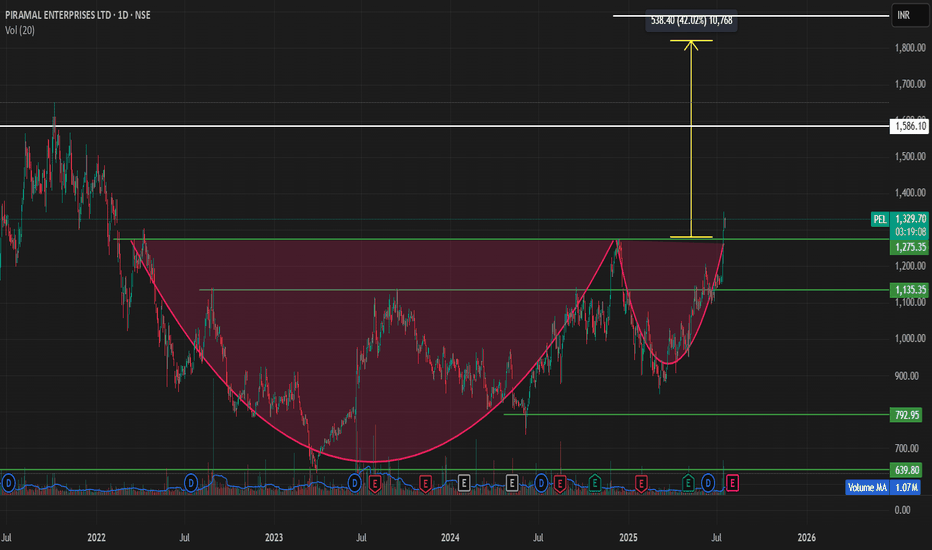

"PEL is having formed a Cup and Handle pattern

*Chart Pattern Identified**:

A **Cup with Handle** formation has been identified on the daily/weekly chart of **Piramal enterprise**, signaling a potential bullish breakout. This classic continuation pattern typically leads to strong upward moves once the handle breakout is confirmed.

🔍 **Breakout Levels and Price Targets**

1. **Primary Breakout Level – ₹1275**

* This marks the neckline of the **Cup with Handle** formation.

* A confirmed breakout at ₹1275 would validate the pattern.

(based on the measured move from the depth of the cup added to the breakout point)

* Acts as a **pre-breakout resistance** or consolidation level.

* A **daily or weekly close above ₹1,275** with strong volume would indicate early momentum and buyer interest.

* **Target after this level is breached**: ₹1275 (primary breakout zone), and if sustained, an extended target of **₹1820**.

### 📌 **Technical Outlook**

| Level | Significance | Action |

| ------ | ------------------------ | --------------------------------------------------- |

| ₹1275| Cup with handle breakout | Key confirmation zone; breakout of pattern |

| ₹1820 | Extended target | Projected move after full breakout confirmation |

---

### 📈 **Trade Strategy**

* **Entry Option 1**: Anticipatory buy near ₹1,275.

* **Entry Option 2**: Breakout confirmation buy above ₹1275 with higher risk-reward toward ₹1820.

* **Volume Confirmation**: Essential at 1275 levels.

* **Stop-loss**: Dynamic trailing stop-loss below handle lows or breakout support zones depending on entry.

---

### ⚠️ **Risk Management & Considerations**

* Ensure confirmation via **volume expansion** and **daily/weekly close** above key breakout zones.

* Be cautious of false breakouts, especially if moves happen on low volume or during broader market weakness.

* Monitor sectoral momentum (capital goods, engineering, or mining equipment) as it may influence breakout strength.

PEL !! PIRAMAL ENTERPRISES LTD appear to be in a Breakout phase This is the Daily Chart of PIRAMAL ENTERPRISES LTD.

PEL is trading above the midline of its ascending parallel channel, with strong support in the ₹1080–₹1150 zone. Historically, whenever it sustains above the midline, it tends to retest the upper boundary resistance of the channel near at 1500 -1540.

If this level is sustain then we may see higher prices in PEL.

Thank You !!

PEL | Breakout Setup | Short-Term Buy | Target ₹1100🟩 Trade Plan:

Buy Zone: ₹1059 – ₹1060

Target: ₹1100 (approx. 3.77% upside)

Stop Loss: ₹1037

Risk-Reward Ratio: ~2:1

Setup Type: Breakout above resistance zone (marked on chart)

Volume Confirmation: Strong bullish candle with high volume

RSI Confirmation: RSI bouncing above 60, momentum building

📈 Chart Annotations (TradingView Tips):

Draw resistance zone on 1H around ₹1060 – ₹1070 (breakout zone)

Plot EMA (9 & 21) or EMA crossover to confirm short-term bullish trend

Use RSI (14) to highlight momentum breakout

Highlight entry point, stoploss, and target with labels

Use TradingView’s “Long Position Tool” to visually display RR

For Education Purposes only

Navigating the Waves: Piramal Enterprises Technical StudyTechnical Analysis of Piramal Enterprises (NSE: PEL)

This analysis is shared for educational purposes only and should not be considered financial advice.

Overview

Piramal Enterprises has shown a promising breakout with significant volume, indicating strong bullish momentum. The Elliott Wave analysis also suggests a positive structure, pointing towards potential further gains.

Elliott Wave Analysis

Wave 1: The stock completed its first impulse wave (1) near 1,140 INR.

Wave 2: The corrective wave (2) concluded around 735.85 INR.

Wave 3: The ongoing wave is expected to be an impulse wave 3, targeting higher levels.

Current Structure

- The stock has completed the corrective wave C of (2) and is now in the early stages of wave 3.

- The recent breakout above the black trendline suggests the start of wave (i) of 3, supported by increasing volume, adding to the bullish sentiment.

Key Levels

- Current Price: 977.85 INR

- Nearest Invalidation Level: 905.00 INR

- Major Invalidation Level: 630.45 INR

Targets

- Elliott wave suggests ahead wave 3 first levels (1.0 Fibonacci Extension of Wave 1): 1,246.00

- Elliott wave suggests ahead wave 3 ideal level (1.618 Fibonacci Extension of Wave 1): 1,561.25

Conclusion

Piramal Enterprises has provided a strong breakout backed by volume, aligning well with the Elliott Wave theory. The structure indicates a continuation of the uptrend with potential targets at 1,246 INR and 1,561.25 INR. The nearest invalidation level is at 905 INR, with a major invalidation level at 630.45 INR.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

#THYROCARE 583 recommended to buy - #stockstowatch Rachit SethiaNSE:THYROCARE

THYROCARE 583

TGT 680

SL 540

Return 16%

TF <6M

RR >2

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

PEL--Channel Breakout??this stock is broken the channel and retested,

if this failed to push the price upside,

fall will continue to demand zones, we have a demand zone at 890 levels,

if this fails fall happens.look for buy at demand zone.

on topside resistance is showing at 1017 levels.

we have a chance of continuation in this stock.

PIRAMAL ENTERPRISES LONGAll time high volume on a monthly chart with a super breakout. Seeing it above my target, but for some technical reasons, target has been reduced. For SL, I have the supply zone which will act as support and SL. Comment if you have any questions regarding this.

Disclaimer: I am not a SEBI Reg. Analyst. Do your own research before investing or trading.

PERUMALIND--Drop base drop form??------>> The stock is trending downwards in daily timeframe.

------>> Drop base drop formation is observed.

------->> if the Base (Strong Support )acts as resistance price drops again from this point.

Keep track this instrument, for further investment plan.

Key level of Support: 640-540-440 range.

Previous Support if acts as resistance price falls again to 640 ranges. Keep track this levels.

PEL Swing Trade Opportunities PEL is following a trendline if we break that then we can go positional in this.

And if you zoom in then you can see its consolidating in a range for some days.

And its trying to move above 50 EMA which is 847 a strong resistance.

So how can we trade this ?

* Wait for a breakout in daily time frame or hourly enter after the breakout

* First target will be 879 then the trendline

* If it breaks and sustains above the trendline then hold

* If it fails trail your SL or exit

For details refer to the image or drop a comment, I'll be happy to help you out.

Happy Trading !

PEL looks to be breaking out of channel patternPiramal Enterprises Ltd is one of India's largest diversified companies. Its businesses are divided into two verticals i.e. financial services and pharmaceutical business.

On short term analysis of chart, a very clear downward moving channel is identified on candlestick chart. Stock has near the upper end of the channel and is also forming triangle pattern.

A breakout above the trendline should indicate that price can move towards its ATH price. For options traders, a bull put spread should be a better alternative than call bull spread as movement may be slow.