#PEPE/USDT or Breakdown? PEPE Eyes 0.00001166 Target !#PEPE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.00000980, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.00000990.

Entry price: 0.00001030.

First target: 0.00001075.

Second target: 0.00001120.

Third target: 0.00001166.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Pepeanalysis

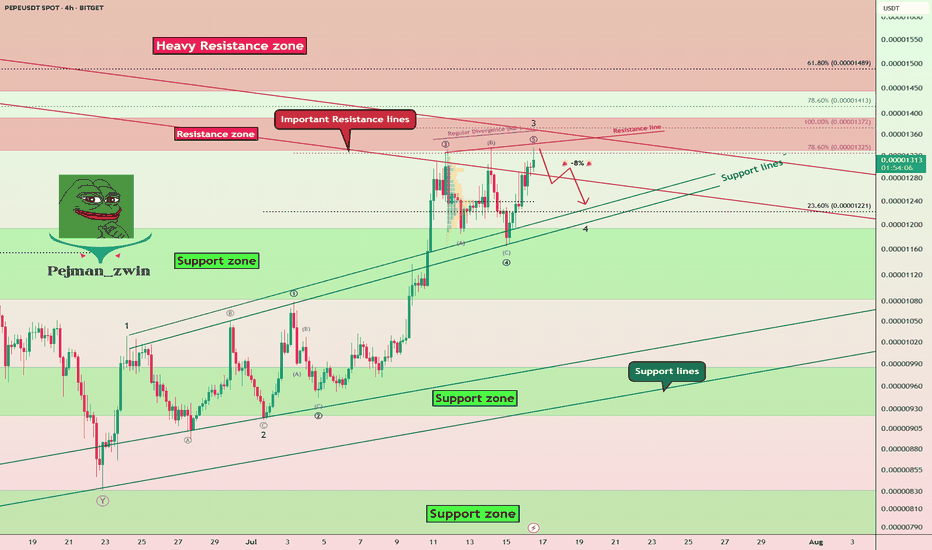

PEPE Faces Key Resistances – Is a -8% Pullback Coming?The PEPE memecoin ( BINANCE:PEPEUSDT ) is currently near the Resistance zone($0.00001392-$0.00001330) and Important Resistance lines . This is the third time that PEPE has attacked the Important Resistance lines .

In terms of Elliott wave theory , it seems that PEPE is completing the microwave 5 of the main wave 3 , so that the main wave 3 is of the extended type .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect a -8% drop for PEPE in the coming hours.

First Target: $0.00001251

Second Target: $0.00001212

Note: Stop Loss(SL)= $0.00001400

Please respect each other's ideas and express them politely if you agree or disagree.

PEPE Analyze (PEPEUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

$PEPE looks ready to leap again!CRYPTOCAP:PEPE looks ready to leap again! 🐸

After its massive December 2024 rally, CRYPTOCAP:PEPE has undergone an equally strong correction — but signs suggest the bottom is in.

✅ Strong support at 0.0000700 and 0.0000650

✅ MACD stabilizing

✅ RSI showing a huge bullish divergence

Momentum is building — don’t lose sight of the frog! 🐸🚀

DYOR

#PEPE #Altcoins #CryptoTrading #BullishSetup #RSIDivergence #MemeCoinSeason #CryptoAlert #PEPEArmy

PEPE Ready to Rip? 3 Take-Profits Lined Up from This Key SupportPEPEUSD is currently forming a potential bullish reversal near the key support zone between 0.00001060 and 0.00001099. This level has acted as a solid demand zone previously, with price bouncing off this range multiple times in the recent past. The current price action suggests consolidation above this level, hinting at potential accumulation by buyers.

We can observe a compression in volatility, with recent candles showing smaller bodies and longer wicks near support—classic signs of weakening bearish momentum. The prior price rejection from the 0.00001318 zone and the smooth retracement to support further confirm this as a healthy correction rather than a trend breakdown.

The DPO (Detrended Price Oscillator) is hovering close to zero, suggesting the asset is entering a potential pivot zone. A move into positive territory would support the bullish scenario, ideally confirmed by an increase in volume on the breakout above short-term resistance.

This setup is particularly attractive for scalpers or short-term traders, aiming to capture quick momentum surges across multiple resistance levels.

📌 Trade Setup

• Entry Zone: 0.00001167–0.00001177

• Stop-Loss (SL1): 0.00001060

• Take-Profit 1 (TP1): 0.00001318

• Take-Profit 2 (TP2): 0.00001443

• Take-Profit 3 (TP3): 0.00001603

Strategy Note: The risk-to-reward ratio is highly favorable, particularly for TP2 and TP3. The setup allows for flexible scaling of positions as price hits each resistance level. With no immediate macro threats on the 4H structure and price defending support, this setup offers a clean bullish opportunity.

PEPE at Key Reversal Zone — Support Test Coming Soon?Today I want to look at the PEPE token ( BINANCE:PEPEUSDT ), which is part of the memecoin category, and provide you with a short-term analysis on the 1-hour timeframe .

PEPE token is trading in Potential Reversal Zone(PRZ) .

In terms of Elliott wave theory , the PEPE token appears to be completing the microwave 5 of the main wave C . The structure is a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect the PEPE token to attack the Support zone($0.0000120-$0.0000108) after completing the main wave C .

Note: Stop Loss = $0.0000362

Please respect each other's ideas and express them politely if you agree or disagree.

Pepe Analyze (PEPEUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Is PEPE Ready for Its Next Leg Up? Key Support Levels to Watch! PEPE/USDT Analysis: Bullish Trend, Pullback, and Opportunity 🚀🐸

👋 Today, I’m taking a look at the PEPE/USDT chart. We’ve seen PEPE in a strong bullish trend lately, riding a strong momentum wave. Theres a shift at the moment when you look at the broader market—US dollar strength is still in play, and we’re seeing some pullbacks in Bitcoin and other major cryptos. 💵📉

PEPE is starting to pull back. This isn’t a bad thing—in fact, healthy pullbacks are what set up the next big moves. What I’m watching for is a retracement down into a key support zone. If price can hold there and we see a bullish break of structure, that’s my cue to look for a buy opportunity. 🛑➡️📈

The key here is patience. I want to see confirmation that buyers are stepping back in—i.e. strong bullish candles, a clear break of the recent lower high (BoS), or even a spike in volume. If we get that, I’ll be ready to ride the next leg up. Until then, I’m biding my time and letting the market come to me. 🕰️

Remember, no FOMO—let the setup come to you, and always manage your risk.🍀

#PEPEUSDT: Ready to launch | Will price hit previous high? EPEUSDT’s price has accumulated and is currently in the distribution phase, where we can anticipate a bullish impulse pattern. There are three targets, but our long-term objective is for the price to surpass its previous record high. We anticipate the price to reach or even surpass the previous high.

Wishing you good luck and safe trading!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

PEPE / USDT : rebounding from support, prepping for breakout PEPE/USDT: Rebounding Strongly from Trendline Support, Prepping for a Breakout

PEPE/USDT is showing signs of strength 📈 as it rebounds from a critical trendline support zone 📊. The pair is forming a bullish setup, indicating a potential breakout 💥 in the coming days. If this breakout materializes, we could witness a powerful bullish rally 🚀. Stay vigilant 👀 and wait for confirmation before taking action.

Key Insights:

1. Trendline Support: PEPE/USDT is respecting a long-standing trendline support, providing a solid foundation for a potential upward move. A breakout above resistance could trigger a strong bullish trend.

2. Volume Surge: Monitor trading volume closely—a significant increase during the breakout will confirm buyer strength 🔥.

3. Bullish Signals: Momentum indicators such as RSI and MACD are turning upward ⚡, supporting the likelihood of a bullish breakout.

Steps to Confirm the Breakout:

Wait for a decisive 4H or daily candle closing above the immediate resistance level 📍.

A noticeable spike in volume during the breakout will confirm strong buying activity 📊.

A successful retest of the broken resistance as a new support zone adds credibility to the move ✅.

Watch out for fake breakouts, such as wicks above the resistance or sudden reversals ⚠️.

Risk Management Strategies:

Set stop-loss orders below the trendline support to protect your capital 🔒.

Position sizing should align with your overall trading plan and risk tolerance 🎯.

This analysis is for educational purposes only and not financial advice. Always conduct your own research (DYOR) 🔍 before making investment decisions.

pepe coin can be legend?"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

PEPE. Smart Money Is Betting Big on PEPE. 12/14/24On December 10th, nine wallets (likely belonging to the same investor) invested 13.8 million DAI to purchase 555 billion PEPE, with an average buying price of $0.000025.

I believe that #PEPE is a dark horse that could deliver a major surprise by the end of this cycle. However, always keep in mind the potential scenario where we may drop to retest the mirrored level at any moment.

A possible strategy: allocate 25% of your intended investment at the current price and set 2-3 limit orders down to the support level marked on the chart. The target is also indicated on the chart.

DYOR.

PEPE price prediction: key price levels to watchPEPE recently saw an exponential rally of over 250%, hitting a new all-time high (ATH) of $0.0000284 on 9 December. This explosive growth coincided with the broader memecoin supercycle and Bitcoin’s sustained bullish sentiment on the charts.

Since its ATH, PEPE has oscillated between $0.000018 and $0.0000247, signaling more market indecision.

The key levels to watch out for are –

Support: The $0.000018-$0.00002 range, aligned with the 20-day EMA, is a critical support zone for buyers. A dip below this range could invalidate the prevailing bullish trend, exposing the token to downside risks towards $0.000015.

Resistance: A decisive close above the $0.000025 resistance could set the stage for buyers to push towards the $0.0000284 ATH. Breaching this level could open doors to an extended uptrend towards $0.00003.

Technical indicators suggested cautious optimism. The RSI, at press time, was hovering near 61 – A sign of moderate bullish momentum. While it seemed to be far from overbought territory, the possibility of a consolidation phase near these press time levels cannot be ruled out.

The MACD was also yet to see a full bearish crossover, hinting at potential near-term pressure on sellers. However, traders should wait for the Signal line to stabilize before predicting a trend reversal.

$PEPEUSDT: Flag Pattern Breakout Incoming?BINANCE:PEPEUSDT : Flag Pattern Breakout Incoming? Don’t Miss This Opportunity!

BINANCE:PEPEUSDT has broken out of a major resistance level and completed its retracement. It’s now forming a bullish flag pattern, signaling the potential for a big upward move upon breakout. Flag patterns are often reliable indicators of continuation, offering great opportunities for traders. Always remember to set your stop-loss to manage risk effectively. Watch closely for confirmation of the breakout!”

BINANCE:PEPEUSDT Currently trading at $0.0000194

Buy level: Above $0.0000199

Stop loss: Below $0.0000169

TP1: $0.0000223

TP2: $0.000026

TP3: $0.000035

TP4: $0.00005

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

PEPE ready to PUMP

PEPE Whale Activity Analysis: Insights from Whale Metrics and CUMULATIVE NET FLOW

Over the last few days, whale activity in PEPE has shown significant changes, as tracked by cumulative net flows and whale count data. Here’s a breakdown of the recent trends and their implications:

Cumulative Net Flow (25th-28th November)

25th November: -10.35 trillion PEPE

Modest outflows suggest minor accumulation or redistribution by whales.

26th November: -10.25 trillion PEPE

Outflows persist but remain within a controlled range.

27th November: -41.3 trillion PEPE

A massive jump in outflows suggests significant accumulation, potentially setting the stage for a bullish move.

Whale Count Changes

Whale count increased by 13 to 14 whales over this period.

This rise in whale count aligns with large-scale accumulation observed in the net flow data.

A growing number of whales often reflects confidence in the asset, as whales prepare for potential price movements.

Implications: Pump or Dump?

Bullish Case (Pump):

Accumulation Dominance:

The increasing negative net flow (cumulative outflows) indicates that whales are actively accumulating PEPE.

The rise in whale count further supports a bullish narrative, as whales typically accumulate before driving prices higher.

Prediction Based on Indicator Logic:

The indicator's Accumulation Signal highlights that this activity is likely to precede a price increase.

Key levels near the last retail liquidation zone could present optimal buying opportunities for retail traders.

Bearish Case (Dump):

No significant distribution signals have been detected, meaning the likelihood of a bearish dump is low for now.

If whale inflows spike and cumulative net flow turns positive, it would signal distribution, potentially leading to a price drop.

Key Observations

Accumulation Activity Surging:

The cumulative net flow dropping to -41.3 trillion on 28th November reflects aggressive accumulation, a strong indicator of bullish intent.

Whale Confidence Increasing:

The rise in whale count to 14 suggests that more significant players are entering the market, likely expecting upward price action.

Retail Liquidations as Entry Zones:

Retail liquidation zones are crucial for identifying levels where whales may push prices before continuing their accumulation or distribution cycles.

Strategy Recommendations

Monitor Accumulation Levels:

Look for buying opportunities near key retail liquidation levels.

Watch for Distribution Signals:

Stay cautious if cumulative net flows shift positive, indicating whales are offloading their holdings.

Conclusion

The significant accumulation activity over the past few days, combined with an increase in whale count, strongly supports a bullish outlook. However, traders should remain vigilant for any sudden shifts in whale behavior or retail liquidation signals to capitalize on market opportunities effectively.

🚀 Prepare for potential upward price momentum, with key support levels near recent retail liquidations!

#PEPE - Long Setup FormationBINANCE:PEPEUSDT looks like it forms some juicy lows for market makers to sweep

and fuel the next leg up

Will it use the closest demand zone for it, or will it need more liquidity below to have enough?

I expect sometime tomorrow to see the pivot for the next leg up so keep an eye on #PEPE to make sure you don't miss this long!

PEPE price stability in doubt as market momentum fadesPEPE price is showing signs of weakening momentum. Key technical indicators suggest the recent uptrend is losing steam. As a result, the coin has fallen almost 10% in the last 24 hours.

Additionally, short-term price indicators, such as the EMA lines, remain neutral, signaling that PEPE may test important support levels in the near future. While the possibility of a downward move exists, a resurgence in bullish momentum could push PEPE toward retesting key resistance levels.

PEPE’s ADX has dropped to 18.86, a sharp decline from its peak of 58.52 on September 30, when PEPE was trading at $0.00001147.

Such a low ADX value indicates that the price is likely ranging within a narrow band, neither gaining nor losing much ground. This aligns with the idea that PEPE is in a period of reduced volatility, even as one of the biggest meme coins in the market.

The sharp drop in ADX also confirms that the strong trend observed in late September has faded, leaving PEPE without a clear directional force. That makes it more susceptible to sideways trading or minor fluctuations until a new trend emerges.

This downward tilt suggests that the bullish momentum is weakening, and a potential shift could be on the horizon. If the current price action continues in this neutral to slightly bearish direction, PEPE might test the support level at $0.00000835 in the coming days. Should this support fail to hold, the price could drop further, with the next strong support at $0.00000776.

However, if bullish momentum picks up again, PEPE price could challenge the resistance at $0.0000119. For now, the market remains in a state of uncertainty, and traders are likely waiting for a clearer signal to determine the next move.

Pepe’s rally not over: here's whyDespite a challenging month with a 5.77% drawdown, Pepe (PEPE) recent performance shows promising signs of recovery, with a 16.11% increase on its weekly chart. Further bullish indicators suggest continued upward momentum.

At press time, the coin was trading within a symmetrical triangle, characterized by converging upper and lower lines that serve as resistance and support zones, respectively.

PEPE recently rallied from a significant horizontal support level at 0.00000701, ascending to the upper resistance of the triangle pattern at 0.00000876. This resistance line also aligns with another key resistance level, emphasizing the strength of the barrier.

While symmetrical triangles typically indicate potential bullish outcomes, a breakthrough above the upper resistance line is essential. Successfully breaching this level could propel the memecoin to its 2024 high of 0.00001725 or to a mid-level target of 0.00001307.

Should PEPE fail to overcome this resistance, it is likely to retreat to the horizontal support line at 0.00000701 or the lower boundary of the triangle, as it seeks to build momentum for another rally attempt.

Moreover, Open Interest, a key indicator that measures trader enthusiasm in the market, has seen a notable increase. It surged from $95.68 million on 23rd September to $114.39 million by 25th September, reflecting heightened trader interest in the memecoin.

What PEPE traders need to know before making the next movePepe (PEPE) was testing a key resistance level of $0.0000077 at press time. This comes after the meme coin rejected a key bullish pennant at $0.0000063 and acquired a massive surge of 20% to the recent trading price.

The $0.0000077 level emerged as a barrier to the bullish momentum breaking out to test the higher resistance at $0.0000091.

This consolidation phase precedes a period of upward movements, raising market curiosity on whether the bull rally will continue or not.

The stochastic RSI indicator for PEPE hinted at a bullish divergence. This suggests the ongoing consolidation might lead to an upward movement. However, a bearish run cannot be written off since the stochastic RSI was approaching an overbought zone.

The bullish pennant pattern on the chart strengthens the chance of a breakout. However, the $0.0000077 resistance level still poses a major challenge for the bulls to beat.

Taking a closer look at market trends, the Coinglass liquidation heatmap revealed some interesting trends on whale activity.

The data showed that PEPE whales are returning. Key market participants are positioning themselves around current prices, which might spark excitement if PEPE makes a significant move.

Looking ahead, market participants are keeping an eye on that $0.0000077 resistance level. Pushing past it could send PEPE rocketing up to its recent high of $0.0000091.

If it fails to break through, we might see it drop back down to support around $0.0000069.

PEPEUSDT.1DThis technical analysis of the PEPE/USDT (PepeCoin against US Dollar Tether) chart provides a comprehensive view of the market dynamics at play. Here’s an in-depth review of the current chart pattern and the critical levels:

Current Price Action:

PEPE is trading at 0.00001259 USDT. The chart reveals a sequence of bullish and bearish phases, now seemingly poised at a crucial juncture.

Key Levels on the Chart:

Support Levels:

S1: 0.00000780, a significant pivot point in recent trading sessions.

S2: 0.00000595, which has acted as both resistance and support in earlier price movements.

S3: 0.00000379, indicating a lower boundary from past pricing zones.

S4: Not shown but would imply a further significant drop.

Resistance Levels:

R1: 0.00001377, a previous support level that could now serve as a resistance.

R2: 0.00001724, the highest recent price and a psychological barrier.

Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD is hovering around the signal line, indicating a lack of strong momentum. The slight convergence above the signal line may suggest a budding bullish momentum, but it remains weak.

RSI (Relative Strength Index): The RSI is at 59.04, which is near the neutral zone but trending upwards, suggesting increasing buying interest without yet reaching overbought conditions.

Technical Analysis and Trading Strategy:

The chart presents a scenario where PEPE has bounced off the low support levels and is attempting to break through higher resistance. The current formation suggests a potential bullish reversal if the market sentiment continues to improve.

Buying Strategy: Consider taking long positions if PEPE maintains its level above S1 at 0.00000780, with a conservative target at R1 (0.00001377). A tight stop-loss just below S1 could help manage risk.

Selling Strategy: If PEPE reaches the resistance at R1, traders should watch for signs of reversal (e.g., bearish candlestick patterns, RSI divergence). Taking profits near R1 or holding out for R2 (0.00001724) with a trailing stop-loss can maximize gains while protecting from sudden declines.

Risk Management: Given the volatility and the lower price per coin, position sizing should be adjusted accordingly to manage exposure and avoid significant losses.

Conclusion:

The PEPE/USDT pair shows potential for short to medium-term gains if it can sustain above established support levels and break through the impending resistance levels. The key will be to watch how the indicators align over the next trading sessions, particularly the MACD for momentum shifts and the RSI for buyer exhaustion signs at higher levels. This approach combines technical signals with strategic entry and exit points to optimize the trading outcome while mitigating risk.

$PEPE trollololing from 0.00000920 to 0.0000260-270 price 185%upAfter hitting a low post-correction we are very much still in a bull market with BINANCE:PEPEUSDT after the correction from 0.00001600 happened. Majority selling volume sitting at 0.00002642.

Invest smart, invest hard.

Boost my post if you like this idea 💡

Also follow and subscribe for more uproars. Let's spread the word together.

Roaring Puppy 🐶 out.

BINANCE:PEPEUSDT