USD/JPY(20250728)Today's AnalysisMarket news:

Trump announced that the US and Europe reached a trade agreement: 15% tariffs on the EU, $600 billion in investment in the US, zero tariffs on the US by EU countries, the EU will purchase US military equipment, and will purchase US energy products worth $750 billion. However, the US and Europe have different opinions on whether the 15% tariff agreement covers medicines and steel and aluminum. Von der Leyen: 15% tariff rate is the best result that the European Commission can achieve.

US Secretary of Commerce: The deadline for tariff increase on August 1 will not be extended. The United States will determine the tariff policy on chips within two weeks.

Technical analysis:

Today's buying and selling boundaries:

147.47

Support and resistance levels:

148.58

148.17

147.90

147.04

146.77

146.35

Trading strategy:

If the price breaks through 147.90, consider buying, the first target price is 148.17

If the price breaks through 147.47, consider selling, the first target price is 147.04

Pin Bar

USD/JPY(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

148.19

Support and resistance levels:

149.23

148.84

148.59

147.78

147.53

147.14

Trading strategy:

If the price breaks through 148.59, consider buying, the first target price is 148.84

If the price breaks through 148.19, consider selling, the first target price is 147.78

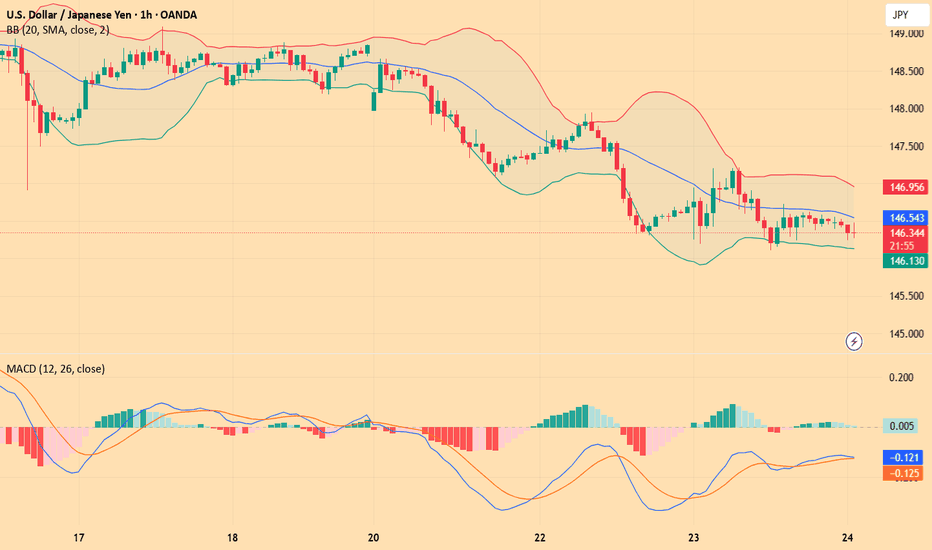

USD/JPY(20250724)Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

146.60

Support and resistance levels:

147.70

147.29

147.02

146.18

145.92

145.51

Trading strategy:

If the price breaks through 146.60, consider buying in, with the first target price at 147.02

If the price breaks through 146.18, consider selling in, with the first target price at 145.92

USD/JPY(20250714)Today's AnalysisMarket news:

① Fed's Goolsbee: The latest tariff threat may delay rate cuts. ② The Fed responded to the White House's "accusations": The increase in building renovation costs partly reflects unforeseen construction conditions. ③ "Fed's megaphone": The dispute over building renovations has challenged the Fed's independence again, and it is expected that no rate cuts will be made this month. ④ Hassett: Whether Trump fires Powell or not, the Fed's answer to the headquarters renovation is the key.

Technical analysis:

Today's buying and selling boundaries:

147.02

Support and resistance levels:

148.39

147.88

147.55

146.49

146.15

145.64

Trading strategy:

If the price breaks through 147.55, consider buying, and the first target price is 147.88

If the price breaks through 147.02, consider selling, and the first target price is 146.49

USD/JPY(20250616)Today's AnalysisMarket news:

Trump: The United States may still intervene in the Iran-Israel conflict. If Iran launches an attack on the United States, the United States will "fight back with all its strength on an unprecedented scale." Iran and Israel should reach an agreement.

Technical analysis:

Today's buying and selling boundaries:

143.79

Support and resistance levels:

145.47

144.84

144.43

143.15

142.74

142.12

Trading strategy:

If the price breaks through 144.43, consider buying in, the first target price is 144.84

If the price breaks through 143.79, consider selling in, the first target price is 143.15

USD/JPY(20250613)Today's AnalysisMarket news:

The number of initial jobless claims in the United States for the week ending June 7 was 248,000, higher than the expected 240,000, the highest since the week of October 5, 2024. The monthly rate of the core PPI in the United States in May was 0.1%, lower than the expected 0.30%. Traders once again fully priced in the Fed's two interest rate cuts this year.

Technical analysis:

Today's buying and selling boundaries:

143.73

Support and resistance levels:

145.09

144.58

144.25

143.21

142.88

142.37

Trading strategy:

If the price breaks through 143.73, consider buying in, the first target price is 144.25

If the price breaks through 143.21, consider selling in, the first target price is 142.88

USD/JPY(20250604)Today's AnalysisMarket news:

Fed Logan: We should focus on achieving the 2% inflation target rather than trying to make up for past inflation shortfalls; Bostic: We still think there may be a rate cut this year.

Technical analysis:

Today's buying and selling boundaries:

143.47

Support and resistance levels:

145.19

144.55

144.13

142.81

142.39

141.75

Trading strategy:

If the price breaks through 144.13, consider buying in, with the first target price of 144.55

If the price breaks through 143.47, consider selling in, with the first target price of 142.81

USD/JPY(20250429)Today's AnalysisMarket news:

The U.S. Treasury Department raised its second quarter debt forecast to $514 billion. U.S. Treasury Secretary: The "X Day" for the debt ceiling issue will be announced soon.

Technical analysis:

Today's long-short boundary:

142.62

Support and resistance levels:

144.52

143.81

143.35

141.89

141.43

140.72

Trading strategy:

If the price breaks through 142.62, consider buying, the first target price is 143.35

If the price breaks through 141.89, consider selling, the first target price is 141.43

USD/JPY(20250425)Today's AnalysisMarket news:

Federal Reserve-①Hamack: If economic data is clear, the Fed may cut interest rates in June

②Waller: It will take until July to get a clearer understanding of how tariffs affect the economy. If tariffs lead to higher unemployment, interest rate cuts may be initiated. ③The Atlanta Fed GDPNow model predicts that the US GDP growth rate in the first quarter will be -2.5%. ④Kashkari: The frequent announcements from Washington have brought challenges to policymakers and everyone.

Technical analysis:

Today's buying and selling boundaries:

142.79

Support and resistance levels:

143.94

143.51

143.23

142.34

142.06

141.63

Trading strategy:

If the price breaks through 142.79, consider buying, the first target price is 143.23

If the price breaks through 142.34, consider selling, the first target price is 142.06

USD/JPY(20250416)Today's AnalysisMarket news:

U.S. import prices fell 0.1% in March from the previous month, the first month-on-month decline since September last year.

Technical analysis:

Today's buying and selling boundaries:

143.10

Support and resistance levels

144.08

143.72

143.48

142.72

142.48

142.11

Trading strategy:

If the price breaks through 143.10, consider buying, the first target price is 143.48

If the price breaks through 142.72, consider selling, the first target price is 142.48

A poem of the marketIn the financial markets, the Pin Bar candle is like a poem silently composed within the charts, a poem that tells the tale of the battle between buyers and sellers. This candle, with its long shadow, narrates the story of effort and defeat, as if one side sought to conquer the sky or split the earth, but in the end, was pushed back, leaving only a shadow of its aspirations.

**The Bullish Pin Bar** is like a poet who, in the darkness of night, sees a star and, with hope for light, draws its long shadow toward the earth. It says, "The sellers tried to pull me down, but I, with the light of hope, rose again and conquered the sky."

**The Bearish Pin Bar** is like a poet who, at the peak of day, sees a dark cloud and, with fear of darkness, casts its long shadow toward the sky. It says, "The buyers tried to lift me up, but I, with the force of reality, returned to the ground and embraced the darkness."

The Pin Bar candle, with its small body and long shadow, is like a poem that encapsulates all the emotions of the market in a single moment. This candle, in its simplicity and beauty, reminds us that sometimes efforts do not yield results, and sometimes, turning back is the only way forward. Within this candle lies the story of hope and despair, effort and defeat, light and darkness—a story that repeats itself every day in the financial markets, each time narrated in a new language.

"Taken from artificial intelligence."

Long Idea on CC1! (Cocoa)1)Climate change is having a significant impact on cocoa production in West and Central Africa, according to a study by Wageningen University & Research (WUR). The region accounts for more than 70% of global cocoa production. Changes in temperature and rainfall are making some areas less suitable for cocoa cultivation.

2) Seasonality gives us a bullish pattern which is 98% correlated with the actual price

3)quantitative data shows 80% win rate with a good profit factor

4) The price rejected the 50 EMA forming a Pin Bar Candlestick pattern

5) The price also bounced on a demand zone

6) Price is undervalued against several benchmarks

What Is a Pin Bar Candle, and How Can You Use It in Trading?What Is a Pin Bar Candle, and How Can You Use It in Trading?

Understanding candlestick patterns is key for traders aiming to analyse market movements. One particularly insightful pattern is the pin bar candle, which can reveal crucial information about market sentiment and potential price reversals. In this article, we'll explore what this candle is and how traders might use a pin bar trading strategy.

What Is a Pin Bar Candle?

A pin bar candle is a distinctive candlestick pattern that traders use to analyse potential market reversals. It stands out on a chart due to its unique shape: a small real body with a long wick. When a pin bar appears on a chart, it reflects a tug-of-war between buyers and sellers that resulted in a significant price rejection. This rejection is captured by a key element, the long wick, indicating that the market tested a price level but couldn't sustain it, which marked a possible turning point.

There are two main types of pin bar candlestick: bullish and bearish. A bullish pin bar features a long lower wick and may indicate that buyers are entering the market after a period of selling pressure. This pattern signals a potential upward movement in price. Conversely, a bearish pin bar has a long upper wick, suggesting that sellers are gaining strength after sustained buying pressure, which can precede a downward price movement.

While the pattern is believed to be reliable at support or resistance levels, it is considered especially important when it forms after a push beyond a key swing high or low. The appearance of a pin bar in these scenarios might indicate a failed breakout, where the market rejected a close above a significant high or low, and may lead to a strong reversal.

How to Identify a Pin Bar on a Chart

Identifying a pin bar involves looking for a candle with a long wick and a small real body. Here's how to spot one:

- Long Wick: The wick should make up at least two-thirds of the candle's total length, ideally more. This long wick represents a sharp rejection of a price level during the trading period.

- Small Real Body: The real body should be relatively small compared to the wick. This indicates that the price closed near where it opened, despite significant movement during the session. While it’s preferable for the candle to close green in a bullish pin bar and red in a bearish pin bar, it’s not essential.

- Wick Position: For a bullish pin bar, the long wick extends below the body, suggesting that sellers pushed the price down before buyers drove it back up. In a bearish pin bar candlestick pattern, the long wick is above the body, indicating that buyers pushed the price up before sellers brought it back down.

- Contextual Placement: Pin bars are believed to be most significant when they appear at key support or resistance levels or within established trends. Their location can enhance their potential relevance in market analysis.

Using Pin Bar Patterns

Pin bars can be a valuable component of a trader's analytical toolkit when used thoughtfully. Here are the specific steps traders might follow to use a pin bar strategy:

Identifying Potential Pin Bars

The first step is to scan the charts for candles that exhibit the classic shape—a small real body with a long wick that makes up at least two-thirds of the candle's total length.

Examining the Context

Once a potential pattern is identified, traders assess its placement on the chart. Pin bars are considered more significant when they occur at key support or resistance levels, trendlines, or Fibonacci retracement levels, and whether they breach and close back inside of these points. They’re only considered reliable when they occur in the opposite direction of a specific trend, such as a bearish pin bar candle during an established uptrend.

Looking for Confirmation

Traders often seek additional signals to validate the implications of a pin bar candle pattern. For instance, if the Relative Strength Index or Stochastic Oscillator indicates a market is overbought or shows a divergence, a bearish pin bar may be considered a stronger signal. Confirmation may boost confidence in the signals provided by the pattern.

Planning Entry and Exit Strategies

Based on the analysis, traders formulate a plan that includes potential entry points, stop-loss levels, and target prices. While some may enter as soon as the candle closes, it's common to consider entering a trade if the price moves beyond the bar in the anticipated direction, potentially with another big bar candle like an engulfing candle or marubozu.

Profit targets might be set at an opposing support or resistance level or a given risk-reward ratio, while stop-loss orders are often placed beyond the candle’s high or low to potentially manage risk if the market moves unfavourably.

Practices for Trading Pin Bars

Trading pin bars goes beyond simply recognising the pattern; it involves understanding how they fit into the broader market context. Here are some practical steps to help you apply a pin bar candlestick pattern strategy in your trading:

Selecting High-Quality Pin Bars

Not all patterns carry the same weight. According to the theory, traders should focus on those with a long wick that constitutes at least two-thirds of the candle's total length and a small real body. The longer the wick relative to recent candles, the more significant the price rejection might be.

Also, the overall size of the candle may boost its reliability. A pin bar that stands out compared to surrounding candles may indicate a significant shift in market sentiment. If it's too small relative to recent candles, it might be less reliable.

Considering the Timeframe

The timeframe you choose can impact the reliability of the formation. Higher timeframes like daily or weekly charts tend to produce more dependable signals because they encapsulate more data and reflect broader market sentiment.

While lower timeframes like 15-minute or hourly charts may offer more trading opportunities, they may also present more false signals. However, a pin bar on a higher timeframe can offer valuable insights into what may drive lower timeframe price movements.

Being Mindful of Market Conditions

Pin bars can be less reliable in choppy or sideways markets where price action lacks clear direction. In such environments, they may form frequently but without leading to significant price movements. According to the theory, traders should apply pin bar strategies in markets that exhibit clear trends or strong momentum, where price rejections are more meaningful.

Likewise, high volatility can lead to erratic market movements, increasing the likelihood of false signals. Paying attention to economic calendars and avoiding trading during major news releases may help in filtering out unreliable setups.

Focusing on Key Psychological Levels

Beyond support and resistance, pin bars may be significant when they form at key psychological price levels, such as round numbers or significant historical price points. These levels often act as barriers where market participants have strong reactions. A pin bar at a psychological level can indicate a substantial price rejection, providing a potentially valuable signal for a trade setup.

Risks and Limitations of Pin Bars

While pin bars can offer valuable insights, they also come with certain risks and limitations that traders should be aware of:

- False Signals: Pin bars can sometimes indicate a potential reversal that doesn't materialise. Relying solely on them without considering the broader market context might lead to misinterpretation and ineffective trading decisions.

- Market Noise: In highly volatile or sideways markets, pin bars may appear frequently but lack significance. These "noisy" signals can make it challenging to distinguish meaningful patterns from random price movements.

- Timeframe Variability: The reliability of the pattern can vary across different timeframes. A pin bar on a 5-minute chart might not hold the same weight as one on a daily chart. Traders should consider the timeframe that aligns with their trading strategy and be cautious when interpreting signals from shorter periods.

- Subjectivity in Identification: Determining what qualifies as a valid formation can be subjective. Differences in candles across various charting platforms or discrepancies in data can lead to inconsistent analysis.

Pin Bars and Other Patterns

Understanding how pin bars differ from other candlestick patterns can enhance your technical analysis. Let's explore how they compare to hammers, shooting stars, and doji candles.

Pin Bar and Hammer/Inverted Hammer

Hammers are essentially the same as bullish pin bars; they just have a different name. Both patterns feature a small real body with a long lower wick and little to no upper wick, appearing after a downtrend and signalling an upward reversal.

The inverted hammer differs from a pin bar in its context and implications. An inverted hammer has a tiny real body, a long upper wick, and little to no lower wick. It typically appears after a downtrend. While it resembles a bearish or red pin bar candle in shape, its position at the bottom of a downtrend signals that buyers attempted to push the price higher but couldn’t. Still, this pattern indicates a possible upward reversal due to emerging buying interest.

Pin Bar and Shooting Star

A shooting star is essentially a bearish pin bar. It appears after an uptrend and retains the same features: a small real body, a long upper wick, and a minimal lower wick. The long upper wick reflects the rejection of higher prices, potentially signalling a downward reversal.

Pin Bar and Gravestone and Dragonfly Dojis

The pin bar, gravestone doji, and dragonfly doji are all candlestick patterns used to indicate potential reversals, but they differ in structure and context. The gravestone doji has a long upper wick and no lower shadow, with the open, high, and close at nearly the same level. This formation suggests that buyers pushed prices higher, but sellers ultimately took control, often indicating a bearish reversal at the top of an uptrend.

The dragonfly doji, on the other hand, has a long lower wick and no upper shadow, with the open, low, and close prices near each other. This pattern suggests that sellers initially drove prices down, but buyers regained control, often signalling a bullish reversal when found at the bottom of a downtrend.

The Bottom Line

Pin bar candles offer traders valuable insights into market sentiment. While incorporating pin bars into your strategy requires practice and a keen eye for market context, they can be a great way to trade market reversals. If you're ready to apply these insights in live markets, consider opening an FXOpen account to access more than 700 markets alongside low-cost, high-speed trading conditions.

FAQ

What Is the Pin Bar Candlestick Pattern?

A pin bar candlestick pattern signals a potential price reversal and features a small body with a long wick which is at least twice longer than the body. The long wick represents price rejection at a specific level, indicating a shift in market sentiment during that trading period. The pattern has two types: bearish and bullish.

What Is the Difference Between a Bullish and Bearish Pin Bar?

A bullish pin bar pattern has a long lower wick, suggesting buyers regained control and a possible upward reversal. A bearish variation features a long upper wick, indicating sellers dominate and a potential downward movement.

How Can You Trade Pin Bars?

To trade pin bars, traders identify them at key support or resistance levels, where they signal a potential reversal. For a bullish pin bar at support, they consider entering a long position above the high of the bar, with a stop-loss below the low to potentially manage risk. For a bearish pin bar at resistance, they enter a short position below the low, placing a stop-loss above the high. Confirmation from other technical indicators or trends may improve the reliability of the setup.

What Is the Difference Between a Hammer and a Pin Bar Candle?

A hammer is a bullish pin bar candle with a long lower wick, appearing after a downtrend to signal a potential upward reversal. While a pin bar can be bullish or bearish, a hammer specifically refers to the bullish variant.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Strong EUR? - A EUR/USD AnalysisEUR/USD has displayed bullish characteristics over the last couple of weeks.

- We have reach a high in the market @ 1.095.

- This high was made after a bullish A,B,C,D pattern aka (Trend).

- In bullish markets, prices tend to find support at the previous high, the previous high in this market (To me) is @ 1.085.

- We currently have made a bullish pin bar rejection candle on 3/19/2024.

- Currently we have untapped orders at 1.098, this is where I believe prices want to go in the next month.

- Breaking the 1.098 level, could lead to a bigger move up toward 1.11.

** as always, trade smart, trade responsible, and manage the risk as much as the reward **

EUR/USD Builds Bullish Momentum with Strong Support and Pin BarAfter bottoming at 1.0760 exactly one week ago, FX:EURUSD has started to consolidate, forming what appears to be a base.

Since then, dips below 1.08 have been consistently bought up, culminating in a strong bullish Pin Bar candle yesterday.

To further support this bullish outlook, this base is forming at a key confluence of support levels, reinforcing the potential for an upward move.

With this in mind, I am looking to buy this pair, ideally on a dip, to ensure a positive risk-to-reward ratio of 1:2.

My target for a reversal is set at 1.0950, with respect to 1.09 resistance (this could serve as short term trader's target)

Strong buy on BitcoinThe price has seen the main break even and made a beautiful pin bar. It works as a strong buy signal. The stop loss is behind the shadow. The last target is the all-time high. As Bitcoin moves, every other coin moves in the same direction, too, so you can have long positions on other assets according to your personal strategy and entry point.

Bullish Divergence + Pinbar in TLTI'll start with the weekly RSI bullish divergence off the 2022 and 2023 yearly lows. In addition to that, there is also a nice bullish pinbar on the 4M chart. This also hints to a possible bottom/bullish reversal. Price is now pushing against the trendline resistance (from Mar 23' to Jul 24'). Once price is able to break and hold this area it could really start moving. There is some overhead resistance that the market will need to overcome and I expect plenty of volatility, so safest play may be to have a stop just below the 23' lows and then stay hands off and give it room to run.

GOLD - Pin bar bullishA bullish pin bar has formed on the gold chart, suggesting a potential rise in gold prices. If the price breaks above the 2325 resistance level, this would confirm the bullish trend. It is advisable to set a stop-loss in the 2310-2305 range to manage risk in case of a breakout.

Liquidity Hunt PatternLiquidity Hunt Pattern

Uncover Hidden Opportunities in the Market

Introduction:

The Liquidity Hunt Pattern is a powerful technical analysis tool that helps traders identify potential turning points in the market. By understanding how this pattern forms and its implications, traders can gain an edge in uncovering hidden opportunities and making informed trading decisions.

What is the Liquidity Hunt Pattern?

The Liquidity Hunt Pattern is characterized by a series of price movements that create a distinct "W" or "M" shape on the chart. This pattern forms when large institutional players, known as "liquidity providers" enter the market to buy or sell large quantities of assets. Their actions create temporary imbalances in supply and demand, leading to price swings that can be exploited by astute traders.

Identifying the Pattern:

The Liquidity Hunt Pattern consists of three key elements:

The "W" or "M" shape: This is the most recognizable feature of the pattern and is formed by a series of price swings that create the distinctive letter shape.

Volume spikes: The pattern is often accompanied by significant volume spikes, indicating the presence of large institutional activity.

Breakout or breakdown: The pattern typically resolves with a breakout or breakdown, signaling a potential change in the market direction.

Trading the Liquidity Hunt Pattern:

Traders can use the Liquidity Hunt Pattern to identify potential entry and exit points for their trades. By understanding the dynamics of the pattern, traders can:

Anticipate potential turning points: The pattern can signal potential reversals or continuations in the market trend.

Identify high-probability trading setups: The pattern can be used to identify areas where the risk-reward ratio is favorable.

Manage risk effectively: The pattern can help traders set stop-loss and take-profit levels to manage their risk exposure.

Conclusion:

The Liquidity Hunt Pattern is a valuable tool for traders of all levels. By understanding its formation and implications, traders can gain an edge in the market and uncover hidden opportunities for profitable trades.

GBPUSD, Short, AB=CD Gartley222, Extended pin bar at key levelWe might play out this as a Gartley222. Not entering at the 78% retracement level,

but we have a great pin bar on the 2Hour chart at a very Key level. Close below the previous major low and a 1 to 1 AB-CD move.

Volume profile- the pin bar occurred on raising volume which for me indicates stops taken, but also it's what Wyckoff will call nonvalidation, huge volume, but the bar closed at its lowest. Nonvalidation is a good edge at turning points.

The red box is the 61% retracement of the AD leg of the Gartley. Some people use this as a target. I manage the trade differently but wanted to illustrate that even this target provides a good Rirk/Reward rate.

P.S. For the harmonic pattern junkies: the red dotted line might be interpreted in the 1-hour chart as a 3 drives pattern, entering at the level was going to be great. I was personally late for it.

NFLX Short: Gap Fill and High RSIHey All,

I wanted to get your feedback on this analysis.

I am solely basing my opinion based on the RSI indicator, MACD and candlesticks on the daily chart.

Although earnings help NASDAQ:NFLX to go up slightly. It had to restest a strong resistance at 562.46. Once it reached the resistance the bears took control which resulted in a pretty strong bearish pinbar, usually signaling a reverse in trend. Along with the pin bar the RSI is way oversold and the MACD is looking like it is being set up for a bearish divergence, where the price action is trending up, but the MACD is trending down. In addition, there was also a gap up during earnings and that gap will need to be filled.

This signals to me that the there will be a short, even if just to fill the gap up.

What do you guys think?