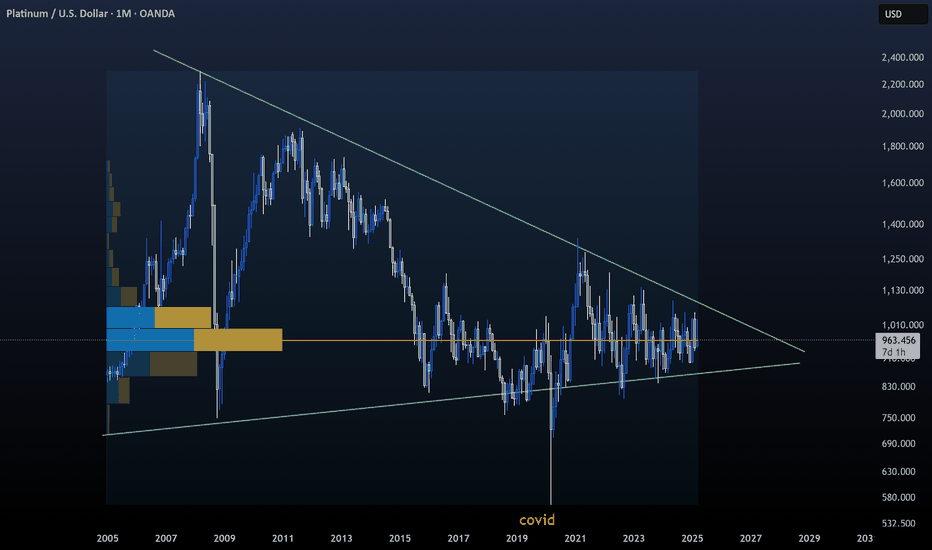

Long Term BUY PlatinumThis is a long-term accumulation and trade for Platinum. In the short term, we can continue to see the range price action.

The previous cycle lasted approximately 3100 days (8.5 years)

I believe we will see a Platinum price of $4000-5000 by 2037.

The next platinum cycle is around the corner. A trendline break will spark the next platinum bull market. For now, I will be accumulating as much platinum as possible. This opportunity can lead to a 4-5x.

If you believe in the fundamentals and idea of this setup, feel free to use and follow it.

Not financial advice.

Platinumlongterm

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

PLATINUM IS COMPLETELY UNDERVALUED, BUY NOW!TVC:PLATINUM CAPITALCOM:PLATINUM

Platinum is absolutely undervalued and is currently trading at only $975 USD.

The Gold to Platinum Ratio just hit a new all time high with the Current Ratio being 3,09 even though Platinum has traded since the 1970s till 2016 at a consistent average of 1:1. Gold's all time low against Platinum was at 0,42 in June 2008; AKA the 'Great Financial Crisis'.

Every single indicator shows that right now is the perfect time to buy Platinum especially because the 'Gold rush' is in its absolute final stages.

Keep in mind that Platinum is around 15 times rarer than Gold on Planet Earth.

May fortune favor the bold, and as always - DYOR NFA ! ;)

CYANE

In Platinum, Triangle formed. 1st Target 1882, 2nd Target 2763.Triangle Pattern formed in Platinum Future, wait for the Breakout. Because Breakout is the Confirmation market move to the Bullish Trend. And 1st Target price is 1882, 2nd Target price 2763.

This is for Long Term Analysis.

I want to help people to Make Profit all over the World.

PLATINUM BREAKOUTS X 3 Platinum Futures

At present Precious Metals all seem to have the wind at their back on longer timeframes.

- A H&S pattern with a potential breakout within a

- Cup&handle with a potential breakout within a

- A long term pennant with a potential breakout.

RSI Indications

- You can see how the green/red circles and resistance lines provided great entries and exits.

- We are approaching the upped resistance line and I would expect some resistance here which aligns with the resistance of the Cup and Handle (which aligns with historic price resistance)

- Use the RSI resistance lines to help manage risk.

In summary I am long term bullish however if we breach the bottom of the long term pennant... we exit the trade. RR is great here if you set a stop under the pennant resistance, this being for a long term 36 - 60 motnh trade.

There are also lots of short term opportunities in this chart from the three patterns identified. These you can see and manage within your own timelines using the chart lines as reference points for buy and sells.

Thanks

PUKA

Will Platinum price explode to the upside?Since the Platinum Bobble burst back in 2008, the price was unable to recover, regardless of the all-time high on other PMs.

However, looking at the weekly posted chart we can see that the low after the burst held extremely strong, and after January's higher low, XptUsd also has broken above the falling trend line.

At this moment the road to 1350 resistance is cleared (medium term) and, a break above this level could lead to further gains to 2k in the long term.

Huge return on platinum for the next couple years This forecast is for investors, now you look at the global events and find some volatility on gold and silver prices as a safe haven also platinum has the same rule but what makes platinum is the best opportunity right now is the current price has fallen enough to reach the desired support

at 770 $- 820$ area I expect the price to continue going down the path to these levels.

Platinum’s prices are likely to rebound since it's used in manufacturing. It also has a future in renewable energy requests. As an investment, platinum may be useful in a variety of ways, including hedging and speculating. However, If you want to include platinum or any of the precious essences in your portfolio, I will recommend that.

For the position, I recommend a buy order on 770-820 level

with 1 Buy limit order at 590 -620 area with the same amount of the first position

last Buy limit at 405- 425 area just in case the price make a strong move against us with 4x amount of the first position

Our targets::

1ST Target 1284 $ - 1320 $ area

2nd Target 1850 $ - 1900 $ area

============================================

The Period of investment starts from 6 months to 3 years (estimated)

I had given you the areas letting you manage your position

Commitment to strategy will bring you the best benefit of the strategy

we expect 130% to 250% return for 3 years of investment

Cup and Handle May be formcup and handle is not a typical pattern but i see it a lot😎

. we have divergence

. volume might rise

. wyckoff is rising

Platinum Wyckoff analysis, Accumulation! 2150 TARGET!Platinum is in Phase D of an accumulation.

It breached a 13 year long trend that lasted from the all time highs in 2008 to the upside.

I'll be entering my long term trade around the 935/920 area.

The price is coming down to retest the long-term trend-line, and will be hitting 2150 according to my point and figure calculations.

Platinum is one of the most used metals in the electric car manufacturing industry, which supports the bullish bias, given the fact that huge oil companies are switching to environmentally friendly solutions.

If you like the idea consider liking it, following me, and supporting me.

Peace.

TrickleDown FX

Platinum - will rise If gold goes up.

I think platinum will rise as well.

What do you think?

Here's the analysis on gold.

You will learn the best place where we can trade this instrument at low risk.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

PLATINUM - monthly supportPreconditions:

- key level

- buy after break out

- locally uptrend

- global uptrend

You will learn the best place where we can trade this instrument at low risk.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Platinum - 2nd Target achieved ✔️✔️This was our FIRST VIDEO of the year , maybe watch it now if you haven't already. Trading 101 paid profits and dividends twice.

Now let's go for more - 2 target profits left: here

My friend Kaush says that:

It’s 8% away from its 20 ema

it’s pullbacks have been roughly 13%

in the past max it’s gone is 10% away from its 20 ema before doing a pullback

What does that mean? Well, it is basically a train going 300 miles per hour. Hard to get on it, happy to be on it. The secret is to buy the dips at the right price (that's why we share with you here).

what's next? #platinumlongterm 👈

The Platinum bull market has begun...REPOSTApologies, the previous idea came out weird.

As can be seen a downward pointing wedge has been formed from 12 years of price action. In the last month the platinum price has broken out. Large patterns usually have large movements, when they're broken and I expect the price to march higher.

Platinum- 1200 on medium term?November was quite a month for Platinum with the price rising 30%, but most importantly with a significant break above 1000 psychological and technical resistance, a resistance that held since 1017.

At this point, the price is in a normal and necessary correction, and confirmation of 1k as new support would bring bulls into the market and the price can rise to the next important zone at 1200.

Buying at 1010-1020 zone could be a great trade for the medium-term and only a drop under 950 would change this bullish outlook

Platinum Playing Catch Up?Looking at the Platinum monthly chart, we see a very large pattern has formed. This is a long term analysis, but judging from the current economic conditions and the fact that the FED will continue to print money and devalue fiat currency, the metals market will likely see slow steady growth over the next few years. Platinum is looking very strong, a break of the downtrend could trigger a large thrust up and be the start of the platinum bull market. Fingers crossed, happy trading to you all.

Stay calm, patient, and level headed.

Platinum Palladium Ratio has Bottomed. Platinum bull market will look to begin in the next 6-8 months based on past performane when this ratio breaks higher from a bullish downward pointing wedge. Once this occurs a platinum bull market usually follows. Watch with anticipation and it would be prudent to prepare for some platinum purchases in the next few months.

Platinum looks like it's trading in a long term bull flag. I find it hard to believe this pattern is a descending triangle, we've just seen the dark blue baseline of the pattern hold support, considering the Macro environment I'm expecting this pattern to finish with a bullish outcome.

The RSI is slowly starting to create a Macro higher high, if we see the RSI continue to creep above the blue line we will see some strong price action to the upside, potentially parabolically given how other metals like gold, silver & palladium have been trading recently.

The DPO is closing above 0 for the first time since roughly 2012, we have seen the DPO touch 0 multiple times over the years but the DPO has never really closed above it since 2010 until more recently, very interestingly bullish.

It's always possible this pattern plays out bearishly, nobody knows for sure, safe trading.