PLTR Earnings About To Print

## 🚨 PLTR Earnings Incoming: +80% Confidence Call Setup into AI Boom 🚀

**🧠 Palantir Technologies (PLTR) Earnings Analysis – August 8, 2025 (AMC)**

**📈 Position:** \$165 Call | 🎯 Entry: \$6.45 | 💰 Target: \$22.58 | 🛑 Stop: \$3.23

**🕒 Entry Timing:** Pre-Earnings Close | Expiry: Aug 8, 2025

---

### 🔍 Quick Breakdown:

* 📊 **Revenue Growth:** +39.3% TTM – AI sector leadership

* 💰 **Margins:** 80% Gross | 19.9% Operating | 18.3% Net

* 🧾 **EPS Beat Rate:** 88% | Avg Surprise: +10.7%

* 📉 **Debt-to-Equity:** 4.43 – watch rates & debt risk

* 📈 **RSI:** 66.88 – strong momentum, near breakout

* 📊 **Volume:** Above average – institutional accumulation

* 🧠 **Options Flow:** Heavy \$165/\$170 call OI = bullish gamma exposure

* 🛡️ **Support:** \$151.94 | 📌 Resistance: \$161.24

* 🔭 **Macro Tailwinds:** AI + defense demand + sector rotation into tech

---

### 🧠 Trade Thesis:

Strong fundamentals + bullish options flow + tech sector tailwinds = **High-probability breakout**

🧨 **IV Rank: 0.75** – Big move priced in

💡 Likely to squeeze if results exceed expectations

---

### 💼 Trade Setup (Recap):

```

💎 Ticker: NASDAQ:PLTR

🔔 Direction: Long Call

🎯 Strike: $165

💵 Entry: $6.45

🎯 Profit Target: $22.58 (250%+)

🛑 Stop Loss: $3.23

📅 Expiry: 2025-08-08

📆 Earnings: August 8 (AMC)

🧠 Confidence: 80%

```

---

### 📌 Hashtags for TradingView:

```

#PLTR #EarningsPlay #AIStocks #TechMomentum

#OptionsTrading #GammaSqueeze #CallOptions

#UnusualOptionsActivity #Palantir #EarningsSetup

#TradingViewIdeas #VolatilityPlay #RiskReward

#AI #DefenseStocks #SwingTrade

```

---

💬 **TL;DR:** PLTR earnings are set to rip. Revenue surging, margins healthy, call options stacked, and momentum rising. Are you in before the AI-driven explosion?

Pltrcalls

PLTR WEEKLY TRADE IDEA – AUG 2, 2025

📈 **\ NASDAQ:PLTR WEEKLY TRADE IDEA – AUG 2, 2025** 📈

⚡️ *Earnings Week Setup – Mixed Signals, But Bullish Flow*

---

🧠 **SENTIMENT SNAPSHOT**

• Call/Put Ratio: **2.29** = Bullish

• Volume Ratio: **1.1x** = Weak breakout support

• VIX: **20.38** = Normal vol, clean setups possible

📉 **RSI DIVERGENCE WARNING**

• Daily RSI: **56.3 (falling)** – losing steam

• Weekly RSI: **71.2 (overbought + falling)** – 🔻Bearish divergence

➡️ *Momentum fading, caution advised*

📊 **INSTITUTIONAL FLOW**

• Strong call buying ahead of earnings

• But... price not confirming = possible **profit-taking**

⚠️ **EARNINGS RISK ALERT**

• Earnings = this week

• Could inject volatility or invalidate setup – size small & use stop

---

🔥 **TRADE IDEA** 🔥

🟢 Direction: **CALL (LONG)**

🎯 Strike: **\$160**

💰 Entry: **\$6.80**

🏁 Target: **\$12.25** (80%+ gain)

🛑 Stop Loss: **\$3.40** (50% risk)

📆 Expiry: **08/08/2025**

⚖️ Confidence: **65%** (moderate risk, macro-backed)

⏰ Timing: **Buy Monday Open**

---

🔎 **STRATEGY TAGS**:

\#PLTR #WeeklyOptions #EarningsPlay #MomentumTrade #SmartMoneyFlow

---

📌 Final Thoughts:

Mixed momentum + strong call volume = **potential breakout**, but **momentum cracks** say **don’t chase blindly**. Small size, tight stop, defined risk = smart approach here.

🚀 *Save + Follow for more option setups each week!*

PLTR WEEKLY TRADE IDEA (07/28/2025)

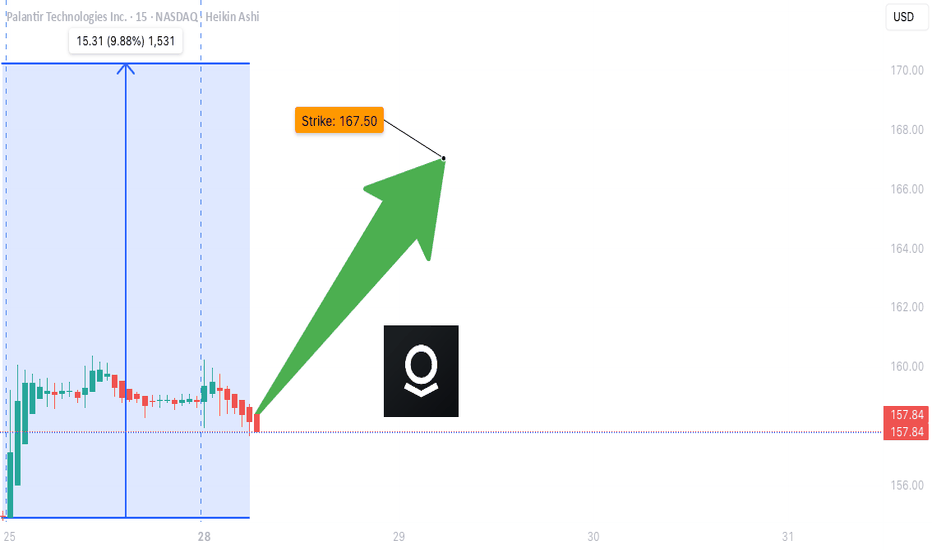

**🚀 PLTR WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Momentum is 🔥 but Volume is the Missing Ingredient**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 71.9 ⬆️ (🚨 Overbought but still rising)

* **Weekly RSI:** 76.7 ⬆️ (📢 Clear Bullish Strength)

➡️ *Strong upside pressure, but entering the overbought zone*

📉 **Volume Insight:**

* Weekly Volume = **0.8x last week**

⚠️ *Weak institutional conviction during the breakout = yellow flag*

🔍 **Options Flow Check:**

* **Call/Put Ratio:** 1.09 = *Neutral*

➡️ Balanced flow = *no aggressive buying yet*

🌪️ **Volatility Environment:**

* **VIX = 15.4**

✅ Favorable for directional trades — low IV supports premium growth

---

📊 **Model Consensus Recap:**

✅ Bullish RSI momentum (unanimous)

✅ Volatility ideal for long calls

⚠️ Volume flagged as a concern by some models

📌 Final stance: **MODERATE BULLISH**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$167.50

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.74

* **Profit Target:** \$1.48 (🟢 2x return)

* **Stop Loss:** \$0.37 (🔻-50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Watch:**

* 📉 Weak volume = possible consolidation before next leg up

* ⏳ Premium decay risk into expiry

* 📊 No strong institutional footprint = stay nimble

---

📌 **JSON FORMAT TRADE DETAILS (Automation Ready):**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 167.50,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.48,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.74,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 10:13:40 EDT"

}

```

---

🔥 TL;DR:

* Momentum is undeniable ✅

* Volume = suspect 🟡

* VIX = Green light for directional play ✅

💬 **\ NASDAQ:PLTR Bulls, are you ready or waiting for volume confirmation?**

\#PLTR #OptionsTrading #BullishSetup #UnusualOptions #MomentumPlay #TradingView #StockMarket

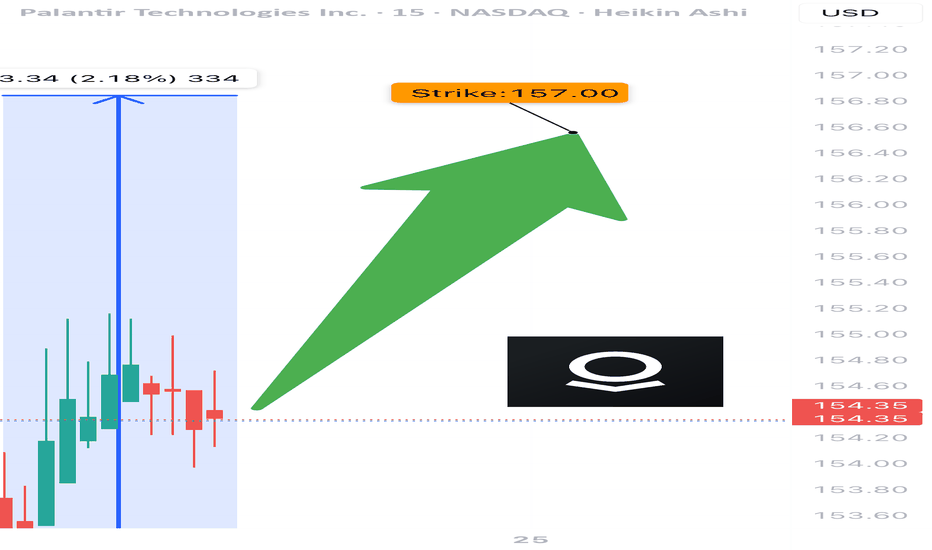

PLTR TRADE SIGNAL (07/24)

🚨 PLTR TRADE SIGNAL (07/24) 🚨

💥 Expiry in 1 day = HIGH GAMMA risk = BIG MOVES coming

🧠 Key Highlights:

• Call/Put Ratio: 1.40 → bullish options flow

• Strong institutional positioning 📈

• RSI cooling off = ⚠️ watch momentum

• Volume concerns → cautiously bullish

💥 TRADE SETUP

🟢 Buy PLTR $157.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $0.89 (50%+)

🛑 Stop: $0.24

📈 Confidence: 65%

⚠️ Gamma + Time Decay = explosive but risky. Tight execution needed.

#PLTR #OptionsAlert #OptionsFlow #UnusualOptionsActivity #TechStocks #DayTrading #GammaSqueeze #TradingView #BullishSetup #CallOption

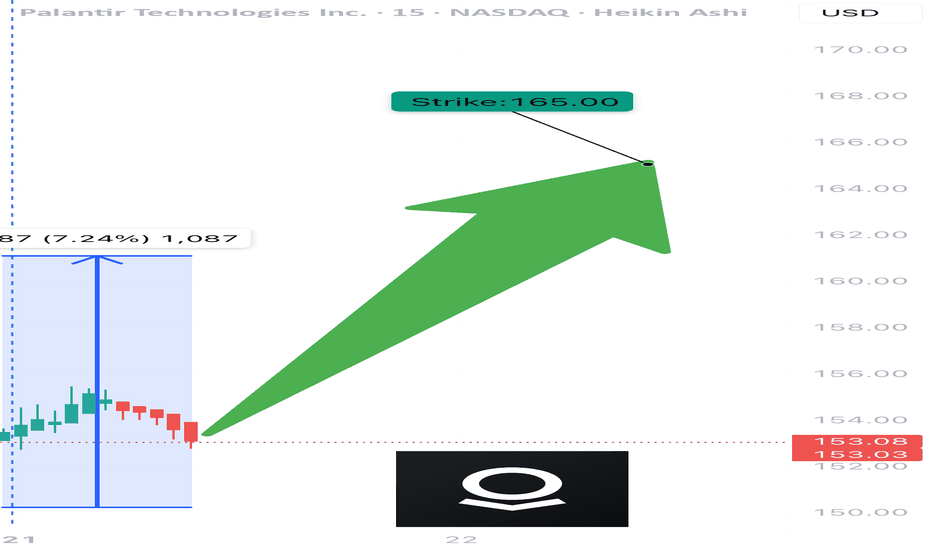

PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025

🔥 NASDAQ:PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025 🔥

Bullish Momentum + Strong Options Flow = Prime Setup 📈

⸻

📊 TRADE SETUP

🎯 Instrument: NASDAQ:PLTR

📈 Direction: CALL (LONG)

💵 Strike Price: $165.00

🟢 Entry Price: $0.59

🛑 Stop Loss: $0.30 (50% risk cap)

🎯 Profit Target: $1.18 (2x reward)

📅 Expiry: July 25, 2025 (Weekly)

📏 Size: 1 contract

💪 Confidence: 75%

⏰ Entry Timing: Market Open

⸻

📌 Why This Trade?

✅ RSI Strength: Daily RSI = 71.0 | Weekly RSI = 75.3 → Bullish continuation

✅ Weekly Range Positioning: Trading at 96.6% of weekly high

✅ Options Flow: Call/Put ratio = 1.47 — institutional bullish bias

✅ Strike Interest: Heavy OI @ $162.50 & $165.00 = strong magnet zones

🟡 VIX = 16.6 → Favorable volatility for short-term premium plays

⚠️ Volume is flat (1.0x) — no surge confirmation, so keep stops tight

⸻

🧠 Execution Plan

• Open position at the bell

• Mental stop at -50%, or ~$0.30

• Target 100% return = ~$1.18

• Exit ahead of Friday’s expiration unless the trade hits target early

⸻

💡 Key Levels to Watch

🔹 Resistance Zone: $155.68 – $156.59

🔹 Support Watch: Below $152 could break structure

🔹 Earnings Risk: Check calendar — volatility can spike unexpectedly

⸻

🏁 Verdict

• Momentum = 🔥

• Flow = 🚀

• Volume = 😐

➡️ Net Bias: MODERATE BULLISH — Risk-managed call with solid R:R

⸻

NASDAQ:PLTR Call @ $165 — Entry $0.59 → Risk $0.30 → Target $1.18 💥

Clean setup for disciplined bulls. Don’t overstay. Ride momentum. 🎯

⸻

#PLTR #OptionsTrading #WeeklyOptions #MomentumPlay #CallOptions #FlowTrade #TradingView #StockSignals #TradeSetup #RiskReward #SwingTrade #SmartMoneyFlow

"Steal the Market: PLTR Trading Strategy Revealed!"🌟 Hola, Money Snatchers & Market Rogues! 🌟

Ready to hit the vault? 💰💸✈️

Here’s the ultimate plan for lifting loot from PLTR (Palantir Technologies Inc.) using the infamous Thief Trading Style. This is no rookie job—we’ve got the techs and the fundamentals to nail the target. Our sights are locked on the high-stakes Red Zone: nuclear resistance, overbought territory, trend reversals, and that sweet electric trap where traders and bearish bounty hunters lie in wait. 🏆💸 It’s time to bag those profits and live like a kingpin!

Entry Point 📈:

Doors are wide open! Snatch that bullish loot at any level—it’s a free-for-all! For extra stealth, set your buy limits around recent 15–30 min swing highs or lows. Pro tip: throw in some chart alerts to stay ahead of the game.

Stop Loss 🛑:

Our Thief SL lands at the recent 2h swing low (116.00) on a swing-trade basis—tight enough to dodge the cops but wide enough to let the heist breathe. Adjust based on your bankroll and risk appetite—don’t get greedy, and always plan your getaway.

🏴☠️ Target 🎯: 152.00—or duck out early if the sirens start blaring!

🧲 Scalpers, listen up 👀:

Only scalp on the long side—no backstabbing shorts here! If you’ve got the bankroll, go all-in; otherwise, team up with swing traders and ride the big wave. Use a trailing SL to keep your loot safe from sudden ambushes.

PLTR (Palantir Technologies Inc.) is on a bullish tear—thanks to a mix of market signals and that sweet fundamental juice:

📰🗞️ Stay locked in with the latest—fundamentals, macro reports, COT updates, geopolitical heat, sentiment, intermarket moves, index breakdowns, position shifts, and trend forecasts. Link’s in the bio—don’t miss it! 👉👉👉

📌 Pro Tip: Markets can flip faster than a getaway car—stay sharp and ready to pivot.

⚠️ Trading Alert:

News drops can spike the alarm system—here’s how to keep your loot safe:

🚫 Skip new trades during releases

🚏 Lock in profits with trailing stops—no one likes getting caught!

💖 Show some love for the crew—💥 Smash that Boost Button 💥—and keep the Thief Trading Style alive. Let’s make bank every day like true market outlaws! 🏆💪🤝❤️🎉🚀

Stay tuned—another big score’s just around the corner! 🤑🐱👤🤗🤩

$PLTR Rapidly Approaching TP1NYSE:PLTR has been extremely bullish since Sept. 25 and has been in a strong uptrend after breaching the orange resistance level. The next key price target, the light blue resistance line, is rapidly approaching. PLTR is a war stock that is benefitting from the new Israel Palestine conflict. Other key events this week are September PPI inflation data and Fed meeting minutes on Wednesday October 11. I think the markets are likely to have some sideways price action on Tuesday in anticipation of the new inflation and fed data.

$PLTR Quarter 3 (Q3) AnalysisPLTR has been extremely bullish, and just received a $250 million contract from the US Army this week. I think PLTR has been a very bullish stock in 2023, and I believe PLTR will have a monster Q4 performance. My key price targets are $28.33 and $37. There is short-term resistance at $19.11, but I believe PLTR will break above $19 in Q4.

PLTR:Very close to trend line!Palantir Technology

Short Term - We look to Buy at 9.19 (stop at 7.55)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. Trend line support is located at 9.00. Support could prove difficult to breakdown. Dip buying offers good risk/reward. Further upside is expected.

Our profit targets will be 12.96 and 14.00

Resistance: 13.00 / 16.00 / 24.00

Support: 9.00 / 6.60 / 4.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

PLTR LONG term investors outlookLooking to buy PLTR if we do go under 23 . Long term we going back into ATH

PLTR: Heading to 40+All signs point to up for PLTR. We are in the early stages of wave 3. Nice breakout of the inverse H&S formation on heavy volume.