Novartis | NVS | Long at $99.00As one of the largest pharmaceutical companies in the world, Novartis NYSE:NVS is poised to grow well into 2027. It's trading at a 17x P/E, earnings are forecast to grow 7% per year, it has low debt, and has been raising its dividend over the past few years (3.8%). The price on the daily chart is nearing the historical simple moving average line and may be poised for another move up. However, entry into the lower $90's or even $80's is still not off the table and, in my view, a great opportunity. Thus, at $99.00, NYSE:NVS is in a personal buy zone.

Target #1 = $110.00

Target #2 = $120.00

Pharmaceutical

Ironwood Pharmaceuticals | IRWD | Long at $0.61Ironwood Pharma NASDAQ:IRWD stock dropped ~89% in the past year due to disappointing Phase 3 Apraglutide trial results, FDA requiring an additional trial, weak Q1 2025 earnings (-$0.14 EPS vs. -$0.04 expected), high debt ($599.48M), and analyst downgrades. So why would I be interested in swing trading this company? The chart. The price has entered my "crash" simple moving average zone, which often results in a reversal - even if temporary. Also, Linzess (GI drug) revenue is steady, and I thoroughly believe that alone pushes the fair value near $0.95, if not higher. Thus, at $0.61, NASDAQ:IRWD is in a personal buy zone with the potential for additional declines before future rise.

Target:

$0.95 (+55.7%)

The Collaborative Edge: Pfizer's Innovation Secret? Pfizer's success in the biopharmaceutical industry hinges on its internal capabilities and a strategic embrace of external collaboration. This proactive approach, spanning diverse technological frontiers, fuels innovation across its operations. From partnering with QuantumBasel and D-Wave to optimize production planning using quantum annealing, to collaborating with XtalPi to revolutionize drug discovery through AI-powered crystal structure prediction, Pfizer demonstrates the tangible benefits of cross-industry partnerships. These initiatives showcase a commitment to exploring cutting-edge technologies to enhance efficiency and accelerate the identification of promising drug candidates, ultimately improving patient outcomes and strengthening Pfizer's competitive position.

The article highlights specific examples of Pfizer's collaborative endeavors. The Pfizer Healthcare Hub in Freiburg acts as a catalyst, connecting internal needs with external innovation. The successful proof of technology in production planning using quantum annealing resulted in significant time and resource savings. Furthermore, the partnership with XtalPi has dramatically reduced the timeframe for determining the 3-D structure of potential drug molecules, enabling faster and more efficient drug screening. These collaborations exemplify Pfizer's strategic focus on leveraging specialized expertise and advanced technologies from external partners to overcome complex challenges in the pharmaceutical value chain.

Beyond these specific projects, Pfizer actively engages with the broader quantum computing landscape, recognizing its transformative potential for drug design, clinical studies, and personalized medicine. Collaborations with technology giants like IBM and fellow pharmaceutical companies underscore the industry-wide interest in harnessing the power of quantum computing. While the technology is still in its early stages, Pfizer's proactive participation in this collaborative ecosystem positions it at the forefront of future healthcare breakthroughs. This commitment to synergy, from basic research to market research, underscores a fundamental belief in the power of working together to drive meaningful advancements in the pharmaceutical industry.

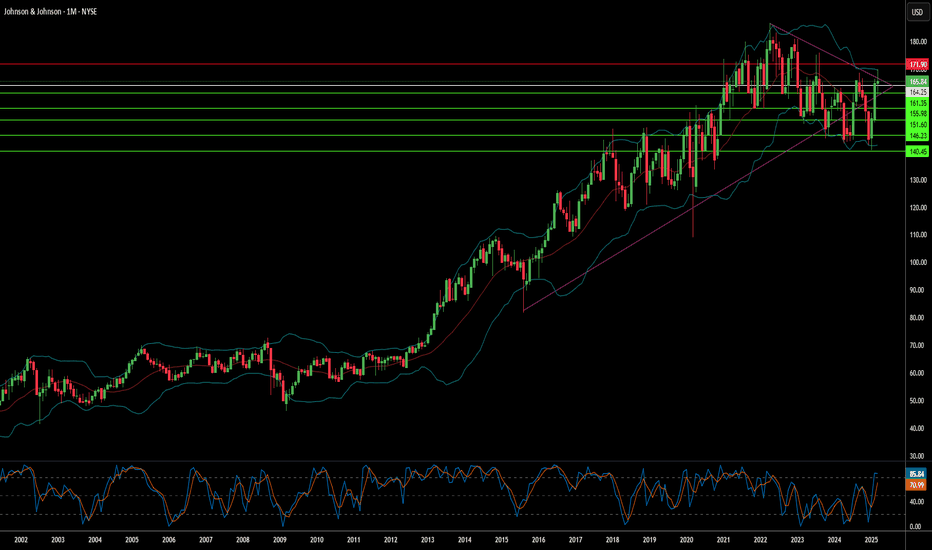

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Can Market Turbulence Create Future Innovation?In a dramatic turn of events that sent shockwaves through the pharmaceutical industry, Novo Nordisk's recent setback with its experimental obesity drug CagriSema presents a fascinating case study in market resilience and scientific progress. The company's stock plummeted 24% after trial results showed a 22.7% weight reduction efficacy, falling short of the anticipated 25% target. Yet, beneath this apparent disappointment lies a deeper story of pharmaceutical innovation and market adaptation.

The obesity treatment landscape stands at a pivotal crossroads, with the market experiencing exponential growth from its modest beginnings to a staggering $24 billion industry in 2023. Novo Nordisk's journey, alongside competitor Eli Lilly, exemplifies how setbacks often catalyze breakthrough innovations. The CagriSema trial, involving 3,400 participants, represents a clinical study and a testament to the industry's commitment to addressing global health challenges.

Looking ahead, this moment of market recalibration might well be remembered as a turning point in the evolution of obesity treatment. With projections suggesting a potential $200 billion market by the early 2030s, the current turbulence could drive even greater innovation and competition. The fact that only 57% of trial participants reached the highest CagriSema dose points to untapped potential and future opportunities for optimization, suggesting that today's apparent setback might pave the way for tomorrow's breakthroughs.

Can Pharma Innovation Rewrite Healthcare's Future?In the rapidly evolving landscape of medical technology, Eli Lilly emerges as a beacon of transformative potential, challenging conventional boundaries of pharmaceutical innovation. With a strategic masterstroke, the company has positioned itself at the forefront of medical breakthroughs, particularly in the revolutionary realm of weight loss and diabetes treatments. The remarkable Zepbound medication stands as a testament to this vision, demonstrating unprecedented efficacy by enabling patients to lose an average of 20.2% body weight - a figure that not only surpasses competitors but also represents a paradigm shift in medical intervention.

The company's financial architecture is equally compelling, reflecting a meticulously crafted approach to growth and shareholder value. With a staggering market capitalization of $722 billion, a 27.4% revenue growth, and an impressive 80.9% gross profit margin, Eli Lilly transcends the traditional pharmaceutical business model. Its recent $15 billion share buyback program and consistent 54-year dividend payment history underscore a strategic philosophy that balances aggressive innovation with prudent financial management, creating a blueprint for sustainable corporate success.

Beyond financial metrics and breakthrough medications, Eli Lilly represents something more profound: a vision of healthcare's future where technology, research, and human potential converge. The company's $3 billion manufacturing expansion, commitment to oncology research with drugs like Jaypirca, and continuous investment in cutting-edge medical solutions paint a picture of an organization that sees beyond immediate profit - an entity committed to reshaping human health through relentless innovation and scientific excellence. In an era of unprecedented medical challenges, Eli Lilly stands not just as a pharmaceutical company, but as a harbinger of hope, demonstrating how visionary thinking can transform global health landscapes.

CAPR projected to see additional volatility NEAR TERM. Recent short attack will likely be a two-part process.

Expecting strong buy wave to 17-18.5 zone near term before renewed aggressive selling down to next liquidity target zone at 10.4-11 level.

There exists a small gap at 9.95-10.05 which may be targeted by shorts. Unsure if it gets filled during market hrs or during extended session.

Planning to go long again from 10.4-11 via limit buy orders sometime this month. Expecting us to get the buy opportunity before 12/20 date before the next swing target to 25.00

once we see a break above 26.5, it'll confirm for me the greater buy sequence will continue on weekly timeframe for advancement to 75-80$ analyst target level. Until then, we may remain rangebound between 15-25$ levels.

Personally expecting price to reach 100$ sometime by late 2025.

ASPEN nearly ready for a strong shot down to R151.06!Inv Cup and Handle has been forming on Aspen.

The price is >20 and 200 showing that the momentum is down.

I am eagerly waiting for a strong break below, before I look at getting into a long holding short (sell trade).

My first target will be at R151.06

Is Pfizer's Golden Goose About to Lay a Different Egg?Pfizer, the pharmaceutical giant that became a household name

during the pandemic, now faces a pivotal moment.

Activist investor Starboard Value has taken a $1 billion

stake, signaling potential changes on the horizon. But

what does this mean for Pfizer's future?

The company that swiftly developed a COVID-19 vaccine

now grapples with declining sales and a tumbling

stock price. Starboard's involvement brings both challenge and

opportunity. Will this be the catalyst for Pfizer's

renaissance or a sign of deeper troubles ahead?

Former Pfizer executives have been approached to assist

in the turnaround effort. Their potential involvement adds

an intriguing layer to this unfolding story. Could

their experience and insight be the key to

unlocking Pfizer's next chapter of success and innovation?

As the pharmaceutical landscape evolves post-pandemic, Pfizer's

response to this pressure could set industry trends.

Cost-cutting, strategic refocusing and potential leadership changes loom

large. How will these moves impact drug development,

patient care, and the broader healthcare ecosystem?

For investors, patients, and industry watchers, Pfizer's

next moves are crucial. Will the company

emerge stronger, leaner, and more innovative? Or will

it struggle to find its footing in a

rapidly changing market? The answers to these questions

could reshape the future of global healthcare.

Eli Lilly's Zepbound: A Game-Changer for Obesity Treatment?In a groundbreaking move that could redefine the landscape of obesity treatment, Eli Lilly has slashed the price of its weight loss drug, Zepbound, by half. But is this simply a strategic business decision, or is it a beacon of hope for millions struggling with obesity? Join us as we delve into the implications of this bold move and explore the potential impact on the future of weight management.

Imagine a world where obesity is no longer a daunting, insurmountable challenge. A world where effective, affordable treatments are accessible to all who need them. Eli Lilly's recent announcement of a significant price reduction for Zepbound brings us closer to that reality.

By making this groundbreaking decision, Eli Lilly has not only demonstrated its commitment to patient access but has also sent a powerful message to the broader healthcare industry. This move has the potential to disrupt the status quo, challenging the outdated policies and practices that have hindered progress in obesity treatment.

As we explore the implications of Eli Lilly's decision, we must consider the broader context of the obesity epidemic. For decades, obesity has been stigmatized and overlooked as a serious medical condition. Many individuals struggling with weight loss have faced limited treatment options and significant financial burdens.

Eli Lilly's move to lower the price of Zepbound could be a game-changer in this regard. By making the drug more affordable, the company is empowering patients to take control of their health and pursue a healthier lifestyle. This could lead to a significant increase in the number of people seeking treatment for obesity, ultimately improving public health outcomes.

However, it is important to note that this is just one step in a larger journey. While Eli Lilly's decision is undoubtedly a positive development, more needs to be done to address the systemic issues that contribute to the obesity epidemic. Policymakers, healthcare providers, and communities must work together to create a supportive environment that promotes healthy eating, physical activity, and access to affordable, effective treatments.

In conclusion, Eli Lilly's announcement of a price reduction for Zepbound represents a significant milestone in the fight against obesity. By making this drug more accessible, the company is not only helping individuals achieve their weight loss goals but also challenging the broader healthcare system to prioritize obesity treatment.

CVS - CVS Health: If the stock drops a few points, I'll be buyiIf the stock drops a few points, I'll be buying very heavily...

CVS and WBA are in the same sector. And both have been decimated. CVS, however, is doing better. And they're paying a dividend.

Target, at least +10%.

Trading at 70% below estimate of its fair value

Earnings are forecast to grow 9% per year

Earnings grew by 140% over the past year

DIVIDEND = Pays a high and reliable dividend of 4.75%

Trading at good value compared to peers and industry

Analysts in good agreement that stock price will rise by 20%

Bayer AG (BAYN.de) bullish scenario:The technical figure Falling Wedge can be found in the daily chart in the German company Bayer AG (BAYN.de). Bayer AG is a German multinational pharmaceutical and biotechnology company and one of the largest pharmaceutical companies in the world. Headquartered in Leverkusen, Bayer's areas of business include pharmaceuticals; consumer healthcare products, agricultural chemicals, seeds and biotechnology products. The Falling Wedge broke through the resistance line on 22/03/2023. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 9 days towards 60.750 EUR. According to experts, your stop-loss order should be placed at 54.890 EUR if you decide to enter this position.

Bayer AG plans to spend $1 billion on drug research and development in the U.S. this year as it works to double its sales in the country by the end of the decade, Bayer's top U.S. pharmaceutical executive told Reuters.

Sebastian Guth, president of Bayer's pharmaceuticals business in the Americas, in an interview with Reuters, said the company increased U.S. employees working on marketing for its pharmaceutical business by around 50% over the last three years and plans to expand on that by another 75% by 2030.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals and cannot be held liable nor guarantee any profits or losses.

10/16/22 IONSIonis Pharmaceuticals, Inc. ( NASDAQ:IONS )

Sector: Health Technology (Pharmaceuticals: Major)

Current Price: $46.36

Breakout price trigger: $47.85

Buy Zone (Top/Bottom Range): $44.65-$39.75

Price Target: $55.50-$56.30

Estimated Duration to Target: 131-139d

Contract of Interest: $IONS 1/20/23 50c

Trade price as of publish date: $3.20/cnt

FRTX | This Will Rocket! | 200%+ PotentialFresh Tracks Therapeutics, Inc., a clinical-stage pharmaceutical company, engages in the development of various prescription therapeutics for the treatment of autoimmune, inflammatory, and other debilitating diseases in the United States. The company develops sofpironium bromide, which has completed Phase III clinical trials for the treatment of primary axillary hyperhidrosis; BBI-02, an oral DYRK1A inhibitor for the treatment of autoimmune and inflammatory diseases; and BBI-10, a covalent stimulator of interferon genes inhibitor for the potential treatment of autoinflammatory and rare genetic diseases, as well as next-generation kinase inhibitors. It has license and collaboration agreements with Carna Biosciences, Inc., Voronoi Inc., Bodor Laboratories, Inc. and Dr. Nicholas S. Bodor, and AnGes, Inc. The company was formerly known as Brickell Biotech, Inc. and changed its name to Fresh Tracks Therapeutics, Inc. in September 2022. Fresh Tracks Therapeutics, Inc. was founded in 2009 and is headquartered in Boulder, Colorado.

Novartis (NOVN.vx) bullish scenario:The technical figure Double Bottom can be found in the Swiss company Novartis International AG (NOVN.vx) at daily chart. Novartis International AG is a Swiss multinational pharmaceutical corporation. It is one of the largest pharmaceutical companies in the world. Novartis manufactures the drugs clozapine (Clozaril), diclofenac (Voltaren), carbamazepine (Tegretol), valsartan (Diovan), imatinib mesylate (Gleevec/Glivec), cyclosporine (Neoral/Sandimmune), letrozole (Femara), methylphenidate (Ritalin), terbinafine (Lamisil), deferasirox (Exjade), and others. The Double Bottom has broken through the resistance line on 07/04/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 29 days towards 86.88 CHF. Your stop-loss order according to experts should be placed at 72.50 CHF if you decide to enter this position.

Novartis CEO Vas Narasimhan is continuing his shake-up of the giant Swiss drugmaker, announcing a corporate restructuring on Monday that the company says will simplify its organizational chart and bring more than $1 billion in annual savings.

Novartis AG NVS announced that the FDA has approved its kinase inhibitor, Vijoice (alpelisib), for the treatment of patients aged two years and above with severe manifestations of PIK3CA-Related Overgrowth Spectrum (“PROS”), requiring systemic therapy. Per the company, following the nod, Vijoice became the first FDA-approved therapy to treat PROS, which includes rare conditions where overgrowths and blood vessel anomalies occur.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

ACRX Daily Long Double Bottom Bullish Long TermACRX has reached the lowest price @.46 a share, it has also double bottomed on the daily, the daily candle is bullish.. Looking to ride this buy for a long term.

Going to ride it up to the red resistance trendline, if it becomes support it should reach $2 to $4. Happy New Year..

FENC Analysis - Dip Buy0.786 can be seen as a previous point of resistance

now that price has moved higher than this level, it will be seen as a point of support for the breakdown of the rising wedge , a pattern that is commonly bearish (as you can see on the chart)

Pharmaceutical companies are possibly hot right now, due to the emergence of the new COVID variant.

Buy the Dip.

$XAIR Symmetrical Triangle BreakBeyond Air has continued a strong uptrend since June. Recently its bin tapering and has shown a symmetrical triangle formation. A Brake out to the upside is likely to continue the uptrend. Watch for a move past the top of the triangle at 11.88 level for conformation and more possible upside. No resistance till 12.50 a high not seen since March 4, 2020

ObsEva, emerging company on verge of phase 3 completion

Hi Ya'll,

I hope you're having a Good Friday night. I came across this gem yesterday and I have to give it a shout out. ObsEva is a unique company, and has lots of potential. They have three drugs currently in pipelines. Its recently broken out and is channeling upward and moving very healthily. I have a price target of $10+. With a long term hold.

Yselty- Phase 3

Ebopripant - Phase 2

Nolasiban -Phase 1

www.obseva.com

Yselty is about to be finished testing. It looks positive and ready to be sold world wide. This product is very good for dealing with uterary fibroids which is very common and has no clear medication to use to solve it.

If y'all can post your own understanding of the significance of these drugs I would appreciate it. I do not fully understand what these drugs do but they seem to be a big deal.

Many analysts have set price targets ranging from $4.00-$28.00 a share.

I will link this.

www.tipranks.com

Please give the company corporate presentation a look, and please tell me if I missed anything crucial, like the executives, etc..

www.obseva.com

Thanks,

Benjamin

Growth potentialThe pharmaceutical sector is one of the most interesting ones in such a troubled period.

I see some growth potential for $ACAD in the short term. It is showing a positive trend that is already consolidated and heading for a possible TP of around 44-45$

I see this level as an important resistance since it has been tested repeatedly in the past.

***As usual, not a trading advice, merely my view for informational and educational purposes only***

Vanda Pharmaceuticals! Earnings 40% Trade!!FA:

Earings release- the last earnings where the estimate was higher than 0.05 per share it led to the stock rallying by 40%- unless, the earings surprise is a negative one; we can expect a rally from Vanda Pharmaceuticals.

TA:

Currently been trading in a limited channel- lack of momentum could lead to a dump if earnings estimate is negative or perhaps mean no rally even if the earnings estimate is positive.

Watch out for the resistance, it is unlikely to take it out in these market conditions.

-Megalodon Whales (Rahim)

Enjoyed Charting this for you all,Please SHARE/LIKE/COMMENT and you are welcome to give your feedback or post your own charts below :)

NASDAQ:VNDA FWB:VM4