Syndax is about to see huge gains to ~$24 a share again. Syndax Pharmaceuticals recently had POSITIVE interim data on their phase 2 study in SNDX-5613 for Leukemia. This data was positive as they saw a 48% overall response rate in patients with MLLr or NPM1c; 67% of responders achieved minimal residual disease-negative status. Out of 43 of patients evaluated, 31 were able to be used as for significant data. These two pieces of news are huge as Leukemia is an extremely life threatening disease where more than 50% of people are dead within 5 years. Any drug that can help save these peoples lives is priceless and the upside of this company is definitely there. I believe the sell off was a big Hedge fund taking their profits and exiting as they were not satisfied with the Positive results from the study, causing stop losses and further panic selling. This has also caused an overcorrection in the stock price which should correct once another big player enters and brings the rest of the bulls with them.

There is a rough bottom at $13 currently on the stock and it is possible for the stock to go down further as this is simply my opinion and is for educational purposes only.

PHARMA

Piggyback the profiteers After some conversation with a young single mom and what she goes through to get her and her 2 yr old diabetes meds @ $13hr...f to the big pharma and f to the health care that does not cover such a life saving drug. It's not a conspiracy...it's a cultural failure to recognize how far we have come in such a short time. Some will call it profiteering...sure but it's also about what is done with those profits...what could be done. So I'm in on medtronic with the mission to take their pillaging and raping of the target audience, get some profits and help someone that needs help with their medication.

www.diabetes.ca you can donate as well....I just want to take the strain off someone I know personally.

SUNPHARMA long term speculationWith a multi-year breakout and current pharma sector conditions, I believe it's going to outperform the sector.

Disclaimer: for education purposes only not recommended for trade.

can use both weekly and daily timeframe for getting the big picture.

Check the notes points for further clarity

#sunpharma

SUNPHARMA - Sun Pharmaceuticals Industries Limited Levels -

Buy - Any dip the CMP or it breaks above 628

T1 - 645

T2 - 700

SL - 610

The undertone of the Pharma sector is bullish amid the second wave of COVID-19 hitting India. Sun Pharmaceuticals has the largest market capitalization and is currently trading at half the price of its all-time high which was close to 1200. The stock has seen a major correction from 1200 levels since FY-15 and now might have resumed a pullback.

Current scenario -

The stock has started trading above all its important exponential moving averages in 5-6 sessions. However the stock has a strong supply zone at the levels of 625-628, so once the stock breaks this level, an upside move up to the levels of 650 followed by 700 looks achievable. A key thing to note here that the stock is trading above all its moving averages and have

NOTE: These findings and levels are purely based upon the knowledge and understanding of the post publisher. The idea here is to predict the future price movements hence, please do not consider this as stock advice or recommendation.

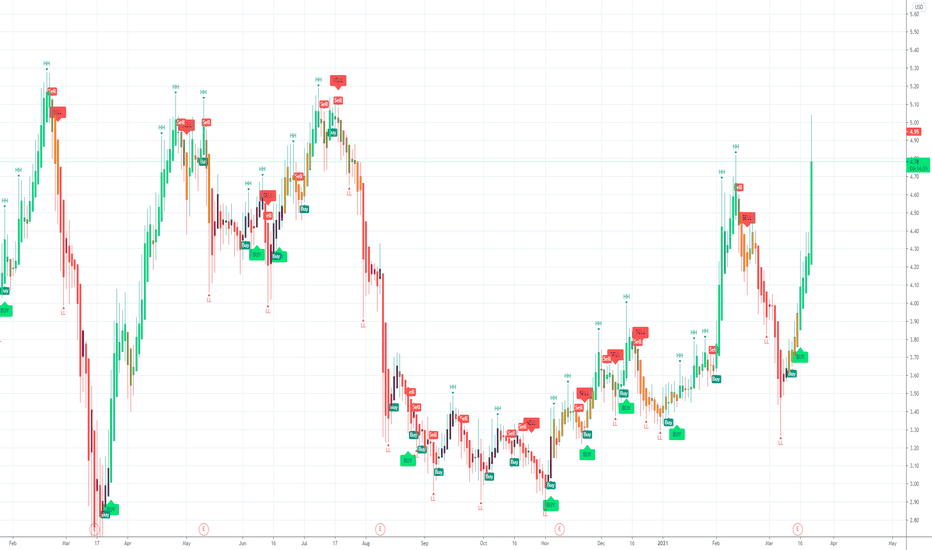

LXRX - a gain again?Possibility to gain again?

It looks like it want to crawl up on a support line (green).

I've packed bags here a little.

Indicators are almost reversed to bullish.

But it still can go lower if it breaks the support line.

Remember to have a stop loss below the support line.

There is a big gap below 5.60.

There also could happen a bear trap, quick fall and then quick retrace and skyrocketing.

This one is going to be fun soon.

But Reward/Risk ratio is promising.

1st target point is 7.60(+over 30% profit).

fundamentally : beating almost every estimations lately.

Good luck!

ATOS - Triple Bottom with a Breakout?Set up looks great. Triple bottom, break out and retest of a diagonal resistance. I absolutely dislike stocks like this but I like the chart. Will there be a catalyst to move this? The only catalyst for this one is the recent FDA "safe to proceed" letter to continue ovarian cancer treatment. If it actually materializes, could see a run towards levels above. It will only move if it catches momo crowd, otherwise just another garbage stonk.

CPRX Catalyst Pharmaceuticals $40M Repurchase P/E Ratio 6.5 WOWCatalyst Pharmaceuticals is a biopharmaceutical company that specializes in therapies for rare neurological and neuromuscular diseases. It announced its fourth-quarter and 2020 financial results on March 15, 2021, reporting a 16% increase in revenue for fiscal 2020 and a 30% increase in operating income. (investopedia.com)

The company posted adjusted earnings of $0.11 per share, up 57% year-over-year, with the figure exceeding analysts’ expectations of $0.09 per share.

The company remains focused on acquiring or in-licensing innovative, technology platforms and early stage programs in therapeutic areas different from neuromuscular diseases. (smarteranalyst.com)

CPRX it`s an easy 50% in my opinion.

$40 Million Share Repurchase.

Market Cap 453.715M.

PE Ratio (TTM) 6.15.

75mil revenue, 119mil earnings in 2020

haven`t seen such a great balance sheet on a penny stock.

now trading at 4,94usd.

3/18/2021 Roth Capital Boost Price Target Buy $6.50 ➝ $7.00

H.C. Wainwright analyst Andrew Fein reiterated a Buy rating on the stock with a price target of $9

If you are also interested to test some amazing BUY and SELL INDICATORS that i use, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

I like the stock!This type of company have the power to change this era. I'm in with 10k shares, plan to buy more for long-term (5-10 years).

INVO Potential Day TradeINVO potential day trade. I may enter above the 5.85 for a price target of 7.45 on a bounce up from support. It appears that volume is concentrated at two primary levels, this trade attempts to profit on that spread.

(Just an idea, not advice)

$RXMDRXMD has moved up from $.04 to $.16 in less than a month. The chart appears to have a classic “head & shoulders” formation.

ONTX loading up for the next move4h hidden bullish divergence... waiting confirmation. What's weird is that my chart's MACD is very different with ext hours on and off.... had to leave exthours on for this also .. Some new site came out with this Analyst price target of ONTX: stock Reiterated by H.C. Wainwright analyst, price target now $7.50...