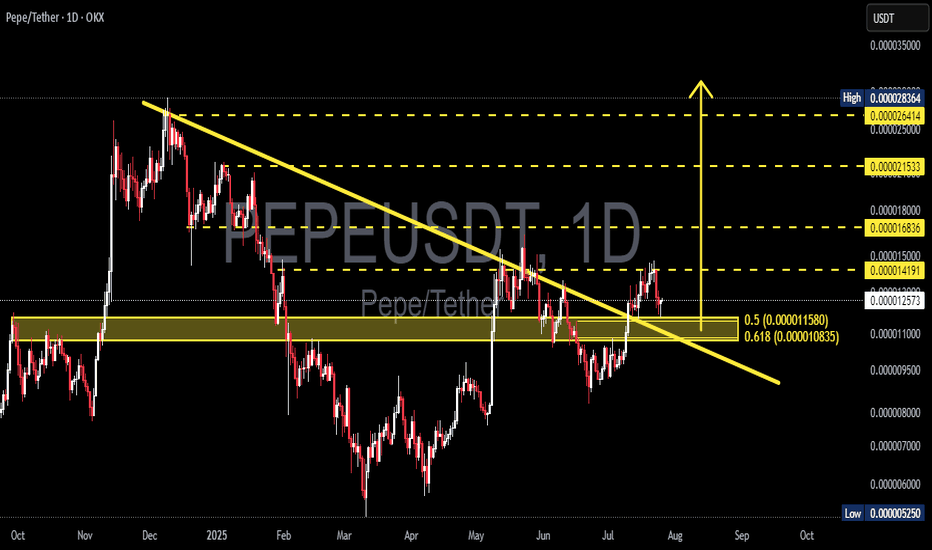

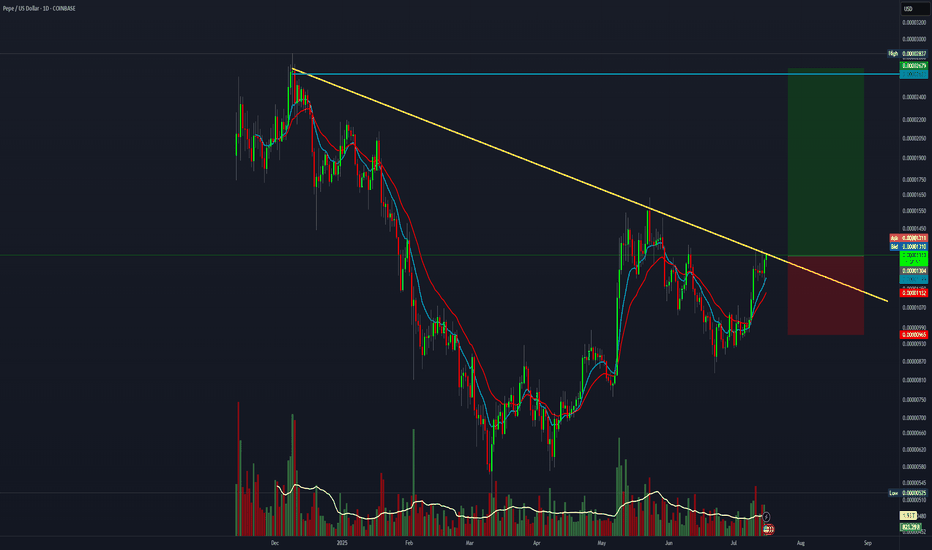

PEPEUSDT – Downtrend Breakout & Golden Zone Retest in Play!📊 Chart Analysis:

On this daily timeframe chart of PEPEUSDT, price has successfully broken above the descending trendline that had capped the price since late 2024. This breakout is a strong early signal that bearish momentum is weakening and a potential trend reversal may be underway.

After the breakout, the price is now performing a retest at a key confluence support zone, including:

Fibonacci Retracement levels 0.5 (0.000011580) and 0.618 (0.000010835) — the Golden Zone

Previous horizontal demand zone (highlighted in yellow)

Retest of the broken descending trendline

This retest area will be crucial for determining the next directional move.

---

🐂 Bullish Scenario:

If price holds above the Fibonacci Golden Zone and forms a bullish confirmation candle, we could see a continuation of the uptrend toward:

0.000014191

0.000015000

0.000016836

0.000021533 (medium-term target)

Possibly retesting the High at 0.000028364

This would confirm the start of a major trend reversal and renewed bullish momentum.

---

🐻 Bearish Scenario:

If price fails to hold above the 0.000010835 level and breaks down below the Golden Zone:

Expect a drop toward psychological support around 0.000010000

And potentially further down to the strong support near 0.000007000

Such a move would invalidate the breakout and put PEPE back into a consolidation or extended downtrend phase.

---

🧠 Chart Pattern Notes:

Descending Trendline Breakout

Golden Zone Retest (Fibonacci 0.5 & 0.618)

Potential formation of an Inverted Head & Shoulders pattern (in early stages)

---

🎯 Conclusion:

PEPEUSDT is at a critical turning point after breaking out of a long-term downtrend. If the support at the Golden Zone holds, there is strong potential for a sustained bullish rally. However, traders should remain cautious and apply proper risk management in case of a breakdown below key levels.

#PEPEUSDT #CryptoBreakout #GoldenZoneRetest #TechnicalAnalysis #FibonacciLevels #PEPECoin #AltcoinAnalysis #TrendReversal #BullishSetup #BearishRisk

PEPEUSDT

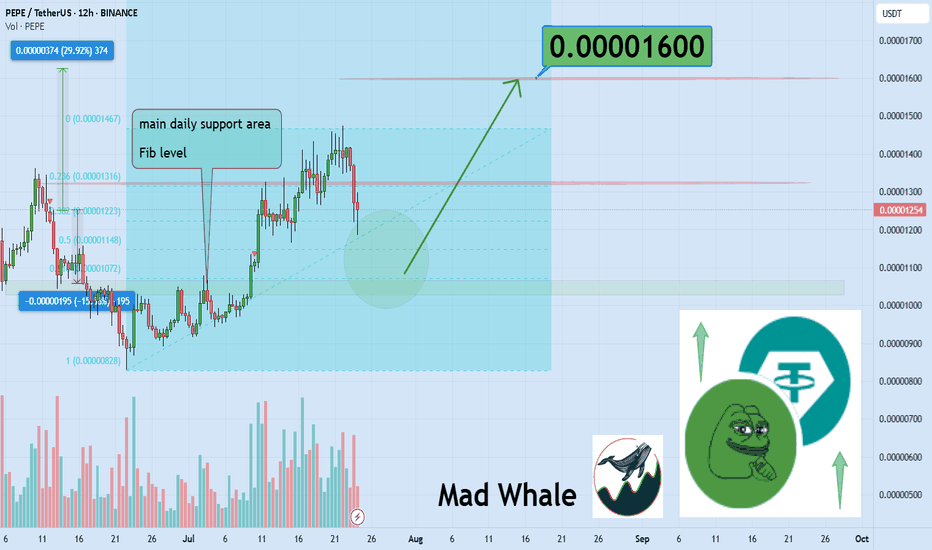

Bounce or Breakdown? PEPE Eyes 0.000016 Target!38% BounceHello✌

Let’s analyze PEPE memecoin’s upcoming price potential 📈.

BINANCE:PEPEUSDT is approaching a key daily support level, which also aligns with the 0.61 Fibonacci retracement. If this level holds, a potential bounce toward the 0.000016 area could offer around 38% upside. 📈🟢

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

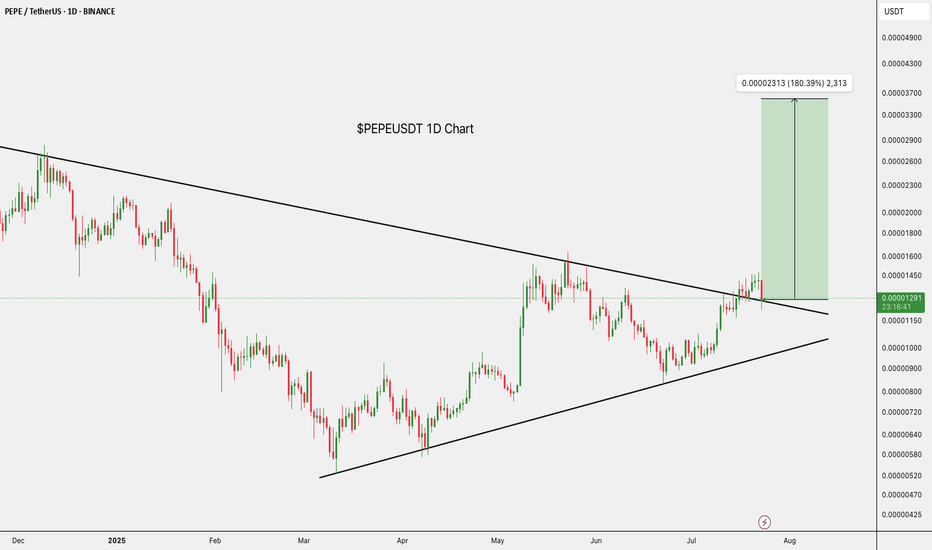

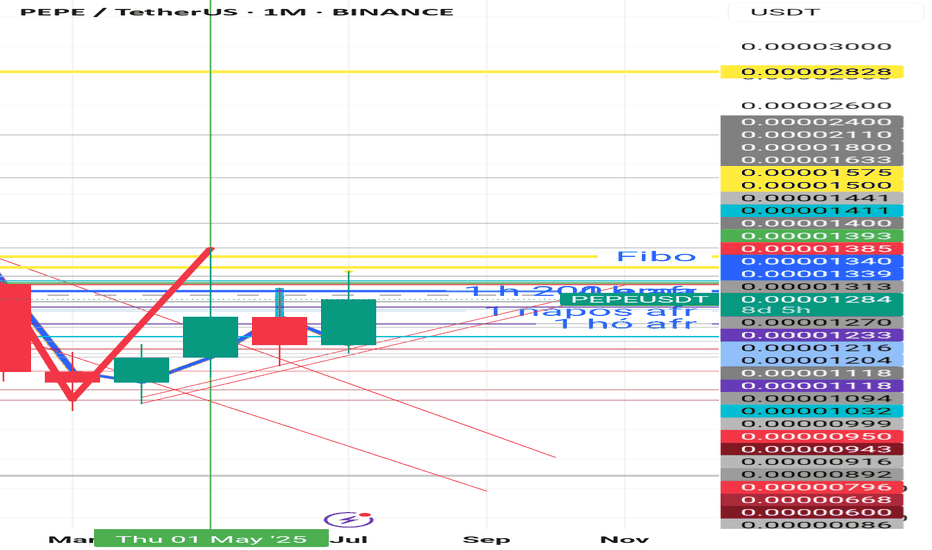

Is the alt season over at Pepe?PEPE

This is not a little suspicious to me. H&S is forming on a 1-month timeframe. I also discovered 4 divergences on a 4-hour timeframe looking back at the past few weeks, which may support my assumption that this is what the off-season was all about and a longer break may be in order.

Was that all the offseason was for Pepe?PEPE

This is not a little suspicious to me. H&S is forming on a 1-month timeframe. I also discovered 4 divergences on a 4-hour timeframe looking back at the past few weeks, which may support my assumption that this is what the off-season was all about and a longer break may be in order.

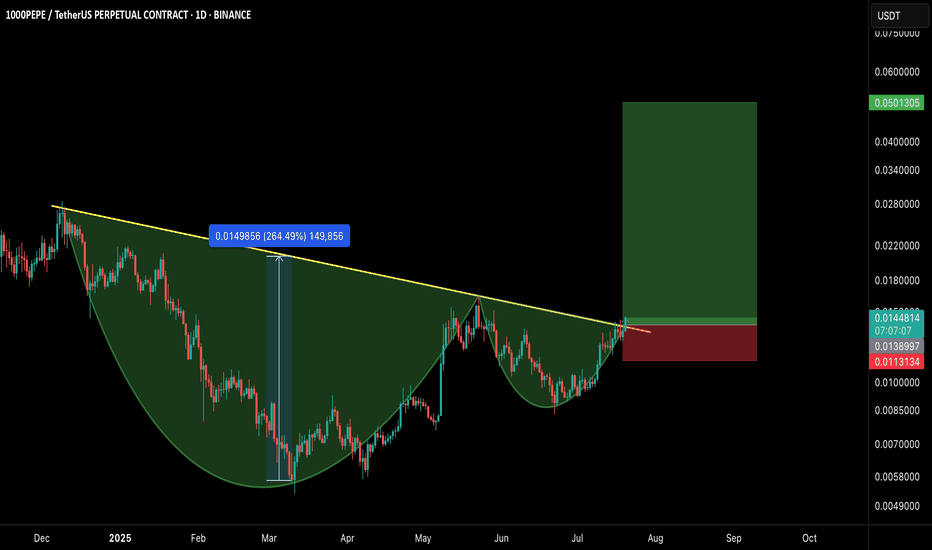

1000PEPE/USDT – CUP & HANDLE BREAKOUT!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

A classic Cup and Handle formation just broke out with strong bullish confirmation, signaling the potential start of a massive trend reversal on the higher timeframe.

📊 Pattern Breakdown

✅ Cup & Handle pattern forming over 7+ months

📐 Breakout above neckline with volume confirmation

📈 Measured move target points towards $0.0501+

🛒 Long Entry:

CMP or on retest near $0.0128–$0.0138

🎯 Targets:

TP1: $0.022

TP2: $0.028

TP3: $0.035

TP4: $0.050

🛑 Stop-loss:

Below handle low — around $0.0113

📌 Risk-to-Reward:

Insane potential here with a 3.5R+ setup even with conservative targets.

📢 Final Thoughts:

This is a textbook reversal pattern breaking out after long accumulation. If BTC remains stable or bullish, meme momentum could supercharge this move.

DYOR + SL is a must!

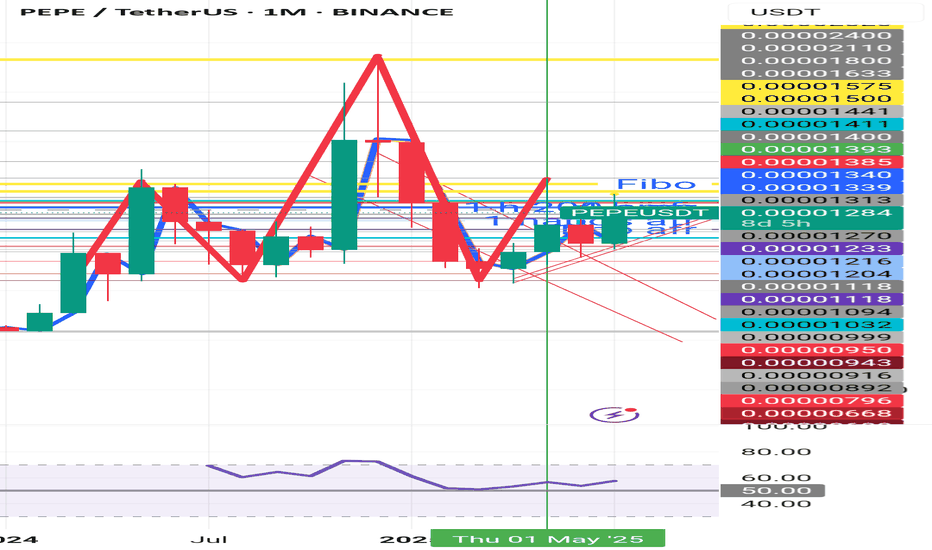

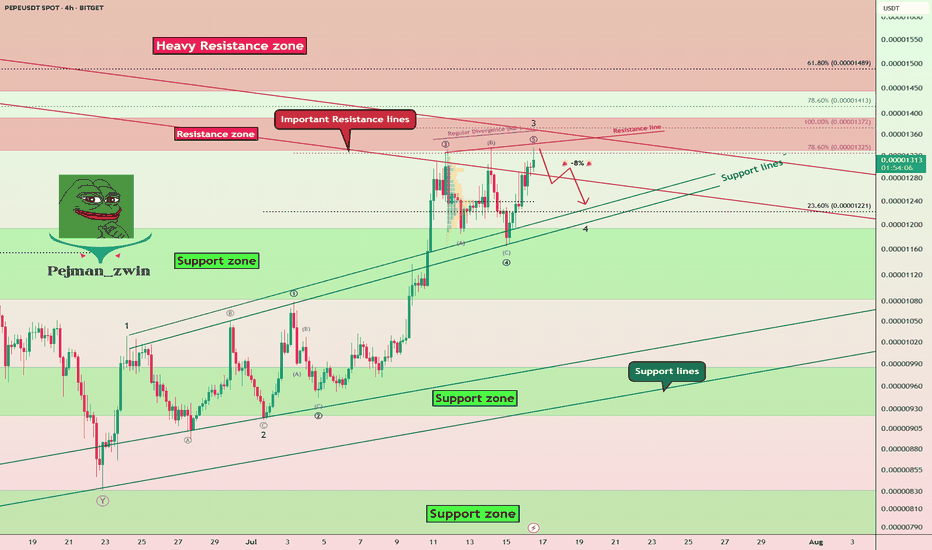

PEPE Faces Key Resistances – Is a -8% Pullback Coming?The PEPE memecoin ( BINANCE:PEPEUSDT ) is currently near the Resistance zone($0.00001392-$0.00001330) and Important Resistance lines . This is the third time that PEPE has attacked the Important Resistance lines .

In terms of Elliott wave theory , it seems that PEPE is completing the microwave 5 of the main wave 3 , so that the main wave 3 is of the extended type .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect a -8% drop for PEPE in the coming hours.

First Target: $0.00001251

Second Target: $0.00001212

Note: Stop Loss(SL)= $0.00001400

Please respect each other's ideas and express them politely if you agree or disagree.

PEPE Analyze (PEPEUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

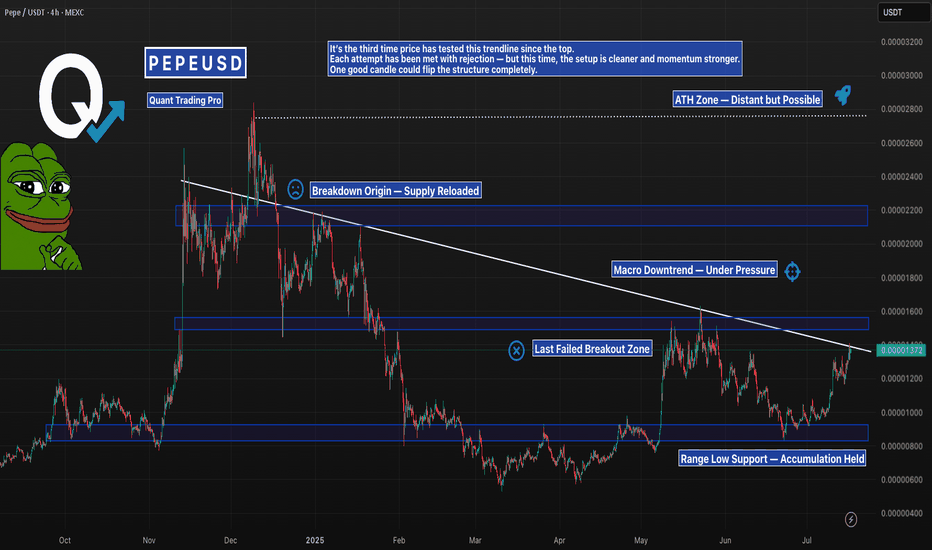

PEPE Pressing Into Its Macro Downtrend — AgainPEPE is back at the same trendline that’s slapped it down twice before — but this third attempt comes with strength.

We’ve got higher lows, reclaimed support, and a solid grind into resistance.

Still, a macro downtrend is a macro downtrend… until it breaks.

This next move will decide if this is the real deal or just another fakeout.

#PEPE #PEPEUSDT #MemeCoinCharts #CryptoAnalysis #TrendlineTest #BacktestEverything #TradingView #QuantTradingPro #CryptoBreakout

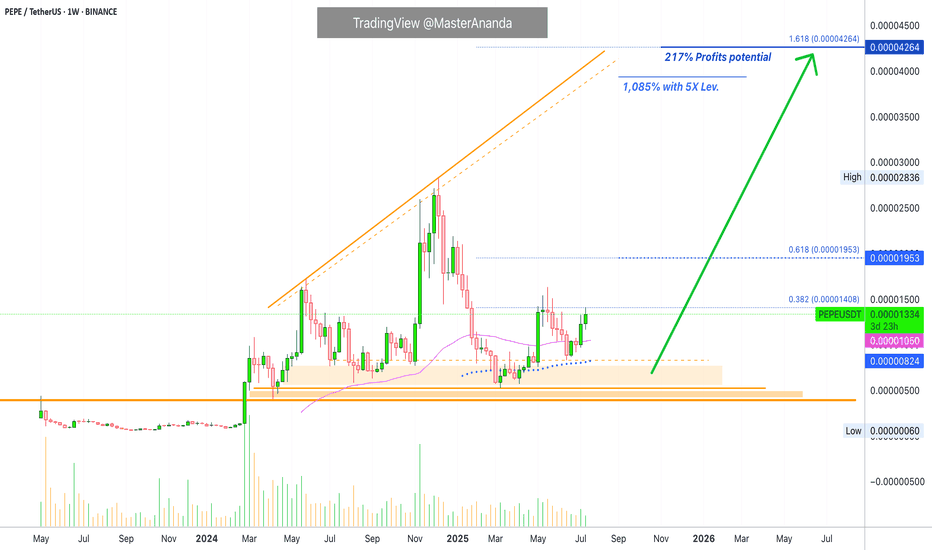

Pepe's Bullish Bias Intensifies · 217% PP = 1085% 5X Lev.The bullish bias for PEPEUSDT is starting to intensify, still early of course. It is still early on this one because the action is still lower than the 19-May high. There are many projects that are already trading above their last high. So it is good news to find a pair that is moving below because we know that soon it will be moving above. In the coming days.

While the 19-May wick high reached 0.00001632, the weekly close happened at 0.00001361. As you can see from the chart, the current price is already higher than the highest weekly close and this gives us a strong bullish signal.

Notice again how the action moved above EMA89 back in mid-April. When the retrace happened, May-June, the recovery happened above this level. A signal of strength.

PEPEUSDT moved briefly below EMA55 only two recover and this is the second week above this level. Trading weekly above EMA55 & EMA89 means that the bullish bias is fully confirmed. A fully confirmed bullish bias means we are set to witness a higher high, and a higher high means prices moving above 0.00001953, short-term. In a matter of days.

The main target for this move is 0.00004264 giving us a nice 217%. With 5X leverage, relatively low risk, that would be beyond 11X (1,085%).

In a matter of days, the entire altcoins market will be bullish and moving higher. Make sure you are fully invested by the time everybody is rushing to buy. That is, you should be all-in now. It is not too late.

Thank you for reading and for your continued support, it is truly appreciated.

Namaste.

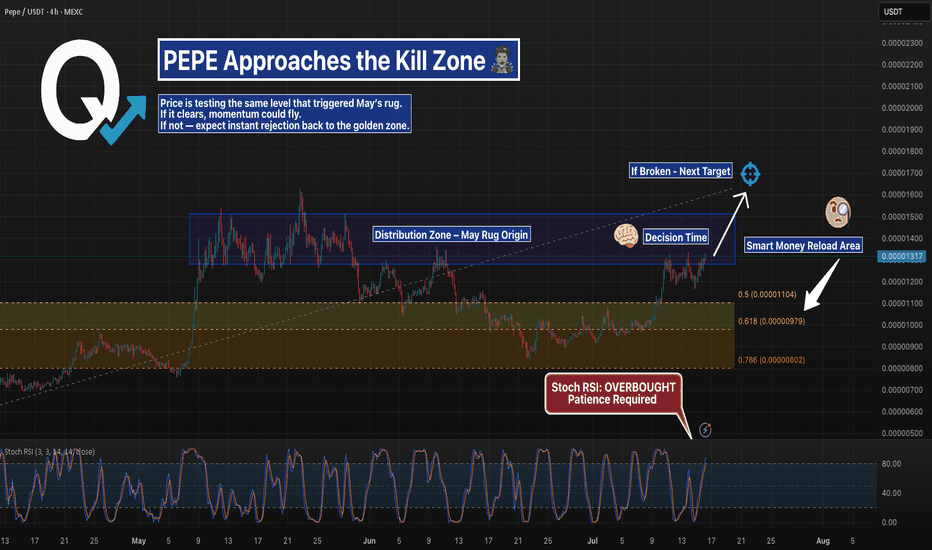

PEPEUSDT – Back Into the Trap Box | Fib Support BelowPEPE is retesting the same high-volume resistance that sparked a selloff in May.

With price pressing into the top box again, this becomes a key decision point.

A breakout sends us higher — but rejection could send price back toward the golden pocket between 0.00001104 and 0.00000979.

Watch the reaction closely.

This is where the next major move begins.

#PEPEUSDT #MemeCoin #SupportResistance #FibRetracement #QuantTradingPro #TradingView

Is Pepe growing? Read the caption, it's important.Hello friends🙌

✔Some factors caused the price to fall, but in a support area that we have drawn for you with several Fibonacci waves, you can see that a classic double bottom pattern has been formed and buyers have entered.

🔊Now there is no more news of a fall and buyers have raised the price to the point where it has created a higher ceiling and floor, and this is very important and signals a change in trend.

📈Now that the price has broken the specified resistance line and is well supported by the specified support line, we can expect the price to move to the specified areas, but do not forget that the most important thing to observe in trading is capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

PEPE – Strongest Setup Among Top Meme Coins

Out of the higher-cap meme coins, I’m leaning more toward $PEPEUSDT.

From a price action perspective, it’s showing more strength than CRYPTOCAP:DOGE , CRYPTOCAP:SHIB , and $WIF. That’s not to say the others won’t pump—but personally, CRYPTOCAP:PEPE looks the most appealing here.

The green box is a solid area to build a position. It’s held the trimester lows well and continues to test them while responding bullishly.

Let’s see how it plays out over the next two months—but I like the odds of upside from here.

PEPE/USD Market Heist: Thief Entry Plan for Big Gains🔥🚨 Thieves of Wall Street: PEPE/USD Crypto Robbery Blueprint 🚨🔥

The Ultimate “Thief Style” Trade Setup That Even Wall Street Would Envy

— A High-Risk, High-Reward Playbook for Market Outlaws —

🌍 Hello Global Money Grabbers!

Hola | Ola | Bonjour | Hallo | Marhaba | Namaste 💰🌐

Welcome to the Thief Trading Zone — where smart rebels don’t chase price, they trap it, rob it, and run off with the profits. 🏴☠️

💸 Mission: PEPE/USD Market Infiltration

🎯 Objective:

Infiltrate the PEPE/USD crypto zone where the big bears sleep — and strike long in the danger zone where most traders panic and exit. That’s where we thrive.

🔍 Trade Setup: The Heist Blueprint

Market: PEPE/USD

Play: Long Entry (Thief-Style Reversal Tactic)

Zone: Red-Hot Resistance Turned Reversal (aka the Profit Trap Zone)

🧨 Entry Strategy:

Wait for the breakout through the Red Moving Average wall at 0.00001060 — that’s your signal the vault is open.

🔑 Execution Plan:

Place Buy Stop Orders just above the breakout level.

Deploy Buy Limit Orders at 15-min/30-min swing lows or consolidation traps.

Use DCA/Layering Entry Style — like a true thief, you never go all in at once.

⚙️ Set Alerts on breakout zones — thieves never sleep on opportunity!

🛑 Stop Loss Tactics (Stealth Exit):

Primary SL: Set just below recent swing low on 5H chart (around 0.00000960).

Wait for the breakout before dropping that SL — don’t get caught too early.

Risk management is your getaway vehicle. Don’t crash it.

🎯 Targets:

Primary Exit: 0.00001200

Optional Early Exit: If the heat’s on, take the bag and disappear. 🏃♂️💨

Always trail your SL to protect your loot.

💡 Scalping & Swing Heist Tips:

Scalpers: Only ride the long waves.

Swing Thieves: Set your traps and be patient — big moves take time.

Big Wallets: Dive in.

Small Wallets: Ride with protection and precision.

🔎 Market Insight (Thief Intel Drop):

PEPE/USD is flashing bullish signals across:

On-chain analytics

COT positioning

Sentiment reversal indicators

Macro economic setups

Intermarket synergy

Get your confirmations before acting — we rob smart, not blind.

⚠️ News & Heat Map Alert:

High-impact news = flashing red lights 🚨

Avoid new positions during major announcements.

Already in the game? Use trailing SL to secure your profits while chaos brews.

🚀 Boost the Robbery!

Smash that Boost Button to join the elite crew of thief traders flipping charts for fun & profit every day. 💎📈

Stay sneaky, stay smart — this ain’t gambling, it’s organized market crimee (the smart kind).

🎭💰 Next Heist Coming Soon — Follow for More Robbery Blueprints! 💣💼

PEPEUSDT Forming Falling ChannelPEPEUSDT is showing promising signs of a potential breakout, supported by a clear price structure that resembles a falling channel pattern. This technical setup is widely known among traders for indicating a possible trend reversal when the price successfully breaches the channel’s upper resistance line. Coupled with good trading volume, the current market sentiment around PEPE is generating optimism for a potential 60% to 70% gain as buyers step in at these attractive levels.

This crypto pair has caught the attention of both retail and institutional investors due to the growing hype and community-driven momentum behind the PEPE token. Despite its meme origins, PEPE has demonstrated significant staying power in the market, with steady liquidity and regular price swings that attract short-term and swing traders alike. As new investors continue to accumulate positions, the probability of a breakout move increases, reinforcing the bullish outlook.

Technically, the price action indicates that PEPEUSDT may be forming a solid base for an upward surge. The falling channel pattern, if validated with a confirmed breakout and retest, could set the stage for a strong push towards higher levels, aligning perfectly with the projected upside potential. Traders should keep a close eye on the breakout level and volume spikes, as these will serve as key confirmation signals for the next move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

PEPE Breakout Sequence – Double Flag Pattern Forming?PEPE continues its breakout sequence on the 1H chart, forming a classic bull flag followed by another possible setup in real time. The first breakout above 0.00000108 triggered strong follow-through. Now, a second flag is forming just under 0.00000130. With Stoch RSI cooling down, this could be the reset needed for continuation.

📍 Watch for confirmation above 0.00000129 to validate the next leg.

#PEPE #BullFlag #Altcoins #MomentumTrading #QuantTradingPro #CryptoBreakout #TradingView

PEPEUSD going to moon according to my analysis. {08/june/2025}Educational Analysis says that PEPEUSD may give trend Trading opportunities from this range, according to my technical analysis.

Broker - binance

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

PEPE Breaks Out After Triple Bottom – Retest Incoming?PEPEUSDT just printed a textbook 3-tap support rejection, followed by a Break of Structure (BOS) through the descending trendline — now bulls are watching for a retest entry opportunity.

--Key Technical Highlights:

🔹 3 Rejections @ Support: Price respected the ~$0.00001000 level multiple times, building a strong base.

🔹 Break of Structure (BOS): Momentum shifted as PEPE broke the local highs and pierced descending resistance.

🔹 Wait for Retest: Ideal entry comes on a pullback to the previous resistance for a clean breakout confirmation.

🔹 Target: $0.00001351 – Based on prior swing highs and fib extension levels.

**A failed retest could invalidate the setup — watch lower support (~$0.00000900) for last line of defense.

PEPEUSDT Critical Decision Zone – Massive Move Incoming?🧠 Macro Technical Analysis

PEPEUSDT is currently hovering within a critical demand zone (0.00000095 – 0.00000110), an area that has historically acted as a strong accumulation base and a launchpad for previous rallies. The chart structure shows multiple interactions with this zone, highlighting its significance as a key inflection level.

This zone is not just a support — it’s a make-or-break battlefield between bulls and bears. Price is consolidating within this zone, setting the stage for a potential explosive breakout or a dangerous breakdown.

🔍 Pattern Breakdown & Key Technical Levels

Accumulation Zone (Yellow Box):

Seen from April 2024 to now, price has bounced several times from this region. The multiple touches and long wicks confirm strong buying interest here.

Sideways Channel / Range-Bound Structure:

Price action between 0.00000110 and 0.00000283 has formed a clear horizontal range, and the current price is once again testing the lower boundary of this range.

Implied Move Projection (Yellow Arrow):

A potential breakout from this range could trigger a measured move to the upside, aiming for the previous high at 0.00000283 — representing a +150% upside potential from current levels.

📈 Bullish Scenario:

1. Price holds above 0.00000100, maintaining structure above demand.

2. Break and daily close above:

0.00000127 (minor resistance)

Then 0.00000140, which could trigger acceleration.

3. Target levels to watch:

🟡 0.00000162 – Intermediate resistance

🟡 0.00000180 – Confluence zone

🟡 0.00000211 – Mid-range mark

🟡 0.00000240 – Major breakout checkpoint

🟡 0.00000283 – Range high and final bullish target

Break above 0.00000283 could open a parabolic rally.

📉 Bearish Scenario:

1. Breakdown below 0.00000095, followed by rejection from the bottom of the demand zone.

2. This could signal:

Weak market structure

Failed accumulation

Invalidation of the bullish setup

Key downside levels:

🔻 0.00000080 – Local support

🔻 0.00000065 – Historical low defense

🔻 0.00000038 – Macro capitulation zone

⚠️ Breakdown from current levels will turn this accumulation into distribution.

🧭 Strategic Takeaway:

PEPE is trading at a decisive zone. A bounce from this level could signal the start of a new bullish phase, while a breakdown could usher in a deeper bearish trend. Traders should closely monitor volume spikes, breakout candles, and confirmations above 0.00000127 to validate bullish momentum.

This is a low-risk, high-reward setup for disciplined traders with proper risk management.

#PEPEUSDT #PEPE #CryptoTechnicalAnalysis #AltcoinBreakout #MemeCoinSeason #CryptoTrading #AccumulationZone #BreakoutAlert #BullishCrypto #BearishScenario

The best-looking HTF meme chart, hands down is $PENGUThe team behind the crypto mascot accomplished a lot over the last couple of weeks, and the TA is showing;

- CBOE filing for PENGU ETF

- Appeared at @Nasdaq

- Listed on @eToro

- Listed on @RevolutApp

- Listed on @Official_Upbit

- Listed on @WebullGlobal Pay

- @NASCAR Partnership

- PEZ x Pudgy Penguins Partnership

- Miles & More Partnership

- @PenguClash reached 2M+ on waitlist

- 1B views per day

All this and much more!

@pudgypenguins are doing it the right way 🐧

Pepe update hello friends✋️

Considering the drop we had, you can see that the price was well supported in the specified area and buyers came in. Now in the return of the price, we can buy step by step in the specified support areas and move with it until the specified goals, of course, with the management of shame and risk...

*Trade safely with us*