Weekly Volatility ReadGood Evening --🌗 🌕🌓

I hope everyone is having a relaxing weekend with friends and family alike because soon we will be in the thick of the price action again -- and it may get spicy! Let't us dive in as we review what happened last week and we look towards the next to trade range or observe.

The CBOE:SPX opened the week fairly slow at $6,193.18 and increased throughout the week wicking up to a new ATH of $6,315.61 only to close the week off at $6,267.28 -- This leaves the IM on the week +$83.10. This closest respects the quarterly implied range that was a 'strength of IV' of 129.30%.

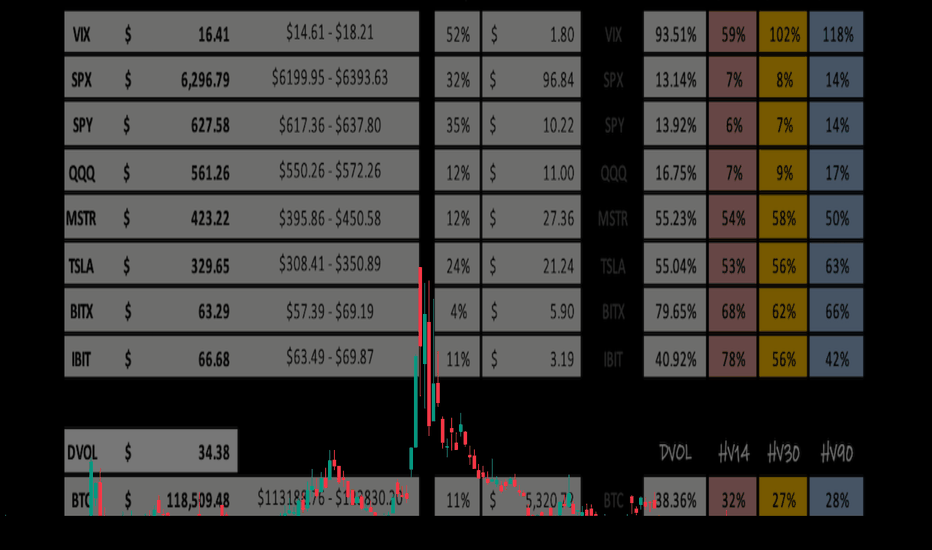

Now looking towards this next week we have extremely low HV across the board in the broader markets. CBOE:SPX IV (13.14%) is trending 32% IV percentile on the year -- premium is seemingly cheap. HV10 (6.97%) is coiled within 97.67% of it's sliding yearly lows, showing a need for short-term volatility to consolidate. HV21 (7.78%) is even more coiled to it's yearly low at 98.76% respectively. Both are roughly mid 50% 'strength to IV' as IV predicts twice the potential move next week.

Lastly, HV63 our quarterly trending values is showing a 'strength of IV' at only 108% but, could be supporting the thesis IV is projecting, as we do need a TVC:VIX pop OR time-wise consolidation. 📈📉

I hope everyone has a great week trading ranges and I will see you next weekend!

Cheers! 🍻🍻🍻

Plan

Weekly Volatility Snapshot Good Evening --

I hope everyone is having a restful weekend and enjoying your time away from markets. Always appreciate it while you can, and spend that precious time with loved ones. Now, let us review the price action last week as we look towards our expectations for the coming trading sessions.

The CBOE:SPX opened the weekly candle at $6,126.15 and closed $6,252.50 -- this respectively puts the weekly move at +$126.35. This is slightly above what IV was stating entering the week. We are starting to see seasonality set in as the markets top and look for consolidation. The TVC:VIX dropped throughout the week putting a bottom in at $15.70 which shows volatility creeping to it's lowest point year-to-date.

We should all expect a volatility bounce in the near future as the run the broader markets have made out of the steep correction needs to cool off before moving forward. Below is my volatility read for the S&P 500. You will see that HV10 (7.94%) is coiled within 3.30% of its sliding yearly lows. This tells me between the low sentiment in fear and the low volatility in short-term trends, we need to cool off a little.

Now looking towards this week, I see the broader markets consolidating and even selling off in order to reset the overbought 'lagging' indicators and pop the VIX up a little bit. The administration has pushed the trade deal deadline off till AUG 1st providing some relief to the markets but, has also created more uncertainties with tariff letters that went out Friday.

Look for a negative news cycle sparking up Sunday night into Monday, potentially creating momentum downwards. However, I believe we stay in range of what HV10 weighted to IV implies -- $6,207.72 - $6,311.78. This range holds a divergence from IV of 5.29% and and price gap difference of -$17.32. To me, this says that what is short-term trending is 'contractive' to what IV states.

That's all for this week. Stay hedged against your bias always and remember to practice your ABCs -- If you like what you are reading and love volatility range analysis as much as i do -- feel free to drop me a comment and ill get back to you! Till next time, Cheers!

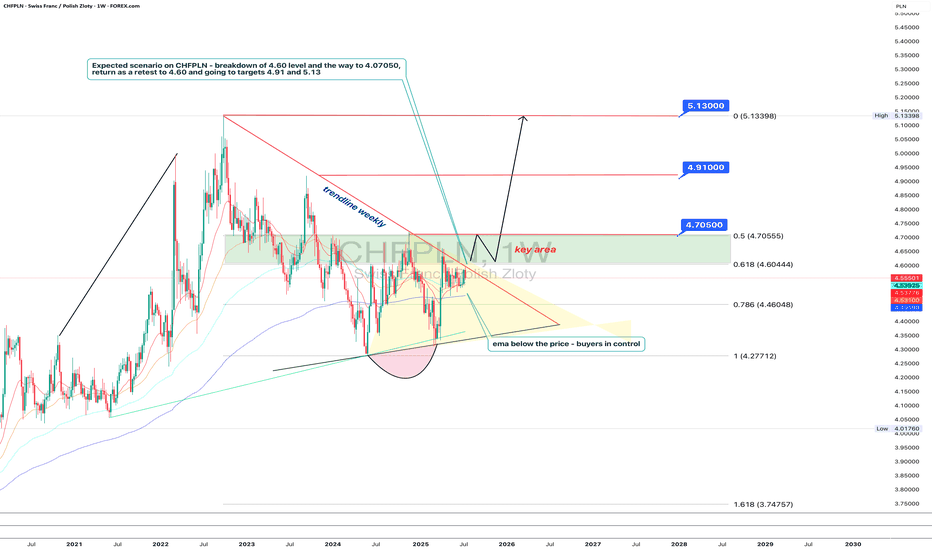

Polish zloty in trouble: Swiss franc is sharpening its teethTechnically, CHFPLN has completed a consolidation phase within a narrowing triangle and broke to the upside. The pair is now testing the 4.60 level (the 0.618 Fibonacci retracement) from below — a decisive zone. A breakout and confirmation above this area opens the path toward 4.705, which coincides with the 0.5 Fibo level and a local resistance. A pullback from that zone back to 4.60 is possible, but this time as a support retest. If the level holds, the targets remain: 4.91 and 5.13 - both marked by Fibonacci extensions and major long-term horizontal resistance. The EMAs are aligned in support of further upside, with price consistently trading above them.

Fundamentally, the Swiss franc remains a safe-haven currency, especially amidst increasing instability in the Eurozone. Weak growth in Germany, looming ECB policy easing, and rising inflationary pressures are all tilting investor interest toward CHF. Meanwhile, Poland faces political uncertainty, budgetary debates, and volatility in the agricultural and energy sectors. All of this strengthens the case for the franc in this pair.

Tactically, the game plan is straightforward: a confirmed breakout above 4.60 signals the start of a bullish impulse. The 4.60–4.705 zone is the key area of interest for buyers. If this zone is reclaimed and held, the next targets - 4.91 and 5.13 - remain valid, where large players may look to take profits.

If this scenario plays out, the zloty may soon be tuning into Polish radio to sing nostalgic songs about the golden days of its strength.

BITx -- Weekly Volatility SnapshotHello Bitcoin community 🤠👾🤑👾🤠

Good morning/Good afternoon, maybe goodnight to you pending where you are in the world!

Nonetheless, I'm glad you found me because here we are going to look over our weekly historical volatility ranges on CBOE:BITX and assess where IV is in perspective to what's trending. Then we will talk targets within my custom adjusted implied weekly ranges.

Entering the week, IV (76.86%) is projecting +17.74% more than what short-term trending markets are showing with HV10 (59.12%) holding a 'strength of IV' of only 76.91%. This is a price differential on the week of -$1.19. Our monthly values with HV21 (71.20%) are hinged slightly below IV, showing a 'strength of IV' slightly more at 92.64%.

In my opinion looking towards this week, IV may be painting the bigger picture of price distribution upwards towards quarterly trends. It is expansive from past weeks and above short-term trending markets with a wider range and with IV percentile slowly creeping up.

If the trend holds that started last week, my price target will be HV63 at $61.07 which draws confluence with the correction impulse wave top of $60.39 -- a price action to implied calculation difference of only +/-$0.69. Fantastic , right?!? This would take BTC approaching new ATHs again. If price action can find quarterly trends we will be seeing a 'strength of IV' of 108.44% -- only slight advantageous over IV premium.

In the end, markets are unpredictably wild and we can only assess and reduce our risk using the tools provided. Always remember your ABCs and to hedge your bias! Come back next week as we recap how the weekly volatility unfolded.

Cheers!

AAPL - Weekly HV/IV PerspectiveGood evening —

I wanted to do one more write up with that being on NASDAQ:AAPL as we enter the week with futures just opening.

HV10 (16.58%) is trending -11.56% below IV (28.14%) showing a weekly price gap differential of -$2.89 on the stated implied move to what trending markets are doing. This current IV value entering the week sits 69% within the sliding year spectrum.

Now, with Apple consolidating in range for almost eight weeks after selling off when it reached its 4T milestone in December of 2024, has now begun advancing back upwards in price. The strength here is obvious and the quality of company is well, Apple.

My price targets on the week is first the upper band of stated IV ($220.58) then moving on towards the upper implied range of HV63 ($225.87). I believe the markets are going to push apple higher while balancing the indices out selling off in other areas. This would start to accelerate HV10, as it is now 91.23% coiled to its yearly lows and needs to unwind. Hopefully with a few short-term trending days increasing we find our regression.

Please come back next week and see how our position and volatility progressed forward.

Weekly Volatility SnapshotGood Evening -- Happy July 4th to everyone

Let us review last week as we look towards the next in anticipation of the trade deal deadline that looms. I had a target on the SP:SPX of $6,253.59 and the weekly high was $6,284.65. The candle on the short week opened at its low of $6,019.21 and closed $6,233.08 making the weekly range +$213.87. This represents closest to HV63 over IV which stated +/-$253.26 and a 'strength of IV' that was 295% . Again the weekly high is above our range target, but my volatility will always be measured close-to-close.

Now as we look towards this week --

IV (13.85%) has shifted upwards slightly with HV10 (7.36%) hinged down and still lowering. In fact, I have bi-weekly volatility as 97.28% 'coiled' to it's sliding yearly low of 4.64% -- HV21 (9.92%) is closer to what IV states with it being 'coiled' 96.61% to it's respective sliding yearly lows.

In my opinion, volatility still has room to consolidate slightly as markets rotate higher. I think we can see upwards $6,327.73, but slowly over the course of the week with the last tariff uncertainty getting out of the way. From there, going into mid July we may need to see a volatility spike. The HV10 range I am watching holds a 'strength of IV' entering this week of only 53% -- this shows the price per move is expensive by almost twice as much.

Till next time, know your ABCs, have a great long weekend, and stay hedge!

CHEERS

Weekly Volatility SnapshotGood Morning -- ☀️☀️☀️

What an amazing last full week of June that was as we pulled out of corrective territory and onto new ATHs with the SP:SPX body of its weekly candle moving +3.41% -- bottom to top. The weekly move open-to-close was +$98.40 as that is how I gauge my volatility metrics. This in comparison is closest in value to IV entering the week as it was stating an implied move of +/-$102.08, which was a volatility read of 16.34% -- As you see in reflection of the weekly chart below and within daily candle structure, price action moved upwards all week surpassing quarterly marks. This in turn is raising short-term volatility and lowering monthly averages as we rotate higher.

Here is the weekly price action of the TVC:VIX from a 5m perspective. This is showing the EOW trend break upwards drilling the indices back down -- A healthy pullback after being seemingly over-extended. This happened during the news cycle release of the U.S. and Canada reciprocal tariff disagreement. Hopefully this settles over the weekend and we rotate higher into the 4th of July week.

Now looking towards this holiday week -- We have the SP:SPX IV (13.29%) after melting during the ATHs move previously -3.09% -- This places IV on the sliding yearly spectrum at the 39% down range showing increasing discount in yearly value. Remember, If you form option positions IV affects VEGA 1% at a time and the algos bid down IV in contracting markets as they rotate higher. HV10 (12.46%) has hinged down and still is contractive per IV prediction but, increasing in comparison with a ' strength of IV ' now showing 94% entering this week.

As the TVC:VIX has closed at $16.32 -- I believe that there is still a little room to extend potentially upwards to the HV10 weekly range of $6253.59. Currently, the SP:SPX YTD return is +4.96% with weekly momentum pointing up and room for volatility to still decrease. If this mark is reached it would put the YTD return at +6.52%. Very feasible and realistic being halfway through the year and going into the 4th of July 🇺🇸🇺🇸🇺🇸🇺🇸 Watch as we climb the wall of worries around us. This would in turn decrease short-term volatility more maybe even to a bottoming point and IV would melt during the rotation upwards with the VIX slowly grinding down.

Come back next week as we review what happened within the implied ranges posted and overlook the volatility potentially bottoming and looking towards a VIX spike in the near future.

Remember to know your ABCs and stay hedged against your bias! CHEERS!

Weekly Volatility SnapshotGood Morning --

I hope everyone had a good week of trading ranges -- although short, we saw some VOLATILITY .

Here we will step back with the year-to-date TVC:VIX in the background as we look towards a fresh week trading within the broader market ranges.

Let us begin --

Last week the S&P500 -- with the SP:SPX gapped up opening into strength of a short week at $6,007.46 and wicking up to $6,050.83 only to sell off during U.S. wartime engagement threats within the news cycle, closing the weeks range at $5,984.57. This provided a move of $96.96 and is most comparative to what IV (16.18%) stated entering last week -- that was predicting a range of +/- $101.24.

Now, looking towards this week -- IV (16.34%) is nearly unchanged as HV10 (9.75%) is showing a 'strength of IV' lowering at only 60% currently. IV within the yearly spectrum sits with an IVp of 74% -- fairly expensive as this can show the majority of money is spending up to protect downside uncertainties.

Understandable of course.

Our long-term trending volatility of HV63 (30.25%) is showing a 'strength of IV' at 185% which is correlating to an implied move of +/- $188.98 for the week. This is an advantage if reached of $86.90 over stated IV. A massive premium capture potential.

With the MACRO news cycle pointing EXTREMELY NEGATIVE, I will be watching for volatility expansion. I believe futures will open up gapping into quarterly marks -- this is just my humble opinion of course.

I see the opposite of last week happening, where we gap down and run up into the week. I don't hold a swing position, just an observation that psychologically retail will flip bearish on wartime news with a massive gap down, only to get trapped as broader markets expand upwards into the week.

That's all for now. Everyone have a good week trading ranges, and I will see you Saturday to review! As always, know you ABCs and stay hedged for whatever your bias may be!

CHEERS

Nvidia - Weekly Volatility SnapshotGood Afternoon! Let's talk NASDAQ:NVDA

Last week we saw HV10 (24.96%) increase above HV21 (23.67%) after starting what could be a regression towards HV63 (39.13%). IV (37.37%) entering this week reflects within 6% of it's sliding yearly lows and resonating around quarterly means. This could be showing a fair prediction to the regression potential and a volatility spike.

Here, the RSI has room but is elevated and hinged down with the MACD crossed red -- lagging indicators showing trend reversal. If bi-weekly values can find regression to quarterly; the implied range I would be watching is $135.47 - $148.47 with IV increasing affecting premium positively. If the grind up continues slowly, expect IV to melt and be watching for contracting HV10 ranges between $137.82 - $146.12 -- Keep an eye on the news, it will ever affect the broader markets and any underlying within.

Follow along through the week as we track our volatility prediction -- I will pull the charts back in at the end of the week to review!

CHEERS!

BITx - Weekly Volatility Snapshot Good Morning -- Happy Father's day to any dad's out there!

Let's took a weekly look at CBOE:BITX -- our 2x leveraged BITSTAMP:BTCUSD fund.

Last week, we saw a beautiful gap up to the upper HV63 implied ranges were profit was taken and accelerated selling begin. Our bi-weekly trending values have increased due to the increasing volatility. The weekly candle ended with some body to it, but was mostly flat due to the gap closing with a big wick up.

Our IV (85.47%) entering the week is trending within 4% of the sliding yearly lows and seemingly increasing as it tracks near-term trending markets -- HV10 (70.04%) has increased from the movement last week +7.35% and is now +22.17% off sliding yearly lows. As the spring is uncoiling, and bi-weekly regresses towards quarterly means our premium capture erodes and our range expands. I love trading volatility and ranges.

The 'strength of IV' here for HV10 is 82% -- so you have to account when positioning that the trending near-term volatility IS INCREASING but IS WEAKER than what is predicted. The 'strength of IV' here for HV63 is 101% -- showing that what is predicted is fairly valued to me on a regression scale.

Please -- Pull my chart onto your layout and use my implied ranges and data, follow along through the week on your own screen as we track and measure the volatility -- let's get this conversation started!

CHEERS

Weekly Volatility Snapshot Volatility, as measured by standard deviation, quantifies market elasticity and provides a level of probability and precision to trade within, that humbles us all.

Last week, the TVC:VIX opened above $21.00 and closed just under $19.00 for a near flat week even for all the eventful action that took place. That being once again, tariff related news with the court of international trade overriding Trump's liberation day, only to have the administration appeal, and the tariffs to be reinstated the following day.

This provided for quite a volatile move, mostly in after hours with everything closing strong to end the month.

As we look towards June starting with next week, just about all indices I track and the magnificent seven are showing near term trending volatility contracting under stated IV, as IV is melting across the board. Notable mention to NASDAQ:NVDA NASDAQ:MSFT NASDAQ:IBIT and CBOE:BITX for all entering the week with great IV value, now let's compare them to their respective trending bi-weekly values to observe what is being predicted to what is happening with near term trending volatility.

NASDAQ:NVDA at a 6% IVp enters the week with an IV of 39.04% -- HV10 (31.70%) is 81% strength of current IV and resonating under monthly values. When you see a large move, that being from the earnings report last week, you will see a massive IV melt to save premium against the PA move due to the beats or misses. With that said, bi-weekly values are just off yearly lows (25.74%) as IV chases it down and i see the underlying as 94.03% coiled for a volatility swing.

NASDAQ:MSFT at a 17% IVp enters the week with an IV of 18.99% -- HV10 (14.55%) is 77% strength of current IV and resonating deeply under monthly values. Bi-weekly yearly lows of 8.56% reflect a coiling of 90.03% at current values.

With both of these, I am looking for a volatility bounce, and regression back to quarterly means. That's where the real fun is and if played right provide excellent opportunity. For further discussion around BITSTAMP:BTCUSD within the funds NASDAQ:IBIT and CBOE:BITX look for my more dedicated posts this weekend.

For those interested in volatility analysis and the application of weighted HV ranges to IV, I encourage you to BOOST and share this post, leave a comment, or follow me to join me on this journey.

We will weekly analyze our ranges under the year-to-date VIX chart and engage in discussions as people please. So hop on board and come along for the ride!

iBIT - Weekly Volatility Snapshot Good afternoon -- Here is my weekly perspective for NASDAQ:IBIT

IV (43.42%) entering the week sits in the 6th percentile for the year. HV10 (28.24%) has been lowering towards it's yearly lows of 23.43% showing a coiling of bi-weekly values at 95.19% from this -- and a divergence from IV of -15.81% . IV is chasing the sinking bi-weekly volatility trends. We generally could see a volatility bounce within this range or continue to grind to new volatility lows.

I always expect and prepare for both, Lewis Pastor once said, "in a scientific setting, chance favors the prepared mind". I hold that true in a lot of situational settings not just scientific, but find it to be very true with BITSTAMP:BTCUSD volatility and risk management.

Moving deeper into the week; what can we expect?

Well, I think that the final shakeout may be here as we consolidate more into the beginning of the week finalizing on Tuesday, June 3rd. I find significance on this date being the extension in time from selling off for 45 days after the initial 'W' distribution off the top -- potentially the start of the volatility swing back towards long-term trending means and maybe the start of another impulse run to track into..stay tuned to find out in observation.

If this week we find regression to HV63 (49.26%), it will be a swift and quick move showing lots of strength. The ability to capture premium between the difference of stated IV from lowering HV10 values to the volatility swing back up above IV to quarterly means, is what it is all about ! This capture can be upwards 5.84% as a volatility metric read and beyond, because when a volatility regression occurs, it moves past means until having to consolidate back downwards again. Rinse and repeat.

For those interested in volatility analysis and the application of weighted HV ranges to IV, I encourage you to BOOST and share this post, leave a comment, or follow me to join me on this journey.

BITx - Weekly Volatility SnapshotGood afternoon -- Here is my weekly perspective for CBOE:BITX

IV (86.99%) entering the week sits in the 3rd percentile for the year. HV10 (60.22%) has been lowering towards it's yearly lows of 47.87% showing a coiling of bi-weekly values at 87.65% from this -- and a divergence from IV of -26.77% . IV is chasing the sinking bi-weekly volatility trends. We generally could see a volatility bounce within this range or continue to grind to new volatility lows.

I always expect and prepare for both, Lewis Pastor once said, "in a scientific setting, chance favors the prepared mind". I hold that true in a lot of situational settings not just scientific, but find it to be very true with BITSTAMP:BTCUSD volatility and risk management.

Moving deeper into the week; what can we expect?

Well, I think that the final shakeout may be here as we consolidate more into the beginning of the week finalizing on Tuesday, June 3rd. I find significance on this date being the extension in time from selling off for 45 days after the initial 'W' distribution off the top -- potentially the start of the volatility swing back towards long-term trending means and maybe the start of another impulse run to track into..stay tuned to find out in observation.

If this week we find regression to HV63 (99.73%), it will be a swift and quick move showing lots of strength. The ability to capture premium between the difference of stated IV from lowering HV10 values to the volatility swing back up above IV to quarterly means, is what it is all about! This capture can be upwards 12.74% as a volatility metric read and beyond, because when a volatility regression occurs, it moves past means until having to consolidate back downwards again. Rinse and repeat.

For those interested in volatility analysis and the application of weighted HV ranges to IV, I encourage you to BOOST and share this post, leave a comment, or follow me to join me on this journey.

S&P 500 Index -- Weekly Volatility Potential Good Afternoon!

This week, I want to talk about the CBOE:SPX and its weekly potential for how I read historical volatility to weight it then to implied volatility -- this creates my custom trading ranges.

Implied ranges for this week are calculated at 4 DTE using my strength of IV method. You can find out more how I do this over at my highlights page on 'X' - Find me @askHVtobidIV

We are entering a short week, with IV currently in the 89th percentile for the year ( 18.31% ) and resonating between bi-weekly ( 19.36% ) and monthly ( 15.13% ) historical values. Quarterly volatility trends ( 31.79% ) have risen more than 10% this year alone due to macro concerns and increased news from tariff uncertainties. This is creating a volatile environment that, in turn, only increases our trading ranges. Something I personally like.

Near-term trends are above the currently high IV environment, suggesting further expansion. This provides premium value on what is happening to what is projected to happen and a “strength of IV” of >100% indicating rising volatility, slowly towards quarterly means, while resonating around monthly trends.

If price action drives downwards, our gap from May 16th could fill around $5,692.56 with confluence of HV21 trends at $5,710.91.

Conversely, I can see HV10 ranges with rising pricing action and good macro news with EU tariffs breaking $5,971.33—Expanding to the price of $5,995.95 with continuing expansion and regression towards means.

Come back next weekend as I will review the chart to see how we developed!

For those interested in volatility analysis and the application of weighted HV ranges to IV, I encourage you to BOOST and share this post, leave a comment, or follow me to join me on this journey.

AUD/USD Forex Analysis – Trading Update for March 2025The AUD/USD pair has been exhibiting interesting price action over the past week. Following a strong bullish movement that took place on March 4th, 2025, the pair has entered a wedge formation. This bullish push was triggered by the announcement of tariffs, effective starting on March 3rd, 2025.

Key Price Action:

The high of the bullish move was marked at 0.63640, after which the price retraced to test a previous key support level at 0.62730. This level proved to be significant, as it was tested five separate times.

During the retest, the market formed lower lows and lower highs, indicating a shift in market structure. To visualize this, a bearish trendline was drawn, capturing the declining momentum.

Break and Retest:

The move we were anticipating was a break of the bearish trendline, followed by a retest of this trendline. This occurred on March 13-14, 2025, confirming the bearish structure.

After this retest, the weekly close showed a bullish push back to the 1-hour previous high at 0.63286, indicating some bullish interest around this price level.

Current Market Structure:

The pair is now trading within a defined range:

Low: 0.62582

High: 0.63288

We are monitoring the 0.63000 level closely, as it is a critical point of interest. A breakout above or below one of the boundaries of this range will provide further confirmation on the pair's next move.

Next Steps:

If the market respects the 0.63000 level and remains within the range, we will continue to observe price action for any further setups. A break above 0.63288 or below 0.62582 will offer more clarity on the pair’s next directional move.

Bitcoin 2 hr analysis 🚨 BITCOIN 2-Hour Analysis 🚨

Here’s what we’re watching:

📈 Upside Targets:

• TP1:99000

• TP2: 100600

📉 Downside Targets:

• TP1: 96450

• TP2: 95100

So we have to watch out for $97400- $97600 level. If BTC stays below then you can target downside targets and if above then you can target above levels mentioned as TP(take profit)

Keep an eye on key levels and trade smart! 💹

What’s your take? Drop a comment below and share this with your trading crew! 🚀

SSEE Framework for successful Trading I want to present you to the 'SSEE' framework today, . This framework is intended for all users, from novices just beginning their journey to seasoned experts seeking to improve their tactics. Three basic steps are involved: ,Self-awareness, Story, Analyze , execute, and Emotional Control. Let's examine each component in turn:

self-awareness:

Self awareness is very important just link finding a trading style that fits your personality, risk tolerance, and financial objectives is the first step towards becoming a successful trader. This encompasses your emotional ease in taking chances, your degree of patience, and the amount of time you dedicate to trading.

Analyzing possible strategies comes next after determining your trading style. Regardless of your preference for technical analysis, fundamental analysis, or a mix of the two, you need to be well-versed in the tactics you choose to use.

Lastly, assess both yourself and the tactics you have selected to develop a solid trading plan. What you trade, when you enter and exit transactions, and the standards you use to make decisions should all be part of your trading plan. Recall that following a plan rather than making exact forecasts is the aim.

Look for Story :

Trends : Identify whether the stock is in an uptrend, downtrend, or sideways movement. Trends can indicate investor sentiment and potential future movements.

Support and Resistance : Look for levels where the stock has historically reversed direction (support) or faced selling pressure (resistance). These can signify psychological barriers for investors.

Volume : Analyze trading volume in conjunction with price movements. Rising prices on increasing volume might suggest strong buying interest, while price increases on low volume could indicate a lack of conviction.

Chart Patterns: Recognize common patterns like head and shoulders, triangles, or flags. Each pattern can suggest potential future movements based on historical behavior.

Indicators: Use technical indicators (e.g., moving averages, RSI, MACD) to assess momentum, overbought or oversold conditions, and potential reversals.

Time Frames: Consider different time frames (daily, weekly, monthly) to get a broader context of the stock’s performance.

Events and Catalysts: Look for spikes or drops in price that coincide with news events or earnings reports. These can help explain the "story" behind sudden movements.

By synthesizing these elements, you can create a narrative that explains the stock's historical performance and potential future directions.

Plan:

Define Your Goals

Investment Horizon: Decide if you're investing for the short term, medium term, or long term.

Risk Tolerance: Assess how much risk you’re willing to take. This will influence your stock selection.

2. Conduct Research

Fundamental Analysis: Look at company financials, earnings reports, industry trends, and economic indicators.

Technical Analysis: Analyze charts, trends, and indicators to identify entry and exit points.

3. Develop a Strategy

Stock Selection: Based on your research, choose stocks that align with your goals and risk tolerance.

Diversification: Spread your investments across different sectors to mitigate risk.

4. Create a Buy/Sell Plan

Entry Points: Determine your buying price and criteria for entry based on technical signals or fundamental reasons.

Exit Points: Set profit targets and stop-loss levels to protect your investment and lock in gains.

5. Execute the Trades

Use a brokerage platform to buy your selected stocks at your planned entry points.

Monitor the trades and overall market conditions.

6. Monitor and Adjust

Regularly review your portfolio’s performance and market conditions.

Be ready to adjust your strategy if new information or trends emerge.

7. Stay Disciplined

Stick to your plan and avoid emotional trading decisions.

Reassess your goals periodically and make necessary adjustments to your strategy.

8. Educate Yourself

Continuously learn about the market, new strategies, and economic developments.

By following this structured approach, you can execute a well-thought-out plan in the stock market. Would you like more details on any specific step?

E xecute :

Step-by-Step Execution

Set Up Your Trading Account

Choose a reputable brokerage platform that aligns with your trading style and needs (e.g., commissions, tools, research).

Ensure your account is funded.

Finalize Your Research

Review your selected stocks, confirming they meet your criteria based on both fundamental and technical analysis.

Check for any recent news or events that could impact stock performance.

Create a Watchlist

Compile a list of stocks you are interested in, along with your entry points and target prices.

Place Orders

Market Orders: Buy stocks at the current market price. Use this for quicker executions but be aware of price fluctuations.

Limit Orders: Set a specific price at which you want to buy or sell. This helps control the price you pay but may not execute if the price doesn’t reach your limit.

Implement Stop-Loss and Take-Profit Orders

Set stop-loss orders to automatically sell if the stock price falls to a certain level, protecting your investment.

Set take-profit orders to secure gains at predefined price targets.

Monitor Your Investments

Regularly check the performance of your stocks and overall market conditions.

Stay informed about news that may affect your investments.

Adjust Your Strategy as Needed

If a stock isn’t performing as expected, reassess your reasons for holding it.

Be ready to sell or adjust stop-loss and take-profit levels based on market conditions.

Review and Reflect

After a set period, review the performance of your trades. Analyze what worked and what didn’t.

Use these insights to refine your strategy for future trades.

Stay Disciplined

Stick to your plan and avoid making impulsive decisions based on market noise.

Keep emotions in check and follow your predetermined strategy.

Emotional Control:

Set Clear Goals

Define your investment objectives, risk tolerance, and time horizon. Having clear goals can help you stay focused and reduce anxiety.

2. Develop a Trading Plan

Create a structured trading plan that includes entry and exit strategies, risk management, and criteria for buying and selling. Stick to this plan to avoid emotional decisions.

3. Practice Mindfulness

Use techniques like meditation or deep breathing to stay calm and centered. Mindfulness can help you recognize emotional triggers and respond more thoughtfully.

4. Limit Exposure to Market Noise

Reduce the amount of news and social media you consume related to the stock market. Constant updates can heighten anxiety and lead to impulsive decisions.

5. Keep a Trading Journal

Document your trades, including your thought process and emotions at the time. Reflecting on your experiences can help you identify patterns and improve future decision-making.

6. Manage Risk

Use stop-loss orders and diversify your portfolio to minimize potential losses. Knowing you have a plan in place can alleviate stress and help you stay composed.

7. Accept Losses

Understand that losses are a natural part of trading. Accepting this can help reduce the fear of losing and prevent you from making desperate trades.

8. Stay Disciplined

Commit to your trading plan and avoid deviating from it due to emotions. Stick to your strategy, even during market volatility.

9. Take Breaks

Step away from the screens when feeling overwhelmed or overly emotional. Taking breaks can provide perspective and help clear your mind.

10. Seek Support

Consider discussing your experiences with other traders or joining a community. Sharing your thoughts and challenges can provide valuable insights and emotional relief.

11. Focus on the Process, Not Just Outcomes

Concentrate on following your plan rather than fixating on short-term gains or losses. This shift in focus can help reduce emotional strain.

Plan Your Trade 6-25-24 - Base Rally DayThis video continues my series on planning your trade around my SPY Cycle Patterns. Today is a Base Rally pattern. I suspect the price will attempt to climb above $544 and may attempt to rally above $550 over the next few days.

This is an excellent opportunity for traders to swing for the fences with long trades.

Time your entry. If the price fails to rally above $544 in early trading, we may see a strong rally later this afternoon.

Tomorrow is a Breakaway pattern in counter-trend mode. I suspect we'll see a bit of a downward price swing tomorrow after today's strong rally. Then, another push to try to rally above $550 on Thursday.

Plan your trade. Learn how I can help you stay ahead of these bigger price swings.

1. Crafting a Trading Plan: Your Compass in the Market StormAs discussed in our previous post, a well-defined trading plan is your invaluable compass, navigating you through the ever-shifting tides of the financial markets. It's not a rigid set of rules, but a dynamic roadmap that evolves with changing market conditions.

Defining Your Trading Goals

Your trading plan begins by clearly defining your trading goals. What do you aspire to achieve through trading? Is it generating consistent income, building wealth, or simply enjoying the thrill of the market? Having clear goals provides direction and motivation, keeping you focused on the long-term. Think “business goals”!

Identifying Your Trading Style

Next, identify your trading style. Are you a day trader, seeking quick profits by capitalising on short-term market movements? Or are you a swing trader, looking for larger gains by holding trades for days or even weeks?

Understanding your trading style helps you choose the right strategies and instruments. This will also depends on your current “life” circumstances, private and professional, i.e. how can you “fit” trading into your day-to-day routine.

Establishing Entry and Exit Criteria

Your trading plan should clearly outline your entry and exit criteria. What conditions trigger you to enter a trade? What signals indicate when to exit? These criteria should be based on sound technical analysis and risk management principles.

Managing Risk and Reward

Risk management is paramount in trading. Your plan should outline your risk tolerance and maximum loss per trade. Never risk more than you can afford to lose. Additionally, consider using stop-loss orders to limit your potential losses. This will be further discussed soon through this media too!

Review and Adapt

Your trading plan is not a static document; it should evolve as you gain experience and market conditions change. Regularly review your plan, assess its effectiveness, and make adjustments as needed. Remember, trading is a continuous learning process.

Remember, your trading plan is your personal roadmap to success. By carefully crafting and adhering to it, you can navigate the complexities of the financial markets with greater confidence and achieve your trading goals.

In our next post, we will expand on the 2nd key aspect of our initial post which will be about “ Unveiling Market Secrets ”.

Gold trade plan Mar13,2023www.tradingview.com

On March 13, 2024, the price of gold might go down because it dropped from its recent high of 2195 to around 2150-2155 on Tuesday, and the candlestick closed in red, suggesting it might continue to decrease. So, it's a good idea to sell.

Sell:

Sell when the price reaches 2165-2166, aiming to close at 2153.

Alternatively, sell at 2176-2178 with a target of 2166.

Buy:

If the price drops to 2152-2155, consider buying and aim to sell at 2161.

Or, if it falls further to 2143-2140, buy and target to sell at 2155.

Make sure to be careful when opening positions and use stop-loss to control risks. Adjust your trading plan based on market conditions.

Nobody sees this BTC move comingOverall Analysis BINANCE:BTCUSDT

The $43.5k-$44k has been a key level which Bitcoin has been rejecting from, and I shared this in our last video. It had several attempts at trying to break it until we fell to the downside. There are a few levels of support which we will be monitoring. I think one of the biggest support levels is going to be around the $41-42k. We saw it act as a large support from the 12th-19th before it broke down and flipped into resistance. It then took over a week to finally break above the level again and now for it to hopefully flip back into support. Overall, this level has been respected 10+ times. There is a potential if we hold this level now that we could form an Inverse Head & Shoulders pattern which would be very bullish.

Liquidity

We have been having a large build-up of liquidity around the FWB:41K as well as a lot of short liquidity up around the $43.7k level. These levels are likely going to determine which direction our next move heads to. There is also a large amount of liquidity sitting around the $39-40k level.

Plan

Waiting for a clear signal, still seeing a possible scenario where we lose this current support level and liquidate the build-up we have to then go and challenge the lower $39.5k liquidity build-up. However, the flip side of this is if we hold onto the current level and push up to the $43k level, we will be confirming the Inverse Head & Shoulders pattern which we would then hope for a flip and pushing to new highs!

Predict the clarity of the price, not it's direction☝️The main purpose of my resources is free, actionable education for anyone who wants to learn trading and improve mental and technical trading skills. Learn from hundreds of videos and the real story of a particular trader, with all the mistakes and pain on the way to consistency. I'm always glad to discuss and answer questions. 🙌

☝️ALL videos here are for sharing my experience purposes only, not financial advice, NOT A SIGNAL. YOUR TRADES ARE YOUR COMPLETE RESPONSIBILITY. Everything here should be treated as a simulated, educational environment.