PETRONET

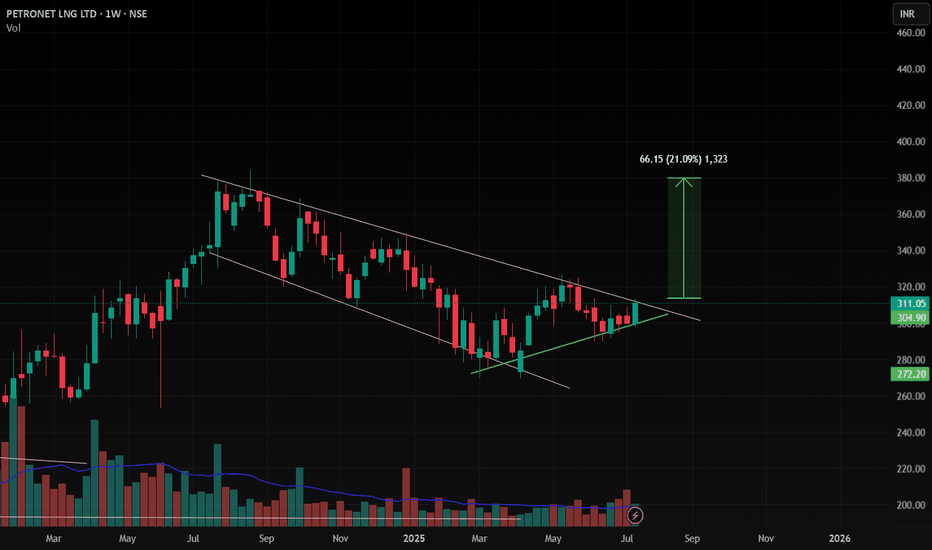

SWING IDEA - PETRONET LNGThis presents an attractive opportunity for swing traders to capitalize on the potential uptrend in Petronet LNG .

Reasons are listed below :

Breakout of Strong Resistance at 300 : Petronet LNG has successfully broken above a significant resistance level at 300, signaling potential bullish momentum.

Bullish Marubozu Candle on Weekly Timeframe : The presence of a bullish Marubozu candlestick pattern on the weekly timeframe suggests strong buying momentum and potential upward movement.

Breakout from 6+ Years of Consolidation : The stock has broken out from a consolidation phase lasting over 6 years, indicating a significant shift in market sentiment and potential for sustained upward movement.

Trading Above 50 and 200 EMA : Petronet LNG is trading above both the 50 and 200 Exponential Moving Averages (EMA), confirming bullish bias and indicating potential for trend continuation.

Support from 0.382 Fibonacci Level : Finding support at the 0.382 Fibonacci level and bouncing back reinforces the bullish outlook and provides a solid foundation for potential upward movement.

Trading at All-Time High (ATH) : Petronet LNG is trading at its all-time high, indicating strong bullish momentum and potential for further gains.

Constant Higher Highs : The stock consistently forms higher highs, reflecting increasing bullish momentum and reinforcing the potential for further gains.

Target - 340 // 380

Stoploss - weekly close below 260

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Strong Buy Petronet cmp 214, target 300, Timeframe 1 month.Petronet is into developing, designing, construction, operation of owned and import Liquified Natural Gas(LNG) terminals in India.

The company is in the niche business of transportation, storage and regasification of LNG. It owns and operates 2 regasification terminals at Dahej (Gujarat) and Kochi (Kerala) with a combined capacity of 22.5 MMTPA. It accounts for 40% of gas supplies in the country and handles ~75% of LNG imports in India. The company's major customers are GAIL, IOCL and BPCL.

Petronet LNG has pioneered the concept of consumption of LNG as liquid ONLY in long distance heavy duty trucks and inter city buses. Small Scale LNG (SSLNG) includes supply of natural gas in the form of LNG to small consumers through unconventional transportation methods like trucks, small vessels etc

Petronet is taking initiatives for promoting environment friendly LNG as a fuel in road transportation. It has commissioned India's first LNG dispenser stations inside Dahej & Kochi LNG terminals and has also commissioned the first commercially approved LNG powered buses of the Country.It has signed MOU's with IOCL, Indraprastha Gas Limited, Sabarmati Gas Limited, State Roadways Corporation like KSRTC for running few buses on LNG and establishing LNG dispensing stations at their locations.

Petronet LNG is planning for construction of LNG regasification terminal at Bangladesh. It has submitted detailed feasibility report for construction of storage and gasification terminal in South Andaman. Similarly it is planning for setting up a Floating storage & regasification terminal at Colombo, Sri Lanka along with Japanese consortium.

Petronet is planning for expansion of the capacities at Dahej Terminal to 22.5 MMTPA from the current 17.5 MMTPA.

Key Ratios:

ROCE - 26.6 %

ROE - 22.8 %

EPS - ₹ 22.7

Dividend Yield - 3.27 %

Debt to equity - 0.20

Price to book value - 2.00

Stock P/E - 9.44

Industry PE - 18.1

Conclusion:

With such a high ROCE and good dividend yield, Petronet is just trading at PE of 9.44 which is considerably undervalued as compared to Industry PE of 18. Technically the stock is poised to give a sharp movement upside as it started rising from strong support zone which is a double bottom pattern and the trend bullish structure is intact. Earlier the breakout of trendline is acting as as support. Trendline connecting lows was taken out for a few days only to grab a liquidity and exit weak hand and to retest strong support levels and from there it has risen sharply with high volumes and it iss again above lower trendline indicating a sharp reversal and good momentum to follow in coming days. The target expected is 300 in timeframe of 1 month which comes to 40% return in just 1 month.

IRB 35 Tgt 42 SL 32 20% upside recommended Buy- Rachit SethiaIRB 35

TGT 42

SL 32

TF <6M

RR > 3

Return > 20%

INVEST NOW !!

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

#GULFPETRO 48 Buy Recommended TGT 63 (30%) SL 43 - Rachit SethiaGULFPETRO 48.70

TGT 63

SL 43

RR > 2.5

RETURN ~30%

TF < 6M

NSE:GULFPETRO

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

#PETRONET 238 Recommended Buy - Rachit Sethia #stockstoWatch #PETRONET 238

Breakout at ATH and Retested

TGT 275 and open for above

SL Not Applicable

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

Divergence on Petronet Weekly ChartThe weekly chart analysis suggests a potential upward movement. The 14-day stochastic oscillator has reversed from the oversold zone, indicating a momentum shift. Price found support at 220 level. A fresh divergence on the chart adds to the indication of an upcoming upward trend.

Buy at Market, Target at 235, Stop Loss at 218

PETRONET BREAKOUT SOON !!1 The price was taking resistance from the long time. Price taken support from the support zone and now trading near resistance and resistance area of 226-232.If price breaks the level of 232 and closes than good move possible towards the upside. After breakout can enter in long position for the target of 230/260/300 in next coming trading sessions.

#PETRONET

👉 Chart Setup looks good👍

👉 Breakout Possible Above 232-34📈

👉Above Breakout Good Upmove can be seen📈

👉Buy Above Breakout For 230/260/300+🎯

👉Keep On radar✅

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad.

#ASIANPAINT #BERGEPAINT #INDIGOPNTS #KANSAINER #SHALPAINTS #OIL#ASIANPAINT

NSE: ASIANPAINT

CMP: 3112

TP: 3332

SL: 3010

TF: <1m

RR > ~2 times

Return > 7%

BERGEPAINT ASIANPAINT KANSAINER SHALPAINTS NSE:INDIGOPNTS

Factors:

BULLISH WEDGE BREAKOUT

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

PETRONET has retested , and showing BULLISH movement hey guys ,

PETRONET stock has shown signs of bullish movement

this stock was moving in a fixed downtrend ,

and first also ,

this stock has crossed it's resistance ,

but was not able to stand there for a long time ,

and it lead to BULL TRAP for traders ,

and after that ,

this stock has again crossed it's resistance,

and now retested.

There are several reasons to buy this stock ;

1. A LONG GREEN CANDLE IS MADE

2. THIS STOCK HAS RETESTED AND TAKEN SUPPORT ON IT'S RESISTANCE

3. MORNING STAR HAS BEEN MADE BY THIS STOCK

due to these reasons ,

i suggest you to buy this stock and earn high returns ,

I have marked the TARGET and STOP LOSS for y'all,

the RISKREWARD RATIO is 1:3

BUT PLS CONSIDER THE GLOBAL MARKET SITUATIONS;

1. INFLATION

2. WAR

3. RISING BANK RATES

4. INCREASED EXPORT DUTY ON CRUDE OIL

AFTER CONSIDERING THESE SITUATIONS

YOU CAN BUY THIS STOCK

PETRONET

😀😀

ALT BAT In PETRONETThere is an Alt Bat Pattern Formation on Petronet hourly chart.

Prices are currently trading in the PRZ zone of the pattern.

RSI is also in the oversold zone, hence there is the probability that we could see some bounce in the stock.

Resistance at 219-220 levels.

The pattern would be negated if prices close below 210 levels.

Disclaimer: Not a recommendation to trade.