How To Think Like A Professional TraderA strategy is only as good as the trader using it. Patterns are not enough, neither is support or resistance. Candle patterns help, but will not do the trick alone. Unless you can understand the structures of the markets, alongside the behaviour, then really and truly you are just trading blind. In this short episode, I go through three trade ideas that were planned out today (03/12/2020) on the RockzFX Academy live trading session, so you can get an idea of what it means to plan your trade, and trade your plan!

Planyourtradetradeyourplan

1/15/2020 USDNOK ( management of the trade ) Another Forex Trading Snack.

From my original posting of the short opportunity that I saw in USDNOK, my tactics have always been in building a position up to take advantage of my longer term bias for the pair. The market will do what’s its going to do and all we can do is catch a ride if we can.

Newer traders might just catch a great entry point but only get taken out for a few pips at best. Usually new traders get all excited to see a trade move into a profit zone, but this caused beginners paralyses in taking good trading practices action far to slowly. However when price bounces back up towards entry price or worse, at this point of the new traders cycle of trading, the new trader tends to take action far to fast in the hopes to avoid trading pain, losses, or an attempt to greatly limit losses. Instead lack of action or trade planing have limited their overall success.

Take this chart view for instants. It shows 3 trades I set up, 2 that were filled and the last one just setup and stands still open at the time of this posting. Each trade was taken with multiple lots per order. In this way a trader can take one lot off to take partial profits while allowing the other to run.

If you only place one lot orders— you are at the mercy of the markets to either give you a profit or a loss. Once you decide to take profits you’re out of the trade. Sure the market could bounce back in your favor to re enter, but just as easy it could keep going. On the flip side a new traders mindset could say if I trade 2 lots I’m taking more of a risk to my trading account. This is also true! However if you place your trades close to confluences, indicators and support / resistance levels / trend lines.... what ever your edge is, you have well defined entry points with limited risk points.

Take this trade setup. My original entry had 100 pips of risk. The first entry moved in my favor and I had a hard take partial profits at 100 pips. So without moving stops on the remaining lot it turned out taking a partial profit eliminating all risk on the remainder of the trade balance.

My bias didn’t change so finding the next attempt at a new entry was easy. Next lower red box, is my take the trade zone as well as where the extreme stop would be. When setting up the second entry and stop I also moved the first balance trade stop as well to the same place. The second entry had 130 pip stop. Because of stop placements and the first trades partial profits taken, the over all total risk take was only 130 pips even though, if the second trade was filled the total lots on this trade would be 3 lots.

1 original lot profit taken +100 pips

1 lot from original entry with a +30 stop

2 lots second entry with 130 pip each or 260 total stop

Over all total risk / profit once second order was filled 130 total pips with 3 total lots.

Again the markets moved in my favor. I took again partial profits of 300 pips this time, leaving 2 remaining lots on my trade idea. Now moving my stops down to the second over all high price on the remaining lots, I’ve eliminated all risk on the remaining 2 lots as well have locked in a 400 pips of profits. Well at the time of the post my 3rd entry has not yet been filled. This 3rd entry will be 3 lots with a 125 pip stop per lot or a total of 375 pips for my total risk. If stops get triggered I still take home 25 pips total profits. Previously locked in 400 - 375 on 3rd entry if stopped out = + 25 pips.

If and when the 3rd orders get filled I plan to allow this trade idea to ride out to my longer term profit zone. The only management of this trade will be moving the over all stop of this trade for all lots. This will by moving stops to lock in profits on all lots of the trade. If the 3rd part isn’t filled the trade management is still the same on the 2 lots still running.

Each currency pair has it own need for different stop sizes according to its own daily average moving range.

As traders we must except that the only part of trading that we can control is our own level of risk taken. With this example I think I’ve shown how to trade a longer term idea while reducing risk without taking yourself totally out of the position until the market takes you out. We should alway be looking to allow your winners to run. Manage your trade ideas to eliminate taking a large loss and your trade plan should include allowing the trade idea to run as far as the market will allow it to run while reducing the overall need to personally manage the trade position. Once a trade gets to a risk free trade with all risk of loss to my trading account eliminating, I just wait fir the market to get to my profit targets or my managed stop levels. Just let the market take you out one way or the other.

As always this is only for educational purposes only.

All the best in your trading.

Trading currencies is the hardest easy money you’ll ever try to make. Plan your trades and trade your plans.

BDR A chance for profits*TIMEFRAME FOR PLAN EXECUTION - Dec 3 2018 - Jan 11 2018*

BDR - PLAN A - I expect to see a move south back to $1.10 with consolidation and diminishing volume.

If indicators are suggesting so, a purchase here $1.10 would be great for a subsequent move north

to $1.30 for an 18.01% win.

PLAN B - Should the $1.10 support not hold up, my opinion is a move south further to $0.97 and a

hopeful buying signal here, followed by a hold to $1.30 by Jan 11, 2019 or longer should the trend

continue, with $1.30 be my target exit price point for a 34.02% win.

WHY? MACD - Is just curling south, suggesting the ceiling has hit/near-hit at this point

EFI - Suggesting a holding pattern here, no real movement north and holding patterns

are not good for this Force Index

RSI - Currently indicates at the least, in my opinion, that the current price may be pushing

overbought territory, meaning patience for a better deal in the price

- PAYtience is the key here! Looking for indicators to get in requires paytience and tenacity. -

*DISCLAIMER - I am not a professional trader. These are merely my thoughts. If you need professional help with your trades,

look for a professional who know all about stocks.*

Possbile long position on GPC on pull back from breakoutThe resistance level that was just broken into is also a psychological level of significance due to the fact that the price at this level is $100. This number usually hold some importance on many stocks. This stock has proven to hold this price level as an area of significance. DG (Dollar General) was also in a similar position not too long ago.

LONG on IBM ready for break out.The overall market did not do so well today. Netflix, Apple and other large tech companies experienced significant sell-offs today as well. Despite all the red across the tech board, IBM managed not only to stay positive, but it has experience some significant buying pressure. IBM is also very close to the 200 sma and is making higher lows towards it on relatively solid volume. The bulls are showing dominance. The volume on the day is about 3.1 million so that is very close to the average of 2.99 million. Increasing volume will be a great confirmation of this move. I have taken a long position, however, I still treat this like all other trades and keep my stop-loss relatively tight just incase there is something I might not be seeing.

Long on POR on PullbackPOR has been trending in the upwards direction for quite a while now. It appears to have some excellent volume support on the way up. Where as downward moves result in a reduction in volume. POR has been respecting the 20 EMA for quite sometime and formed a bullish candle today a with the lows at the 20 EMA. POR also has a zacks rank of 2 (buy) which is a good enough rank for a swing trade. It has beaten earnings estimates over the last 4 quarters. It also has a cool 3.14% dividend yield which isn't too bad for some our longer term holders. POR has an ATR of 0.67 at this time which means it wont be making any drastic moves unless something big happens. I will stay in for a couple days to a couple weeks.

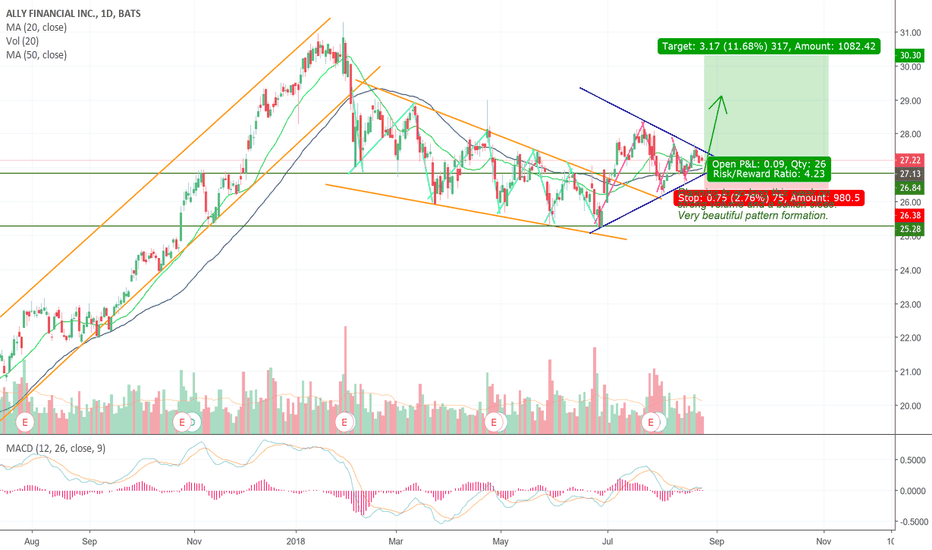

Long on ALLY.. possible breakoutALLY has recently been upgraded by Zacks.com to a rank 1 (strong buy). It has beaten earnings for the past 4 quarters. It is currently setting up for a possible break out. I will be looking to go long this week on the close above the upper trendline of the symmetrical triangle.

Buy VSTM on break outVSTM has been trending up for quite some time now. We can see a beautiful ascending triangle has formed and two tops have been made. VSTM has recently beaten earnings however, it only has a zacks rank of 3 (hold) so I wont be holding this for too long. The MACD is also trending downwards but it can reverse if it continues the move to the upside. Volume has also been increasing on the move to the upside which supports the move. The price of the stock is cheap yet it has solid volume. VSTM is also in the healthcare sector which has been doing very well over the past year.

Possible Trade on GME? What do you guys think?GME broke out of a beautiful symmetrical triangle. I can buy on the break above the upper supply area. However, it has recently been downgraded to a zacks rank of 4 (sell). There is however a possibility of a buy out which would result in significant move to the upside. Also, zacks analysts do not expect GME to meet earnings estimates which is not too far away. I will go long in my paper trading account to learn from such a situation.

Buy ALDR on bullish closeALDR was recently upgraded by zacks to a rank of 2 (buy). ALDR is in the healthcare sector which has been doing well over the past 6 months. It is currently making a nice move up with higher highs and higher lows ( Ascending triangle). There may be a couple more days of consolidation so I will wait for a bullish confirmation with some strong volume to support the move. There is some overhead resistance to look out for ( I have highlighted this are in red ). The risk reward ratio on this trade is gorgeous. Almost 1 to 4 . I will take some profits at 1 to 2 and let it ride the rest of the way while continuously tightening my stop loss.

BUY ECHO on pullbackECHO has a zacks rank of 1 (strong buy). It pulled back to the 61.8 Fibonacci retracement level on the wick of a bullish candle. It is also consolidating around this price level. it has also closed above the 20sma.There is definitely some historical resistance overhead, however, I believe it can break above this level due to the fact that earnings have been doing well over the past couple quarters. It has experience a strong reversal and has a lot of potential. although this may be true, there is always a possibility of things not going our way so I will continue to move my stop loss up.

Buy HLX on the pullbackI bought this on today's close. This stock is in nice uptrend and recently experienced a nice pullback to the 50% Fibonacci retracement level. It is also consolidating very nicely at this level. There was also a nice increase in volume today to support the move. I could have waited for a bullish conformation but all other factors are good so I entered early for a better risk reward ratio. There is also some previous significance at this price level as I have highlighted in yellow. HLX was also recently upgraded by Zacks.com to rank 1 strong buy. My Risk reward on this trade is 1 to 2 on first profit taker and 1 to 3 on second profit taker.

EURJPY > Buy OpportunityEURJPY > Long Probability

1D / 1W

Area of Interest: 133.25 / 133.30

T/P @ 135.30

S/L @ 132.70

Expecting consolidation toward 134.00 /134.40 level with possible break above toward 135.00/60 levels.

A break below 132.70 could see decline toward 131.66 area where bullish rebound would be expected.

Pullback to 133.25/30 level is required for set-up to remain valid.

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

USDCHF > Buy OpportunityUSDCHF > Long after Pullback

Buy Entry @ 0.95750

T/P @ 0.97750

S/L @ 0.94750

Resistance @ 0.98370 broken with expected rise toward 0.98590 / 0.99000 level for re-test.

Expecting consolidation toward 0.97050 fib retracement, followed by 0.96700 and 0.95650 primary support.

Expecting 0.95650 support to hold and bring rebound toward psychological level of 1.00000 which is not expected to reach and anticpating another decline to follow.

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

AUDUSD > Short OpportunityAUDUSD - Short @ 0.78750

1W

IND: 20 SMA / 50 EMA

Area of Interest: 0.78750 > 0.78970

T/P 1 @ 0.7770

T/P 2 @ 0.7733

T/P 3 @ 0.7700

Extended @ 0.76600

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

NZDUSD > Short OpportunityNZDUSD - Psychological Support Broken

1W > IND: 10SMA / Elliot Wave

Pair broke psychological support @ 0.70000 reaching 0.69700 setting new 5-Month low

Further decline expected toward 0.69070 / 0.68440 levels

Key resistance @ 0.70550 w/anticipated upward movement expected to be held by 0.71020 representing falling 10SMA.

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

USDCHF > Entry Point AnalysisUSDCHF- 1W > 10/22/2017

IND: 20 SMA / 100 SMA

Broken resistance @ 0.9835 indicates further rise to 0.9990 testing w/20 SMA adding additional confirmation to uptrend.

Break of 0.9846 from weekly 100 SMA adds confirmation to upward momentum, IMO.

Break and Hold above 0.9990 indicates further rise to 1.0342 re-test resistance.

Key support @ 0.9736 with break and hold below would indicate decline toward 0.9587 re-test.

Personal bias: Bullish

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

EURJPY > Entry Point AnalysisEURJPY - 1W > 10/22/2017

Pair remains trading in 131.69 - 134.39 range

Decisive Break and Hold above 134.39 indicates further rise to 141.04 re-test in longterm

Decisive Break and Hold below 131.69 indicates further decline to re-test of 127.55 support in longterm

Personal bias: Neutral

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

USDCAD > Longterm to 1.3130?USDCAD Longterm Range: 1.2445 > 1.3130

Broken resistance @ 1.2598 indicates possible further rise to 1.2777 level in test of resistance

In Longterm, Break and Hold above 1.2777 could see rise to 1.3065 / 1.3130 levels

1.2432 support must hold for above set-up to maintain validity through end of 2017

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

USDJPY > Longterm to 119.70?USDJPY - Longterm Range: 113.70 > 119.70

Broken resistance @ 113.43 indicates possible further rise to 114.49 level in test of resistance

In Longterm, Break and Hold above 114.49 could see rise to 118.65 / 119.97 levels

111.64 support must hold for above set-up to maintain validity through end of 2017

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

EURUSD > Entry Point AnalysisEURUSD > 1.2091 > 1.1510

Week of 10/22/2017

IND: 20 SMA w/ 50 EMA

Decisive break and hold above 1.1879 indicates possible further rise to 1.2091 level

Break and hold below 1.1669 indicates possible further decline to 1.1510 level

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.

USDJPY > Resistance and Support TradingUSDJPY > Week of October 22, 2017

Pivot Point @ 113.20

R3 114.97 R2 114.28 R1 113.90

S1 112.82 S2 112.13 S3 111.75

Overall bias: Bullish to 114.40 > 114.86 w/ possible test to 115.00 area

* Personal analysis only. Please use your own rules and strategies prior to entering market.

** Forex trading involves HIGH RISK.

Before entering a trade, carefully consider your objectives, financial resources and level of experience.