Pharmaceuticals

Bearish Divergence on Weekly tf.FEROZ Update

Closed at 362.90 (20-06-2025)

There is a Bearish Divergence on Weekly tf.

So important to Cross the Strong Resistance Zone

around 380 - 410.

Crossing this level with good volumes may lead

it towards further upside around 500.

Important Supports are around 330 - 333 & then

around 260 - 265.

Potential outside week and bearish potential for TLXEntry conditions:

(i) lower share price for ASX:TLX below the level of the potential outside week noted on 2nd June (i.e.: below the level of $24.91).

Stop loss for the trade would be:

(i) above the high of the outside week on 5th June (i.e.: above $27.40), should the trade activate.

Important note for the trade:

- Observe market reaction at two key areas illustrated in the chart above, should the trade activate ($24.79 and $24.47), which could act as support against the short trade.

Novartis | NVS | Long at $99.00As one of the largest pharmaceutical companies in the world, Novartis NYSE:NVS is poised to grow well into 2027. It's trading at a 17x P/E, earnings are forecast to grow 7% per year, it has low debt, and has been raising its dividend over the past few years (3.8%). The price on the daily chart is nearing the historical simple moving average line and may be poised for another move up. However, entry into the lower $90's or even $80's is still not off the table and, in my view, a great opportunity. Thus, at $99.00, NYSE:NVS is in a personal buy zone.

Target #1 = $110.00

Target #2 = $120.00

Ironwood Pharmaceuticals | IRWD | Long at $0.61Ironwood Pharma NASDAQ:IRWD stock dropped ~89% in the past year due to disappointing Phase 3 Apraglutide trial results, FDA requiring an additional trial, weak Q1 2025 earnings (-$0.14 EPS vs. -$0.04 expected), high debt ($599.48M), and analyst downgrades. So why would I be interested in swing trading this company? The chart. The price has entered my "crash" simple moving average zone, which often results in a reversal - even if temporary. Also, Linzess (GI drug) revenue is steady, and I thoroughly believe that alone pushes the fair value near $0.95, if not higher. Thus, at $0.61, NASDAQ:IRWD is in a personal buy zone with the potential for additional declines before future rise.

Target:

$0.95 (+55.7%)

Though Bullish on Monthly tf, butGLAXO Closed at 390.42 (23-05-2025)

Though Bullish on Monthly tf, but weekly bearish

divergence has started appearing.

Important Support level is around 367 - 372; but

important to Sustain 388 - 390 atleast for further upside.

Immediate Resistance is around 410 - 420

Breaking 300 will bring more selling pressure.

Can Lilly Redefine Weight Loss Market Leadership?Eli Lilly is rapidly emerging as a dominant force in the burgeoning weight loss drug market, presenting a significant challenge to incumbent leader Novo Nordisk. Lilly has demonstrated remarkable commercial success despite its key therapy, Zepbound (tirzepatide), entering the market well after Novo Nordisk's Wegovy (semaglutide). Zepbound's substantial revenue in 2024 underscores its rapid adoption and strong competitive standing, leading market analysts to project Eli Lilly's obesity drug sales will surpass Novo Nordisk's within the next few years. This swift ascent highlights the impact of a highly effective product in a market with immense unmet demand.

The success of Eli Lilly's tirzepatide, the active ingredient in both Zepbound and the diabetes treatment Mounjaro, stems from its dual mechanism targeting GLP-1 and GIP receptors, offering potentially enhanced clinical benefits. The company's market position was further solidified by a recent U.S. federal court ruling that upheld the FDA's decision to remove tirzepatide from the drug shortage list. This legal victory effectively halts compounding pharmacies from producing unauthorized, cheaper versions of Zepbound and Mounjaro, thereby protecting Lilly's market exclusivity and ensuring the integrity of the supply chain for the approved product.

Looking ahead, Eli Lilly's pipeline includes the promising oral GLP-1 receptor agonist, orforglipron. Positive Phase 3 trial results indicate its potential as a convenient, non-injectable alternative with comparable efficacy to existing therapies. As a small molecule, orforglipron offers potential advantages in manufacturing scalability and cost, which could significantly expand access globally if approved. Eli Lilly is actively increasing its manufacturing capacity to meet anticipated demand for its incretin therapies, positioning itself to capitalize on the vast and growing global market for weight management solutions.

A Long-term Bullish Trend ?With an upcoming Earnings report we can observe rather uncertain future behavior.

But since the trend has been bearish for a longer period of time and the price is "nearly" at the same position which was achieved for the first time in early April in 2019, we can, mostly based only on the technical analysis and Earnings report, determine quite confidently that the price is ready to rise.

Important data:

EPS Estimate: -$3.12

Revenue Estimate: $106 million to $166.7 million

Notable developments:

Cost-cutting initiative = Targeting $1.1B in reductions by 2027

By the end of 2024 $9.5 billion allocated in investments

Undervalued, Oversold, Overlooked: MRK Hits The Key Zone!Hi all,

Merck & Co. (MRK) is a global pharmaceutical titan and is currently trading near its 52-week low of ~$79. Anchored by Keytruda’s 7% YoY revenue growth, a stable ~4% dividend yield, and an average fair value estimate of $156.59 (98% upside), MRK appears significantly undervalued.

Analysts forecast a 12-month price target of $118.05, implying 49% upside, supported by a strong pipeline and solid financials. While tariff concerns and Keytruda’s 2028 patent expiration pose risks.

Technically speaking, MRK has fallen 43% from its all-time high and has reached the strongest area on the chart—a key support zone offering a compelling opportunity to build mid- or long-term positions. This critical area is defined by multiple technical factors, creating a high-probability setup for a potential reversal:

Role Reversal Support: A broad, well-established resistance zone, aged like fine wine, has now flipped to act as support. This classic role reversal provides significant confluence to the setup.

Textbook Trendline: A perfectly respected trendline, straight out of technical analysis textbooks, has consistently held. The price has approached this trendline from higher highs, underscoring its strength as a key support level.

50% Retracement Level: A critical level often watched for potential reversals.

Monthly EMA200 Confluence: The 200-period exponential moving average on the monthly chart adds further strength to this area, reinforcing its technical significance.

Strategic Guidance:

This setup requires strong conviction. If you’re not prepared to buy in the lower gray areas of this support zone (marked on the chart), do not initiate a position.

In today’s market sentiment, your fundamental research must be robust, and technical analysis allows you to get that much confidence to make it happen!

Ask yourself: If the price falls further into the gray zones, am I willing to buy more? If your answer is yes, the current price presents a strong entry point for mid- to long-term positions.

If the answer is no—if you’re unsure about buying at lower levels or find yourself questioning what to do if prices drop further—refrain from starting a position. In volatile markets, clarity and discipline are essential. Only enter if your strategy is clear and your conviction matches the opportunity!

Good luck,

Vaido

NEULANDLAB short opportunityUpon the breakdown of the trendline NEULANDLAB has immense downside of 42 odd percentage. Next quarter results will be the catalyst, making or breaking the stock. Negative surprise in last two consecutive results declare us participants to beware of the liquidity present below this key level.

Short below daily close of 11,100

Stoploss - 8%

TP - Trail the 50 DMA close above

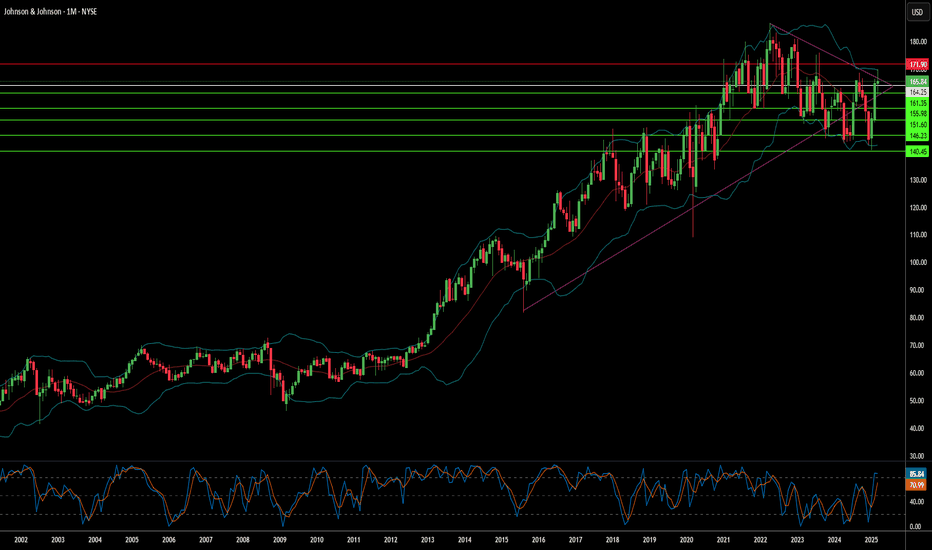

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Recently made LL on Shorter TF, but..Recently made LL on Shorter TF,

but also it is a Support level with Double Bottom.

Hidden Bullish Divergence on Daily TF.

Immediate Support lies around 86 - 89

& Immediate Resistance is around 91 - 92.

Sustaining 91 - 92 on Weekly TF, would

lead it towards 98 - 99.

Ultimate Target (if 109-110) is Sustained,

is around 128 - 130.

Should not break 81 now.

Zoetis | ZTS | Long at $156.94Zoetis NYSE:ZTS , the largest global animal health company, generated more than $9 billion in revenue in 2024 and earnings have grown 9.3% per year over the past 5 years. Free cash flow for FY2024 was over $2.2 billion. Dividend consistently raised every year for the past for years (currently 1.28%). The growth of the company isn't expected to slow any time soon, and I believe the animal health care market will grow right alongside the human health care market - if not potentially faster (people love their pets).

Thus, at $156.94, NYSE:ZTS is in a personal buy zone. There may be some near-term risk with the potential for a daily price-gap close near $136.00, but I personally view that as an even better buy opportunity (unless fundamentals change).

Targets

$170.00

$180.00

$200.00

Finally a stock I like...this one is a real dealFinally, an investment idea! (after how much doom and gloom?) — Novo Nordisk.

You will all be familiar with Ozempic, the Danish company’s flagship product and the reason so many celebrities, influencers, b listers and regular schmegular Americans are suddenly skinny. I ignored the stock for most of ‘23/24, because it was so expensive. I am still a value investor (for my sins) and I just didn’t see a lot of value there — it was priced in.

Imagine my surprise as I was thinking about “megatrends” (vom) for the year ahead — AI, data, 'zempy. Novo stock has fallen 37.80% in the last six months. And you know what that means…that’s a real deal!

Why is it a real deal? (Don’t you like booze stocks Eden?)

Ozempic is not going away. At this point it is synonymous with weight loss as “Uber” is to ridesharing or Google is to search.

Note this data per Barclays, from recently issued rx data in the US — Ozempic script issuance has grown +8.4%, while WeGovy slightly trails it at 7.4% — both owned by Novo. While Eli Lilly also makes a GLP, Novo is still the leader.

Strong guidance from management on sales — +16% - 24% — roughly implies revenue of $48bn for ‘25 and $57bn for ‘26…that’s a compounder.

America and much of the western world has an obesity problem. There is a clear incentive for governments to underwrite the drug because obesity has a clear social + fiscal cost on society — per UoA, the fiscal cost of obesity in NZ is at least $2bn¹.

People have an incentive to use Ozempic, because they are vain.

This is a nice hedge against the booze stocks I like so much. Benefit from both sides of the trade — buy booze at low teens multiples; buy Novo and benefit from lower drinking rates as there’s several studies that imply ‘Zempy reduces drinking.

I don’t want Ozempic, because I like to live the good life.

This does not mean the vast majority of people won’t use Ozempic. At the moment, one in eight Americans have used a GLP. That’s +334mn people. 40% of Americans are obsese.

There’s a Lollapalooza effect happening here — a bunch of incentives — vain people, governments wanting less obese people, the various side health benefits of GLPs, etc. I like when a lot of incentives are aligned because you’re relying on psychology rather than projecting numbers on an excel spreadsheet.

Novo has sold off recently due to a trial of its CagriSema drug missing expectations. Eyes on the prize, though — current GLPs, which still have plenty of market to saturate.

Eli Lilly has traded up in recent times, while Novo has traded down. The two tend to trade in lockstep so the disconnect is an opportunity to buy the world’s leading GLP maker at a good price.

Eli Lilly is the closest comp, but it trades at a 38x fwd multiple, while Novo trades at 20x — i.e. an almost 50% multiple discount (see chart). I like that too…

Note analyst recs on chart also…

This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

Can Pain Be Managed Without Addiction?Vertex Pharmaceuticals has achieved a monumental breakthrough in pain management, securing FDA approval for Journavx, the first new class of painkiller in over 20 years. This non-opioid drug introduces a paradigm shift, targeting pain signals directly at the source without the addictive risks associated with traditional analgesics. The significance of this development cannot be overstated, as it promises a new era where acute pain can be treated effectively and safely, potentially altering the landscape of medical treatment for millions.

Journavx operates by selectively inhibiting NaV1.8, a sodium channel vital for pain signaling, thus preventing pain signals from reaching the brain. This mechanism not only offers relief but does so without the side effects that have long plagued opioid use. The implications for healthcare are profound, offering doctors and patients alike a tool that can redefine how we approach pain management in clinical settings. Vertex's success with Journavx showcases the company's commitment to pioneering treatments that address some of the most pressing needs in modern medicine.

Financially, this approval has bolstered Vertex's market position, evidenced by a significant uptick in stock performance following the announcement. With a revenue projection for 2025 set between $11.75 and $12.0 billion, Vertex is not just riding the wave of this single approval but is also expanding its therapeutic horizons. The strategic leadership transitions announced alongside this approval signal a robust plan for future innovation, challenging investors and healthcare professionals to think about the evolving landscape of drug development and patient care.

This moment invites us to ponder the future of pharmaceuticals - one where efficacy does not compromise safety, where innovation in treatment could lead to broader societal benefits by reducing dependency on addictive substances. Vertex's journey with Journavx might just be the beginning of a new chapter in medical science, urging us to envision a world where pain management is humane and humane-centered.

Can a Pharmaceutical Giant Rewrite Its Own Destiny?In the complex world of global pharmaceuticals, Teva Pharmaceutical Industries Ltd. emerges as a compelling narrative of strategic reinvention. Under the leadership of CEO Richard Francis, the company has transformed from a struggling enterprise to a potential market leader, executing a bold "Pivot to Growth" strategy that has captured the attention of investors and industry experts alike. The company's remarkable journey reflects corporate resilience and a profound understanding of how strategic focus and innovative thinking can resurrect a seemingly faltering business.

Teva's renaissance is characterized by calculated moves that challenge traditional pharmaceutical business models. By strategically divesting its Japanese joint venture, selectively targeting high-potential generic markets, and developing promising drug candidates like Anti-TL1A, the company has demonstrated an extraordinary ability to reimagine its core strengths. The financial metrics tell a compelling story: a 66% market capitalization increase, double-digit revenue growth, and a strategic pipeline that promises future innovation in critical therapeutic areas such as neurology and digestive system treatments.

Beyond financial metrics, Teva represents a broader narrative of corporate transformation that extends beyond balance sheets. Its commitment to patient access programs, such as the recent inhaler donation initiative with Direct Relief, reveals a deeper organizational philosophy that intertwines strategic growth with social responsibility. This approach challenges the traditional perception of pharmaceutical companies as purely profit-driven entities, positioning Teva as a forward-thinking organization that understands its broader role in global healthcare ecosystems.

The company's journey poses a provocative question to business leaders and investors: Can strategic vision, relentless innovation, and a commitment to patient care truly redefine a corporation's trajectory? Teva's emerging story suggests that the answer is a resounding yes—a testament to the power of adaptive strategy, visionary leadership, and an unwavering commitment to pushing the boundaries of what's possible in the pharmaceutical landscape.

Can Pharma Innovation Rewrite Healthcare's Future?In the rapidly evolving landscape of medical technology, Eli Lilly emerges as a beacon of transformative potential, challenging conventional boundaries of pharmaceutical innovation. With a strategic masterstroke, the company has positioned itself at the forefront of medical breakthroughs, particularly in the revolutionary realm of weight loss and diabetes treatments. The remarkable Zepbound medication stands as a testament to this vision, demonstrating unprecedented efficacy by enabling patients to lose an average of 20.2% body weight - a figure that not only surpasses competitors but also represents a paradigm shift in medical intervention.

The company's financial architecture is equally compelling, reflecting a meticulously crafted approach to growth and shareholder value. With a staggering market capitalization of $722 billion, a 27.4% revenue growth, and an impressive 80.9% gross profit margin, Eli Lilly transcends the traditional pharmaceutical business model. Its recent $15 billion share buyback program and consistent 54-year dividend payment history underscore a strategic philosophy that balances aggressive innovation with prudent financial management, creating a blueprint for sustainable corporate success.

Beyond financial metrics and breakthrough medications, Eli Lilly represents something more profound: a vision of healthcare's future where technology, research, and human potential converge. The company's $3 billion manufacturing expansion, commitment to oncology research with drugs like Jaypirca, and continuous investment in cutting-edge medical solutions paint a picture of an organization that sees beyond immediate profit - an entity committed to reshaping human health through relentless innovation and scientific excellence. In an era of unprecedented medical challenges, Eli Lilly stands not just as a pharmaceutical company, but as a harbinger of hope, demonstrating how visionary thinking can transform global health landscapes.

Lupin Long-Term Investment IdeaAs we can see on the month chart stock breakout it rounding bottom after a many years with very good volume and retesting. Bullish crossover on November 2023

Technical Analysis & indicators 🔍

Monthly Chart

Rounding Bottom

Educational content 📖

This stock analysis is designed for educational purposes and should not be taken as financial advice. Please carry out your own research or consult with a financial advisor before investing.

Visit the website and check fundamental

ELI LILLY: This consolidation is a buy opportunity.Eli Lilly is neutral on its 1D technical outlook (RSI = 52.880, MACD = 1.910, ADX = 25.797) as well as on 1W as for the past 7 weeks it has turned sideways. This consolidation is taking place half-way through the new bullish wave of the Channel Up that started in early 2023. As you see it is supported by the 1W MA50 and every bullish wave in the beginning was almost at +50% but the latest one was +35%. Consequently we expect a minimum of +46.22% from the bottom and that's what we're aiming for (TP = 1,095).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ELI LILLY Always a solid buy below its 1D MA50.Eli Lilly (LLY) broke on Friday below its 1D MA50 (blue trend-line) for the first time since August 09. As the stock trades within a long-term Channel Up since the March 01 2023 bottom, every time the price was below the 1D MA50, it didn't stay for long, thus providing the most effective buy entry.

Even though it could dip some more as with July's decline (only such case though out of 6 corrections), as long as the 1D MA200 (orange trend-line) holds, we expect the Channel Up to be extended.

The initial Higher Highs were closer to the 1.5 Fibonacci Channel extension, the last one however was exactly on the 1.0 Fib. As a result, we will take a more conservative Target on that trend-line, thus turning bullish now and aiming at $1100 by the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇