Breaking: $PEPE Coin Dipped 10% Today- Is the Frog Meta Dead?Pepe the Frog ( CRYPTOCAP:PEPE ) memecoin saw its token price plummet by 10% today albeit the general crypto landscape experienced a deja vu as The US Personal Consumption Expenditures (PCE) inflation numbers for February have been released, showing a steady trend in headline inflation but a slight uptick in core inflation.

Bitcoin and altcoins have extended losses further from earlier today as BTC slips under $85,000, while Ethereum (ETH) tanks 7% slipping under $1,900. Current trend shows that investors could expect strong volatility over the weekend.

US PCE Data Shows Inflation Remains Sticky

As per the Bureau of Economic Analysis, the US PCE inflation data remained unchanged at 2.5% for the month of February, aligning with the market expectations and the previous month’s reading. However, the year-over-year core inflation came hotter-than-expected at 2.8%, higher than both the previous reading of 2.6% and the expected 2.7%.

Technical Outlook of PEPE

As of the time of writing, CRYPTOCAP:PEPE is down 8% trading within a bearish trend pattern. the asset is approaching the 65% Fibonacci retracement point is serving as support point should selling pressure submerged. Furthermore, with the RSI at 45, there might be further consolidatory move by CRYPTOCAP:PEPE to cement a perfect liquidity pick region to increase the demand for $PEPE.

Pepe Price Live Data

The live Pepe price today is $0.000008 USD with a 24-hour trading volume of $519,642,130 USD. Pepe is down 8.84% in the last 24 hours. The current CoinMarketCap ranking is #31, with a live market cap of $3,265,213,245 USD. It has a circulating supply of 420,689,899,653,544 PEPE coins and a max. supply of 420,690,000,000,000 PEPE coins.

Pepecoin

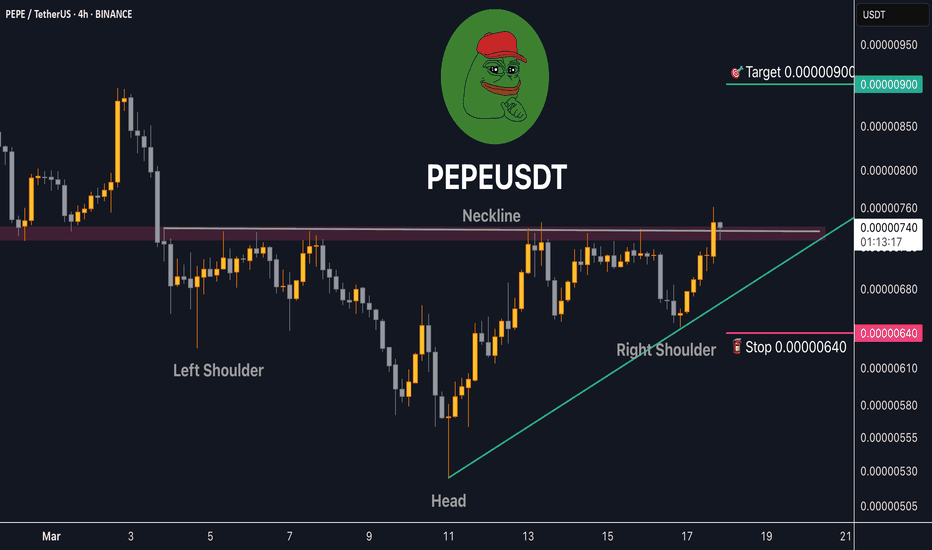

PEPE/USDT:BUY LIMITHi friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

PEPE resparking the FLAME to PARABOLICA SKY from here. 0.0000070PEPE 2024 has been a rosy one to say the least.

It has gone parabolic last year reaching an impressive ATH of $0.00002803, a quadruple increase in its valuation.

This year, along side the mother coin BTC, the market went on a bleed mode season --cooling down what has heated up for so long. MEMEs suffer the most -- returning to ground back to the base, or even lower due to extreme volatility.

Today, PEPE is starting to show some basing behavior -- hinting of an impending price shift from the current range. It took weeks for this coin to accomplish this saturation levels.

We expect price to reverse to the upside from this bargain levels. A rare opportunity to seed before it re-attempt the multiple x price growth.

If you notice on our diagram, NET LONGS / BUYERS are trying to respark the price around here conveying massive accumulation -- pre hinting of a massive price surge ahead thats about to transpire soon.

BTC is also showing some long term shifting behavior -- which will benefit the market including PEPE. When the heat up starts, fomo season starts, and you know what happens thereafter.

Spotted at 0.00000700

Target at x4 price at ATH 0.00002803

TAYOR. Trade safely.

PEPE: Bear Market Bottom or Just a Dead Cat Bounce?Overview:

BINANCE:PEPEUSDT PEPE experienced a brutal three-month bear market, shedding around 80% of its value from its peak. Currently, PEPE is at a crucial juncture, having reached an important cluster support level—a zone historically respected by traders and often indicative of short-term reversals.

Technical Analysis:

- Bearish Trend (3 months): An 80% decline signals severe selling pressure, common in meme coins after parabolic rises.

- Cluster Support Zone: The current price area (highlighted clearly on the chart) has historically attracted buying interest. It has served multiple times as a pivot point.

- Price Action: The recent bounce looks tentative, indicative of a potential "dead cat bounce" scenario—a temporary recovery in prices before a continuation of the bearish trend.

Key Levels to Watch:

- Immediate Support: Current cluster around 0.006-0.007 USDT. A decisive break below may trigger another sharp sell-off.

- Resistance: Strong overhead resistance around 0.010 USDT, crucial for bulls to regain control. A failure to breach could confirm bearish continuation.

Opinion:

From my experience navigating multiple crypto cycles, meme coin rallies typically end in severe corrections like this one. A bounce at current levels is expected, but caution is essential. This looks like a classic bear market relief bounce rather than a true trend reversal.

Trading Strategy Recommendation:

- Short-term traders may consider playing the bounce cautiously, setting tight stops below the recent lows.

- Long-term investors should remain cautious. Wait for stronger confirmation, ideally above resistance at 0.010 USDT, to confirm the bearish trend is weakening.

Conclusion:

PEPE is currently at a critical inflection point. While a short-term bounce is probable, remain vigilant for confirmation before taking major positions. Protect your capital and trade wisely.

Stay safe & trade smart.

What do you think about PEPE's current situation? I'd love to hear your insights below.

#PEPE #CryptoTrading #TechnicalAnalysis #CryptoVeteran #TheCryptoFire

$PEPE - Local SupportCRYPTOCAP:PEPE | 4h

The price is now outside the distribution curve and is starting to establish a base here

If we can hold .0070 to .0068 (PoC), I believe we could test .008 to .009 (short-term target).

I expect the price would pull back down to the current level .0070s before we reach higher targets.

Breaking: The $PEPE X Account Has Been CompromiseThe CRYPTOCAP:PEPE team took to their telegram community to announced that the official X (Formerly Twitter) account has been compromise. Needless to say that the token was already down 3.54% as of the time of writing. With the RSI sitting at 36 more selling pressure could surmount.

What Is PEPE?

PEPE is a deflationary memecoin launched on Ethereum. The cryptocurrency was created as a tribute to the Pepe the Frog internet meme, created by Matt Furie, which gained popularity in the early 2000s.

The project aims to capitalize on the popularity of meme coins, like Shiba Inu and Dogecoin, and strives to establish itself as one of the top meme-based cryptocurrencies. PEPE appeals to the cryptocurrency community by instituting a no-tax policy and being up-front about its lack of utility, keeping things pure and simple as a memecoin

Pepe Price Live Data

The live Pepe price today is $0.000007 USD with a 24-hour trading volume of $454,987,385 USD. We update our PEPE to USD price in real-time. Pepe is down 4.22% in the last 24 hours, with a live market cap of $2,861,929,455 USD. It has a circulating supply of 420,689,899,653,544 PEPE coins and a max. supply of 420,690,000,000,000 PEPE coins.

PEPE/USDT Breakout Watch: Key Level to Trigger a Bullish SurgeKey Level Analysis

The phrase "if the price closes above this level then" suggests a confirmation level that must be broken for an upward move.

The highlighted level seems to be an area of previous support-turned-resistance (around 0.00001150 - 0.00001200 USDT).

If the price closes above this level on the weekly timeframe, it signals:

Breakout confirmation → Likely leading to a strong bullish rally.

Trend reversal → A shift from bearish to bullish structure.

Momentum entry point → A trigger for potential buy positions.

Potential Price Movement

If the weekly close is above the key level:

The price could rally significantly (illustrated by the large blue arrow).

Next resistance levels could be around 0.00001700 - 0.00002200 USDT.

If the price fails to close above the level:

It could mean a continuation of the downtrend.

Retesting lower support areas around 0.00000650 - 0.00000550 USDT.

PEPUSD POTENTIAL SETUP

**Overview:**

PEPEUSD is currently trading within a descending channel, respecting key supply and demand zones. The market is approaching a critical decision point that could determine the next major move.

**Key Levels:**

🔹 **Support:** 0.00000719 - Strong demand zone where price has recently bounced.

🔹 **Resistance:** 0.00000850 - Key breakout level to watch.

🔹 **Major Target:** 0.00001031 - Potential upside target if bullish momentum takes over.

**Analysis:**

- The price is currently in a downward structure but has shown signs of potential reversal from the demand zone.

- A **break above the 0.00000850 zone** could confirm bullish momentum, making it a strong area to accumulate more positions.

- If the price fails to break this resistance, we may see further consolidation or a continuation of the downtrend.

**Trade Plan:**

📌 **Bullish Scenario:**

- Wait for a confirmed breakout and retest of 0.00000850 before entering long.

- Target **0.00001031** with a proper risk-reward setup.

📌 **Bearish Scenario:**

- If price rejects resistance, short opportunities could be considered with a stop above the resistance.

- Target the previous low at **0.00000719** for a potential retracement.

*Final Thoughts:**

This setup requires patience and confirmation. Always manage risk accordingly and wait for clear price action signals before executing trades. 🚀📊

$PEP Pepecoin, The next DOGE? COINEX:PEPUSDT NO TA needed. Buy the dip, hold for 5 years, and thank me then. Pepecoin is the hidden gem that you are looking for within the Crypto (memecoin) space. Not a token, never will be. It is a Layer 1 coin that has a decentralised network, just like BTC. Pepecoin is also merge mineable with DOGE, LTC. If you need any more info that explains much better than I do, then head to pepelum.site or pepecoin.org . Everything that explains about Pepecoin is all there! Another interesting website to look at is pepecoin-nodes.com where nodes are increasing everyday, increasing the strength and security of the network. Last time I checked Pepecoin had about 2029 nodes, which is a lot for a coin developed only last year!

I believe that Pepecoin has the ability to rank behind DOGE or even surpass it in the future. If you are even thinking of putting money into a sh*t Solana coin then think again. Pepecoin has a great future with a massive potential on its way.

NFA (not financial advice 😉)

However if you are interested in this coin, head to www.reddit.com to join the Pepecoin community. Discord can also be accessed via the reddit. IMO pepecoin discord is also a great place to be.

Very Bullish on its future. Like I said before head to the sites I mentioned as it explain Pepecoin in much greater detail.

$PEP Pepecoin, The next DOGE? NO TA needed. Buy the dip, hold for 5 years, and thank me then. Pepecoin is the hidden gem that you are looking for within the Crypto (memecoin) space. Not a token, never will be. It is a Layer 1 coin that has a decentralised network, just like BTC. Pepecoin is also merge mineable with DOGE, LTC. If you need any more info that explains much better than I do, then head to pepelum.site or pepecoin.org . Everything that explains about Pepecoin is all there! Another interesting website to look at is pepecoin-nodes.com where nodes are increasing everyday, increasing the strength and security of the network. Last time I checked, Pepecoin had about 2029 nodes, which is a lot for a coin developed only last year!

I believe that Pepecoin has the ability to rank behind DOGE or even surpass it in the future. If you are even thinking of putting money into a sh*t Solana coin then think again. Pepecoin has a great future with a massive potential on its way.

NFA (not financial advice 😉)

However if you are interested in this coin, head to www.reddit.com to join the Pepecoin community. Discord can also be accessed via the reddit. IMO pepecoin discord is also a great place to be.

Very Bullish on its future. Like I said before head to the sites I mentioned as it explain Pepecoin in much greater detail.

#PEPE/USDT#PEPE

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.00000935

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.00000950

First target 0.000000960

Second target 0.00001000

Third target 0.00001047

PEPE/USDT 1H: Bearish Consolidation Reversal –Target 0.00000970PEPE/USDT 1H: Bearish Consolidation Reversal – Next Target 0.00000970?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Condition:

Price currently at 0.00000928 in a bearish consolidation following a significant drop.

RSI at 46, showing neutral momentum.

Hidden bullish divergence is forming on RSI while price makes lower lows.

Market Maker Activity:

Accumulation is evident in the 0.00000890-0.00000920 zone with multiple tests, indicating MM buildup before the next leg up.

Key Levels:

Support: 0.00000890

Resistance: 0.00000970

Current Price: 0.00000928

Trade Setup (Confidence 7/10):

Entry: Consider a long entry at 0.00000920 with tight stops.

Targets:

T1: 0.00000950

T2: 0.00000970

Stop Loss: Place at 0.00000885.

Risk Score:

6/10 – Favorable risk-to-reward, but waiting for confirmation above 0.00000940 may offer a safer entry.

Recommendation:

Long positions are recommended given the MM accumulation and hidden bullish divergence.

Monitor for confirmation above 0.00000940 before fully committing.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

#PEPE/USDT#PEPE

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0.00000970

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0.00000986

First target 0.000001013

Second target 0.00000103

Third target 0.000001068

PEPE/USDT 1H: Bullish Breakout in Play – Can $0.00001200 READY!PEPE/USDT 1H: Bullish Breakout in Play – Can $0.00001200 Be Reached?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Bullish breakout confirmed, price breaking above $0.00001060 resistance with strong momentum.

RSI at 75.21, indicating bullish strength, but still below extreme overbought conditions.

Pattern: Ascending triangle breakout, signaling trend continuation.

Key Levels:

Support: $0.00000950 (previous accumulation zone).

Resistance: $0.00001200 (next major target).

Current Price: $0.00001064.

Trade Setup (Confidence 8/10):

Entry Zone: Current price ($0.00001064) or pullback to $0.00001020 for better positioning.

Targets:

T1: $0.00001150 (initial resistance).

T2: $0.00001200 (major liquidity zone).

Stop Loss: Below $0.00000920 (below previous accumulation zone).

Risk Score:

7/10 – Favorable R:R setup, but RSI suggests watching for pullbacks.

Market Maker Analysis:

Accumulation phase complete, now transitioning into markup.

Breakout above previous range confirms institutional positioning.

Hidden bullish divergence on RSI, reinforcing trend strength.

Recommendation:

Long positions remain favorable at $0.00001064 or pullback to $0.00001020.

Tight stops below $0.00000920 to protect against invalidation.

Watch for rejection at $0.00001150 before confirming move to $0.00001200.

Confidence Level:

8/10 – Strong breakout structure, Smart Money accumulation confirmed.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

PEPE 10x imminentPay your attention to PEPE. This is an underestimated project that will easily show 10x on the current market. From a technical point of view the asset is very oversold, we should wait for a strong push up. Wintermute made their asset 2 times cheaper and finished accumulation. Growth start next week.

PEPE/USDT 1H: Accumulation Underway – Breakout to 0.00001050?PEPE/USDT 1H: Analysis

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Condition:

Price at 0.00000943, consolidating within the Fair Value Gap (FVG).

RSI at 44.83, indicating neutral momentum with bullish divergence forming.

Trading in the equilibrium zone, positioned between the premium and discount areas.

Smart Money Analysis:

Market Makers are likely creating liquidity at 0.00001050 (premium zone).

Weak lows suggest accumulation phase before a potential bullish breakout.

Trade Setup:

Entry Zone: 0.00000943 - 0.00000950.

Targets:

T1: 0.00001000 (equilibrium zone).

T2: 0.00001050 (premium zone).

Stop Loss: Below 0.00000900 (discount zone invalidation).

Risk Score:

7/10 – Favorable R:R, but requires confirmation of momentum shift.

Market Maker Intent:

Hidden bullish divergence present on RSI—higher lows forming while price makes lower lows.

Market Makers likely accumulating before pushing price to the premium zone.

Wait for confirmation above 0.00000950 for a higher probability setup.

Recommendation:

Long entries are favorable within the 0.00000943-0.00000950 range.

Volume confirmation above 0.00000950 will strengthen bullish momentum.

Maintain a tight stop-loss at 0.00000900 to minimize downside risk.

Confidence Level:

7/10 – Bullish signs forming, but confirmation is essential before full commitment.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!