Pivot

Ark / Bitcoin (ARK/BTC): Supports, Pivots & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

Ark / Bitcoin (ARK/BTC): Supports, Pivots & Resistences – Short-Term

District0x / Bitcoin (DNT/BTC): Supports, Pivots & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

District0x / Bitcoin (DNT/BTC): Supports, Pivots & Resistences – Short-Term

ODE / Bitcoin (ODE/BTC): Supports, Pivots & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

ODE / Bitcoin (ODE/BTC): Supports, Pivots & Resistences – Short-Term

Paxos Standard / Bitcoin (PAX/BTC): Support, Pivot & ResistenceFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

Paxos Standard / Bitcoin (PAX/BTC): Support, Pivot & Resistence – Short-Term

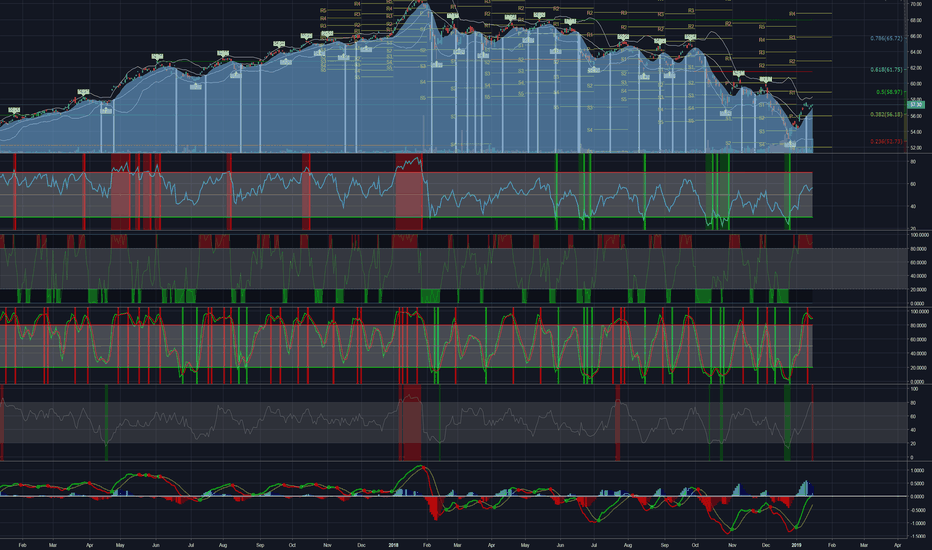

CHESAPEAKE ENERGY CORPORATION (CHK): Pivot, Support, ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

CHESAPEAKE ENERGY CORPORATION (CHK): All The Pivots, Supports & Resistences

FISERV, INC. (FISV): All The Pivots, Supports & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

FISERV, INC. (FISV): All The Pivots, Supports & Resistences

FIRST DATA CORPORATION CLASS A (FDC): All The Pivots, Supports &Find Winning Trades In Seconds >> efcindicator.com (Special Discount)

FIRST DATA CORPORATION CLASS A (FDC): All The Pivots, Supports & Resistences