JNCE - Huge Buyers Hit Market At Different Trading PriceJounce Therapeutics Inc (NASDAQ: JNCE) shares are trading higher after the company announced an amended licensing agreement with Celgene Corporation (NASDAQ: CELG), the latter of which has agreed to be acquired by Bristol-Myers Squibb Co (NYSE: BMY). (Source: finance.yahoo.com)

Jounce Therapeutics, Inc. is a clinical stage immunotherapy company, which treat cancer by developing therapies that enable the immune system to attack tumors and provide long-lasting benefits to patients. Its products pipeline include JTX-2011 (ICOS); JTX-4014 (PD-1); Lead Macrophage Program; Macrophage Targeting; T Reg; B Cells; and Stromal Targeting. The company was founded by Louis M. Weiner, Drew M. Pardoll, Thomas F. Gajewski, James P. Allison, Robert Schreiber and Padmanee Sharma in 2013 and is headquartered in Cambridge, MA.

SHORT INTEREST

456.94K 06/28/19

P/E Ratio (with extraordinary items)

-5.04

Analyst Target Price $12.50

Recommendation: HOLD

Penny

Amazon Partnership!Watching 6.30 for break and re-test for bullish entry. And 6.00 level is our support, watch that level for break and re-test for short play. There was positive news for this stock today. "Amazon.com Inc. is partnering with Realogy Holdings Corp. to funnel potential buyers to the brokerage company’s agents. Clients who go on to purchase a home will receive up to $5,000 in products and services from Amazon, giving the company a way to market things it already sells -– handyman services, smart-home gadgets, furniture -– to people who are likely to need them." -Yahoo news.

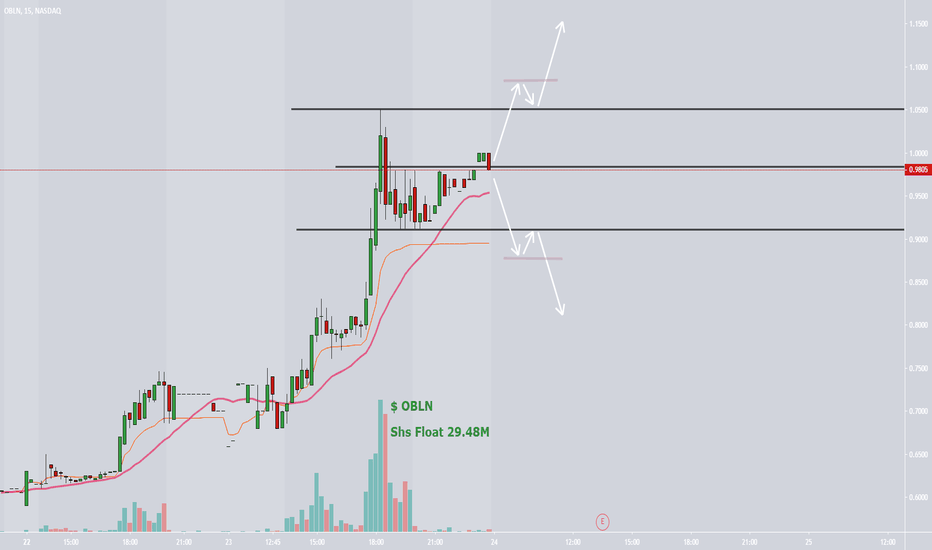

Earnings Tomorrow!This stock has been bullish the last two days, with some positive news today "Obalon Enters Into Commercial Lease for its First Company-Owned Retail Weight Loss Center". The Share Float is 29.48M and the market cap is 29.04M. I will be watching two levels, 1.05 & 0.91 - for a bullish play we will watch for break and retest of 1.05, for a bearish play we will watch for break and retest of 0.91!

Pre Market RunnerThis was a pre market runner from 0.90 -> 2.25, but could not find strong enough support and ended up falling right at market open, through out the entire day. I will be watching for continuation trade, and will set my alert at 1.58 level, as that will be key. Break and re-test at 1.58 is what is needed for the trade.

Can We Rebound?We have found support at 1.75, will be watching for break of 2.35, if we can re test off 2.35, ill look to enter after we get stabilization. There was positive news today, (GHSI), Announced that it has received a patent from the Patents Registry in Hong Kong (Hong Kong Patent No. HK1204758 titled “Apparatus for Use in the Measurement of Macular Pigment Optical Density and/or Lens Optical Density of an Eye”) for its proprietary medical device, the MapcatSF®. The MapcatSF® measures the macular pigment density in the human eye, thus facilitating treatment for several ocular conditions and diseases that affect a large number of patients.

CEI Acquisition NewsNews today "May-15-19 08:00AM Camber Energy Announces that Lineal Star Holdings Has Entered Into A Letter of Intent to Purchase An Engineering and Procurement Firm". Shs Float 12.53M, Market Cap 3.69M. Watching for continuation.

BIGG Breakout comingShorts getting squeezed out, double bottom + higher low price action, accelerating volume, consecutive upper wicking on the day chart, news catalysts in the pipeline, BTC short term bullishness = $$$$$$$

STRAP IN.

Calling 0.15-0.175 by midweek (or sooner)

JP<3

RDU, What is happening?WARNING Very low cap penny stock extremely risky would not recommend to trade.

However, this small mining company produced no news since December 2018 and has not done anything groundbreaking and somehow more than doubled last week.

Despite the dry headlines and average earnings, RDU managed to break a 5 year resistance of 0.185CAD and run all the way to .46 on Friday.

RDU is officially up-trending until it crosses below the 20 cent mark.

It ended red 15% today but I don't think its ready to roll over yet.

PRPO ShortAs seen in the graph, the stock has a strong possibility of going up on Monday. The RSI and the Squeeze Momentum graph show a promising uptrend when the market opens. The stock also shows large decreases with health recovery, not from the point of the drop, but still up after a down trend. Average volume is 3 million meaning good for day traders. This might be a good swing trade when the market opens and I believe one to watch.

Possible bottom on RYU Stock Hidden GEM! After hitting the 0.07 Region, it is consolidating to a point where there seems to be large possible momentum up. Considering the 100% Retracement and the activity it is getting signing a 3 million follower instagram influencer recently means this is not dead and is something to take into consideration!

DSS is our NYSE listed technical breakout pick. #79pctUpside

=====================

Our New Pick is: DSS

Current Price: $1.20

Float: 12.61M

Target Price: $2.15

Investor Presentation

========================

Members,

Act fast, and start your research on our latest trade idea DSS (Document Security Systems Inc.).

We've be scanning the market for the next big bullish breakout opportunity, and DSS really grabbed our attention today.

Based on our research, the chart on DSS is showing us a potential upside of nearly +80%.

This leader in anti-counterfeit, authentication, and diversion protection technologies, is due to get plenty attention from the Street tomorrow.

Here's why....

The Company's packaging and brand protection executives will be presenting the DSS platform of anti-counterfeiting technologies and packaging design to members of the global cannabis industry at MJBizCon being held at the Convention Center in Las Vegas, Nevada November 14-16.

“Cannabis products are quickly going mainstream which means they are fighting the same threats from fraud as other products. But with less mature supply chains and limited controls to protect against counterfeiting the threat is even greater for cannabis providers. DSS can assist these companies with supply chain security, anti-counterfeiting tools, and even printing and packaging solutions,” stated Mike Tobin, DSS VP Sales & Marketing.

The Company’s printing and packaging division, Premier Packaging, offers custom structural designs for folding cartons that are tailored for the cannabis market and their product offerings. Additional competencies include materials management, logistics, converting and inventory management programs; and when coupled with its product authentication technologies, gives DSS a strong value proposition to vertically integrated cannabis brands.

“The cannabis market is also heavily regulated with many states requiring tracking from seed to finished product along with proof that taxes and duties have been paid,” added Tobin. “We can provide companies with a comprehensive, very secure solution starting with a digital signature on the packaging all the way through to consumer engagement, including a blockchain-based option.”

DSS's customized product authentication solutions are powerful enough to protect against the most sophisticated forms of fraudulent activity, safeguarding brand integrity and value. Based on the Company’s patented AuthentiGuard™ technology, any authorized smart phone enables all supply chain personnel and consumers to easily authenticate products, and with the integrated GPS feature, it also has the ability to report diverted goods.

Additional features of AuthentiGuard™ include:

True 2-factor authentication

Secure tie-in to serialization and codes

Traceability from seed to finished product

Counterfeit resistant, patented technology which is secure against copying, scanning and high-resolution photography

Strong data collection capabilities with unified records management on individual plants & products

Iimmediate Bullish Catalysts for DSS:

The Company's packaging and brand protection executives will be presenting the DSS platform of anti-counterfeiting technologies and packaging design to members of the global cannabis industry at MJBizCon being held at the Convention Center tomorrow

Chart is looking extremely bullish at the moment.

Float is just 12.61M

Zero Insider Selling Within the Past 12-Months

On March 19, 2018, DSS announced its partnership with the Hong Kong Logistics and Supply Chain MultiTech R&D Centre (LSCM) to conduct research focused on developing the next generation of DSS’ Brand Protection products utilizing blockchain technology to secure product transactions across multiple channels, including retail and online distribution.

About Document Security Systems Inc.

For over 15 years, Document Security Systems, Inc. (“DSS”) has protected corporations, financial institutions, and governments from sophisticated and costly fraud. DSS' innovative anti-counterfeit, authentication, and brand protection solutions are deployed to prevent attacks which threaten products, digital presence, financial instruments, and identification. AuthentiGuard®, the company's flagship product, provides authentication capability through a smartphone application so businesses can empower a wide range of employees, supply chain personnel, and consumers to track their brands and verify authenticity. For more information on DSS, visit www.dsssecure.com.

Investor Highlights

Focused on high-growth commercialization and high-margin licensing opportunities

Valuable near-term growth opportunities with AuthentiGuard™ & other technology products

Entrance into Asia Pacific market represents significant opportunities within world’s largest counterfeit packaging market

DSS is advancing the Authentication Model from reactive to predictive, involving the use of data to validate product authenticity

Mobile authentication tool, allows all parties in the supply chain the ability to authenticate

Technology platform fills consumer demand for product authentication capability

Adding consumer generates very valuable data that will become cornerstone of businessstrategy and intelligence

Integration of data from supply chain will enable product origin and tracking, critical in food,beverage, health and beauty markets

Technical Analysis

RSI is Showing Bullish Divergence

15-Day Moving Average breaking above its 50-Day Moving Average, forming a "Golden Cross" (Major Bullish Indicator).

We are setting our price target for DSS at $2.15, which is an upside of nearly +80% from our $1.20 alert price.

We are feeling confident that DSS is going to go on multi-day bull run.

The chart is looking extremely attractive, and we believe that DSS will hit our target price of $2.15

We are excited to hear what news will come out of the upcoming MJBiz conference.

We could be looking at the NYSE's biggest winner tomorrow!

As such, we are urging all members to act fast, start their research, and make sure to have DSS up on your screen's and ready to trade.

(*Remember to use a Stop-Loss Order or basic Limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The PennyStock101 Team

Don't Miss Our Next Huge Winner...

Text 'PS101' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have not been compensated to conduct investor relations advertising and marketing for DSS. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.

NCS iH&S pattern confirmed in pre marketNCS completed an inverted head and shoulders in pre-market. going long for price target of 17.30.

price may pull back and form additional right shoulder, (peep the RSI) for a target of around 19.35, but we'll cross that bridge when we get to it fam.

this is a risky trade, stop loss accordingly.

STAY UP

SK

BTC UPDATE. Bottom confirmedHi, guys! Hope you like my last charts and you made money together with me :)

We have a lot of good news:

1) We found strong support ~5800-6000

2) We broke the longtime downtrend channel

3) We broke 6200 resistance

4) !!! We are approaching 4/1 Gann Fan that I talked about in my previous charts. It's currently at 6800 and breaking this level should bring an explosive rally.

5) RSI and MACD turned around and going up

6) Momentum went literally vertical

This is the worst time to be bearish :)

//This information is not a recommendation to buy or sell. It is to be used for educational purposes only//

BTC UPDATE! DIAMOND BOTTOM PATTERN. Hi, guys! As we discussed earlier, BTC didn't manage to close the inside bar over 6200 which led to another quick drop. Now, we have a double bottom, but most interesting that price drew a very rare Dimond Pattern. Now we have a diamond bottom and breakout from 5950 will be a bullish confirmation. This pattern is rare and this is a reversal pattern that works out very well. Let's watch the price action and enjoy :)

//This information is not a recommendation to buy or sell. It is to be used for educational purposes only//

BTC UPDATE! UNDERLOOKED FALLING WEDGE - TARGET $13,50016 week Triangle that everyone was talking about seems to be a WEDGE! Here is why:

Since we almost don't have wicks on the top(check it yourself on the Daily chart), we should disregard wicks on the bottom

#1 rule: Wicks to wicks, body to body. If we charting it properly following this rule, we can clearly see a falling wedge and price just bounced from the lower line. That's why it spiked like that recently. $5800 has been tested multiple times and showed a strong support and now BTC testing resistance at $6250. If we will manage to break it, next stops are $6800-$7050, $7600-$7800, 9k, 10k, 11600 => Target

The measured target of this Wedge is $13500

Stay tuned!

//This information is not a recommendation to buy or sell. It is to be used for educational purposes only//

BTC UPDATE! Bottom, bounce, waves and levelsHi, guys!

In this chart, I want to share with you the most important Support and Resistance levels that necessary to know regardless how things will unfold.

At first of all, I want to bring your attention to the inverse H&S that I called a week ago. It keeps forming but with a little delay. Smaller INV H&S already was executed, target reached and we are heading to the right shoulder of large inv H&S.

We just broke a short time resistance at $6220 which for me was a reversal/buy confirmation, but I've been greedy and scooped some at 6050 and 5950 without confirmation because it was the level of the strongest support that BTC ever has , and it would be unforgivable to miss it.

Now, look at the support/resistance levels. This is key levels that we should keep an eye on to don't sell the support and buy resistance, as many folks like to do.

Thiknes of this levels is calculated very accurately, so, don't disregard it , the thickness is different for a reason! Level can't be considered as broken without complete penetration of the level.

My target ATM is 7600 where we will meet a very strong downtrend line that showed brutal resistance three times in a row. If for any reason that level will be broken, resistance at 9k will be a confirmation of the big move up to $13500 . Of course, we will need to deal with all resistance levels that you see on the chart on the way up, so keep this chart close to check up later on, or mark this levels on your own.

//This information is not a recommendation to buy or sell. It is to be used for educational purposes only//

QLC - Qlink - Penny GEM PICK 100% Profit PotentialQlink is the world’s first decentralized mobile network.

If the Dev team keeps up the good work, QLC will fly.

Today has broken the downtrend.

4hr indicators look good, momentum building with a lot of room left to go.

RSI just over 50 on the 4hr, and still under 50 on the Daily.

MACD turned up on the 4hr, ready to come above ground.

MACD still yet to turn on the daily.

My trading strategy as posted to our Discord:

Penny GEM PICK

QLC on Binance

Buy up to 2000

T1: 2500 25% profit

T2: 3000 50% profit

T3: 3500 75% profit

T4: 4000 100% profit

Stop Loss : 1700

Rating : 4 stars out of 5

Volume 607 BTC