$PHG Shares Surge 46% as it Settles U.S. Respiratory Device CasePhilips ( NYSE:PHG ), the Dutch medical devices giant, experiences a surge in its stock price following a groundbreaking $1.1 billion settlement in the U.S. for personal injury cases linked to the recall of its sleep apnea devices. While the settlement marks a significant milestone for Philips, questions linger about the impact on patient safety and the company's financial future.

Philips ( NYSE:PHG ) shares soared by a staggering 46% to reach a two-year high after the company announced a monumental $1.1 billion settlement in the U.S. for personal injury cases tied to the recall of its sleep apnea devices. The agreement, which comes amid concerns over potential cancer risks associated with the devices, has catapulted Philips ( NYSE:PHG ) back into the spotlight, alleviating uncertainty surrounding its legal battles.

The company's decision to settle reflects a strategic move to address mounting litigation and restore investor confidence. While Philips ( NYSE:PHG ) vehemently denies any fault or liability, CEO Roy Jakobs emphasized the company's commitment to patient safety and quality, stating, "We have taken important steps in further resolving the consequences of the Respironics recall."

Despite the substantial provision for the settlement, analysts are cautiously optimistic about Philips' financial outlook. The settlement amount, significantly lower than anticipated, has assuaged fears of a worst-case scenario, signaling a positive development for the company's bottom line. Barclays analyst Hassan Al-Wakeel remarked that the settlement is a "capped amount" that brings much-needed closure to ongoing litigation.

However, challenges remain for Philips ( NYSE:PHG ) as it navigates remaining legal cases in Europe and seeks to regain market trust. While the settlement marks a pivotal moment in the company's journey, questions persist about the long-term impact on its reputation and future growth prospects.

With the majority of legal cases now settled, Philips ( NYSE:PHG ) is poised to refocus its efforts on core business operations and strategic initiatives. CEO Roy Jakobs expressed confidence in the company's ability to bounce back, reaffirming full-year guidance and raising cash flow projections.

Technical Outlook

NYSE:PHG stock is up 46% on Monday's Pre-market trading with a Relative Strength Index (RSI) of 87 which is a clear indication of an overbought scenario traders need to be cautious of a trend reversal. The daily chart pattern shows a symmetrical Triangle pattern in the near term breaking above the ceiling of the previous pivot point.

Philips

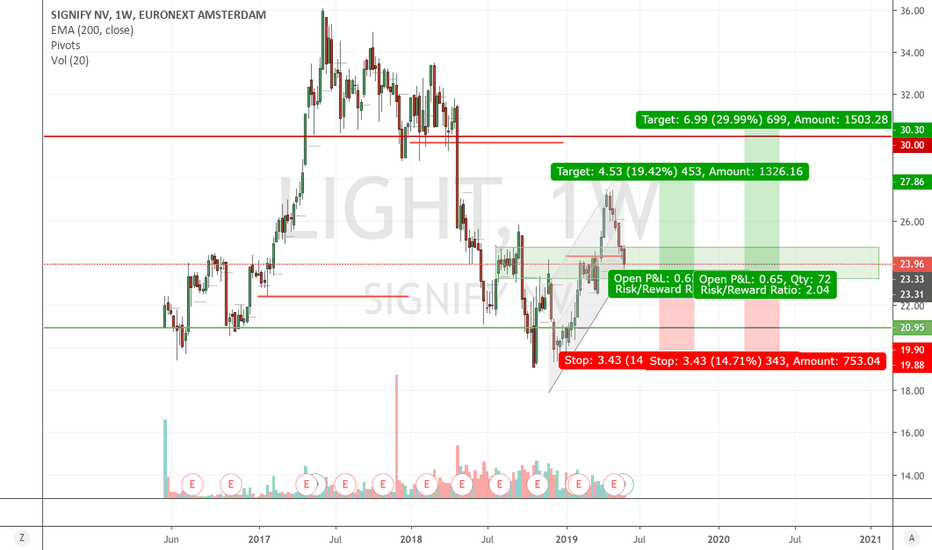

PHILIPS - Oversold - LongpositionOn the Philips chart (PHIA - 4h timeframe), We can see the price is currently oversold. The price is approaching a support area and is probably going to bounce off. Enter and leave the trade at the level defined on the chart.

The three indicators used are Bollinger Bands, RSI, and Stochastics. All these three indicators are confirming the oversold condition.

See all further details on the chart.

Good luck!

PHILIPS Setup for long-termPhilips is not a weak company that can go bankrupt very easily. It had a massive drop over the past year and forming a double bottom. The correction has been massive and now looks like a good entry for a long-term hold position. It might go more down but then a good investor averages down :)

You see both bullish and semi-bearish cases in the chart :)

Philips shares can Show It's Power Soon.Hello Dear Traders, i Think we have 2 possibility In the near future:

something will happen Like Financial recession of 2008 and the all worlds' stocks and shares will fall or they should Rise and go Up A.S.A.P because it's not normal to stay for a long time in Lower Line of Up Trend Cuz it can Break it so Strongly and there will be a Mega Bearish Trend.

Result: J.K(Just Kidding) :-D

Buy Philips Stock and You will see Profit and benefit of your patience.

A backward stepBig investors seem interested in Philips, and that’s been happening for a while now.

For various legal vicissitudes the Stock has had to suffer a pressure from part of some types of investor and for last the collapse happened some days before.

However, the trend towards short-term reductions by institutional investors and professional investors has not been affected.

The recent collapse seems mostly due to a mass sale by private investors and traders.

That’s why I think Philips will go back exactly where he started and then continue his ascent.

PHIA | Time to buyPhilips has reached it's (nearly) lowest levels for the last 3-5 years,

The reason seems to be a recall of equipment of a value of about 4bl$.

In general the company is quite healthy, no debts, positive cashflow, not very impressive, but still good PE and EPS ratios.

They have concrete development plans and solid background for upcoming profits.

The stock price may in the near future go below 30 euros, down to 27 euros as worst in my opinion.

Considering the fundamental background information and technical analysis expectations (which logically support each other), in a year or two, the stock price could reach the 55-60 euros, meaning doubling.

Considering the purchase price, background info and technically expected future price, now it seems to be a good time to enter the market.

The only drawback investing in PHIA, could be longer return periods, than initially expected.

Since the company is not generating high profits, and pays dividends, they might need much longer time to recover and grow further.

For the rest, it's a healthy company, strong brand and pretty cheap offer, for those who might like the company as investment item.

Philips - Finally a breakthrough soon? PT: €100 / €115Price target: €100 / €115

Philips second-quarter earnings beat forecast as pandemic fuels demand

Philips delivers Q2 sales of EUR 4.2 billion, with 9% comparable sales growth; net income amounts to EUR 153 million and Adjusted EBITA margin improves 280 basis points to 12.6%; company announces EUR 1.5 billion share buyback program

www.globenewswire.com

BE PREPARED: Bought me some Philips TechAlright my loyalest of followers, gather round for another prophecy.

Today a Philips Razor was ordered. Soon it wil be within my grasp. Thus, a sharp look shall be foretold. Such will inspire many a man in the coming times. As the tale of my newest of beards spreads, more men will reach for a Philips device to attain a similar legendary status. All will fail to amount to my stature, but as we all know: sales maketh the stock.

And so Our Prophecy™ concludes: Philips whilst raise through the heavens carried by its immortal shaved steeds.

Philips losing steam, also cheap light bulbs?I have alot of lightbulbs in my appartment that are ready for replacement. Will this short play out and will I get my discount?

- Not the most perfect bear div on the daily, but it looks convincing enough to me to say that momentum has died.

- PIHA price closed below 4h uptrend line, will the hidden bull div play out? I don't think so personally.

- I also want to add that Bollinger bands on the OBV are pinching. A move is incomming, my bets are on a nice downmove, marking the start of a daily downtrend.

- Stopsell @ 41.45 for entry.

Short-entry Philips (Euronext)With general market weakness (or exhaustion, if you like) we are focussing on new short-entries for the near term (1-3 months).

PHIA ( EURONEXT:PHIA ) has shown a recent breakout failure followed by the setting of a new lower peak. We expect prices to take out the trigger at

31.25. The first target comes in at 29.55 and we suggest keeping stops tight at 32.15. Risk/reward is roughly 1:1.8 which is ok for a near term trade.

Lowering the target if momentum picks up is a possibility. We'll have to monitor developments over the coming period.

Philips Lighting: bulls are ready for take-off!The share price moves between a small range of levels. Nevertheless the indicators suggesting a new rebound of the bulls to at least 35 and maybe 37 euros within a few days or weeks. On Friday 21th July Philips Lighting presents its 2nd quarter earnings and this can lead to a new direction in the long term trend. Although the trend is your friend, we can see that the bulls are preparing a new attack, so get in on the short term for a longer period is an excellent idea. Take advantage of this setup!

Setup Philips 'Euronext' General thoughts:

- There should be some energy left for at least another wave up (volume, resistance / support)

- It will face some difficulties with breaking the all-time high, so some consolidation after it has touched would seem appropriate. I already bought at 31.5, looking to take most of the profit inside the yellow box.

Stop loss:

- Stop loss is riding along the MA30. corrective wave 2 didn't get much further down, so I don't expect a 2nd correction wave to go much below that, but I will try to stay a little bit flexible because 3rd waves can have heavier corrections, so I will trust indicators like sell volume to determine when to close my trade.

Only Gap At This Point Is RequiredAs Said in title only gap at this point can make this market move to dogs.

Rules to short:

Short when market breaches the red horizontal line

Reasons To Short:

Standing on the volume any gap can make this market to go bump

Divergence will be eliminated after gap so there will be nothing left to hold this market

Market will follow trend if gap down

News looking like we can have a gap so waiting for that as well

holded at this area and moving in a upward channel which is very strong pattern

Do Join Our Daily Live Trading Webinars As Webinars Free Of Cost To Watch.

attendee.gotowebinar.com

In Order to stay Connected And Recieve Premium Features From 2smart2trade Logon to our website www.2smart2trade.tv

Add us on different social media platforms as well.

Skype:Toosmart2trade

Whats app:+923131086711

Twitter: twitter.com

Facebook: www.facebook.com

Youtube:https://www.youtube.com/channel/UCNlWVSJS2GFrY3VFUgMputQ

Google+:https://plus.google.com/u/0/+2Smart2Trade/posts

Tradingview:https://www.tradingview.com/u/2Smart2Trade/#published-charts

Linkedin:https://pk.linkedin.com/in/2smart-2trade-115248bb