Possible 2.25p retrace entry - 3.81p targetLooks like a 2.25p possible entry for a retrace

2.85p resistance but if broken above 3p then I can see easily a target of 3.81p before it takes a breather...

I no longer hold this stock & sold at small loss. I will evaluate at some point once trend reversal is fully confirmed above 3.81p where it is 50% of the big retrace move.

Pennystock

Bullish 10p & 16.66p target - H&S - RSI strongExtremely bullish here as progress is being made within the company.

Please watch latest interview with Tony Gilby at Proactive investors.

A very strong Q2 coming with newsflow!

We have an H&S pattern and are within a range at moment 5.36p-6.34p so once that breaks then momentum will come.

RSI seems stronger even at this levels which proves there is some volume buying

10p is a solid target for a good slice but ultimately 16.66p is the best one. after that long term as gas flows & revenue increases then this could become a major company with over £100m £300m mcap +

Smells Like a PumperBreakout about the 100 day VWMA and CCI is crawling out of the hole, another rush upwards is in the works. To what point is anyone's guess. Personally not going to buy in unless it has a nice pullback toward the 2.00 level.

Best to play this like anything else - with patience and discipline.

weekly RSI & Daily 200ma support - Bullish from 0.75p-0.80pBought first time at 0.54p & sold at 1.3p

Re-bought today at 0.80p 1st tranche.

We could still touch the weekly 50ma at some point but for now 200ma daily seems stronger.

RSI landed right at support & why I waited for that range for weeks.

News to come very soon so this could do extremely well from this levels.

50ma resistance 108p / bullish divergence 155p target90p possible retrace where 20ma is, before next leg

108p next resistance

155p after.

Bear in mind:

Cash and net debt

The Group carried a cash balance of GBP0.7m at the end of the reported

period as against an opening balance as at the 1 July 2018 of GBP1.9m.

Funds have been deployed in the continued building of the customer

list and on-line marketing spend. The Company also acquired a further

1% of the Skinny Tan subsidiary from the founder during the period.

The Company expects a profitable and cash generative second half

with discussions already underway with a major financial institution

to provide global banking services and financing should funds be

required to support incremental growth opportunities.

1.40p 2.32p resistance / 0.95p support /Graphite play$30m capex to $300m NPV Graphite mining play

Last placing at 1.1p & possibly a good price for entry around there.

Warrants at 2.2p within 3 years.

Please be aware that Paul Johnson is now on the ACP board.

-- Test-work programme aimed to progress the MOU to a binding agreement is planned to start before the end of Q1 2019

-- Discussions regarding the remaining 19,000tpa of production ongoing with a number of potential customers

-- Feasibility study drilling completed with further site activities

- Don't hold any shares -

A higher risk play as down trend hasn't been reversed & no confirmation of it as yet.

Strong last week - above t-line - 9p-10p resistanceIt managed to close above t-line & 20ma so this week it could head back to resistance but watch for any weakness as it's not out of the woods yet.

We need to have a bullish divergence on RSI as well on next bill run as if not it could be weak & head back below.

9-10p is next resistance for a slice in case it doesn't break out. or for a break out trade wait for close above 10p or check volume when a break happens.

At strong support & possible bounce - bullish divergencePlacing was at 1.75p so bear in mind they are fully funded at the moment.

Very strong bullish divergence & strong support here.

I don't hold but see is as a possible trade from this levels.

if 1.5p is lost then best to leave stock as we might be heading to new lows.

Metals play including vanadium.

Potential RSI break - 20ma 50ma cross -1.4p target #mfchartRSI giving an early signal of a potential good move to come next week.

All determined by end of the day but so far its looking good.

Some good news as of late announced and more drill results to come.

Great BoD and patience needed as it is a gold explorer but grades seem very good so far.

Low mcap so plenty of potential

Expose wisely.

I don't hold but like the company.

Weekly T-line close to break / RSI stronger #mfchartRSI trend line stronger and towards end of day a few buys kicking in and almost closing above t-line, tomorrow might be the day we could end the week above it.

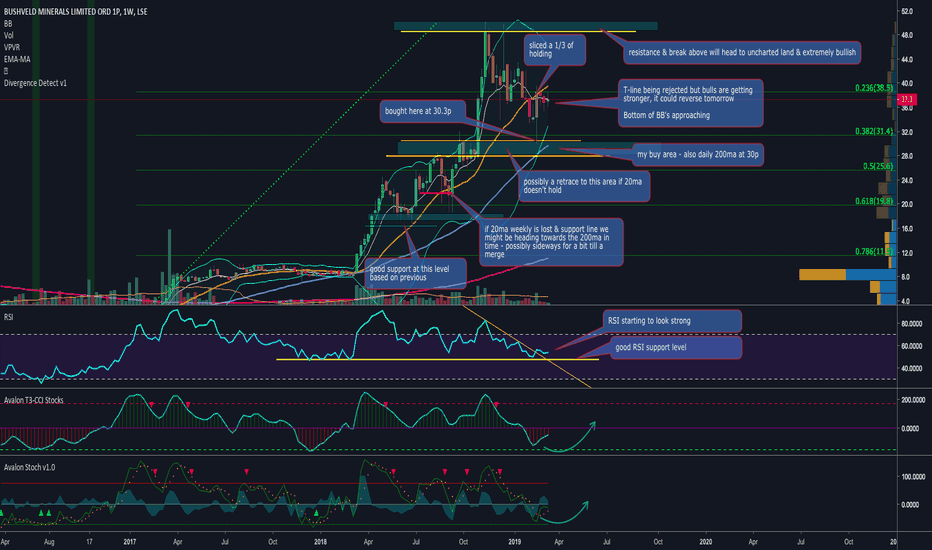

Bought at 30.3p and sliced 1/3 at 38.5p and holding the rest for bigger %

will add more if we test the support again but bottom of BB's are moving up.

there’s a couple of things expected in Q1 for BMN:

- Brits resource estimate

- Capital allocation framework and dividend policy

Both were reiterated in their latest presentation released a week ago

Big news I’m expecting later in the year:

- JSE listing

- Mokopane mining right

- Brownfield processing acquisition

- Bushveld Energy results from battery test with Eskom and potential contracts for grid level storage

I’m also expecting the vanadium price to move up as the year progresses, there’s a structural supply deficit which isn’t expected to disappear until 2023 or so.

Keep an eye for entry / possibly double bottomT-line being rejected at moment so we could have a double bottom to attract new buyers

Bullish diveregence being formed as of late

Not sure how many warrants are missing

bottom support at 3.7p - 3.9p

worth checking on L2 at the time

Near support level - Bullish divergence - RSI break #mfchartKeep an eye here for T-line break & close above

we had a bullish divergence happen recently and bounced from the support which was previous resistance back in 2015

1.7p-1.8p is next resistance level & a few resistance areas like 200ma so be wise & slice accordingly - Don't hold forever.

20p-22p resistance / slice area - 32p next #mfchartNeeds to hold 15p or it could drop back to re-test all time support so expose wisely

keep an eye for entry -Resistance 120p / 205p - support #mfchartResistance at 120p / 205p

Support 65p - 70p

Don't forget to slice some in case it comes down on a retrace

At support area - Top up / entry - 50ma closebyWe have reached top up / entry area here again right where previous resistance was.

50ma daily (at 7p now) is creeping in which might give extra support as well

if lost then we could head to 6.8p as another potential

Bullish to 7.5p-8p 200ma / 50ma resistance #mfchart5p is support area and great for entry opp if it ever comes again (bear in mind spread so at times it's best to buy at 5.10p / 5.15p)

if 5p is lost then bail as it could get back to 2p.

I would look for 7.5p-8p target for a profit slice once we close above 6.42p

Neutral / resistance 11.66p / bullish divergence / no supportA risky trade but if RSI breaks we could lead back to resistance at 11.66p

No 100% confirmation on a bounce coming as of yet but bullish divergence looks good for now.

Bear in mind bullish divergence can happen a few times on the way down.

Weekly t-line cross with 20ma upwards could well start to become bullish so keep an eye here

Very bullish / 200ma strong support / Resistance 10pOne of my favourite patters with perfect waves.

Bought in this stock 4 tranches on every 200ma touch.

Delayed news already priced in and plenty of sticky holders.

Massive project in Mozambique to supply a 300mw of power.

Government on board and awaiting final go ahead timetable.

+60% in 30 days "Pennystock" Bounce Strategy. +30% bounce comingThis is another trade that I really like to do, even though this stock is not under a penny, I use this strategy most for small caps and penny stocks where volume plays an incisive role and provides great and clear signals.

Once again, our tool of choice is the Spectro M2

And we are using only two features with this robust trading plan.

1 - Volume Analyzer

The setting used is the Sine Wave Method( Spectro M2 offers 4), and it is the green/orange/red background we can see under the price action. It tells you the direction and strength of the move based on the volume.

2 - Adaptative Fibonacci

It's an extremely powerful tool that Spectro M2 offers, that provides you instantly all the levels you should be watching for your entry/exit points.

3 - Buy Zone

This one I made with a simple visual average of the lowest low in this channel and the lowest closes, it doesn't have to be super precise, as long as you know the lowest low for your stop-loss any buy-limit order in this area is fine.

It's a long trade but it didn't happen yet so wait for the conditions to confirm otherwise you're not following the strategy.

Consider breaking your buy-limit order all across the buy-zone to get a good avg entry price.