Pharmastocks

Liminal BioSciences, a risky play85% below the July peak of last year and 99% below its all-time high.

Orbiting a major support level around $4.

A capital injection began in mid-November that is still not properly reflected in price.

Stochastic at the oversold point and RSI close to touching it.

It could give the surprise of giving a significant bounce to the marked lines.

The risk is that it has been trading at a loss for some time.

"Liminal (Nasdaq: LMNL) is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing novel treatments for patients suffering from diseases that have high unmet medical need, including those related to fibrosis in respiratory, liver and kidney diseases."

MRK - Merck & Co - WEEKLY Setup - Holding the 200emaI Hate Trading Pharma But...

MRK

BUYZONE = 74 - 76

Cost Avg Down (CAD) = 72 - 70

1st Target = 79

2nd Target = 82

3rd Target = 86

HODL Target = ATH

______________________________________________________________________________________________________________________

This content is for informational, educational and entertainment purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

Long CNSP to $4.12 above 3.50Long CNSP to $4.12 above 3.50

CNSP has reentered a trading range if you look left.

Symmetrical triangle formation, in confluence with the 786 fib, and monthly resistance levels.

100% measured move on the possible breakout would put us near $4.20, and just under a historical closing range at $4.32

Possible targets above that would be the 1.618 fib at 4.66, or 5.27. All time highs would be 5.71

However, the RSI looks over extended on the 4HR and the macd implies buyers are exhausted

on the breakdown, i would look for support at the 786 fib at 3.35 or the 618 at 3.08

Beyond that weekly support would be 2.85 and not unrealistic that we would get a retest of support if we break to the downside.

Concluence with the 786 fib and the parallel trading channel in red, would imply we could find support at what used to be our monthly resistance.

If we fall out of that trading range, i would look for entry at 2.85 or 2.70

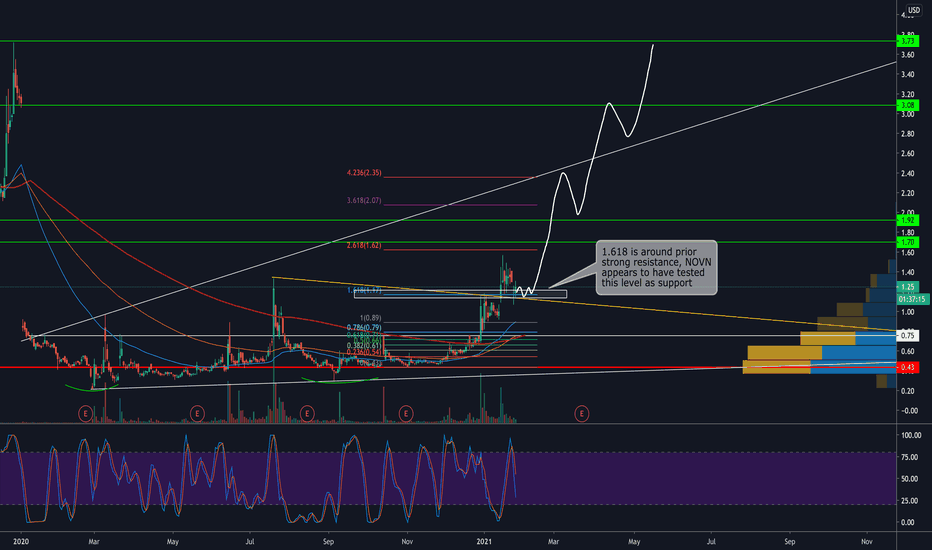

NOVAVAXif market keep is bullish euphorique structure, we are close to start the 3 wave that is extensive.

fundamental:

with covid trubbles and vaccination approval we can see that the probable futur trend will be bullish.

investor tend to go with hot stocks or easy to guest safe heaven sector, in the case of a global pendemie the one industry that cannot suffer from this is the medical and pharmacetical ones.

therfore the probability of a 3 wave arround the corner is really high.

also the wave 2 bounce from the 0.618 golden fib ratio, and wave 2 and 4 tend way more that just often to bounce from fib retracement. guessing a probal wave three from past support and resistance and using again the 0.618 to se were wave 4 should bounce at we have a strong probability to succes this trade.

as we know fib retracement tend to magicaly worked as resistance and support since so many investor/trader have orders at those levels.

entering now in the trade give you a stop loss at 80 so that would be 47 dollar risk/per share to a potential 120 dollar reward/ per share.

i don't know about you but i lile those kind of 3:1 reward to risk ratio.

best regards, patryck trader at richmonstocks funds.