Platinum Breakout Stalk: Thief Entry Only After Confirmed🧠 Thief's Heist Plan Activated!

Asset: XTI/USD (PLATINUM) 💎

Strategy: Bullish Pullback + Breakout Play 💥

🔍 We stalking platinum's neutral zone… waiting for that clean breakout!

No early entries, no premature SLs. Discipline = Profits. 🎯

🎯 Entry: After breakout confirmed. Use multiple DCA limit orders to layer in like a ghost.

🔐 Stop Loss: ONLY after breakout – Place at 1280.00 🛡️

💎 Target: 1560.00 – Vault unlock point! 💰

📵 DO NOT place SL or orders before breakout – patience is the thief’s edge. 🧘♂️

This isn’t gambling... this is precision trading. Breakout = green light 🚦

Get ready to raid the platinum vault!

#ThiefTrader #BreakoutStrategy #PlatinumHeist #XTIUSD #BullishSetup #SmartMoneyMoves

Platinumusd

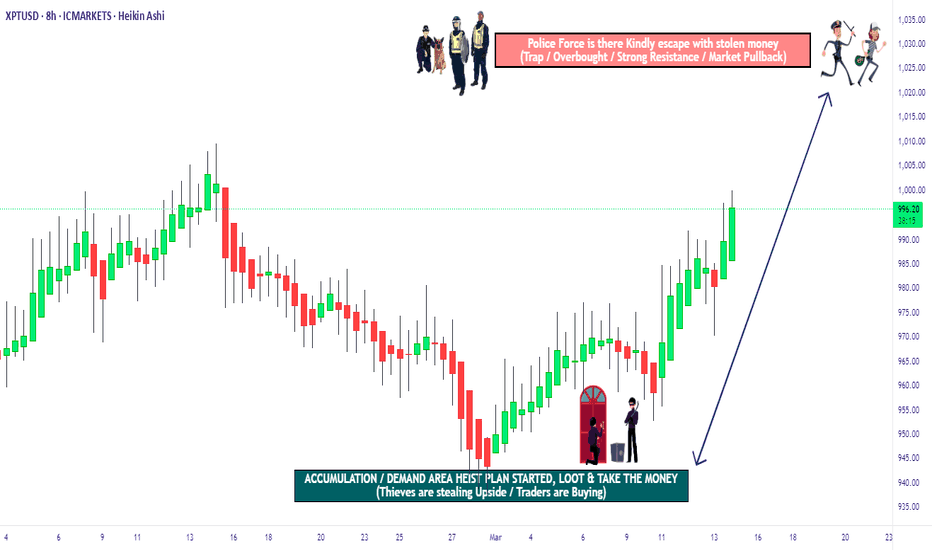

XPT/USD "The Platinum" Metals Market Bull Heist Plan (DAY Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (935.000) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1015.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XPT/USD "The Platinum" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Supply and Demand Factors, Future trend targets with Overall outlook score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XPT/USD "The Platinum" Metals Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (975.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (945.000) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1004.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XPT/USD "The Platinum" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

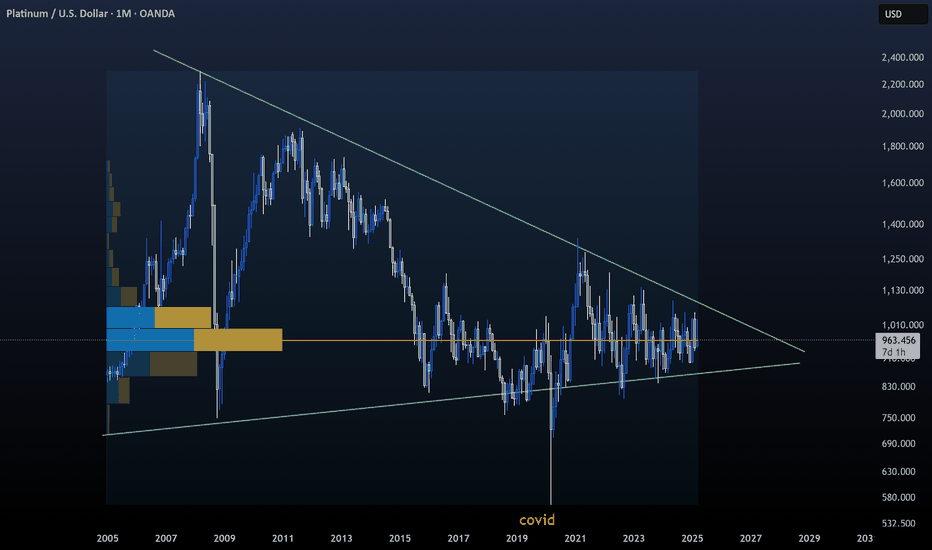

Long Term BUY PlatinumThis is a long-term accumulation and trade for Platinum. In the short term, we can continue to see the range price action.

The previous cycle lasted approximately 3100 days (8.5 years)

I believe we will see a Platinum price of $4000-5000 by 2037.

The next platinum cycle is around the corner. A trendline break will spark the next platinum bull market. For now, I will be accumulating as much platinum as possible. This opportunity can lead to a 4-5x.

If you believe in the fundamentals and idea of this setup, feel free to use and follow it.

Not financial advice.

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

XPT/USD "The Platinum" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (970.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1025.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XPT/USD "The Platinum" Metals Market is currently experiencing a bullish trend,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XPT/USD "Platinum vs US Dollar" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "Platinum vs US Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1070.000 (or) Escape Before the Target

🔵Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XPT/USD "Platinum vs US Dollar" Metals Market is currently experiencing a Bullish trend., driven by several key factors.

🟢Fundamental Analysis

Demand and Supply

- Demand for Platinum is increasing due to its use in catalytic converters and investment appeal.

- Supply disruptions in South Africa, a major Platinum producer, may impact global supply.

Market News

- Platinum prices rose 1.5% yesterday due to increased demand and supply concerns.

- The US dollar index is down 0.2% today, supporting precious metal prices.

⚪Macro Economics

- Global Economic Outlook

The global economy is expected to grow at a slower pace in 2025, with a forecast of 3.0% global GDP growth rate.

- Interest Rates

The US Federal Reserve is expected to keep interest rates on hold in the near term, while the European Central Bank is expected to maintain its accommodative monetary policy stance.

- Inflation

Inflation expectations are muted, with the US Consumer Price Index (CPI) expected to rise by 2.0% in 2025.

- Geopolitics

Geopolitical tensions between the US and China remain a concern, with the potential to impact global trade and economic growth.

🔴Trader Positioning

Institutional Traders

52% short, 48% long

Retail Traders

55% long, 45% short

Hedge Funds

50% short, 50% long

COT Report

Non-Commercials (Speculators)

net long 5,500 contracts

Commercials (Hedgers)

net short 3,500 contracts

🟠Market Sentiment

Retail Sentiment

Bullish (55% of retail traders are long)

Institutional Sentiment

Bearish (52% of institutional traders are short)

Hedge Fund Sentiment

Neutral (50% of hedge funds are short, 50% are long)

🟡Overall Outlook

Based on the analysis, the overall outlook for XPT/USD is bullish in the short term, driven by increasing demand, supply concerns, and a bullish market sentiment. However, the pair may experience a short-term correction due to the bearish sentiment among institutional traders.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XPT/ USD "PLATINUM" Metals Market Heist PlanHola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XPT/ USD "PLATINUM" Metals Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 2H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

XPT/USD "Platinum" Market Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XPT/USD "Platinum" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 30m timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

In Platinum, Triangle formed. 1st Target 1882, 2nd Target 2763.Triangle Pattern formed in Platinum Future, wait for the Breakout. Because Breakout is the Confirmation market move to the Bullish Trend. And 1st Target price is 1882, 2nd Target price 2763.

This is for Long Term Analysis.

I want to help people to Make Profit all over the World.

Platinum welcomes Bull Market since April 2023SInce April, we've seen the price on a strong decline from $1,143 down to $843.

It then reached a low and has consolidated around forming a Triple Bottom.

The price has broken above the downtrend along with the neckline of the pattern.

This means, we are ina bull market.

But hold up. There are two ways this can go.

EIther the market continues to consolidate and move sideways which will be a drag holding onto platinum longs. Or the bulls will do what they can to push up and take us to the target.

With the Santa Claus Rally on the way and the positive sentiment reverberating world-side, I can only hope for the latter.

My first target will be $1,094.00.

Decoding Market Trends: Platinum's Dance with AI-Predicted ShiftDear Esteemed TV Members,

P latinum has been swaying within a bearish trend. However, insights from Support Vector Machines (SVMs) applied to daily candles suggest a potential weakening of this bearish momentum. This predictive analysis, coupled with a possible rising channel pattern on the Relative Strength Index (RSI), indicates that the bearish trend might be approaching its conclusion, paving the way for a potential shift towards a bullish scenario.

S VMs, a formidable machine learning algorithm, serve a dual purpose in classification and regression tasks. In market analysis, SVMs are invaluable for identifying candlestick patterns, forecasting price momentum, and pinpointing crucial support and resistance levels. As per my SVMs, Platinum's price seems to be on the verge of entering a support zone, marked by the blue rectangle on the chart. This support zone could act as a catalyst, drawing in sufficient demand to instigate a reversal of the trend into a bullish trajectory.

V isualizing this potential scenario, I've outlined it with blue arrows and proposed a long position in the chart. However, a word of caution: Should Platinum experience a downturn below the outlined demand zone (as indicated by the purple forecast), it would be prudent to steer clear of the long position. In such a scenario, an alternative bullish outlook may emerge, capitalizing on Platinum's oversold conditions—a phenomenon observed previously on March 19, 2020, and a possibility hinted at in the alternative blue forecast.

Happy Trading!

A crucial disclaimer accompanies this insight: This is not investment advice, and the responsibility for trading decisions rests solely with the individual. It's imperative to conduct thorough research, exercise caution, and embrace effective risk management strategies.

Best regards,

Ely

Platinum's Bearish Path: A Closer Look at the Price ActionPlatinum continues to be confined within a persistent bearish channel, characterized by a pattern of lower highs and lower lows in its price movement. This ongoing trend suggests a prevailing bearish sentiment in the market. As the price of platinum remains locked within this channel, there is a possibility of a new bearish impulse emerging.

Given the current market conditions and the downward trajectory of platinum, our target for the foreseeable future remains at $985. This target signifies a further decline in the price of platinum, aligning with the prevailing bearish outlook. Traders and investors should closely monitor the price action and market developments to assess potential opportunities within this bearish context.

PLATINUM BREAKOUTS X 3 Platinum Futures

At present Precious Metals all seem to have the wind at their back on longer timeframes.

- A H&S pattern with a potential breakout within a

- Cup&handle with a potential breakout within a

- A long term pennant with a potential breakout.

RSI Indications

- You can see how the green/red circles and resistance lines provided great entries and exits.

- We are approaching the upped resistance line and I would expect some resistance here which aligns with the resistance of the Cup and Handle (which aligns with historic price resistance)

- Use the RSI resistance lines to help manage risk.

In summary I am long term bullish however if we breach the bottom of the long term pennant... we exit the trade. RR is great here if you set a stop under the pennant resistance, this being for a long term 36 - 60 motnh trade.

There are also lots of short term opportunities in this chart from the three patterns identified. These you can see and manage within your own timelines using the chart lines as reference points for buy and sells.

Thanks

PUKA

PLATINUMHELLO GUYS THIS MY IDEA 💡ABOUT PL1! is nice to see strong volume area....

Where is lot of contract accumulated..

I thing that the buyers from this area will be defend this LONG position..

and when the price come back to this area, strong buyers will be push up the market again..

UP TREND + Resistance from the past + Strong volume area is my mainly reason for this long trade..

IF you like my work please like and follow thanks

Platinum Analysis & Trade IdeaPlatinum has reached an important poi. Could be poised to take a fall.

It may take some time, as the USD has been weakened by slightly better inflation news, so we'll see.

The D1 momentum is bullish , currently, so waiting for confirmations for sells is the best course of action.

Look for bearish price action at current levels.

Jamie Gun2Head Trade - Selling Platinum Trade Idea: Selling Platinum

Reasoning: Bearish outside candle on daily chart, head and shoulders top forming?

Entry Level: 925

Take Profit Level: 887

Stop Loss: 936

Risk/Reward: 3.45:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Platinum USD long 1D Time Frame The trend of Platinum USD on the 1D time frame is showing a reversal. Firstly you can see a downtrend in the form of LH and LL then at the bottom, you can observe the HH and HL which is a sign of trend reversal or consolidation phase. So you can buy from here by putting a stop loss at the LL point mentioned in the chart.

Platinum- Good 1:3 R:R tradeAfter rising above 1k in mid-April, Platinum has started to roll back down and has dropped to 900 zone important support (see daily chart).

After reaching this support the price started to consolidate last week and finally has broken up.

Now the price came to confirm this break and is trading in the last resistance now support zone.

I expect a new leg up above 1k and I will remain bullish as long as the price is above daily support

Platinum backtest complete. Violent rallies ahead for 2022.Platinum has completed a backtest on the upward resistance line (now support) of the bearish wedge pattern it has been trapped in for 12 years.

A breakout and a retest is incredibly bullish and i'd expect the price to reflect the set up we are seeing by 2023/2024 by reaching old highs.

PLATINUM for a lower low 🦐 PLATINUM on the daily chart is trading over a weekly dynamic support.

The price after the test of the 0.5 Fib level has been rejected and potentially can create a lower low.

According to Plancton's strategy if the market will break below and satisfy the ACADEMY rules we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.