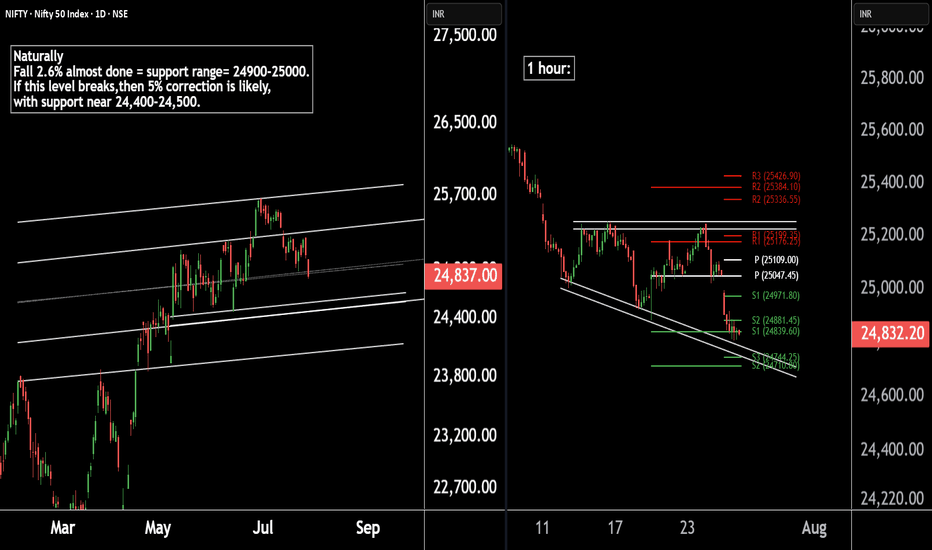

Nifty 50 Update | Technical Levels MappedThere are two chart of Nifty50.

Nifty 50 is trading within a well-defined parallel channel. As part of its natural corrective phase, a potential decline of around 5% cannot be ruled out, with key support anticipated near the 24,400–24,500 zone.

Nifty is forming a broadening wedge pattern on the 1-hour timeframe, with crucial support around 24,740. Additionally, both the weekly and monthly pivot supports are aligned in the 24,740–24,710 zone, reinforcing the significance of this level.

If this level sustain then we may see higher prices in Nifty50.

Thank You !!

Pivotlevels

GBPUSD Week 21 Swing Zone/LevelsNot Always.

Not always will price conform to hypothesis, but in following good RRR success is assured.

We setup week 21 levels and zone as shown with the predicted pathways.

Trade Parameters: Entry on 5 mins chart

Sl 10-15pips

TP usually dynamic but typically 5x

Follow on for trade updates.

As Always PRICE determines trades

A Bitcoin Prediction (2025)In this chart, we continue the journey of testing whether Bitcoin can live up to the expectations as published in my previous Bitcoin prediction chart (2024). Since we had technically hit my ATH cycle top for 2024–25, we are now gambling with the possibility that we might not have hit the highest cycle top targets and may just extend that little bit more. I think 2025 has most people asking, "Are we done yet?" or are we on the verge of something else? We'll just have to wait and see....

Upside:

As you can see in ATHs, there are several targets, and I've mentioned this in my previous chart. Ultimately, the high side of what this chart can expect from a cycle high is a 2-week close of $131k. Wicks can extend beyond this price, but I expect a close below (according to this chart). A close above will invalidate this chart. All prices within the lows and highs are acceptable.

Downside:

In my previous chart, I hadn't posted any projected targets during a bear market; I only highlighted the lows, as generally that is what most may consider important enough to know—when can we resume the bull market again? Well, in this chart, I have labeled two additional downside targets. Although these do not follow the same pattern as other targets, they do have a significant similarity to previous cycle lows. Expect bounces from these levels, but if the pattern holds true, they will fail and continue to lower prices. In the short term, resistance sits at $98,511, and again this is on a 2-week close. So this next week, we can wick above, which might be the path we are on.

Summary: I'll be posting updates close to each 2 week close, if I see something I'll be sure to post and update.

2024 Chart linked below.

TradeCityPro | analyzing SUI as Bitcoin Dominance Declines👋 Welcome to the TradeCityPro Channel!

Today, I’m analyzing the popular SUI coin for you. SUI, a prominent Layer-1 blockchain in the market, has gained significant attention from investors in recent months. With an influx of capital into its network, the SUI coin’s price has experienced notable growth.

👑 Currently, Bitcoin continues its upward trend, marking a new all-time high (ATH) at $98,380. However, Bitcoin dominance has started to decline after a fake breakout of 61.32, leading to corrections. As a result, while Bitcoin consolidates, altcoins have begun to move.

⚡️ For instance, Ethereum has climbed 9%. If Bitcoin dominance continues its downward trend, we may expect a short-term altcoin season. Should the decline persist, Bitcoin dominance could retest its ascending trendline.

🔽 Key downward targets are 59.56 and 58.64. If dominance reaches these levels while Bitcoin prices rise, we could witness significant rallies in altcoins.

📅 Weekly Timeframe: Pullback to $1.786 and Movement Toward New Targets

In the weekly timeframe, you can observe that buying volume entered SUI around July, when it hit a low at $0.5694. This buying pressure has driven the price upward, helping SUI achieve a new ATH.

🚀 Currently, after breaking the previous ATH at $1.786 and pulling back to this level (which aligns with the monthly R1 pivot), the price surged to R3, setting a new high at $3.70. If this bullish momentum persists, the next pivot-based target will be $4.75.

✅ Moreover, SUI features a parabolic trendline that has reacted twice so far. While this diminishes its reliability, a third interaction would validate its importance.

🌱 The RSI oscillator, after two consecutive candles closed in the overbought zone, has started correcting and is now testing the 70 level. As long as the RSI remains above 70, further upward movement is expected.

📅 Daily Timeframe: Beginning of a Correction?

In the daily timeframe, SUI has had two bullish legs so far: the first from $1.00 to $2.1368, and the second from $2.1368 to $3.8111. At the peak of each leg, RSI reached 84, followed by corrections. The first correction was time-based, and the second is likely to follow a similar pattern.

📊 Currently, with RSI dropping below 70, a correction may have begun. However, if RSI re-enters the overbought zone, another bullish leg could occur. Using the yearly pivot and Fibonacci levels, targets for the next leg are $4.74, $6.40, and $9.17.

📈 If you purchased SUI after breaking resistances at $1.00 or $2.1368, I recommend securing your initial investment if your profit exceeds 100%, while holding onto the gains. Otherwise, wait for a trend reversal before taking further action.

🧩 As the market enters a corrective phase, buying volume is naturally declining, which actually supports the continuation of the bullish trend. If the price corrects further and RSI drops, the 50 level on the RSI will be crucial.

📅 4-Hour Timeframe: Futures Triggers

In the 4-hour timeframe, I’ll outline the key futures triggers based on my analysis.

🔍 After reaching the $3.8814 zone, as noted in the daily analysis, the price entered a correction phase, dropping to $3.4295. If you’re holding a long position from the breakout at $2.3649, I suggest taking profits if the price stabilizes below $3.4295. The next support zone lies between $2.80 and $3.00, which aligns with the Fibonacci golden zone and is likely to halt further declines.

🔴 If the correction continues, the next critical level is the trendline visible in the daily timeframe.

📈 Should buying volume return and RSI holds above 40.91, the breakout of $3.8814 becomes a reliable trigger for futures trading, with the first target at $4.7422.

💎 SUI/BTC Pair Analysis

The SUI/BTC chart mirrors the USDT pair, showing an upward trend but struggling with significant resistance. Today’s green daily candle highlights Bitcoin dominance’s impact on altcoins.

Currently, the pair is testing resistance at 0.00003820, with another resistance zone at 0.00004202 nearby. If both levels are broken, the price could climb to 0.00005130.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

New Features For Dynamic Pivot Levels - Percentage indicatorIn our latest update, we’ve packed in some exciting new features and enhancements that will elevate your analysis experience to the next level:

Exciting New Features: We’ve added additional Exponential Moving Averages (EMAs), allowing you to track five different EMAs tailored to your needs. But that’s not all – we’ve introduced smiley indicators that give you instant feedback on whether the price is above or below the moving average. Now you can analyze with a clean, clutter-free chart!

Fibonacci Level Enhancements: We’ve upgraded the logic behind Fibonacci levels to give you more accurate insights. The improved Fibonacci calculations provide a clearer, more precise visual representation, helping you make better-informed decisions.

A Sleek, Streamlined User Interface: We know how important it is to work with a smart, efficient tool, so we’ve revamped the user interface! Settings are now neatly organized into categories, allowing you to quickly and easily customize everything you need. This makes your workflow smoother and faster.

This update doesn’t just bring new capabilities – it makes the tool more accessible and user-friendly than ever. It’s your key to staying focused on precision analysis, without the distractions!

Which way will Bitcoin Go?Either way, I expect Bitcoin to still recover in the long term. In the short, it may seem bearish but people are failing to zoom out. Study the monthly, weekly, and daily and you will see that the top hasn't formed yet and this bull run might be the most massive so far. I know it sounds farfetched but with Wall Street money and mass adoption pre-government. This could be crypto's last hoorah.

UPL :: Turning around to (Agrow)Chemical Stock? - It's been decades we have seen that AgriCulture is contributing almost about 18-20% in India's GDP growth yet this sector remains to be more politically inclined to their specific actions during major elections.

- GDP contribution by Top 3 sectors:

Agriculture: 18.4%

Industry: 28.3%

Services: 53.3%

- NSE:UPL is one of the top 5 global providers of total agricultural solutions with a footprint in 138+ countries.

Going by the current situation we see the following observations -

1) Script is trading at a Money-based range dating back to the pandemic lows after hitting 52W Lows due to global headwinds.

2) After a stellar doubler move from Dec'20 to May'21 the script delivered almost more than 100% return to its investors and eventually we see a exhaustion after an eventual double top like pattern with a neckline candle marked in a red zone.

3) Interestingly, you see a SWAP LEVEL marked to denote the beautiful Yearly Low of 2021 being protected for next 2yrs and finally breaks down nearing ending of 2022 while being in a range of 200p within the red zone and swap level for that existing period.

4) While, we talked about price action in the previous point we missed out the lethal info being nudged in by our FUNDFLUX tool which showed consistent outflow of money in first 2Q's of 2022 before it out the swap level in Q3 of 2022.

5) What happens next will make you understand why we call the marked blue dotted line as the "Swap level" as after the breakdown we see a retest of the same level now turning out to be a resistance for script and eventually the Yearly Pivot Level of 2024 .

6) Now, currently the script trades in a good money-based range eventually dodging out YL4 breakdown and here the risk seems to be minimum as per the return is concerned as after 510-520 the script will be ripped for 640-650 initial target making a return of 30-35% in cash from entry being in the marked money-based green range and it can be in news in this quarter as elections are nearing and as said in the beginning - "AgriCulture" will be on one of the top agendas of the political parties and alongside if we see a relief from destocking and price revisions in the West after the much anticipated rate cuts then it will be an icing on the cake for the script as margins will improve in the coming quarterly results and lastly monsoon season is about to begin in India in a month and till now SKYMET expects Monsoon to be 'normal' in India.

A RELEVANT ARTICLE -

www.livemint.com

SPY: Daily and Weekly Chart InsightsDaily Chart: Ascending Channel and Key Breakout

The daily chart of the SPY shows a robust upward trend within an ascending channel. The price has been making higher highs and higher lows, respecting the channel's boundaries. Key levels include the lower boundary of the channel as dynamic support and the 21-day EMA as a critical support level. Recently, SPY broke above the previous top at 533.07, suggesting a continuation of the bullish trend. Only if the SPY loses the 21-day EMA and this $533.07 support we would see a mid-term pullback. If the price continues to respect the ascending channel, it could reach higher resistance levels around 560.

Weekly Chart: Bullish Momentum and Support Levels

The weekly chart highlights a strong bullish trend with consistent higher highs and higher lows. The price is well-supported by the 21-week EMA. Key support levels include the 21-week EMA and the previous swing low at 524.11. The recent break above previous highs around 533 indicates sustained buying interest. If the bullish momentum continues, SPY could move towards the 550-560 range. However, a break below the 21-week EMA might signal a potential correction, with the next support around 500-510.

Conclusion: Strong Bullish Momentum with Clear Support and Resistance

Both the daily and weekly charts of SPY indicate a strong bullish trend within an ascending channel. The recent breakout above the previous top at 533.07 on the daily chart and the consistent higher highs and higher lows on the weekly chart suggest that the bullish momentum is likely to continue.

Key support levels to watch are the 21-day EMA at 534.43 and the lower boundary of the ascending channel on the daily chart, as well as the 21-week EMA at 514.79 on the weekly chart. Resistance levels include the upper boundary of the ascending channel and the psychological levels around 550-560.

Overall, SPY appears poised for further gains as long as it remains within the ascending channel and above the key support levels. We should monitor these levels closely for potential breakout or reversal signals.

For more detailed technical analyses and insights like this, be sure to follow my account. Your support helps me continue providing valuable content to help you make informed trading decisions.

Remember, real trading is reactive, not predictive, so let's stay focused on the key points described above and only trade when there is confirmation.

“To anticipate the market is to gamble. To be patient and react only when the market gives the signal is to speculate.” — Jesse Lauriston Livermore

Next Week's IWM, 21 Day Pivot Standard Deviation RangeLooks like the medium term bias is to the downside for small caps, as we see the weekly pivot (red solid line) fall below the monthly pivot (dark solid line) with AMEX:IWM closing below both.

Both deviation boxes represent two standard deviations above and below the a moving monthly pivot. We may see demand in the lower deviation range if we fall to start off the week.

A rally to start of the week will likely be met with resistance from our pivot points and a fresh downward move from the 21 day moving average.

Investors that want to take advantage of this medium term bias could short volatility in the short term (June/July) for IWM using AMEX:TZA but bet bigger on long volatility in the longer term (September/January2025).

Take any short term gains to the upside and hold onto your short thesis heading into the second half of the year, into 2025.

RBLX Deeply Undervalued LONGRBLX on the 4H chart is presently at the low extreme in its trading range over the past six

months with the VWAP bands and volume profile overleaid. Pivot highes in the winter were

in the 46-47 range while the 2023 pivot low was 25. RBLX is a kid's favorite and compets

well with the other competing gaming setup. At present price touched 26.75 on 4X relative

volume ( selling). This is an obvious bottom. I will puck up a long trade here targeting

the VWAP and POC lines at the range of 37.50 to 39.50 and so seeking a profitable trade of 20-

25% overall in two pieces at the respective levels. Call options will be entertained if

there is sufficient volume to support ease of liquidity.

USD/JPY Technical Analysis: Reversal on the Horizon?In the latest 4-hour chart, USD/JPY is showing signs of a potential pullback following a surge that saw prices exceed the upper Bollinger Band and touch the R1 weekly pivot level. Notably, this price action correlates with the pair moving back down towards the central Bollinger Band and the untouched weekly pivot, suggesting a range-bound environment.

The RSI indicates an overbought market, adding credence to the possibility of a reversal. Historically, such RSI levels often precede a retraction in price, aligning with our observed downward trajectory. Further support for this pullback is found at the 20-period SMA of the Bollinger Band, which currently sits at an interpolated level of 154.997. This level could soon play a pivotal role as a short-term target for bears.

In summary, traders should keep a close eye on the 154.997 level and monitor RSI for signs of weakening momentum, which could indicate the early stages of a broader retracement.

NQ Power Range Report with FIB Ext - 5/2/2024 SessionCME_MINI:NQM2024

- PR High: 17513.00

- PR Low: 17484.00

- NZ Spread: 65.0

Key economic calendar event

08:30 | Initial Jobless Claims

Inventory dip below Tuesday low

- Lifting above prev session close and open

- ~225 points from prev session high

Evening Stats (As of 12:05 AM)

- Weekend Gap: +0.16 (filled)

- Gap 5/2 +0.07% (open < 17481)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 306.63

- Volume: 24K

- Open Int: 241K

- Trend Grade: Bull

- From BA ATH: -6.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NMDC :: Iron Ore Rebounds?NSE:NMDC

- Script sees a breach of Monthly Bearish GPZ alongside Quarterly Bearish GPZ making it a "HOT PIVOT LEVEL" to keep on radar!

- Money Zones are marked alongside in 3 different shades as per the analysis from FUNDFLUX .

- This "Pivot & Price" action is been seen as iron ore prices have rebounded after 2weeks of down-fall and are further expected to rise on the hope of rate cuts from the West and fresh stimulus from China.

- If the trajectory remains strong supported by the anticipated news that this script can see a potential upside of 15-30% on upper levels of 255/280/310.

News Article is provided below -

www.moneycontrol.com

AUDCHF 4H Analysis: Bearish DivergenceAUDCHF's recent trend exhibits bullish behavior with prices achieving higher highs above the R1 monthly pivot, suggesting strength. However, beneath the surface, signs of caution emerge.

The Commodity Channel Index (CCI) displays lower highs, creating a bearish divergence against the price's higher highs. This divergence hints at weakening upward momentum, urging traders to stay vigilant.

Further signaling a potential shift, the Moving Average Convergence Divergence (MACD) teeters on a bearish crossover . Such a move could forecast a momentum downturn.

Additionally, an untouched monthly pivot at 0.58496 beckons, potentially drawing prices down in a correction.

Compounding the cautious outlook, the Relative Strength Index (RSI) retreats from overbought territory , aligning with indicators suggesting a cooling phase may be on the horizon.

In essence, while the bullish trend above the R1 pivot indicates strength, emerging signals from CCI, MACD, and RSI suggest a momentum shift, with a pullback to 0.58496 as a conceivable target. Traders should monitor these developments closely and adjust strategies accordingly.

AVAX/USD 2h: just a few pips, but there's money on the tableThe AVAX/USD pair exhibits promising signs of an upward trajectory on the 2-hour chart, marked by key technical indicators. Initially, a regular bullish divergence was spotted, a reliable harbinger of potential reversal. This divergence occurs when the price charts lower lows while the RSI (Relative Strength Index), an oscillator measuring the momentum and possible trend reversals, shows higher lows. This discrepancy signals weakening downward momentum, suggesting that buyers are gradually gaining ground.

Complementing this bullish signal, the MACD (Moving Average Convergence Divergence) indicator, a tool used to identify trend direction and momentum, crossed above its signal line prior to the divergence. Currently, the MACD and its signal line are advancing in parallel, reinforcing the bullish momentum .

With these technical indicators in alignment, the price has commenced its upward movement. The immediate profit target is set at the monthly pivot point of $51.51 , serving as the next significant resistance level. Traders should monitor these levels closely, as a sustained move above could further validate the bullish outlook for AVAX/USD.

In conclusion, the convergence of bullish divergence and a favorable MACD configuration offers a compelling case for an impending uptrend. Investors should consider these technical signals in their trading strategy, keeping an eye on the pivotal $51.51 level for potential profit-taking opportunities.

Bearish Divergence on the CADCHF 4h ChartBearish Divergence with CCI (Commodity Channel Index)

A bearish divergence occurs when the price is making higher highs (indicating bullish sentiment), but the CCI, which measures the variation of a security's price from its statistical mean, is making lower highs. This discrepancy can signal weakening momentum in the upward price movement, suggesting a potential reversal or pullback.

In this case, this divergence on the 4h chart indicates that despite the price climbing, the momentum behind this rise is fading, hinting at a possible downturn.

MACD (Moving Average Convergence Divergence) Crossing Down

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. A downward cross, where the MACD line crosses below the signal line, is a bearish signal. It suggests that the short-term momentum is slowing down compared to the long-term momentum, reinforcing the bearish sentiment indicated by the

bearish divergence in the CCI.

Price Touching the Upper Bollinger Band

This suggests the market might be in an overbought condition, especially in the context of the bearish divergence with the CCI and the MACD crossing down. When the price hits the upper band, it's common for traders to expect a retracement or reversal, as the market could be seen as stretched too far to the upside.

Price Ranging Above an Untouched Weekly Pivot Point

Pivot points are used to identify potential support and resistance levels. The fact that the price is ranging above the weekly pivot point and hasn't touched it yet indicates that this level could act as a target for the downward movement. Pivot points are often considered floors or ceilings in market price movements, with the price making significant moves upon reaching these points.

Potential Drop to the Weekly Pivot Point at 0.66417

Considering the bearish signals from both the CCI divergence and the MACD crossover, along with the price's current position above an untouched pivot point, the analysis suggests that there's potential for a downward move towards the weekly pivot point at 0.66417. This level could serve as a short-term objective for bears in the market or a reversal point for traders to watch closely.

Summary

This analysis points to a cautious stance for traders, with a bearish outlook in the short term based on the technical indicators that were highlighted. It would be wise to monitor these indicators closely, along with other market factors, to confirm any potential moves before making trading decisions.

Always remember, while technical analysis can provide insights into market movements, it's crucial to consider a wide range of factors, including market news and economic indicators, before trading.

XAU/USD Quick Analysis: What's Next?On the 4H chart, we’ve got a classic bearish divergence with gold prices hitting higher highs and the CCI (Commodity Channel Index) not keeping up, hinting at a slowdown. Also, the price danced with the R1 pivot level, dipped, tried to recover, but looks like it might dip again.

Switching to the weekly, it’s the same song - prices climbing, but CCI’s enthusiasm is waning. This suggests we might be heading for a correction soon.

The monthly pivot at 2169.520 hasn’t been touched yet, which is interesting. While a full retreat to this point seems a stretch, a pullback in its direction looks increasingly likely.

In short, both charts are whispering (or maybe starting to shout) that a downturn could be on the horizon. Whether we actually hit that monthly pivot or not, it’s clear the market’s got some rethinking to do. Keep an eye on these signs and plan accordingly!

A Bitcoin Prediction (2024)In this chart, I uncover price levels across an identified cyclical pattern hidden within Bitcoin.

I was initially hesitant to publish this, as I had been pondering the theory for a few days. However, as the price approaches the Phase 2 level, I believe the timing cannot be ignored, and a reaction may be imminent as Bitcoin could be on the verge of breaking out into Phase 2... I've posted a screenshot prior to where BTC is now (below)

My discovery in finding this was not intentional nor was it believable. However, after identifying some familiar projective price targets deriving from Bitcoin's first cycle the compelling results left me intrigued and were enough for me to continue. Whilst continuously applying my method more and more results seemed to match with key pivotable phases. Once I hit 2020, I was sure to expect some variances, but to my surprise, there was not, and price levels were again matched to pivotable levels. It is to that point I followed through into 2024 and beyond. As stated in the chart there is no trickery rather, there is logic and reason. It appears, these predictions beyond 2024 are realistic and do not point to crazy moon boy levels. So with that, I leave this here to revisit and pay my respects.

Some Observational and Key Points:

I base some findings on a 2 x 8-year cycle rather than the conventional 4-year cycle. However, it may appear shorter than expected. Just as there are diminishing returns, there too is an aspect of diminishing cycle timing.

While cycles are often recognised by their low and high targets, not many observe the time it takes to surpass a previous all-time high (ATH) or low. This is interesting because Bitcoin does not exhibit this repetitive behaviour in its history.

I observed the peaks and troughs while noting the counts and periods across cycle phases and took a visual snapshot towards 2022-24 playing into more likely that of 2013-16.

I've projected 2 ATHs as a range due to the nature of placement. The first target is primary, and wicks above could stretch into the second. Projections are also based on a 2-week (close) timeframe.

Final comments:

This is not an indication to be mega bullish and is NFA. The chart merely highlights developments I've identified and is not certain to play out, although quite probable. It is more of a "let's look back and indulge" - at least for me.

Thanks and Enjoy!

AUDJPY - Bullish Correction Complete Looking at AUDJPY, We have a pivotal moment at current price of 97.25 .

A push to it-and-through it , will find bulls taking the lead out the gates for continued bullish momentum, However, eager and more experienced traders find themselves awaiting the better prices off the lows of 96.70s in order to target the full reversal push all the way to 98s .

The latter coinciding with my initial EURJPY bullish setup.

BTC/USDT - Short term SHORT with 2 Target ZonesThere is a potential for a short term SHORT trade on BTC/USDT. If todays bar closes < 34.7k (~3.5 hours till close) there is potential for a short. There are two target zones:

Yellow zone, this is the most likely zone it may dump to between 32.5 and 32.8k

White zone, between 30.3k and 31.8k, this may happen if the lower level of 32.5k in the Yellow zone fails to hold. Please note that the upper level of this zone at 31.8k may also act as a Support.

There are many reasons why this short may happen:

The price faced resistance at the trend line.

The price has closed above the upper purchase zone level since October 16th, and it MAY close below it today.

We are currently in a Blood Diamond which has been confirmed (white circle within the YinYang Momentum Oscillator).

YinYang RSI is at 98.08 and very Overbought and is closing in with the YinYang RSI MA which is now at 94.94.

The Buy Volume is bending towards the Sell Volume.

YinYang Momentum is very Overbought, the predictive mountain is already angling towards the regular and may dump inside of it soon. Likewise we can see the Confirming Blood Diamond appeared on the current bar (white circle).

YinYang Momentum Trend Line has turned Bearish.

The reason it may correct to these zones specifically:

Yellow Zone:

The Basis line is here.

There is a Downwards Trend Line within here.

The Fourth level of the Purchase Zone is there.

White Zone:

The high of 31.8k was a long lasting Resistance Pivot.

the low of 30.3k is where the Volume Profile is.

the low of 30.3k faced lots of resistance recently.

Please note this is a short term short, on the long term BTC may remain bullish.

Indicators used to make this analysis:

YinYang Trend

YinYang Volume

YinYang Momentum

YinYang RSI