Petrobras (PETR): Bearish Divergence - Heading for a Dip After the market closed yesterday, Petrobras, a Brazilian stock, released a new earnings report. We're analyzing it in Brazilian Real (BRL) to get the most accurate view of the chart. On the weekly chart, we anticipate a mild but noticeable bearish divergence, especially since the beginning of 2024 when the stock has significantly appreciated.

There is considerable downside potential as we expect the completion of Wave (3), followed by a downward adjustment in Wave (4). The exact retracement level for Wave (4) is yet to be determined, but we anticipate a pullback to around 38.52% before the stock resumes its upward trajectory in Wave (5).

Our downside target is around 50 BRL, considering Petrobras' high dividend yield. This makes the stock attractive not only for its growth potential but also for its income-generating ability.

A closer look at the daily chart reveals potential scenarios for either the completion of Wave 5 or Wave (3), highlighting areas where bearish divergence becomes more apparent. This divergence is evident due to the significant impulsive rises in the stock over recent months and weeks, which have created several imbalances. Despite closing gaps and reaching new highs, a downward correction is likely needed before we can see further upward movement.

We anticipate that the correction in Wave (4) will take the stock lower, potentially reaching levels between 28.28 and 23.30 BRL.

Petrobras

Petrobras Uncovered: A Dividend Gem with Potential?

Petrobras' ON N2 shares from Brazil are particularly interesting, notably due to their high dividend yield. As the largest oil producer in Brazil and one of the biggest in South America, this stock holds significant importance over the coming years. It has experienced a strong rise, with our Wave (2) starting at 2.2 Brazilian Reals. Since then, it has risen and completed Wave (3) at the 227.2% extension level. Now, we should be entering Wave (4) and ideally not fall below the level of 19 Brazilian Reals. For Wave (4), we expect a retracement level between 38,2% and 50%. Given that we're looking at the weekly chart, this represents a very long-term scenario. We'll definitely keep you updated and may provide short-term entry opportunities as they arise. In the coming months, we expect to develop Wave B and finally Wave C. After that, as previously mentioned, holding this stock long-term could be very beneficial due to the remarkably high and attractive dividend yield.

Petrobras Loses Over $10 Billion in Market CapitalizationBrazil's state-run oil giant Petrobras ( NYSE:PBR ) finds itself in the eye of a storm as investor frustration boils over following a contentious boardroom decision. The company's market value plunged by over $10 billion in the wake of a heated debate over dividend payouts, marking a significant setback for Chief Executive Jean Paul Prates and igniting concerns about government influence and capital allocation.

The crux of the issue lies in Petrobras' ( NYSE:PBR ) decision to withhold an extraordinary dividend, much to the dismay of investors who had anticipated a more generous payout. The move, attributed to board members aligned with the government, underscores the delicate balancing act facing Prates, caught between the interests of minority shareholders and a government keen on prioritizing capital spending.

Petrobras ( NYSE:PBR ), once hailed as a cash cow for its shareholders, has seen a reversal of fortunes under new management appointed by President Luiz Inacio Lula da Silva. While the prior management had been generous with dividends, the current regime has adopted a more conservative approach, sparking discontent among investors accustomed to hefty payouts.

The fallout from the dividend debacle has been swift and severe, with a slew of downgrades from prominent financial institutions signaling heightened risk perception and casting doubts on Petrobras' ( NYSE:PBR ) future trajectory. Analysts at Bank of America, Bradesco BBI, and Santander have all expressed concerns about the company's growing cash reserves and questioned its capital allocation strategy in the absence of an extraordinary dividend.

Chief Financial Officer Sergio Caetano attempted to allay fears by emphasizing that the reserves earmarked for "capital remuneration" are strictly designated for dividend distribution and not intended for investments. However, skepticism lingers amidst uncertainty surrounding the timing and magnitude of future payouts, amplifying investor anxiety and contributing to a sharp decline in Petrobras' ( NYSE:PBR ) stock value.

The repercussions of Petrobras' ( NYSE:PBR ) dividend decision extend beyond the confines of the boardroom, sending shockwaves through Brazil's stock market and dampening investor sentiment. The company's fourth-quarter earnings report, while surpassing analyst expectations, has done little to assuage concerns, highlighting the precarious balance between profitability and shareholder satisfaction in an increasingly volatile environment.

As Petrobras ( NYSE:PBR ) grapples with the fallout from its dividend debacle, the road ahead appears fraught with challenges. Navigating the complex interplay of government influence, investor expectations, and operational imperatives will require deft leadership and strategic foresight. For now, all eyes remain firmly fixed on Petrobras ( NYSE:PBR ) as it seeks to regain investor trust and chart a course towards sustainable growth in the face of mounting uncertainty.

Selection is not dead - and who said Growth ever was?INVESTMENT CONTEXT

Lithuania limited railway cargo transit across its territory from Russia to Kaliningrad; Russia dubbed the move as "openly hostile"

Russia overtook Saudi Arabia as China’s biggest supplier of crude oil. Russian crude exports to China surged 55% in May

Turkey, Sweden and Finland met to discuss Turkey's opposition to the Nordic countries bid to join NATO

French President Emmanuel Macron lost parliamentary majority as the country's far-right regained momentum after the Presidential elections held last April

European Commission President Ursula von der Leyen warned against the bloc's "backsliding" into coal as the continent tries to weave itself off Russian gas

Terra/LUNA project staff were banned from flying as South Korean authorities deepen investigations on LUNA's demise

PROFZERO'S TAKE

It's hard to look at the EU without feeling something disruptive is about to happen. The bloc's inflation rate is not too far from that of the U.S. (8.1% vs. 8.6%, respectively) - yet the ECB's base rate, even after the 25bps hike earlier in June, is still negative by 25bps, while the Fed is already pricing cash at 150bps. The Fed has stopped sustaining fixed income markets by not rolling over USD 30bn Treasury bonds and USD 17.5bn MBS per month - the ECB tried to walk down the same path, only to face backlash from traders which sent interest rates on the weakest countries (Greece, Italy and Spain) to fresh highs. And as Russia curtails natural gas supplies, the countries that are most exposed to energy security - notably including Germany and Italy - scramble to diversify the energy mix, stumbling upon the harsh reality that coal will attract criticism from environmental groups (and voters) while LNG supplies need re-gasification plants - whose dearth won't be made up for until 2024.

Nigel Bolton, BlackRock's co-Chief Investment Officer, said on June 20 he saw "extreme valuation opportunity in European banks". ProfZero would really, sincerely like to share the same optimism - or opportunism

Speaking of Europe - after dismissing blockchain assets as "worth nothing" (and therefore badly needing regulation, in a rare moment of pure pneumatic vacuum of logics), ECB President Christine Lagarde said "While the correction in asset prices has so far been orderly, the risk of a further and possibly abrupt fall in asset prices remains severe". ProfZero concurs with Madame Lagarde - absent energy security and supply strategy, foggy monetary policy (to tighten or not to tighten?) and a much feared fragmentation of borrowing costs already happening, traders are having it good shorting European assets. If only there was a strong Regulator...

In the opinion of ProfZero, the market-wise breadth of June 13's collapse has a deeper structural meaning, and could in fact contain cues on portfolio construction to cross summer season: (i) Markets are not done pricing a recession, nor the Fed's and the ECB monetary policy. After the 50bps rate hike on May 5, the S&P 500 and Nasdaq plunged 3.56% and 4.99%, respectively; after the 75bps rate increase on June 15, the indexes nosedived 3.27% and 4.08%, respectively. The Fed is meeting four more times this year; current expectations are for 75bps flat increases at each meeting. Should inflation fail to be absorbed in the economy, calling for more rate increases, equities would bear the brunt of the selloffs, (ii) Investors are starting to see Value as fairly priced - possibly signaling the beginning of reversal on commodity stocks, especially in the energy space. At the same time, Growth is not dead. Apple (AAPL), Alphabet (GOOG) and Microsoft (MSFT) dropped less than 5% on average in the last month, compared to almost 15% by Occidental Petroleum (OXY), Petrobras (PBR), and Shell (RDS.A), (iii) It is still too early to construct risk positions. A clear trough has not been touched and even a touted recession has not materialized. No clear industrial path has emerged from the bear market; and without such, longs are but reckless positions. No time to cry; no time to risk either

Petrobras. Chasing oil prices.Petrobras (Petroleo Brasileiro) is the largest Brazilian oil and gas company. The company is in the top 20 largest oil and gas companies in the world by capitalization with a value of $69.9B. Petrobras also ranks 7th in terms of oil production, producing almost 2 million barrels per day (Saudi Aramco produces 10.9 million and ranks 1st).

➡️ On the daily chart, the rise after March 2020 forms zigzags, suggesting that this move represents the start of an initial diagonal. In the second half of the past year, the price consolidated above the broken level of $9.3 - $9.6 , forming a triangle presumably in the {b}of3 wave of the diagonal.

➡️ On the hourly chart, stock is growing along with oil prices, moving within the wave (iii)of{c}of3. This suggests a slight correction after a sharp growth of almost 20% over the past 10 days.

📈 The estimated goal of the movement is the level at which the shares were traded before the start of the COVID - $14.5 - $15 per share. As well as the local maximum of 2019, which the price tested as many as 5 times – $17 .

➖ Local levels, where my wave interpretation should be revised are $10.7 , $9.2 and $7 .

The PBR is out of its bearish channelEverything is clear in the picture.

The downward channel that has been broken upwards and today's red candle can be considered as a pullback.

The Brazilian Stock Exchange index may drop about five percent after this and then move up, so it can put this share under a bit of pressure, but overall my opinion is bullish in the medium term. Oil prices have risen dramatically and for the next two months there is no news of Iran's return to the JCPOA and the oil market (away from sanctions) and it seems that the sentiment is positive for now.

The company's report next week is also very important, so please review any transaction by yourself.

That was just my opinion and there is no certainty

I'll be happy to share your opinions with me.

PBR PetrobasPETROBRAS-ADR C is an integrated company operating in exploration, production, refining, retailing and transportation of petroleum and its byproducts at home and abroad.

Analysis:

This company impresses me from a financial perspective. This is a company that is managing their debt and cashflow during adverse times within an underperforming sector. I've seen that they've been having alot of activity going on this past month which indicates future sustainability when comparing their operating cashflow to their short term and long term debt scenario. Interested to see how this company performs over time!

On the daily time frame, price is currently overbought when looking at the RSI and the MACD. Even with this sentiment, the previous high was broken on the 4 hour time frame. So I took a look at the smaller time frames and it seems like price is ready to start retracing to a near support level considering that the 200 and 50 ema is crossing on the 15 min time frame and under. It looks like the gap is closing on the 1 hour and the 4 hour going down. I would like to see where price is at when the rsi is oversold and the macd reverses it current crossover. If this company continues to have stable operating and free cashflow over the next few quarters, I don't see why the share price wouldn't have positive expectancy.

I have a price target of $31 but realistically, I just price reach support and retrace the resistance.

*not advice. just an analysis.

Petrobras (Brazil) - possible more than 10% short-term gainsPETR4 seems to be tracing minute wave 3 up of a C counter trend move. If prices crosses up 18.60, the odds increase for this scenario with the most probable target around the 22.00 level. If prices crosses down 16.60, this analysis should be revised. FOLLOW SKYLINEPRO TO GET UPDATES.

The "Future of the Gas Station? (Latin America)The "Future of the Gas Station”?

(“Christ the Redeemer of Oil?”)

One of the most beautiful (UNBELIEVABLY beautiful) and largest “mega cities” in the world which is also named one of the New Seven Wonders of the World is (in) the city of Rio de Janeiro. Perhaps the only other mega-city “city” on Earth that can come close to matching the natural amazing cliffs and crazy “year round” beautiful beaches of Rio de Janeiro is “Hong Kong” (there are many secret cities around the world that are better then Rio de Janeiro or Hong Kong for example along the Perl River or along Southern China or maybe someplace else hidden on Earth?) However, many larger cities are much much more expensive (Rent in Hong Kong for example is about 600% higher then in Rio de Janeiro and food prices in Hong Kong are are about 200% higher maybe even more if you dont trust the numbers??)

Interestingly perhaps the “largest ever” oil corruption and fraud charges in the ENTIRE HISTORY of “ALL” of Latin America was quite recently (and is still going on to this day at least from the Brazilian stock market BOVESPA index’s perspective??).

This was a major lawsuit that started at some “Gas Station” outside of Rio de Janeiro Brazil and centered around one of the largest oil companies in the world. At least 11 different countries where involved in the lawsuit for "corruption indictments" (even the United Stated SEC made off with $10’s of millions of dollars (cold cash) from this case?), at least 18 different companies where involved and 400+ people (criminals) involved with many going to jail for anywhere between 10 to 30 years of jail time and by some estimates something like R$6.2 billion (USD$2.5 billion) (which is about equivalent to price of construction of 10+ off shore oil rigs?). Even the president of Brazil was sentences to jail for 9 years and went to jail for about one full year+?

What makes Rio de Janeiro especially beautiful and “amazingly religious” is a 600+ “ton” statue of “Christ the Redeemer” shining with “hands stretched open” above the mega metropolis of 10+ million people. The statue of Christ above Rio de Janeiro is truly one of the most amazing religious concepts that any modern megacity on earth lives and works under. The statue of Christ is so big and so fundamental that two thousand years from now it might still be there… it is a 600 ton god statue?!

Perhaps its more often then we realize in Europe and North America, but religion is and has a very important key to Latin America (and many other cities on Earth). However, for Rio de Janeiro “god (apparently) is the key”? The giant statue of Christ the Redeemer atop Corcovado mountain looking down at everyone happens be one of the most stunning and most “godly” and fundamental religiously famous landmarks of our Earth? It one of the “wonders of the world?”

One of the interesting things about the oil industry is that there is a lot of “suspicion” that everyone involved “maybe” is making a “ton” of money. Many people suspect the oil executives of being a type of “cult club”. Its possible that the corruption charges against Petrobras are “very complex” and even “creatively created” by a mastermind who understood the legal system and that they might have to “go to jail” just to convict everyone of what they are doing wrong anyway.

In a lot of ways the (socialist “working class”) president of Brazil learned a very very important legal lesson after spending one year in jail and “getting out” and being “set free” after even contacting the United Nations Human Right Commission. The corruption maybe was with the legal system itself.. the judges? and Petrobras maybe wanted to see the Judges go to jail in addition to the president? However, the president was “popular” especially with labor activists and was eventually set free. The president was convicted of “money laundering” and “passive corruption”, defined in Brazilian criminal law as the receipt of a bribe by a civil servant or government official. Lula was sentenced to nine years and six months in prison and only served about one year. However, the president learned a very very important lesson about “doing things legally correctly” and maybe will even run for president again? (see many articles of news on this topic)

So how does the “oil mafia” really work? How do we know if there really is such a thing as a “oil” corruption (problem) and how does this all actually work and do people really go to jail and get “busted”? What about the police operations in Brazil did they want some of this “oil” money too?? What was this Brazilian “Operation Car Wash?” And most importantly what can we do about all this? (for everyone!?) Whats the suggestions for Petrobras’s Future and the future of “oil” in Latin America?

In the oil industry and in “big-time” obese operations world there is a term called “downstream”. Some companies get so chubby that they essentially dont need any of there sales stores that they actually sell their products in… in the oil industry a lot of companies “don't need gas stations” anymore so they “spin off” what is called their “downstream assets” and basically the gas stations are no longer part of the company. This allows for some “corruption”? However, there is good and bad sides to this, it makes it easy to “own a McDonald’s or Petrobras Gas Station franchise” but difficult to do anything “differently” or create “unique competition” with the financiers (the people with all the money) or the people that gave you the money at the top get “lazy” and want even more money from the Gas Stations.

The law is typically behind the “money” and not the people who own and run the businesses day to day. A lot of these people are not use to “dealing with the legal system”. However, what happened in Brazil’s Oil Business was that someone working at a “gas station” might have “purposely” tried to “go to jail” just to get Petrobras “media light and attention” and then the real problem was actually something more “fundamental” to franchising and just being “reasonable”.

The problem “with” Petrobras actually has to do with something called “franchising” and how gas stations all over the world really work. Imagine two possibilities a world where “everything is run by big oil business” or a world where there is a lot of independent smaller business. The problem is we need both and both sides say we only need that side.

However, what if the problem is with wealth is maybe something “gravitational” or “universal”?

Is there fundamental problems with ALL of capitalism?

In the Communist Manifesto written by a Eastern European named “Karl Marx” believed that capitalism contained the seeds of its own destruction. He described how the wealth of the bourgeoisie depended on the working people (just like the people who actually work at these Petrobras McDonald (only franchise) Gas Stations) ... Eventually the proletariat (gas station worker) would lead a revolution against the bourgeoisie (Petrobras). The final struggle would lead to the overthrow of capitalism itself. Because the businesses (got too obese and fat) (and the governments that regulate them too) would just get too big and too powerful.

For more then a few hundred years capitalism has hidden behind democracy… but what if? What if there was something really wrong? With both communism and capitalism then what? (we will not discuss that here.. however, there maybe some new political revolution needed that isn’t socialism, or capitalism or communism)?

The art of franchising and “gas station-ering” maybe needs a “global overhaul”… the secret maybe isn’t in “more franchising” but allowing “greater freedom” and allowing independent business owners essentially to start their own unique businesses. And when we leave earth that all will get even more complected (this is the “transport” industry?)

There are many detailed videos on corruption and “operations carwash” and it may help to hear what others have to say about this problem of “franchising”. Part of the key to understanding both sides of “real corruption” to understand “both sides” and even look into helping both sides solve those problems.

It maybe that both sides wanted good? Even the Brazilian military “discovered” the problem in the first place? The head of Brazil's army wanted the president “behind bars”? and the New York Times even claimed "Brazil’s democracy is now weaker than it has been since military rule ended".. however, maybe the truth was different?

Hope this helps you!

Asher

:)

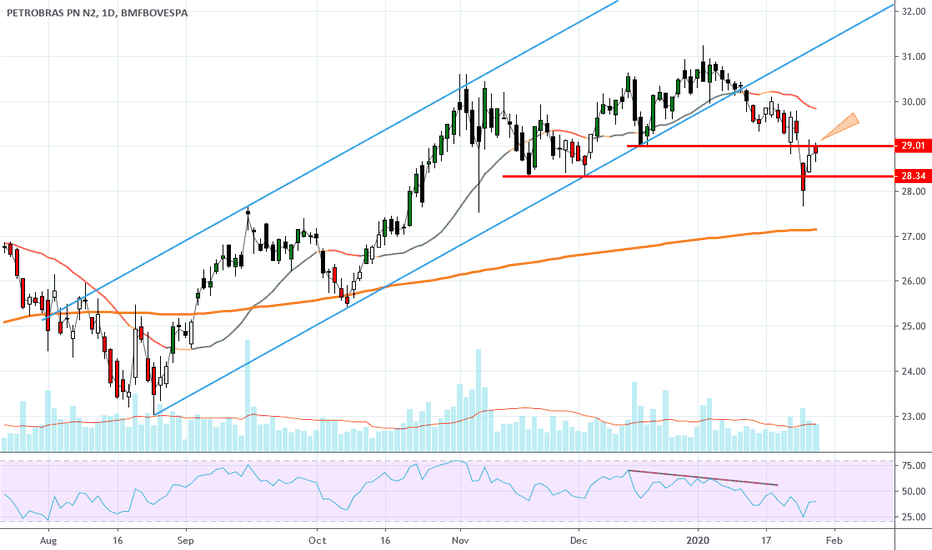

PETR4 segue feia...Depois da queda brusca do dia 27 e aparente recuperação em 28/01, PETR4 parece que enroscou no antigo suporte perdido nos R$29,00.

Essa enroscada no antigo suporte que virou resistência fica bem clara também no gráfico da ADR de Petrobras NYSE:PBR , coincidindo bem com a média de 200 no diário deste gráfico.

Com o clima avermelhado no IBOV e nas demais bolsas, não tenho muita esperança de ver a Petro subir forte, ganhar os R$30,10 e reverter essa baixa no curto prazo.

Se vier a perder a região dos R$27,70-27,10 (média de 200 no diário e retração de 50% de Fibonacci da última pernada de alta do semanal) eu enxergo um próximo suporte na região dos R$25,40. Nesse caso a média de 200 já estará virada para baixo e a coisa já vai estar bem feia.

Lembrando que tem oferta do BNDES e divulgação de resultados em fevereiro. Sigo acompanhando.

PETR4 - Attack x Defense AnalysisAs a war game, there are base points to be defended by the owner.

Armies will fight to gain control of these points.

The stronger side takes the base point and attacks the next forward point.

The weak side just try to defend, back to the next base.

The points are the known resistances and supports.

Strength is measured by the result of each action.

Here comes Sun Tzu's knowledge in The Art of War.

$IBOV al limite en el cierre de la semanaEl índice de la bolsa brasilera cerró esta semana en los 102.900 puntos, estacionándose sobre la linea de tendencia bajista que trae desde hace dos meses. Si bien falló en el primer intento de quebrarla, parece haber conformado un pequeño banderín alcista.

El próximo lunes parece ser decisivo para ver si logra quebrarla. De hacerlo, se habilitaría el objetivo de 106.000 puntos y máximo histórico (objetivo planteado por el Inverse Head And Shoulders formado durante el último mes). En caso de no prosperar y rebotar en el soporte dinámico, iríamos a la zona de 101.000 puntos como primer objetivo.

Por último, el MACD no da señales buenas en el gráfico de 60 minutos pero si lo hace en gráficos de 2, 3 y 4 horas.

A esperar y ver cómo define.

Petrobras - PETR4 - Se romper o retângulo, pode dar entrada.Traçando uma extensão alternada de Fibonacci da ultima pernada de alta e considerando a consolidação do ultimo mês,

temos alvos de ST em 27,20 e 27,70(80).Um alvo mais longo ainda podemos considerar 29,90(100% de fibo).

Enquanto o IBOV andou 10 mil pontos em 2019, Petro andou dentro deste retângulo.

Stop curto e mais barato em 24,50.

Ponto de entrada: Talvez seja mais vantajoso entrar usando o gráfico de 60m, confirmando o rompimento do retângulo.

Obs.: Este é um estudo, não é call de compra ou venda.

PETR4 - Pullback e continuação ?Analise PETR4

No gráfico acima verificamos um canal de alta , no qual é formado por 3 linhas sendo: Suporte do canal correspondendo a LTA (linha de tendencia de alta), linha intermediaria, linha de resistência máxima no topo do canal.

Verifica-se que dentro desse canal de alta visualizado de forma "macro" observamos um outro canal. O mesmo foi rompido fazendo que o ativo tivesse uma queda acentuada buscando a MM200 que serviu como suporte para o ativo.

Acima indicado com circunferências os pontos onde ocorreu o rompimento e a retração de preço. Interessante observarmos que alem da MM200 tínhamos também a linha de 50% de Fibonacci, fazendo com que esse suporte fique mais forte e o preço retraia.

Gráfico de 1h

Já no gráfico de 1h observa-se a alta após a retração no suporte citado acima, rompimento da MM200 de 1h e no atual momento o ativo se encontra cotado na margem da resistência intermediaria, essa resistência foi testada e observado que o ativo perdeu força compradora e passou a ter uma força vendedora, onde está iniciando um possível "pull back" que pode buscar o suporte de 24,00 a 24,40.

E verificado que o ativo está desenvolvendo a onda 5 de elliot, com isso, após esse "pull back"há a grande probabilidade de ir buscar a resistência intermediária novamente e realizando rompimento da mesma pode-se dar continuidade a tendencia.

Suporte importante no WTITem um indicador que eu gosto de olhar em relação o petróleo é a relação ouro/barril de petróleo, é uma estimativa de quantos barris de petróleo eu consigo comprar com uma onça, tenho comigo como parâmetro que comprar 15 barris significa que o petróleo está caro e comprar 30 barris o petroleo está extremamente barato. Em setembro a relação estava 1 onça comprava 16 barris, e atualmente estamos com 1 onça compra 24 barris, esse indicador me dá a dica que o petróleo pode estar ficando barato, e podemos notar que o WTI está em uma zona de importante suporte que pode oscilar até os 45$ (Não seria um bom sinal fechar abaixo desse patamar no gráfico semanal), uma reversão positiva na região entre 48~51$ pode ser uma boa entrada para novos rallys.

Mas cuidado com qualquer notícia de tensão na Venezuela.

Realização no petróleo pode abrir nova oportunidade para comprasO barril de petróleo do tipo wti rompeu a deriva, com esse movimento podemos esperar que o ativo posso chegar ao valor entre 59 e 61 dólares, que é uma região de antiga resistência e agora é suporte. O volume no tempo diário mostra uma distribuição, porem no tempo gráfico semanal mostra que os players estão bem comprados. Minha ideia é aguardar o petróleo chegar a esse suporte (se chegar) e esperar uma reversão positiva nesse ponto.

Petróleo WTi, Formação de deriva no semanalOlá amigos, o petróleo wti está encontrando resistência na região dos $75, e caso essa resistência não seja rompida podemos estar diante da formação de uma deriva. Outubro é um mês conhecido de grande volatilidade e as eleições norte americanas em novembro traz instabilidade ao mercado dessa comodity. Porém a priori devemos no ater a tendência de alta, no momento as operações de compra são mais favorecidas principalmente se a cotação tocar a linha de suporte e retornar a subida até o último topo e quem sabe o rompimento. Porém uma vez perdida essa linha de tendencia ascendente podemos estar diante da formação de uma deriva e a correção no semanal dessa comodity, abrindo oportunidades de venda no curto prazo, e possibilidades de novas compras nos suportes anteriores.

Este é apenas um estudo, não sendo sugestão de compra ou venda. Sempre tenha consciência dos riscos em operar no mercado de valores.

PETR4: EVALUATING THE LAST WEEK.1-To get to the Fibo, it would still need to fall another week.

2- But the recovery in the week was 3.24% + or -, as

see the figure. This indicated force and volume.

3- There is a good "distance" to the average in orange, this

indicates that there may be an return to the average on this week,

but, everything depends on the monday candle.

TIPS:

Begin the week with daily candle and go always

looking at the weekly candle, if it is "Green"

equal to the dollar, keep buying.