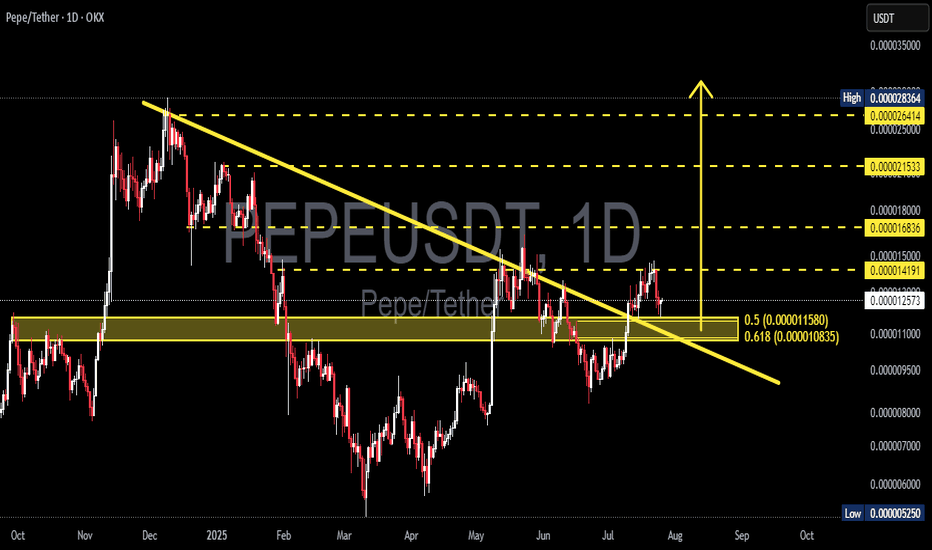

PEPEUSDT – Downtrend Breakout & Golden Zone Retest in Play!📊 Chart Analysis:

On this daily timeframe chart of PEPEUSDT, price has successfully broken above the descending trendline that had capped the price since late 2024. This breakout is a strong early signal that bearish momentum is weakening and a potential trend reversal may be underway.

After the breakout, the price is now performing a retest at a key confluence support zone, including:

Fibonacci Retracement levels 0.5 (0.000011580) and 0.618 (0.000010835) — the Golden Zone

Previous horizontal demand zone (highlighted in yellow)

Retest of the broken descending trendline

This retest area will be crucial for determining the next directional move.

---

🐂 Bullish Scenario:

If price holds above the Fibonacci Golden Zone and forms a bullish confirmation candle, we could see a continuation of the uptrend toward:

0.000014191

0.000015000

0.000016836

0.000021533 (medium-term target)

Possibly retesting the High at 0.000028364

This would confirm the start of a major trend reversal and renewed bullish momentum.

---

🐻 Bearish Scenario:

If price fails to hold above the 0.000010835 level and breaks down below the Golden Zone:

Expect a drop toward psychological support around 0.000010000

And potentially further down to the strong support near 0.000007000

Such a move would invalidate the breakout and put PEPE back into a consolidation or extended downtrend phase.

---

🧠 Chart Pattern Notes:

Descending Trendline Breakout

Golden Zone Retest (Fibonacci 0.5 & 0.618)

Potential formation of an Inverted Head & Shoulders pattern (in early stages)

---

🎯 Conclusion:

PEPEUSDT is at a critical turning point after breaking out of a long-term downtrend. If the support at the Golden Zone holds, there is strong potential for a sustained bullish rally. However, traders should remain cautious and apply proper risk management in case of a breakdown below key levels.

#PEPEUSDT #CryptoBreakout #GoldenZoneRetest #TechnicalAnalysis #FibonacciLevels #PEPECoin #AltcoinAnalysis #TrendReversal #BullishSetup #BearishRisk

Pepeusdtrading

PEPE/USD Market Heist: Thief Entry Plan for Big Gains🔥🚨 Thieves of Wall Street: PEPE/USD Crypto Robbery Blueprint 🚨🔥

The Ultimate “Thief Style” Trade Setup That Even Wall Street Would Envy

— A High-Risk, High-Reward Playbook for Market Outlaws —

🌍 Hello Global Money Grabbers!

Hola | Ola | Bonjour | Hallo | Marhaba | Namaste 💰🌐

Welcome to the Thief Trading Zone — where smart rebels don’t chase price, they trap it, rob it, and run off with the profits. 🏴☠️

💸 Mission: PEPE/USD Market Infiltration

🎯 Objective:

Infiltrate the PEPE/USD crypto zone where the big bears sleep — and strike long in the danger zone where most traders panic and exit. That’s where we thrive.

🔍 Trade Setup: The Heist Blueprint

Market: PEPE/USD

Play: Long Entry (Thief-Style Reversal Tactic)

Zone: Red-Hot Resistance Turned Reversal (aka the Profit Trap Zone)

🧨 Entry Strategy:

Wait for the breakout through the Red Moving Average wall at 0.00001060 — that’s your signal the vault is open.

🔑 Execution Plan:

Place Buy Stop Orders just above the breakout level.

Deploy Buy Limit Orders at 15-min/30-min swing lows or consolidation traps.

Use DCA/Layering Entry Style — like a true thief, you never go all in at once.

⚙️ Set Alerts on breakout zones — thieves never sleep on opportunity!

🛑 Stop Loss Tactics (Stealth Exit):

Primary SL: Set just below recent swing low on 5H chart (around 0.00000960).

Wait for the breakout before dropping that SL — don’t get caught too early.

Risk management is your getaway vehicle. Don’t crash it.

🎯 Targets:

Primary Exit: 0.00001200

Optional Early Exit: If the heat’s on, take the bag and disappear. 🏃♂️💨

Always trail your SL to protect your loot.

💡 Scalping & Swing Heist Tips:

Scalpers: Only ride the long waves.

Swing Thieves: Set your traps and be patient — big moves take time.

Big Wallets: Dive in.

Small Wallets: Ride with protection and precision.

🔎 Market Insight (Thief Intel Drop):

PEPE/USD is flashing bullish signals across:

On-chain analytics

COT positioning

Sentiment reversal indicators

Macro economic setups

Intermarket synergy

Get your confirmations before acting — we rob smart, not blind.

⚠️ News & Heat Map Alert:

High-impact news = flashing red lights 🚨

Avoid new positions during major announcements.

Already in the game? Use trailing SL to secure your profits while chaos brews.

🚀 Boost the Robbery!

Smash that Boost Button to join the elite crew of thief traders flipping charts for fun & profit every day. 💎📈

Stay sneaky, stay smart — this ain’t gambling, it’s organized market crimee (the smart kind).

🎭💰 Next Heist Coming Soon — Follow for More Robbery Blueprints! 💣💼

PEPEUSDT Critical Decision Zone – Massive Move Incoming?🧠 Macro Technical Analysis

PEPEUSDT is currently hovering within a critical demand zone (0.00000095 – 0.00000110), an area that has historically acted as a strong accumulation base and a launchpad for previous rallies. The chart structure shows multiple interactions with this zone, highlighting its significance as a key inflection level.

This zone is not just a support — it’s a make-or-break battlefield between bulls and bears. Price is consolidating within this zone, setting the stage for a potential explosive breakout or a dangerous breakdown.

🔍 Pattern Breakdown & Key Technical Levels

Accumulation Zone (Yellow Box):

Seen from April 2024 to now, price has bounced several times from this region. The multiple touches and long wicks confirm strong buying interest here.

Sideways Channel / Range-Bound Structure:

Price action between 0.00000110 and 0.00000283 has formed a clear horizontal range, and the current price is once again testing the lower boundary of this range.

Implied Move Projection (Yellow Arrow):

A potential breakout from this range could trigger a measured move to the upside, aiming for the previous high at 0.00000283 — representing a +150% upside potential from current levels.

📈 Bullish Scenario:

1. Price holds above 0.00000100, maintaining structure above demand.

2. Break and daily close above:

0.00000127 (minor resistance)

Then 0.00000140, which could trigger acceleration.

3. Target levels to watch:

🟡 0.00000162 – Intermediate resistance

🟡 0.00000180 – Confluence zone

🟡 0.00000211 – Mid-range mark

🟡 0.00000240 – Major breakout checkpoint

🟡 0.00000283 – Range high and final bullish target

Break above 0.00000283 could open a parabolic rally.

📉 Bearish Scenario:

1. Breakdown below 0.00000095, followed by rejection from the bottom of the demand zone.

2. This could signal:

Weak market structure

Failed accumulation

Invalidation of the bullish setup

Key downside levels:

🔻 0.00000080 – Local support

🔻 0.00000065 – Historical low defense

🔻 0.00000038 – Macro capitulation zone

⚠️ Breakdown from current levels will turn this accumulation into distribution.

🧭 Strategic Takeaway:

PEPE is trading at a decisive zone. A bounce from this level could signal the start of a new bullish phase, while a breakdown could usher in a deeper bearish trend. Traders should closely monitor volume spikes, breakout candles, and confirmations above 0.00000127 to validate bullish momentum.

This is a low-risk, high-reward setup for disciplined traders with proper risk management.

#PEPEUSDT #PEPE #CryptoTechnicalAnalysis #AltcoinBreakout #MemeCoinSeason #CryptoTrading #AccumulationZone #BreakoutAlert #BullishCrypto #BearishScenario

#PEPEUSDT: Major Swing Upcoming! Get Ready! PEPEUSDT is currently in phase two of accumulation and will distribute the price soon. We expect the price to move in a bullish impulse pattern as we anticipate volatility in the coming days. However, we advise having a secondary bias while investing or trading on cryptocurrency, as it is highly risky and lacks the same volume as forex or gold.

Good luck and trade safely!

Team Setupsfx_

Is PEPE Ready for Its Next Leg Up? Key Support Levels to Watch! PEPE/USDT Analysis: Bullish Trend, Pullback, and Opportunity 🚀🐸

👋 Today, I’m taking a look at the PEPE/USDT chart. We’ve seen PEPE in a strong bullish trend lately, riding a strong momentum wave. Theres a shift at the moment when you look at the broader market—US dollar strength is still in play, and we’re seeing some pullbacks in Bitcoin and other major cryptos. 💵📉

PEPE is starting to pull back. This isn’t a bad thing—in fact, healthy pullbacks are what set up the next big moves. What I’m watching for is a retracement down into a key support zone. If price can hold there and we see a bullish break of structure, that’s my cue to look for a buy opportunity. 🛑➡️📈

The key here is patience. I want to see confirmation that buyers are stepping back in—i.e. strong bullish candles, a clear break of the recent lower high (BoS), or even a spike in volume. If we get that, I’ll be ready to ride the next leg up. Until then, I’m biding my time and letting the market come to me. 🕰️

Remember, no FOMO—let the setup come to you, and always manage your risk.🍀

#PEPEUSDT: Ready to launch | Will price hit previous high? EPEUSDT’s price has accumulated and is currently in the distribution phase, where we can anticipate a bullish impulse pattern. There are three targets, but our long-term objective is for the price to surpass its previous record high. We anticipate the price to reach or even surpass the previous high.

Wishing you good luck and safe trading!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

Trend Shift Alert: $PEPE Closes Above Resistance + EMACRYPTOCAP:PEPE has closed above the 50 EMA after reclaiming a key resistance zone, previously acting as support. This breakout is a strong technical signal suggesting a trend reversal may be in play.

RSI is climbing and currently sits near 63, indicating increasing buying strength but not yet overbought.

If price holds above the reclaimed zone and the 50 EMA, it could trigger a continued move upward toward previous highs.

DYOR, NFA

PEPEUSDT Eyes the Sky!BINANCE:PEPEUSDT has shown a strong bounce from a key support level, signaling potential for a continued bullish move. The overall market sentiment is positive, which could act as a catalyst for further upside. With the price structure leaning bullish and momentum picking up, there’s a good chance we’ll see higher highs in the coming sessions. Traders should keep an eye on the next resistance zone as a possible target while maintaining disciplined risk management. Always trade with a clear plan—and most importantly, don’t forget your stop loss!

$1000PEPEUSDT Currently trading at $0.00735

Buy level : Above $0.0071

Stop loss : Below $0.0056

Target : $0.0145

Max leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

PEPE/USDT 1H: Bulls Building Momentum Toward $0.00001850 PEPE/USDT 1H Chart Analysis

🚀 Follow me on Tradingview if you respect our charts 📈

Current Price: $0.00001578

Market Structure:

Bullish momentum building after a double bottom formation.

RSI: 59.57, indicating bullish divergence and upward potential.

Order Block: Formed at $0.00001450, acting as strong support.

Trade Setup (Confidence Level: 7.5/10):

Entry Zone: $0.00001550-$0.00001580

Targets:

T1: $0.00001700 (FVG fill).

T2: $0.00001850 (previous high).

Stop Loss: Below $0.00001450 (recent swing low).

Risk Score: 6/10 (moderate risk due to meme coin volatility).

Smart Money Analysis:

Institutional accumulation visible in recent volume profile.

A break above $0.00001600 could trigger stop hunts and drive price higher.

Liquidity pools above $0.00001700 act as magnet levels.

Recommendation:

Long position valid in the $0.00001550-$0.00001580 range.

Watch for a confirmed breakout above $0.00001600 to strengthen bullish conviction.

Manage risk carefully due to potential volatility.

Confidence Level: 7.5/10 for bullish continuation.

🚀 Follow me on Tradingview if you respect our charts 📈

PEPEUSDT: Anticipating a Correction Before the UptrendGreetings, fellow traders!

The recent surge in Bitcoin's price, sustained over the past 72 hours, has injected a bullish sentiment into the broader market. For those considering a long position on PEPEUSDT, I anticipate a potential price correction before the primary uptrend commences.

I foresee a possible retracement to the $0.000014150 level, followed by a renewed upward trajectory with two price targets: $0.000017500 and $0.000020000. My recommendation is to consider entering a long position after the anticipated correction, above the $0.000015300 threshold.

Best of luck and profitable trades to all!

BINANCE:PEPEUSDT

PEPEUSDT %85 Daily Volume SpikeWe previously observed a 25% reaction from the blue box in PEPEUSDT, as mentioned in my earlier analysis. As you can see here:https://www.tradingview.com/chart/PEPEUSDT/VP77qwjf-PEPEUSDT-Flash-Crash-I-m-Ready/

If you utilized low-time frame market breakdowns, you could have caught some excellent risk-to-reward (RR) opportunities. From the latest blue box.

Currently, the price seems to be consolidating, and there is an 85% increase in trading volume today, which is significant. Despite my overall bullish outlook, I believe the price may seek lower levels before continuing its upward trajectory. This potential pullback could provide a new and favorable positioning opportunity.

How to create a position?

When price going down, sometimes CDV goes up, it means an opportunity if general outlook is bullish.

Sometimes we took a retest from volume profile "Point of Control" line and when we reach there we see huge buyers coming in Volume Footprint, it means you can look for an entry.

When trading the blue box, I will rely on indicators like:

Cumulative Delta Volume (CDV)

Liquidity Heatmap

Volume Profile

Volume Footprint

Additionally, I will look for upward market structure breaks in lower time frames for confirmation.

If you'd like to learn how to utilize CDV, liquidity heatmaps, volume profiles, and volume footprints effectively, feel free to visit my profile and contact me.

Best of luck and manage your risk wisely!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

pepe coin can be legend?"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

PEPE - Ready for another PUMP

If you have been following my previous PEPE analysis, you will find whale movements and sentiment has been covered accurately across the past month of trading.

We have seen a whale re enter a position yesterday potentially confirming another key support for PEPE, If you are interested check out my previous PEPE posts to see how whales have manipulated the market.

ALERT:

Yesterday's whale re entering market sees Net Cumulative flow head back to - 7 trillion PEPE, signaling a move from exchanges back into cold wallet storage. this along with my whale tracker saw another whale enter the chat.

Key takeaways, we should now be looking for key level buying opportunities, but keep an eye on whale movements, they may take advantage of the bearish sentiment caused by liquidating over leveraged longs, don't panic sell, PEPE definitely has room to grow this alt season

$PEPEUSDT: Flag Pattern Breakout Incoming?BINANCE:PEPEUSDT : Flag Pattern Breakout Incoming? Don’t Miss This Opportunity!

BINANCE:PEPEUSDT has broken out of a major resistance level and completed its retracement. It’s now forming a bullish flag pattern, signaling the potential for a big upward move upon breakout. Flag patterns are often reliable indicators of continuation, offering great opportunities for traders. Always remember to set your stop-loss to manage risk effectively. Watch closely for confirmation of the breakout!”

BINANCE:PEPEUSDT Currently trading at $0.0000194

Buy level: Above $0.0000199

Stop loss: Below $0.0000169

TP1: $0.0000223

TP2: $0.000026

TP3: $0.000035

TP4: $0.00005

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#PEPE - Long Setup FormationBINANCE:PEPEUSDT looks like it forms some juicy lows for market makers to sweep

and fuel the next leg up

Will it use the closest demand zone for it, or will it need more liquidity below to have enough?

I expect sometime tomorrow to see the pivot for the next leg up so keep an eye on #PEPE to make sure you don't miss this long!