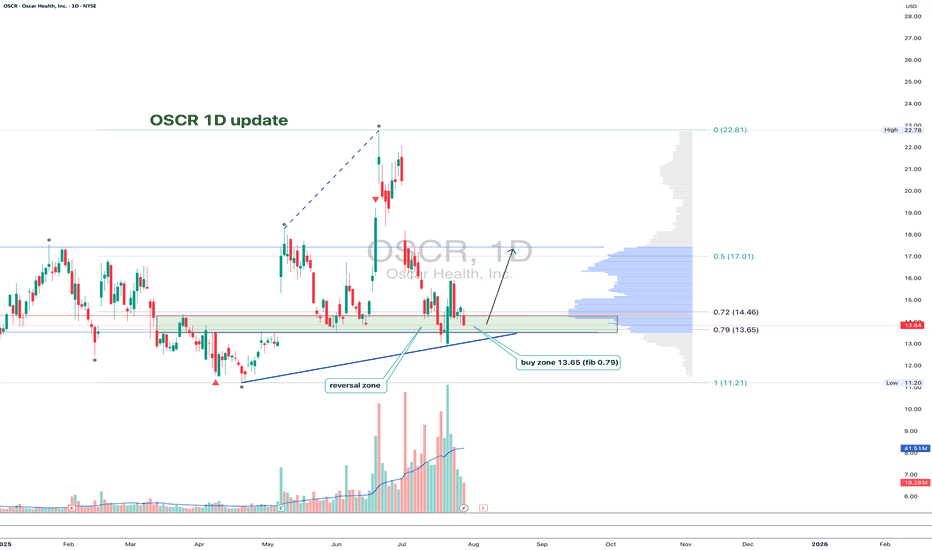

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.

Pivotpointstrategy

How Do Traders Use the Pivot Points Indicator? How Do Traders Use the Pivot Points Indicator?

Pivot points are a popular technical analysis tool for spotting areas where the price is expected to react, i.e. pause or reverse. Calculated using the previous day’s high, low, and close, they’re projected onto the current session to highlight potential support and resistance levels, especially useful for intraday traders.

Alongside stock charts, pivot point levels can be used in a wide variety of markets, including forex, commodities, and cryptocurrencies*. As a versatile indicator, pivot points also come in many different types. This article breaks down the definition of pivot points, the variations traders use, and how they can fit into a broader trading strategy.

A Deeper Look at Pivot Points

A common question in technical analysis is, “What is a pivot point?” Pivot points trading, or pivot point theory, is a popular technical analysis concept used in a range of financial asset classes, including stocks, currencies, cryptocurrencies*, and commodities. The indicator assists traders in gauging overall market trends and determining possible support and resistance barriers.

How to Read Pivot Points

The pivot point indicator is static—it’s an average of the high, low, and close prices from the previous trading day. It includes three levels: pivot point (P), support (S), and resistance (R). If the price is above the pivot point, it is supposed to target resistance barriers. Conversely, if it’s below the pivot, it could move to support levels. Thus, support and resistance levels serve as targets or stop-loss zones. They remain constant throughout the period, enabling traders to plan ahead.

In the EURUSD daily chart below, the price is trading above R2; therefore, market sentiment is assumed to be bullish. R3 indicates the next possible price target. Should a shift below P occur, bearishness arises, and S1 becomes the upcoming support level.

Pivots are widely used with trend indicators such as moving averages and Fibonacci tools. In the chart below, Fibonacci retracements could be used to identify intermediate levels of support and resistance within widely placed pivots.

How to Calculate Pivot Points?

There are four key types of pivots, including standard, Woodie’s, Camarilla, and Fibonacci. While there’s no need to use a pivot points calculator—they’re calculated automatically when implemented on a price chart—it is worth looking at their formulas to understand how they differ from each other.

Note the labels for the following formulas:

P = pivot point

H = high price

L = low price

C = close price

Standard Pivot Points

Traders commonly use standard pivot points. Traditional pivots (P) identify potential levels of support (S) and resistance (R) by averaging the previous trading period's high, low, and close prices.

P = (H + L + C) / 3

S1 = (2 * P) - H

S2 = P - (H - L)

R1 = (2 * P) - L

R2 = P + (H -L)

Although they are popular among traders, they can produce false signals and lead to incorrect trades in ranging markets and during periods of high volatility.

Woodie’s Pivot Points

Woodie's pivots are similar to standard pivots but include a slight modification to the calculation. In Woodie's method, the close price is assigned more weight.

P = (H + L + 2 * C) / 4

R1 = (2 * P) - L

R2 = P + H - L

S1 = (2 * P) - H

S2 = P - H + L

However, their extra sensitivity can make them less reliable during choppy markets or when the price lacks a clear direction.

Camarilla Pivot Points

Camarilla pivots use a set formula to generate eight levels: four support and four resistance. They are based on the previous day’s close and range and multiplied by a certain multiplier. The inner levels (R3 and S3) often act as reversal zones, while R4 and S4 are watched for breakouts. Still, in trending markets, the reversals can fail frequently.

R4 = C + (H - L) x 1.5

R3 = C + (H - L) x 1.25

R2 = C + (H - L) x 1.1666

R1 = C + (H - L) x 1.0833

P = (High + Low + Close) / 3

S1 = C - (H - L) x 1.0833

S2 = C - (H - L) x 1.1666

S3 = C - (H - L) x 1.25

S4 = C - (H - L) x 1.5

Fibonacci Pivot Points

Fibonacci pivot points are based on the Fibonacci sequence, a popular mathematical concept in technical analysis.

They are calculated in the same way as the standard indicator. However, the levels of support and resistance are determined by including the Fibonacci sequence with a close monitoring of the 38.2% and 61.8% retracement levels as the primary price points.

P = (High + Low + Close) / 3

S1 = P - (0.382 * (H - L))

S2 = P - (0.618 * (H - L))

R1 = P + (0.382 * (H - L))

R2 = P + (0.618 * (H - L))

Despite their popularity, Fibonacci pivots can become less reliable when the price reacts to other fundamental drivers.

Trading with the Pivot Points

Although every trader develops their own trading approach, there are common rules of pivot point trading that are expected to improve their effectiveness.

Day Trading

Day trading with pivot points is usually implemented for hourly and shorter intraday timeframes. As pivot levels are updated daily and calculated on the previous day's high, low, and close prices, this allows traders to react promptly to market changes and adjust their strategies. Some traders prefer Camarilla pivots as their calculation takes into account the volatility of the previous trading period to produce pivot levels closer to the current price.

Medium-Term Trading

When looking at a medium-term analysis, weekly pivot levels are added to four-hour and daily charts. These are calculated using the previous week's high, low, and close prices, which remain unchanged until the start of the next week.

Long-Term Trading

For longer-term analysis, traders use monthly pivots on weekly charts. These levels, gathered from the previous month's data, offer a broader picture of market trends and price movements over time.

Pivot Point Trading Strategies

The pivot points indicator is typically used in two ways – breakout and reversal trading.

Breakout Trading Strategy

The breakout approach seeks to take advantage of market momentum by entering trades when prices break above or below significant levels of support and resistance.

- Bullish Breakout. When levels P and R1 are broken, and the price closes above either, it’s more likely a rise will occur.

- Bearish Breakout. When levels P and S1 are broken, and the price closes below either, it’s more likely the price fall will occur.

Strong momentum and high volume are two critical factors needed for a solid price movement in both cases.

Trading Conditions

If a breakout is confirmed, traders enter a trade in the breakout direction. A take-profit target might be placed at the next pivot level. A stop-loss level can be placed beyond the previous level or calculated according to a risk/reward ratio. Traders continuously monitor their trades and adjust their stop-loss levels to lock in potential returns if prices move in their favour.

Reversal Trading Strategy

The reversal strategy seeks to take advantage of a slowdown in market momentum by entering trades when prices stall at significant levels of support or resistance.

- Bullish Reversal. When levels S1 and S2 are not broken and the price stalls above either, a reversal is more likely to occur.

- Bearish Reversal. When levels R1 and R2 are not broken and the price stalls below either, a reversal is expected to happen.

Note: Reversals are always confirmed by another indicator or a chart pattern.

Trading Conditions

If a reversal is confirmed, traders consider entering a trade in its direction. The next level may be a take-profit target, which might be trailed to the next level if the market conditions signal a continuation of a price move. A stop-loss level is typically placed below a swing low or above a swing high, depending on the trade direction.

Pivot Points and Other Indicators

While pivots show where the price may reverse, there’s nothing to say a market won’t trade through these areas. Therefore, traders typically pair them with other technical indicators and patterns.

Candlestick and Chart Patterns

Traders often combine levels with specific reversal candlestick formations, like three black crows/three white soldiers or engulfing patterns, to confirm a change in market movements. For example, a bullish engulfing candle forming at S1 could reinforce the idea of a reversal at that level.

Moving Averages

When a pivot aligns with a major moving average, e.g. the 50-period or 200-period EMA, it strengthens the area. As moving averages act as dynamic support and resistance levels, an overlap can signal a strong area where a reversal might occur.

RSI and Stochastic Oscillator

Momentum indicators like RSI or Stochastic help judge whether the price is likely to bounce or break through a pivot. If it hits support and RSI is oversold, that adds conviction. But if momentum is still strong in one direction, it might get ignored.

Considerations

Even with strong confluence, these combinations can fail. Markets don’t always respect technical alignment, especially around data releases or sharp movements in sentiment. For instance, in stocks, pivot points may be ignored if an earnings release strongly beats analyst estimates. Instead, they are believed to work when treated as one piece of a broader technical framework.

Limitations

Pivot points are widely used, but like any tool, they have flaws. They’re based purely on past price data, so they don’t account for news, sentiment shifts, or broader market context.

- False signals in ranging markets: The price often oscillates around pivot zones in markets without a clear direction, meaning setups might not follow through.

- Less reliable during strong trends: In trending conditions, the price can blow past several levels without reacting.

- No built-in volatility filter: The points don’t adapt to changing volatility, so levels might be too close or too far apart to be useful.

- Lag in real-time shifts: Since pivots are pre-calculated, they don’t adjust mid-session as new data emerges.

Final Thoughts

Pivot points are widely used in stock trading as well as in commodity, cryptocurrency*, and currency markets. While they can be useful tools, their limitations cannot be overlooked. It is essential to conduct a comprehensive analysis and confirm the indicator signals with fundamental and technical analysis tools.

FAQ

What Is a Pivot Point in Trading?

The pivot point meaning refers to a technical analysis tool used to identify potential support and resistance levels. It’s calculated using the previous day’s high, low, and close prices, and helps traders find areas where the price may react during the current session.

What Is the Best Indicator for Pivot Points?

There isn’t one best indicator, but traders often pair pivot points with moving averages, RSI, or candlestick patterns to confirm a potential reversal. The most effective setup usually depends on the strategy and market conditions.

What Are the Pivot Points’ R1, R2, and R3?

R1, R2, and R3 are resistance levels above the central point. They represent increasingly stronger potential resistance zones where the price may stall or reverse.

Which Is Better, Fibonacci or Camarilla?

Fibonacci offers wider levels based on retracement ratios, useful in trending markets. Camarilla focuses on tighter reversal zones, which are mostly used for intraday strategies. Each suits different trading styles; neither is objectively better.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

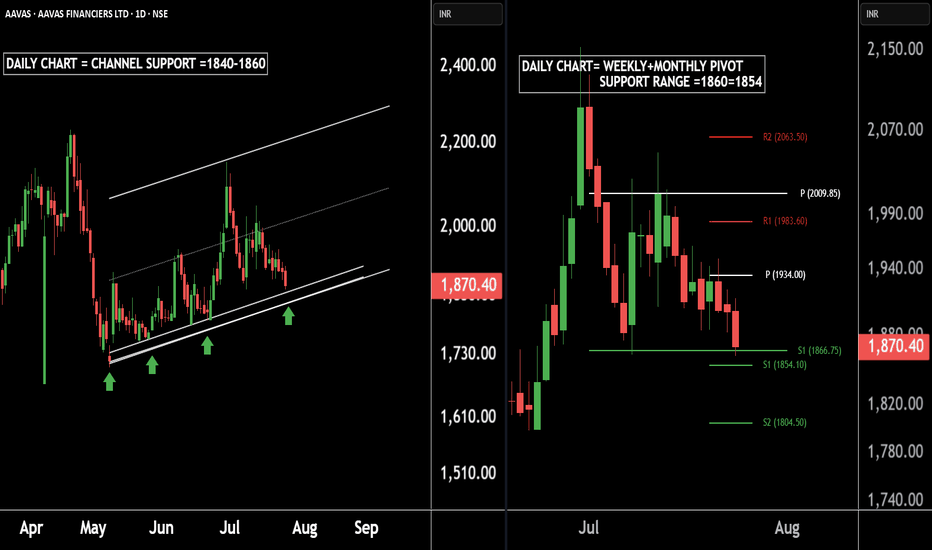

AAVAS Housing – A Hidden Gem for Medium-Term InvestorsThere are two charts of AAVAS FINANCIERS.

On the first chart AAVAS FINANCIERS is moving in a well defined parallel channel with support near at 1840-1860.

On the second chart AAVAS FINANCIERS is taking Weekly + Monthly support near at 1866-1854.

If this level is sustain ,then we may see higher prices in AAVAS FINANCIERS LTD.

Thank You !!

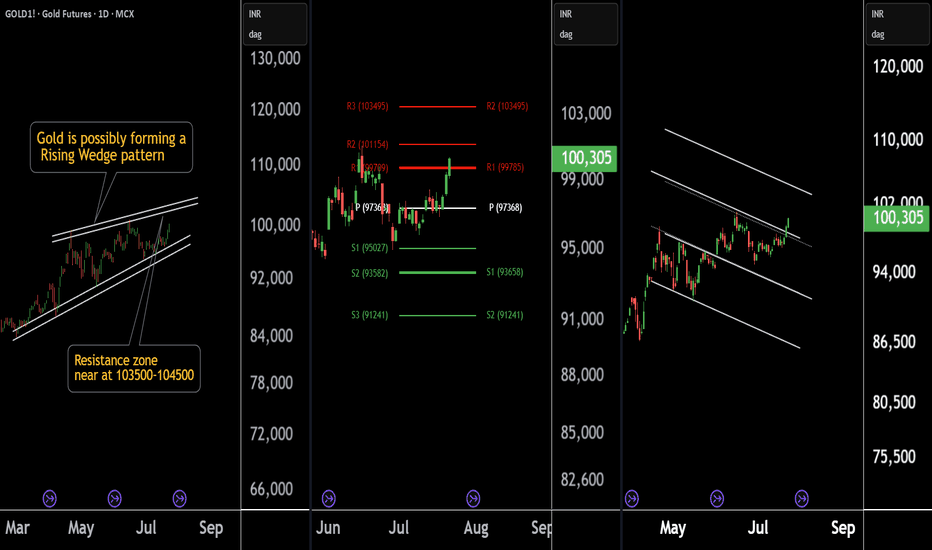

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

RELIANCE INDUSTRIES at Best Support !! Keep It On Your Radar !!There are two chart of RELIANCE INDUSTRIES on Daily and 4 hour Timeframe.

On the 4-hour timeframe, Reliance is likely to respect its LOP (Line of Polarity) as support, with the support range near 1460-1475.

On the Daily timeframe, the monthly pivot is also positioned around 1473, reinforcing this level as a potential halt or reversal zone.

If this level is sustain we may see higher prices in RELIANCE INDUSTRIES.

Thank You !!!

EURAUD ForecastMy observations on FX:EURAUD chart to take a trading position include the following:

- Completion of a Gartley Harmonic Pattern

- Completion of the fourth wave of an Elliott wave pack and waiting for the formation of wave 5

- Overlap of the target of the 5th Elliott wave with the target of the Gartley pattern (if the pattern works)

- Positive price bounce reaction to SMA200 and an upward guard to cross SMA21 and the pivot line as an important resistance. (Pivot Point Standard)

The mentioned signs for my personal trading system are a certificate to take a trade, of course, with risk management and logical budget plan ( risk no more than %1 of capitol)

The goal is to execute the trading plan correctly and systematically, regardless of the outcome.

Bullish AU200: Key Fundamentals & Probability StrategyThe AU200 (ASX 200) index is showing bullish potential due to several key fundamentals. Australia's economy continues to demonstrate resilience, with a strong labor market and low unemployment rate of 3.6% supporting consumer spending. Additionally, the country's resource-rich economy benefits from robust global commodity prices, particularly in key exports like iron ore and coal. The Reserve Bank of Australia's supportive monetary policy, despite recent tightening to combat inflation, further underpins the positive outlook for the AU200.

I'm incorporating probability top-down analysis into my trading strategy for the AU200 to make more informed decisions and improve my chances of success. By using probability tools on my charts, I can assess the probability of price movements reaching specific levels, helping me identify high-probability trade setups.

Now let's get into the top-down process:

12M:

2W:

4H:

What are your thoughts on the AU200? Share your ideas and insights below!

AUDJPY Short Setup: Leveraging Probabilities for Better TradesKey Fundamentals

China's Economic Slowdown: Australia relies heavily on trade with China. If China’s economy weakens, it can hurt Australia’s economy and the Australian Dollar.

Safe-Haven Demand: In uncertain times, investors often turn to safe-haven currencies like the Japanese Yen, which could lead to a drop in AUD/JPY.

Different Central Bank Policies: The Bank of Japan is keeping interest rates low, while the Reserve Bank of Australia may consider rate hikes. This difference can strengthen the Yen against the Australian Dollar.

Using Probabilities for Short Trades

By combining these fundamentals with a probability-based strategy, I aim to effectively trade AUD/JPY.

12M:

2W:

2H:

On this timeframe I can get positioned into shorts based on probabilities.

Leveraging Pivot Points for Intraday Trading StrategiesIntroduction to Pivot Points:

A pivot point serves as a pivotal indicator in technical analysis, aiding in discerning market trends across various time frames. Essentially, it's an average of the intraday high, low, and closing prices from the previous trading day.

Traders interpret trading above the pivot point as indicative of bullish sentiment and below as bearish.

Key Features:

Pivot points form the foundation of this indicator, from which support and resistance levels

are projected. These levels offer insights into potential price reversals or continuations. It's widely utilized in equities, commodities, and forex markets to identify trend shifts and

reversals.

Traders leverage pivot points to determine entry and exit levels, aiding in strategic decision-

making for intraday trades.

Formulas for Calculation:

The formulas for pivot points involve simple calculations based on the previous day's high, low, and close prices. These calculations yield pivotal support and resistance levels crucial for trade planning.

The Formulas for Pivot Points:

P= High+Low+Close / 3

R1=(P×2)−Low

R2=P+(High−Low)

S1=(P×2)−High

S2=P−(High−Low)

where:

P=Pivot point

R1=Resistance 1

R2=Resistance 2

S1=Support 1

S2=Support 2

Calculation Method:

Pivot points can be manually calculated using the prior day's data, which includes the high, low, and close prices. These levels are essential for traders, especially for intraday strategies.

High indicates the highest price from the prior trading day,

Low indicates the lowest price from the prior trading day, and

Close indicates the closing price from the prior trading day.

Interpreting Pivot Points:

Pivot points provide traders with static support and resistance levels throughout the trading

day. This enables traders to pre-plan their trades based on potential price movements.

Traders utilize pivot points in conjunction with other indicators to enhance their trading

strategies, aiming for more accurate predictions and better risk management.

Comparison with Fibonacci Retracements:

Pivot points and Fibonacci retracements share the common goal of identifying support and

resistance levels. However, pivot points rely on fixed numbers derived from the previous

day's prices, while Fibonacci retracements are based on percentage levels drawn between

significant price points.

Limitations and Considerations:

While pivot points offer valuable insights, they are not foolproof indicators and may not work

for all traders. It's crucial to integrate them within a comprehensive trading plan and

acknowledge their limitations.

Price movements may not always adhere strictly to pivot point levels, requiring traders to

exercise caution and employ additional analysis techniques.

Conclusion:

Pivot points remain a fundamental tool in the arsenal of intraday traders, aiding in trend identification and trade planning. By understanding their calculations, interpreting their implications, and integrating them with other indicators, traders can harness the power of pivot points to make informed trading decisions.

Disclaimer: This trading idea is for educational purposes only and should not be considered as financial advice. Traders are encouraged to conduct thorough research and exercise caution when implementing any trading strategies.

📈TON Breaks ATH: Eyes on $6-7 Target?🚀🔥🔍TON coin has recently shattered its all-time high (ATH) with a convincing candle on the weekly timeframe, marking a significant 32% move from the trigger candle. The uptrend appears to be continuing, with a potential next target range around $6-7 based on Fibonacci levels. If you bought at lower levels, it is advisable to hold for now.

✨Taking a glance at the annual pivot points, TON has reached the R2 level and seems to be consolidating. Observing the reaction at this level will be crucial in determining the next move. A break above R2 could indicate further upward momentum, while failure and a trigger candle might signal a potential sell-off.

📊The recent influx of volume into this coin over the past two weeks suggests strong interest from investors. If there's a reaction to the annual R2 level, monitoring the trendline drawn can provide insights. In case of a breakdown and confirmation candle, selling could be considered.

💥The RSI oscillator has entered overbought territory, signaling a potential sharp movement similar to the recent 30% surge. Fundamentally, TON is associated with the Telegram messaging platform. If you believe in the widespread adoption of this messenger, investing in its coin could be lucrative.

🛒Waiting for a pullback to the trendline with confirmation from a candle could be a viable strategy if you're still on the sidelines. Keep an eye on the market dynamics and react accordingly for potential profit opportunities.

🧠💼Just remember, jumping into trades too quickly before the main trigger can be risky. Always manage your money wisely and be aware of the risks involved.

BIST100 - Backtest the break out and continueBIST100 got a nice rally with the improved relations with US. There is a resistance for the short term at 8515 (Monthly second pivotal resistance level). RSI is also showing a bearish divergence. The index may want to test the previously broken channel. Then, with the election environment and the positive relations with US and NATO, we may see the continuation of the rally.

-----------------------------

Disclaimer – WhaleGambit. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

TSLA: The Most Important Chart Structures! (D & W charts).TSLA shares are up today, reacting above the 21 EMA seen on the daily chart, which, by the way, is still pointing upwards. What's more, it hasn't managed to lose support at $226, which we nailed in our last public study (the link to my previous TSLA analysis is below this post).

Given the technical evidence described above, TSLA maintains bullish sentiment in the medium term, as it has failed to trigger a bearish reversal structure by losing its key support levels. However, it has not yet broken through the previous top of $246.70 so that it could make a higher high again, resuming the pattern of higher highs/higher lows that makes up an uptrend.

As mentioned above, only if TSLA loses the $226 area would this trigger a bearish technical reversal pattern on the daily chart, as we would see it making a lower low after failing to break through the previous top of $246 - a classic bearish pivot point. For now, the situation seems to be under control. Now let's take a look at the weekly chart:

Here we see why it is so important for TSLA to maintain the bullish sentiment. TSLA’s price is still inside a Descending Channel, which could be part of a huge Bullish Flag pattern, but it must confirm an upwards breakout so it can turn the long-term sentiment bullish again.

TSLA is almost there and if it breaks this channel, it could easily look for the next resistance around $300 again. So far, there is no apparent bearish reaction suggesting a top or a correction to the support line of this channel – in fact, TSLA is finally above the 21 ema on the weekly chart again.

I’ll keep you posted on this, so remember to follow me and support this idea, if you liked it!

Best regards,

Nathan.

Bearish divergence for EUR/JPYEURONEXT:EUR / $JPY has started the year at the yearly pivot point. After 9 months, it is flying around the second yearly resistance. The price has started to stall at the monthly resistance point and RSI shows bearish divergence. If we break this resistance, I don't expect the price to break the second yearly pivotal point.

Disclaimer – WhaleGambit. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Two potential points for a long entryWith the FUD and SEC manipulation, BINANCE:BTCUSD price dropped heavily and didn't join the technology rally. Though that might be a sign for bitcoin is becoming a risk-off asset. With a correction in the stock markets we can see a move towards 35k.

There are two good spots for long entry if the price drops further. First stop is the trendline which is coinciding with weekly second support around 24.1k. The price may further go down as a fake breakout toward 23.6k area. This area has also high volume support from previous breakout. Let's see when this FUD ends and our mighty bitcoin shows some strength.

Disclaimer – WhaleGambit. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Tipping pont for NVDA, What's in the Cards?Next level down for NASDAQ:NVDA is at around $334.05, which would be back to the Pivot and yet another pivotal moment, where if there are not enough buyers it could be bed time for the AI narrative for now. Full disclosure I am already short NVDA stock and looking to exit near the pivot.

Check out the Equity Channel Podcast for more information on trading and investing.

USDJPY COT-STUDY Q1-23: BEARISH CONTINUATION?Monetary Policy:

- BOJ is making a significant change

- Longterm YieldCurveControl target of 0,25% is relaxed to 0.50%

- Higher targets are to be considered

- This would mean more YEN-strength

- FED still hiking rates, but expected target-rate for 2023 is moderate: 4,75% - 5.00%

COT:

- Institutions started distributing USD-Longs since Q3-22

- Insititutions started distributing JPY-Shorts since Q4-22

- Both moves reinforce eachother in pushing down USDJPY

- Distribution-phase seems to continue in Q1-23

Seasonality:

- JAN is generally weak for USDJPY, so in line with expectations

- FEB & MAR are not weak for USDJPY (but Monetary Policy & COT outweigh Seasonality)

Pivot Points:

- Q4 was (fast) run from Quarterly R1 to Quarterly S1

- Looks like mid-DEC was start of frontrun Q1-23

- Projected Quarterly Pivot for Q1-23 was sold end DEC-22

- Quarterly Pivot predicts Quarterly S2 with QS1 as (conservative) first target = 125

Pivot Point Levels For XRPUSD (September 8th, 2022)Watch Pivot Point Levels For A Possible Entry. Specifically, watch for a rejection candlestick at pivot point.