EUR/PLN SHORT Investment Opportunity 4HHello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently on a 4-hour (4H) chart, and some technical indicators suggest increasing bearish pressure. The overbought signals and the loss of momentum suggest that we could be facing a possible bearish reversal, making this configuration particularly interesting.

Here is the Investment Setup:

The entry price for the trade is set at 4.2854.

There is a SELL signal with a target price set at 4.2066, corresponding to a TP of 1.85%.

The stop loss is set at 4.2593, corresponding to a SL of 0.61%.

This short position offers a favorable risk/reward ratio, taking advantage of the current bearish pressure and the possible confirmation of a bearish trend on EUR/PLN.

As always, I encourage you to monitor this setup carefully and apply strategic and conscious risk management to your trading plan. Happy trading! 📉

Pln

EUR/PLN 4H SHORT Selling Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently in a 4-hour chart (4H) and my indicator "WaveTrend + Multi-Timeframe Alerts", published in the SCRIPT section of my TradingView profile, signals an overbought situation both at 4H and 8H. In addition, we are also in a downtrend phase, so we have more signals that support this opportunity.

In the attached chart we can observe the following details:

The current price is around 4.62400.

There is a SELL signal with a target price set at 4.61400, corresponding to a TP of 1.06%.

The stop loss is set at 4.63400, corresponding to a SL of 0.32%.

The suggested short position has a favorable risk/reward ratio.

These combined signals indicate a potential downtrend reversal, making this setup particularly interesting for investors looking for short selling opportunities on EUR/PLN.

I encourage you to monitor this setup closely and act prudently, always considering risk management in your trading plan. Happy trading!

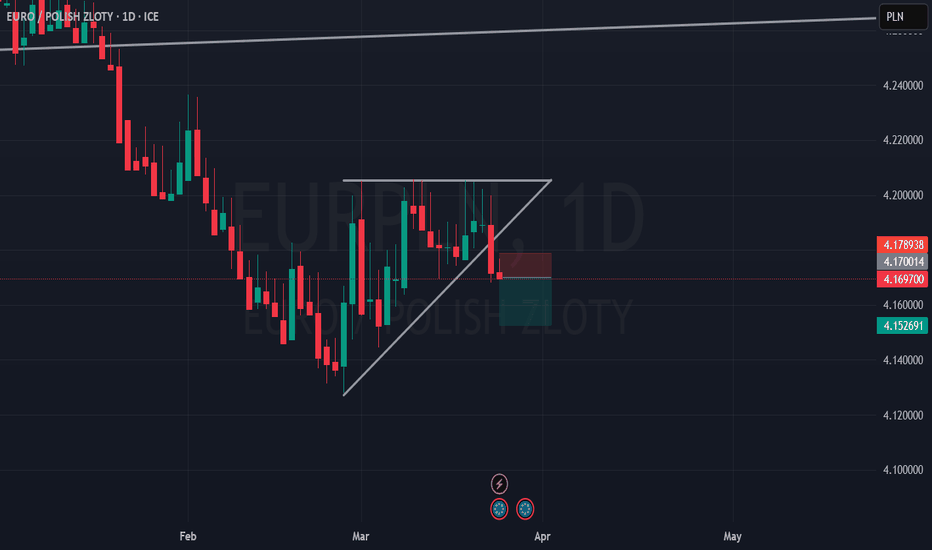

EURPLN Short Trade SetupAfter conducting an analysis on EURPLN, we are excited to present our trade setup.

This opportunity boasts a favorable risk/reward ratio, although it does require patience due to a longer waiting period.

Nevertheless, swing traders may find this setup intriguing and worth considering.

EUR/PLN Bearish Momentum Building Below 200 EMA

⚫Back in April 2024, the EUR/PLN pair tested the 4.2500 support zone, where a triple bottom was established. Over the past five months, the price has consistently failed to break below this level. Simultaneously, we can identify a resistance area near 4.3750, where a double top was formed, indicating a clear trading range between 4.2500 support and 4.3750 resistance—a classic example of range trading.

⚫Looking at the broader picture, in January 2024, the 4.4100 area, previously a support level, flipped to become resistance, confirming the continuation of a long-term bearish trend. Additionally, EUR/PLN remains below the 200 Exponential Moving Average, further reinforcing the likelihood of continued downward movement.

⚫Recent price action, particularly from an Elliott Wave perspective, suggests the formation of an ABC corrective pattern, which was halted at the 4.3311 resistance level, precisely aligning with the Volume Profile. (For those unfamiliar, the Volume Profile highlights the price level where the most trading volume occurred.)

⚫Analyzing the potential Elliott Wave count, EUR/PLN appears to be progressing into the strongest downward wave—wave 3. Overall, the technical outlook remains exceptionally bearish for the long term. As a downside target and potential final support for the 5-wave decline, we can consider the double 227.2% Fibonacci support, located around the 4.1425 area.

⚫While the odds strongly favor the downtrend, it's crucial for traders to remain vigilant. In the event that the price breaks above the 4.3750 resistance, it could signal the beginning of a shift from a bearish to a bullish trend.

Trade Like A Sniper - Episode 46 - USDPLN - (17th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USDPLN, starting from the 3-Month chart.

If you want to learn more, check out my TradingView profile.

USDPLN D1 Bullish - front running Interest Rate decisionAs the inflation is near 2% in Poland, yet the Interest Rates were not cut for a while, I am expecting big positioning in favor of US Dollar.

Unstable situation in the region is also a + for this trade idea.

The stop loss for me is 3.895 and I am looking to take partials at 4.05, 4.10 and targeting 4.20 for USDPLN.

4.25$ SupportDollar once again hit 4.25$ level which was resistance from 2016 to february 2022 when price went above and this way created support which was tested in may/june 2022, january/february 2023 and right now. It seems solid so I would expect 5$ level retest in the near future and that way creating double bottom on current support. But if price will go below 4.25 and the volumen will be significant it can fall down. On 12th April US CPI level is going to be published and on 14th April PL CPI. Having up-to-date information, I do not plan to open a position earlier than next week.

Time to short the Polish ZlotyThe idea is very simple... Despite it having a significantly higher interest rate than the US, capital isn't flowing in the country. Poland is in a very tough place right now, as it has a relatively small economy and doesn't have a currency that is widely used. Europe overall is a big mess, and the PLN is affected by the EUR too. The ECB still has rates at -0.5% and Poland has rates at 6%, yet EURPLN is near its ATHs. In the charts below you can see how bad EURUSD looks, which I think will go below 1.03 to sweep the lows and then maybe bounce for a while, and how EURPLN might have formed a massive top. Therefore it might be a better idea to short EURUSD than going long USDPLN (short PLNUSD), as it will have a lower carry.

Yet the structure of USDPLN is much cleaner, and a breakout could be massive. I definitely expect to see the USDPLN highs swept, then a pullback and then continuation higher. This consolidation looks very bullish, and a breakout would potentially lead to a major expansion over time. The main fundamentals behind this is that Poland can't sustain such high rates with such high energy prices as the economy will collapse, and at the same time it does look like Poland would be one of the next countries that Russia will attack. Unfortunately it feels like a matter of time until Russia fully conquers Ukraine, something that will hurt Poland very badly due to its ties with Ukraine, and then it feels like a matter of time until they begin their next war.

USD.PLNThe reading, preliminary, of CPI inflation for July did not bring much surprise. The dynamics amounted to 15.5% y/y equaling the June reading. A large part of the market assumed that a month ago we observed a peak in dynamics, meanwhile we received a flattening. From the MPC's perspective, this doesn't change much (sub-1x25b expected). Interestingly, we received a comment from the PFR today suggesting still a space of 50-75bp.

USDPLN looks like PLN will get stronger despite inflation scareLong term chart of USDPLN

Charts like to tell the future. That is why i treat them like a magic device.

Despite huge PLN inflation at more than 4% it looks like it will grow stonger against two giants like USD and EUR. Both charts look very similar.

Saving this chart for future reference.

Good luck.

Buy the breakout CONFIRMATIONPatience... allow for the 4H candle to close ABOVE the red resistance, than purchase confirmation which closes also above.

Things to be aware off - failed confirmation might possibly lead to Wyckoff Accumulation Schematics.

Further idea development will be described as scenario unfolds...

EURPLN lookout for headwindIt looks like PLN will get stronger despite the inflation.

Isn't it perfect to get everyones attention to growing money supply (inflation) and at the same time make the currency stronger?

How is that possible? I am not a fundamental analyst so i can't tell you how the mafia operates but one thing for sure is the less people know, the more money for those that call the shots and take you by surprise.

Calling EUR aswell as USD to get weaker against PLN in coming months.

Good luck.

EURPLN for new recent highs 🦐EURPLN is moving inside an ascending channel and the price is now near to monthly structure .

Currently the market is consolidating below a minor resistance.

According to Plancton's strategy if the price will break above we can set a nice long order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.