PFG | SHORT NASDAQ:PFG

Technical Analysis of Principal Financial Group Inc (PFG)

Key Observations:

Current Price Action:

Price: $75.41

Recent Drop: -4.05 (-5.10%)

Support and Resistance Levels:

Immediate Support: $72.63 (Target Price 1)

Further Supports: $68.67 (Target Price 2), $64.54 (Target Price 3), and $58.88 (Target Price 4)

Resistance: The price has broken below several support levels indicating potential further downside.

Trendlines:

The price has broken below a key upward trendline, signaling a potential shift from a bullish to a bearish trend.

Relative Strength Index (RSI):

Current RSI: 40.49

The RSI is nearing the oversold zone, indicating increasing selling pressure and potential for further declines.

Target Prices:

Target Price 1: $72.63

This level is the immediate support and a potential first target for any continued downward movement.

Target Price 2: $68.67

If the price breaks below the immediate support, the next target is around $68.67, a previous support level.

Target Price 3: $64.54

Further downside could see the price reaching $64.54, another key support level.

Target Price 4: $58.88

In a more bearish scenario, the price could fall to $58.88, a significant support level.

Summary:

Principal Financial Group Inc (PFG) has experienced a significant drop, breaking below several key support levels and its upward trendline. The next levels to watch are $72.63, $68.67, $64.54, and $58.88. The RSI indicates potential for further declines if market conditions remain negative.

Pfg

PFG - Bullish Assumptions Inverted H&S has been completed on chart, this is shown in green circles

I am expecting this right shoulder move however to push price up further, towards the dashed white line above, this is also shown with the bars pattern in green.

The overall structure of this chart looks quite bullish in my eyes.

PFG Bull flag I own some in my portfolio. Nice long bull trend. Bull flag is a continuation pattern in a long uptrend. The way I play a bull flag like this is to buy when the stock breaks out of the upper flag channel (above 92.53). Stop at 90.70 (C). A breakout would take PFG on to test prior high at (B) 96.17, at which point it would either breakout to new highs or repel backward to form a double top. A bull target on a flag like this would be a 1.618 extension to 99.46 (D).

P&L & W/L:

Buy at 92.53, Stop 90.70; take profit at (B) 96.17.

Max win: 3.93%

Max Loss: 1.98%.

W/L: 2 to 1

Buy at 92.53, Stop 90.70; take profit at (D) 99.46.

Max win: 7.5%

Max Loss: 1.98%.

W/L: 3.78 to 1

XLF (financials) sector has shown some bullishness, and PFG is a financial which has bucked the bear. A bull flag like this has shwon a 66% chance of continuation in a bull. (rarely reverses). But heed the stops just in case.

Always be aware of the round benchmark numbers ($100)-- they can be stubborn to break through.

PFG - a dead company, 1M overviewProvident Financial to close doorstep lending business after 141 years

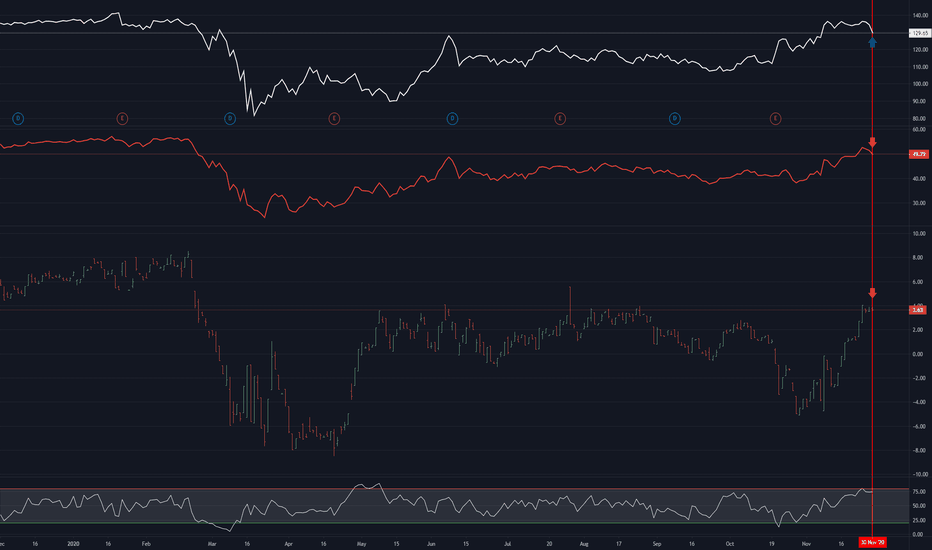

PFG: Dark Pool Footprints Show Accumulation in a BottomAs a new generation starts families and buys homes, the growth in Life Insurance also booms. There are several life insurance companies forming bottoms right now and many are nearing completion for future position trading, intermediate term holds or even long term holds.

This chart has a specific footprint in the chart patterns that confirms the bottom has begun with accumulation from the Dark Pools. The bottom completion should be confirmed before entry for position-style to longer-term as it could easily retest its lows several more times while you are holding in the red waiting for the move up. Always, buy into strength.

New trade signalled - Buy PFG LNProvident Financial is outperforming the benchmark index over the past 3 months. The shares are trending higher within a channel and have bounced neatly from the lower end. Buy with a stop at 2956p. Target 3528p