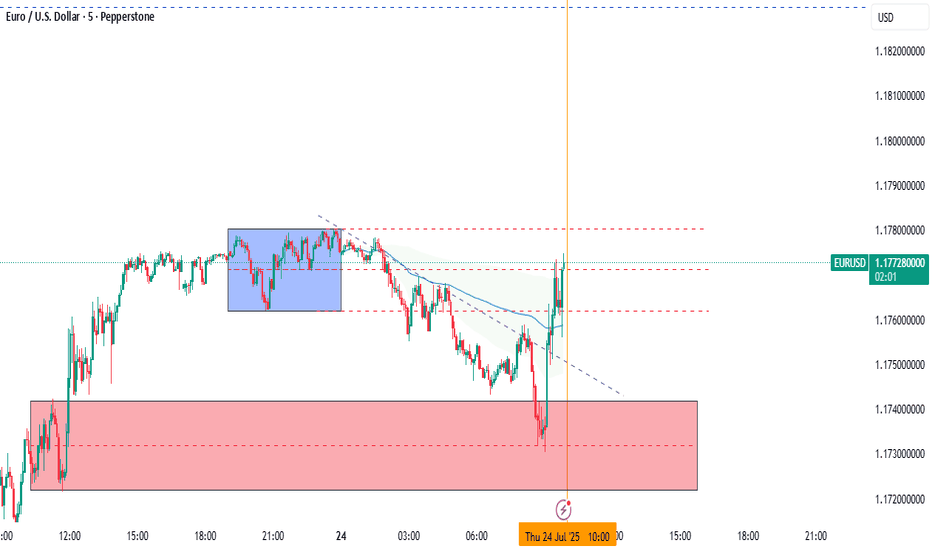

EURUSD LIVE TRADE 65PIPS 5K PROFITEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

PMI

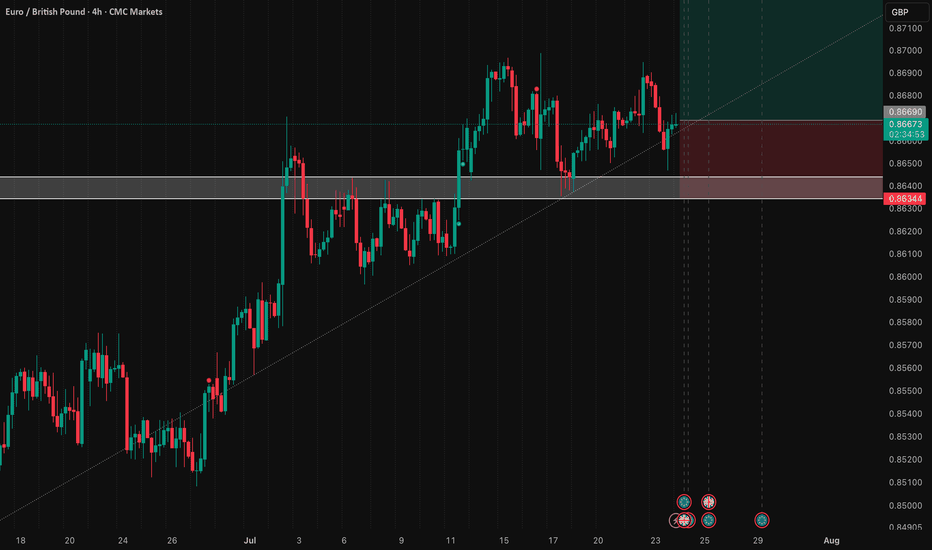

EUR/GBP: Bullish Stance Above 0.8640This signal outlines a tactical long entry on EUR/GBP, positioning for a bullish resolution from today's major fundamental events.

📰 Fundamental Thesis

This position is taken ahead of the two primary market movers: the ECB rate decision and the UK PMI data. The core thesis is that the ECB policy statement will be the dominant catalyst, providing strength to EUR that will outweigh the impact of the UK data release.

📊 Technical Thesis

The trade is defined by a sound technical structure. The stop loss is anchored beneath the critical support zone at 0.8640. The profit target is set to challenge the resistance area just above 0.8722. This setup offers a favorable and clearly defined risk-to-reward profile.

🧠 Risk Management

Execution is timed before extreme event-driven volatility. Adherence to the stop loss is critical to manage the inherent risk of this pre-news strategy.

Trade Parameters

⬆️ Direction: Long (Buy)

➡️ Entry: 0.86690

⛔️ Stop Loss: 0.86344

🎯 Target: 0.87382

✅ Risk/Reward: 1:2

Banana zone starts when PMI is above 53.Check your charts to verify this fact.

Total 2 with the US Purchasing Managers Index overlain.

The PMI is one of the most reliable leading indicators for assessing the state of the U.S. economy.

Previous Banana zones have coincided with the PMI above 53.

so not just when the economy is growing, but when the economy has entered humming along approaching full acceleration.

This is when most people will feel confidence and WANT to take on more risk as they are most optimistic about the future when the economy is in this state of being.

XAUUSD - Gold is on the verge of a very important week!Gold is trading above the EMA200 and EMA50 on the four-hour timeframe and is trading in its ascending channel. I predict the path ahead for gold to be upward and if the resistance level is broken, we can look for buying opportunities. If gold corrects, we can also buy it with a reward at an appropriate risk.

Gold prices experienced a mild decline over the past week, with market sentiment shaped less by fundamental shifts and more by mixed messages and scattered commentary around tariffs.Despite the noise, many traders chose to rely on data and technical charts rather than reacting emotionally—data that painted a more subdued picture than the headlines suggested.

Rich Checkan, CEO of Asset Strategies International, responded confidently in a recent survey, predicting further gains in gold. “The trajectory for gold is clearly upward. Prices have stabilized around the $3,300 level and appear ready for a new rally, especially if the appellate court’s ruling on tariffs is upheld,” he said.

Checkan also pointed to another macroeconomic factor that could support gold: “A new tax bill, described as large and costly, is set to be voted on in the Senate soon. If passed, it will likely widen the budget deficit, which historically leads to increased liquidity and rising inflation—a favorable environment for gold.”

On Friday, the PCE inflation report showed easing price pressures, though not enough to put the Federal Reserve at ease. Core PCE (excluding food and energy) rose by 0.1% month-over-month and 2.5% year-over-year in April—matching expectations and slightly down from 2.7% the previous month. The headline PCE also increased 2.1% annually, just below the forecast of 2.2%.

The key point: these data reflect the first month in which Trump’s new tariffs were active, yet there’s little evidence so far that they’ve caused inflation to rise. Still, the disinflationary trend remains sluggish and distant from the Fed’s 2% target. In its latest minutes, the Fed warned that inflation may prove more persistent than previously thought.

Nick Timiraos of The Wall Street Journal, despite the seemingly positive PCE numbers, issued a cautionary note with four key insights:

• The inflationary impact of tariffs is expected to begin showing up from May and be fully reflected in June’s data. This could accelerate goods price increases and disrupt the path of disinflation.

• Last year’s monthly PCE figures were particularly weak (May: 0%, June: 0.1%, July: 0.2%). As these drop out of the annual calculation, even if monthly gains remain steady, YoY rates could rise mathematically.

• The three-month average for Core PCE from May to October 2024 was only 0.1%. If upcoming monthly figures hit 0.2%, annual disinflation could stall or even reverse.

• While the latest report is encouraging, the effects of tariffs and the removal of last year’s weak data could complicate the inflation trajectory.

Looking ahead, market attention will focus heavily on a suite of crucial U.S. labor market indicators. The Job Openings and Labor Turnover Survey (JOLTS) is due Tuesday, private sector employment data (ADP) on Wednesday, and jobless claims on Thursday. However, the most anticipated release will be Friday’s Non-Farm Payrolls (NFP) report for May—widely viewed as a key factor influencing rate expectations.

Alongside labor data, markets will also watch other critical economic reports. The ISM Manufacturing PMI on Monday and the ISM Services PMI on Wednesday will offer broader insight into U.S. business activity. In the realm of monetary policy, interest rate decisions from the Bank of Canada (Wednesday) and the European Central Bank (Thursday) are expected to trigger notable movements in the currency and gold markets.

USDCAD RETEST OR FRESH DOWNTREND? PRICE AT A CRUCIAL CROSSROAD!USDCAD 22/05 – KEY RETEST OR FRESH DOWNTREND? PRICE AT A CRUCIAL CROSSROAD!

🌐 MACRO BACKDROP:

Canada’s CPI and Retail Sales have come in weaker than expected, signaling sluggish consumer demand and reducing the probability of near-term rate hikes by the Bank of Canada.

Meanwhile, the USD is stabilizing, supported by steady U.S. Treasury yields after the Fed reaffirmed its “higher for longer” stance.

Oil prices, a major driver of the Canadian Dollar, have shown no significant breakout, further weakening CAD’s bullish momentum.

🔍 TECHNICAL OVERVIEW (H1–H4 Chart):

After hitting a key swing low at 1.3820, USDCAD is now retracing towards the 0.5 Fibonacci zone (1.3889 – 1.3913), which also aligns with:

The 200 EMA resistance (red line)

Previous structure rejection zone

➡️ This area is critical – it could act as a trap zone before price resumes downward or breaks to confirm a short-term bullish reversal.

📈 TRADE SETUPS:

🔻 SELL SETUP (HIGH PROBABILITY IF PRICE FAILS AT RESISTANCE):

Entry: 1.3900 – 1.3913

Stop Loss: 1.3930

Take Profit Targets: 1.3884 → 1.3859 → 1.3847 → 1.3820

🔹 BUY SETUP (IF PRICE HOLDS ABOVE THE BASE ZONE):

Entry: 1.3820 – 1.3823

Stop Loss: 1.3805

Take Profit Targets: 1.3847 → 1.3880 → 1.3913

⚠️ STRATEGY NOTES:

Be cautious during the New York session, as potential comments from Fed officials or crude oil updates could spike volatility.

This is a textbook case of “reaction vs. continuation” at a Fibo cluster – stick to confirmed candlestick signals to avoid false breakouts.

📌 FINAL THOUGHTS:

USDCAD is in a corrective rally after an extended decline. The 1.3913 zone is a key decision point. Sellers should watch for signs of exhaustion, while buyers can target short-term retracements if support holds at 1.3820.

EURUSD 21 Feb 2025 W8 - Intraday Analysis - EU & US PMI Day!This is my Intraday analysis on FX:EURUSD EURUSD for 21 Feb 2025 W8 based on Smart Money Concept (SMC) which includes the following:

Market Sentiment

4H Chart Analysis

15m Chart Analysis

Market Sentiment

It's PMI Day today:

EU: Flash Manufacturing PMI - Flash Services PMI

US: Flash Manufacturing PMI - Flash Services PMI

The market still in the same sentiment detailed in my Weekly Analysis . Below a summary:

Short-Term Bias: Cautiously bullish for EUR/USD, driven by optimism over delayed tariffs, geopolitical progress, and hopes for softer inflation.

Key Risks:

A hot PCE report reviving Fed hawkishness.

Sudden tariff escalations or breakdowns in peace talks.

4H Chart Analysis

1️⃣

🔹Swing Bullish (Reached Swing Extreme Demand)

🔹INT Bearish (Reached Extreme Supply)

🔹INT-INT Bullish (Reached EQ (50%)

🔹Swing Continuation

2️⃣

🔹With the deep pullback to the Bullish Swing extreme discount and mitigating the 4H/Daily demand zones, price turned Bullish forming a Bullish CHoCH.

🔹The current Bullish move from Swing extreme discount to current price level having 2 scenarios (Previously I’d the following 2 scenarios where now I favors the 2nd scenario due to the impulsive nature of the move):

Scenario 1: Pullback for Bearish INT Structure and with the recent Bearish CHoCK and Minor Demand zones are failing, I expect Bearish continuation to target the Weak INT Low which aligns with the Daily/Weekly Bearish Structure/Move. (Counter Swing – Pro Internal)

Scenario 2: Bullish Swing continuation to target the Weak Swing High. Which requires to have Demand holding and Supply failing. The first sign required to confirm this scenario will be the current Demand which price is currently at to hold and we form a Bullish CHoCH. (Pro Swing – Counter Internal)

🔹As expected yesterday, price managed to continue Bullish after reaching the INT-INT structure EQ (50%) in a solid impulsive move aligns with the Swing continuation move.

3️⃣

🔹Still expectation is set to continue Bullish targeting the Weak Swing High as long LTFs holds Bullish structures. Also, In my mind I’m not neglecting the current Bearish 4H INT structure and we already reached that structure extreme where we are getting the current corrective Bearish OF.

15m Chart Analysis

1️⃣

🔹Swing Bullish

🔹INT Bullish

🔹Reached Swing EQ (50%)/Discount

🔹Swing Continuation Phase

2️⃣

🔹The 15m Bullish Swing pullback phase is still intact with continues Bearish INT structures.

🔹Price had reached Swing extreme demand in Swing Discount.

🔹With the recent Bearish iBOS, price had formed Liq. above the 15m Demand which was sept with the break of the Weak INT Low, mitigating the 15m Demand and forming a Bullish CHoCH to initiate the Bearish INT Structure Pullback.

🔹With the Bullish iBOS yesterday, we confirmed that the Swing Pullback phase may have ended and we are in a new Bullish continuation phase.

3️⃣

🔹With the recent iBOS, price is currently in Pullback Phase to HP POIs to then continue Bullish.

🔹As yesterday expectation of continuing Bullish, still on the expectations of price continuing Bullish targeting the 15m Weak Swing High / 4H Weak Swing High.

AUDJPY SHORT: Caixin Services PMI lower than estimatedChina's January Caixin Services PMI was 51.0 vs. 52.2 in December. This shows a slowing service sector in China. As a result of this economic news release, the Australian dollar is expected to potentially weaken against the Japanese yen. We must remember that China is one of Australia's biggest trading partners, so anything that happens in China will almost always affect the Australian dollar.

XAUUSD - Gold Awaits Weekend Data Releases?!Gold is trading above the EMA200 and EMA50 on the 4-hour timeframe and is in its ascending channel. If gold rises towards the channel ceiling and supply zones, we can look for short positions targeting the channel midline.

The gold market has kicked off 2025 with one of its best starts since 2023 and is on track to achieve its strongest monthly performance since September. Prices are currently testing the high range near $2,750 per ounce.

A fund manager noted that this robust start to January could signal another strong year for the precious metal, even after gold recorded a 27% price increase last year.

In his 2025 outlook report, Eric Strand, founder of the precious metals-focused AuAg Funds, projected that gold prices will surpass $3,000 per ounce this year. He stated: “We expect gold to break the $3,000 barrier during the year and possibly reach even higher levels by year-end, with a realistic target of $3,300.” Strand’s bullish target represents a 20% increase from current levels.

Strand suggested that the new Trump administration might usher in a period of more accommodative monetary policies and larger government stimulus programs. In his report, he explained: “Both Donald Trump and Elon Musk have built their empires on extensive borrowing while driving forward at full speed.

This approach will likely persist for the next four years as governments strive to avoid an economic downturn at any cost to create a positive boom. However, the price of this strategy will be monetary inflation. Such an inflationary boom creates a financial environment where commodity prices, including gold, rise significantly.”

As U.S. national debt has reached unprecedented levels, now exceeding $36 trillion, Strand highlighted that the United States is not alone in facing this challenge. He emphasized that governments worldwide continue to increase spending through deficit financing. He noted: “The amount of money circulating in the system is increasing without generating substantial real growth, which naturally means each unit of currency becomes less valuable.”

Meanwhile, gold prices remain near all-time highs against major currencies such as the euro, British pound, Chinese yuan, Canadian dollar, and Australian dollar.

Gold continues to stand out as a safe-haven global asset as the trend of de-globalization accelerates. Countries are moving away from dependence on the U.S. dollar and diversifying their currency reserves. (De-globalization refers to the process of reducing or reversing global integration, including less free trade, restricted capital flows, reduced interdependence, and a rise in nationalist and local policies.)

Strand stated: “We have seen the beginning of de-globalization, and it appears to be gaining momentum, particularly as the U.S. seeks to impose conditions that serve its own interests. Policies such as ‘America First’ and high tariffs may benefit the U.S. economy, but they also undermine trust in the country as a leader in free-market economies.” He added: “This new phenomenon is likely to create inflationary pressures and may lead to waves of currency devaluation in other nations as they attempt to offset the effects of tariffs.”

The Purchasing Managers’ Index (PMI): What Does It Tell Traders?The Purchasing Managers’ Index (PMI): What Does It Tell Traders?

The Purchasing Managers’ Index (PMI) is a widely watched economic indicator that helps traders assess the overall health of the economy via an early snapshot of business activity. Traders often use this data to analyse potential market movements across different asset classes, from equities to forex. In this article, we’ll explore what the PMI is, how it works, and why it matters for traders.

PMI Definition

The Purchasing Managers’ Index (PMI) is a key economic indicator that offers insight into the business conditions of the manufacturing and services sectors. It’s derived from monthly surveys sent to purchasing managers at various companies, who provide data on several aspects of their business activities. The idea is to get a snapshot of how the economy is performing based on the people making the procurement decisions. PMI data is released in various countries, including majors.

PMI is calculated by analysing five main components:

- New Orders: Measures the level of new orders received by businesses, indicating future demand.

- Inventory Levels: Looks at the stock of goods that companies have on hand, reflecting production expectations.

- Production: Assesses the output levels of companies, showing current economic activity.

- Supplier Deliveries: Tracks the time it takes for suppliers to deliver goods, which can signal supply chain conditions.

- Employment: Monitors hiring levels, providing clues about the labour market.

The PMI is reported as a number between 0 and 100. A reading above 50 suggests that the sector is expanding, while a figure below 50 indicates contraction.

There are different types of PMIs to be aware of:

- Manufacturing PMI: Focuses on the manufacturing sector and is often watched closely because manufacturing is a significant part of many economies.

- Services PMI: Covers the services sector, which includes industries like finance, healthcare, and retail.

- Composite PMI: Combines data from both the manufacturing and services sectors to give a broader picture of overall economic health.

How the PMI Is Calculated

The PMI economic indicator is calculated using survey responses from purchasing managers who report whether conditions have improved, remained the same, or worsened. Each response is assigned a score: 1 for improvement, 0.5 for no change, and 0 for deterioration. The PMI is then calculated using the formula:

PMI = (P1 × 1) + (P2 × 0.5) + (P3 × 0)

Where P1, P2, and P3 represent the percentages of each response.

PMI as a Leading Economic Indicator

The PMI is widely regarded as a leading economic indicator, meaning it often signals shifts in the economy before other data figures catch up. This is because it’s based on real-time data from purchasing managers, who have a front-row view of their companies’ supply chains and business activity.

Early Signals

The PMI often catches shifts in the economy before broader indicators like GDP can reflect them. For example, there may be a multi-month decline in the PMI index, meaning that an economic slowdown is coming, giving traders a chance to adjust their positions before the data is widely recognised.

Global Comparisons

PMI isn’t just available for one country; it’s tracked across the world. Comparing PMI data from different regions allows traders to see how various economies are performing relative to each other. For instance, if the Eurozone PMI is climbing while the US PMI is dropping, it might indicate stronger growth prospects in Europe.

Correlation with Broader Economic Trends

PMI trends are often correlated with other major indicators like GDP growth, inflation, and industrial output. For traders, this makes the PMI a useful tool to anticipate how markets might react to upcoming economic reports. If the PMI has been rising, GDP or job growth numbers are likely to follow suit, offering a way for traders to estimate upcoming economic releases.

Why the PMI Report Matters to Traders

The PMI indicator is a valuable tool for traders because it provides early insight into the state of the economy. Here’s why traders pay attention:

- Economic Sentiment: A rising PMI suggests that businesses are seeing higher demand and increasing production, which can boost confidence in economic growth. On the flip side, a falling PMI can hint at slower activity, creating caution among traders.

- Stock Market Reactions: Traders often see PMI data as a way to gauge how different markets might respond. For instance, if the PMI shows strong expansion, stock markets may react positively, especially in sectors sensitive to economic health like manufacturing or retail. Conversely, a weak PMI could lead to declines as concerns about slower growth set in.

- Currency Impact: Currencies tend to strengthen when PMI data indicates economic expansion, particularly for major economies like the US or the Eurozone. This is because higher economic activity usually leads to higher interest rates, which can make a currency more attractive to investors.

- Commodities: In commodities, a strong PMI often means higher demand for raw materials like oil and metals, while a weaker PMI could signal reduced demand.

If you’d like to see how past PMI releases have impacted markets, head over to FXOpen to explore a world of stocks, currency pairs, commodities, and more.

Interpreting the PMI in Trading

When traders look at PMI data, they’re not just interested in whether the number is above or below 50—they’re looking for trends and context. As mentioned, a PMI above 50 generally signals economic expansion, while below 50 suggests contraction, but the details matter.

Key Thresholds

While 50 is the main dividing line, traders often watch for more specific levels. For instance, if the PMI climbs above 55, it usually points to strong growth. If it dips below 45, it could indicate a deeper economic slowdown. Traders pay attention to these shifts because they can signal changes in market sentiment.

Month-to-Month Changes

It’s not just about the latest PMI reading but how it compares to previous months. For example, a PMI of 52 might still suggest growth, but if it’s down from 57 the month before, traders may see it as a warning sign of slowing momentum. Conversely, an increase over several months can signal improving conditions.

Market Reactions to Surprises

Market expectations play a huge role in how PMI data is received. If the PMI reading is significantly higher or lower than expected, markets can react swiftly. A higher-than-expected PMI might push stock prices up as traders anticipate stronger economic growth. Conversely, a lower-than-expected PMI could spark sell-offs in risky assets.

Sector-Specific Insight

Traders don’t just look at the headline PMI—they break down the numbers by sector. For example, if the manufacturing PMI is rising but the services PMI is stagnant or falling, it could mean that only certain parts of the economy are doing well. This helps traders understand which sectors might perform better in the short term.

Global Context

PMI data from major economies like the US, China, and the Eurozone can influence global markets. For example, strong US PMI data could push equities higher around the world, while weak data from China might affect commodity prices like copper or currencies like the Australian dollar.

The Limitations of Using PMI

While the PMI is a useful tool for understanding economic trends, it’s not without its limitations. Traders need to be aware of potential pitfalls when using this data in isolation.

- Sector-Specific Focus: PMI primarily covers manufacturing and services, which means it might not fully represent the broader economy, especially in economies where other sectors, like technology or agriculture, play a significant role.

- Short-Term Volatility: PMI data can be sensitive to short-term factors, such as seasonal demand fluctuations or temporary supply chain disruptions. These one-off events can distort the numbers, making it tricky to draw long-term conclusions based on a single month’s report.

- External Factors: Sometimes, external factors like geopolitical tensions or sudden policy changes can have a bigger impact on markets than the underlying economic trends reflected in PMI. It’s always wise to consider the broader context.

- Complementary Analysis Needed: Relying solely on PMI data without looking at other economic indicators, like employment figures or consumer spending, can lead to a narrow view. Therefore, it’s usually used as part of a broader economic analysis.

The Bottom Line

The PMI offers valuable insights into economic trends, helping traders analyse potential market movements across various asset classes. While not without its limitations, it's a key indicator for understanding market sentiment. For those looking to take advantage of PMI data in their trading, opening an FXOpen account provides access to more than 700 markets and low-cost, high-speed trading.

FAQ

What Does PMI Stand for in Markets?

PMI stands for Purchasing Managers’ Index. It reflects the sentiment of purchasing managers who are responsible for buying goods and services in various industries. Their responses to monthly surveys form the basis of the PMI data, meaning traders can better understand which sectors are expanding or contracting.

What Does PMI Mean in Trading?

In trading, the PMI meaning refers to the Purchasing Managers’ Index, a key economic indicator that traders use to assess the health of the manufacturing and services sectors. It helps traders gauge economic growth or contraction, which can impact asset prices like equities, currencies, and commodities.

How to Use PMI in Forex Trading?

In forex trading, PMI data is closely monitored because it provides insight into economic strength. A higher PMI typically signals economic growth, which can strengthen a currency. Conversely, a lower PMI may suggest weaker economic activity, potentially putting downward pressure on the currency.

How Does the PMI Index Work?

The PMI index is calculated from monthly surveys of purchasing managers in manufacturing and services. The data covers areas like new orders, production, employment, supplier deliveries, and inventory levels. Readings over 50 demonstrate an expanding economy, while below 50 indicate a contracting economy.

What Is Manufacturing PMI?

Manufacturing PMI focuses solely on the manufacturing sector. It tracks changes in production, new orders, inventories, and more to reflect the overall health of the manufacturing industry.

What Is the Difference Between the ISM and PMI Index?

The ISM PMI index is produced by the Institute for Supply Management and focuses on the US economy, while PMI is a broader term that refers to similar indices in other regions, like IHS Markit’s global PMI.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Australian dollar falls as core CPI dips lowerThe Australian dollar is lower for a second straight trading day. In the North American session, AUD/USD is trading at 0.6214, down 0.27% at the time of writing. The Australian dollar dropped as low as 0.60% but has pared much of those losses.

Australia's inflation report was a mixed bag in November. Headline inflation rose 2.3% y/y, up from 2.1% in the previous two months and above the market estimate of 2.2%. This marked the highest level since August and was partially driven by a lower electricity rebate for most households.

At the same time, the trimmed mean inflation, the Reserve Bank of Australia's preferred core inflation gauge, fell from 3.5% to 3.2% in November. This reading is close to the upper limit of the RBA's target band of 2%-3% and supports the case for the RBA to join the other major central banks in lowering rates.

The RBA has maintained the cash rate at 4.35% at nine consecutive meetings but is this prolonged pause about to end? In the aftermath of today's inflation report, the money markets have priced in a quarter-point hike in February at over 70%. Australia releases the quarterly inflation report for the fourth quarter on Jan. 29 and if inflation is lower than expected, expectations of a rate cut will likely increase.

The US economy has been solid and this week's services and employment indicators headed higher. The ISM Services PMI rose to 54.1 in December, up from 52.1 and above the market estimate of 53.3. JOLT Job Openings jumped to 8.09 million in November and 7.8 million in October. The market is looking ahead to Friday's nonfarm payrolls, which is expected to drop to 154 thousand, compared to 227 thousand in November.

AUD/USD tested support at 0.6214 earlier. Below, there is support at 0.6182

0.6250 and 0.6282 are the next resistance lines

XAUUSD - Gold is waiting for an important week!!In the 4-hour timeframe, gold is above the EMA200 and EMA50 and is in its short-term descending channel. The continued rise of gold towards the supply zones will provide a position to sell it with a suitable risk reward.

The year 2024 turned out to be unprecedented for the global gold market. This precious metal witnessed a remarkable growth of nearly 30%, outperforming all other commodities and emerging as one of the most prominent financial assets of the year. Such exceptional performance has continued to gain the trust of analysts and professionals in the gold and jewelry industry, drawing the attention of many traders to this market.

Despite forecasts suggesting that gold prices could surpass $3,000 per ounce in 2025, the beginning of 2024 told a different story. Spot gold prices started the year at around $2,000 but fell to $1,992 by mid-February. However, Valentine’s Day marked a turning point, as gold rebounded strongly, climbing back above $2,000 and successfully maintaining this critical level.

A significant market milestone occurred at the end of February. In just two days, gold prices surged by over $60, and on the first trading day of March, the metal broke past the $2,100 threshold, setting a new record. After a period of price consolidation at higher levels, gold resumed its upward trend in the final days of the month, surpassing $2,200. By mid-April, gold approached the $2,400 mark. However, traders were not yet prepared to accept these levels, and by the end of April, spot gold prices had retreated below $2,300.

May saw renewed optimism in the precious metals market. On May 16, spot gold decisively broke through the $2,400 resistance level. Nonetheless, after reaching a peak of $2,426, prices entered the longest consolidation phase of 2024.

Finally, on June 10, gold once again broke the $2,400 resistance and managed to establish it as a support level. From that point onward, gold embarked on one of its most stable upward trends of the year, which continued through late summer and early autumn. On October 30, gold prices hit a new record of $2,788.54 per ounce.

However, the election of Donald Trump on November 5, 2024 (15th of Aban 1403), interrupted gold’s rally. Spot gold, which had reached $2,743 on November 4, dropped within 10 days to the $2,560 range.

Nevertheless, gold quickly found new support. The president-elect’s threats of tariffs and trade wars, combined with renewed inflationary concerns, pushed gold prices back above $2,700. Although the metal did not return to its October highs, it maintained strong support at $2,600 for the remainder of the year, preventing further declines.

Meanwhile, Goldman Sachs revised its forecast for gold prices, stating that the metal would not reach $3,000 in 2025. However, the bank remains optimistic that gold prices will continue to rise, albeit at a slower pace than before.

NAS100 - Nasdaq, no interest in Santa Rally!The index is above the EMA200 and EMA50 in the four-hour timeframe and is trading in its descending channel. If the index corrects towards the demand zone, you can look for the next Nasdaq buy positions with the appropriate risk reward. Nasdaq being in the supply zone will provide us with the conditions to sell it.

In the annual rebalancing of the Nasdaq Index, the shares of Tesla, Meta Platforms, and Broadcom saw a reduction in their weighting, while Apple, Nvidia, Microsoft, and Alphabet gained more weight. According to data compiled by Bloomberg, this marks the second time in roughly a year that index regulators have adjusted the allocations for its largest members.

The rules governing the Nasdaq 100 are designed to prevent a small number of companies from exerting excessive influence on the index. These rules have become increasingly relevant in recent years due to the extraordinary growth in market value of major companies and advancements in artificial intelligence. Although the Nasdaq 100 is weighted by market capitalization, certain limits are enforced if a few companies grow disproportionately large.

This recent rebalancing may have been prompted by a rule that allows regulators to reduce the weighting of the top five companies to below 40%, with other adjustments made accordingly. Steve Sosnick, chief strategist at Interactive Brokers, remarked, “At times, the Nasdaq 100 has to take such measures because it becomes a victim of its own success; the largest stocks in the index have grown significantly faster than others.”

This year, the shares of major technology companies have risen sharply due to advancements in artificial intelligence. Broadcom, a key chip supplier for Apple and other tech giants, reached a market value of $1 trillion. Tesla also surged by around 75% following the U.S. presidential election.

In the Nasdaq 100, Apple’s weighting increased from 9.2% to 9.8%, while Nvidia rose from 7.9% to 8.4%. Microsoft and Amazon also gained weight, and Alphabet saw a slight increase. However, Broadcom’s weighting fell from 6.3% to 4.4%, Tesla’s dropped from 4.9% to 3.9%, and Meta’s decreased from 4.9% to 3.3%.

Currently, over 200 exchange-traded products, with combined assets totaling approximately $540 billion, track the Nasdaq 100 or its variations globally. Athanasios Psarofagis of Bloomberg Intelligence noted, “This highlights the increasing influence of index providers on market dynamics.”

Last year, thanks to the resilience of the economy, strong earnings reports, a 100-basis-point rate cut by the Fed, and the leadership of the Mag7, the S&P 500 recorded 57 new all-time highs (ATHs).

On Friday, Richmond Fed President Tom Barkin, speaking at the Maryland Bankers Association, outlined the conditions needed for rate cuts and discussed the broader impacts of the new tariff plan proposed by President-elect Donald Trump. Barkin downplayed the immediate and direct effects of the tariff program. Markets do not anticipate any rate changes in the upcoming Fed meeting.

The private and non-farm payrolls report (ADP) set to be released on Wednesday, along with Thursday’s weekly jobless claims data, could offer a clearer picture of the U.S. labor market ahead of the Non-Farm Payrolls (NFP) report. Additionally, the ISM Services PMI for December, scheduled for release on Monday, could provide further insights into the overall performance of the U.S. economy, as the services sector accounts for over 80% of GDP.

The minutes of the December Fed meeting will also be published on Wednesday, but they are unlikely to have a significant impact on markets as updated economic forecasts have already been released.

The November Non-Farm Payrolls (NFP) report showed a sharp increase in job creation, with 227,000 new jobs added to the U.S. economy. This contrasted with just 12,000 jobs added in October, marking the weakest job growth since December 2020. If the December report also indicates that October’s weakness was temporary, some investors might conclude that even two rate cuts in 2025 would be excessive. This could contribute to the continued strength of the U.S. dollar against other major currencies.

The key question is whether the stock market, given expectations of fewer rate cuts, will continue its downward trend or recover with signs of robust economic performance.

A December to forget for the yenAs the global markets reopen have the New Years' Day, Japanese markets are closed for a holiday. It's a very light economic calendar today, with no Japanese releases and only one US tier event - unemployment claims. In the European session, USD/JPY is currently trading at 157.12, down 0.12% on the day. We can expect a quiet day for the yen.

December was absolutely dismal for the yen, which lost which plunged 11% against the US dollar. On Tuesday, the yen dropped to 158.07 per dollar, its lowest level since early July. Investors are nervous that Tokyo could intervene in the currency markets in order to stem the yen's sharp drop. Is the 160 level the red line in the sand for Japanese authorities?

Earlier in the week, Japan's Manufacturing PMI was revised to 49.6, up from 49.5 in the initial estimate and above the November reading of 49.0. This marked the sixth straight deceleration in manufacturing activity but was the highest level since September. Manufacturers' sentiment was relatively strong, with optimism for improvement in the semiconductor and auto markets, which have been hit hard over the past several months.

The Bank of Japan doesn't typically telegraph its intentions to the market. One reason is the central bank doesn't want to tip its hand to speculators, who are looking to cash in on the yen's sharp swings. The BoJ summary of opinions from the December meeting provide some insights, as the summary indicated that some Bank policymakers are leaning toward a rate hike in the near future.

The summary showed that there is a split among the nine-member board over rate policy. The hawkish members argued that conditions are falling into place as inflation is steady and the yen is sliding lower. The doves countered that wage growth is lagging behind inflation. Governor Ueda could be the decisive vote and investors will be following his every word right up to the January 24 meeting.

There is resistance at 157.38 and 158.09

USD/JPY tested support at 156.70 earlier. Below, there is support at 155.59

XAUUSD - China, still buying gold?!Gold is below the EMA200 and EMA50 in the 4H timeframe and is moving in its ascending channel. The continuation of the movement of gold depends on the failure or failure of this channel, and you can trade in that direction. In case of breaking the bottom of the channel, we can see the continued decline and see the demand zone and buy within that range with the appropriate risk reward. Maintaining the channel has paved the way for gold to rise to the supply zone, and gold can be sold within that zone.

Recent credible research analyzing undisclosed purchases since May 2024 confirms that China has been secretly buying gold. A recent analysis has validated long-held suspicions that, since the beginning of Russia’s invasion of Ukraine, China has been a significant and covert buyer of gold beyond officially reported levels. Goldman Sachs had previously hinted at such activity, and new findings by the analyst at Money Metals further substantiate this claim.

According to the report, the People’s Bank of China (PBOC) discreetly purchased approximately 60 tons of gold in September alone. This trend has been ongoing since May 2024, with evidence suggesting a drawdown from London reserves dating back to May this year. While the PBOC has not reported any gold purchases since April, Goldman Sachs’ NowCast data estimates that around 50 tons of institutional gold purchases were conducted by China in May through the over-the-counter (OTC) market in London.

This strategy is not unique to China. Other nations, such as the UAE and Saudi Arabia, also employ similar tactics to accumulate gold discreetly while avoiding price spikes. The covert nature of these transactions reflects their intent to bolster reserves while maintaining low market prices.

One market analyst has cautioned investors hoping for a Christmas rally in gold prices to proceed with caution, as recent volatility may signal a peak in prices, at least for this year.

Ole Hansen, head of commodity strategy at Saxo Bank, noted in his latest report that gold has consistently experienced price increases in December over the past seven years. However, he warned that while recent price corrections might attract bargain hunters in the final month of 2024, gold’s current high prices remain a risk factor.

In his note, Hansen stated that the greatest challenge is the 28.3% rise in gold prices this year, bringing it close to the 29.6% growth seen in 2010 and 31% in 2007. While the fundamental supportive outlook for 2025 remains intact, such significant growth could prompt profit-taking and position adjustments before the year ends.

Hansen predicted that while gold may struggle to achieve new highs in December, his outlook for 2025 remains bullish, with prices expected to reach $3,000 in the new year. He added that geopolitical uncertainties will continue to support the precious metal as a safe haven.

At the same time, the introduction of new trade tariffs on U.S. imports next year is generally perceived as a positive factor for the U.S. dollar. However, the side effects of a stronger dollar could ripple through the global economy, particularly affecting countries reliant on dollar-denominated debt, commodity trade, and export-driven growth. This dynamic might sustain interest in alternative investments like gold and silver.

Hansen further emphasized that Trump’s plans for tariffs, tax cuts, and immigration policies could exacerbate inflation and debt—two key risks that gold investors seek to hedge against.

BOJ’s Ueda hints at rate hike, yen dipsThe Japanese yen is lower on Monday. In the European session, USD/JPY is trading at 150.03, up 0.26% on the day.

Bank of Japan Governor Ueda has been hinting about a rate hike and gave what was perhaps his strongest hint on Friday. In a newspaper interview, Ueda said that interest rate hikes are “nearing in the sense that economic data are on track”. Ueda also added that the BoJ has a “big question mark” over the outlook for US economic policy, with Donald Trump taking office next month. Ueda reiterated that the central bank wants to see a sustainable rise by inflation to the 2% target and expressed concern about the weak yen, warning the BoJ could respond with “countermeasures”.

The BoJ makes its next rate announcement on Dec.19. Will it raise rates at that meeting or wait until January? The BoJ has done a poor job of communicating its intentions and after the surprise BoJ rate hike in August triggered turmoil in the financial markets. Ueda’s comments may have been an attempt to show greater transparency, although he failed to mention a timeline for the next rate hike. The markets have fully priced in a rate hike by January, with the probability of a December hike at around 60%.

In the US, it’s a busy data calendar, highlighted by nonfarm payrolls on Friday. The ISM Manufacturing PMI will be released later today, with a market estimate of 47.5 for November, compared to 46.5 in October. Manufacturing has been in a prolonged recession, with only one month of growth over the past two years.

USD/JPY tested resistance at 150.30 earlier. Above, there is resistance at 151.13

There is support at 148.89 and 148.06

Euro gains on lower Treasury yields to counter weak German dataThe Euro is back on the rise today, rising 0.2% against the US Dollar, reclaiming the 1.051 level while still remaining near its lowest levels this year.

The euro’s is capitalizing on the correction in US Treasury yields after reaching levels that seem at attractive spot to buy. This has given the euro the ability to confront the continuous stream of weaker-than-expected data, the latest of which indicated a collapse in confidence in the German economy with the lowest reading of the GfK Consumer Climate Index since last April.

The GfK headline reading was -23.3 in November, which was far below expectations. This was in light of a sharp decline in income expectations and some decline in the willingness to buy, in contrast to an increase in the willingness to save, according to the report. The report also indicated that consumers have become more pessimistic about the current economic situation, in addition to the continued dwindling hope for recovery, and this pessimism was due to the rise in insolvencies and job losses. Consumer expert at the Nuremberg Institute for Market Decisions Rolf Bürkl said that consumer uncertainty has increased recently, which explains the increased willingness to save.

Today's GfK report follows the Ifo Business Climate report for November, which we saw earlier this week, and also pointed to the "floundering" in the German economy amid declining business sentiment, both regarding the current situation and future expectations, with companies in the manufacturing, services and construction sectors becoming increasingly pessimistic.

These two reports also come in addition to the shocking purchasing managers' reports from S&P Global that we saw last Friday. Service activity in Germany and the eurozone contracted unexpectedly, and manufacturing activity continued to contract, amid very low business sentiment.

Meanwhile, the PMI reports have sparked renewed concerns about the health of the region's economy, especially in light of the expected trade wars with the return of Donald Trump, in addition to concerns about the escalation of the conflict in Ukraine and its spiraling out of control.

This worrying economic performance has raised the possibility that the European Central Bank will cut interest rates by 50 basis points at a meeting in December, according to the Financial Times.

On the other side of the Atlantic, the Federal Reserve is cautious about the pace of rate cuts next year, and the minutes of the last meeting published yesterday further confirmed this, with policymakers talking about the need to take a gradual approach to the cuts. While Fed members see risks of a slowdown in the labor market or the economy as having diminished.

In addition, the November PMI for the US report also indicated that sentiment has recovered after the end of the presidential election, which surrounded the economy with uncertainty, and this was accompanied by a faster-than-expected expansion in services activities.

Therefore, the probability of a Fed rate cut in January is still low, at only 15%, according to the CME FedWatch Tool. While the expected quarter-point cut in December is still likely.

Despite all this, we find the euro trying to rise today, amid the decline in US Treasury yields. The 10-year yield above 4.4% seems to be a buying opportunity, especially after a rate cut and relatively low inflation that has taken real yields to their highest levels since 2015.

However, the 10-year German bund yield continue to fall sharply and are at their lowest levels since early October in light of the gloomy economic outlook. While the return of Treasury yields to the rise, driven by fading hopes for the pace of rate cuts next year, has pushed the yield gap with Eurozone bonds to a widening trend, which could pressure the euro to resume its losses.

The gap between the 10-year Treasury and its German bund counterpart is 2.11%, which is close to the highest levels since last April, which we saw on Friday.

Euro could be under pressure as yield gap widensThe Euro is recovering today, rising more than 0.5% against the US Dollar, reclaiming the 1.0478 level after hitting its lowest level in nearly two years last Friday.

While today’s decline in the Dollar appears to be a correction and comes in anticipation of a series of crucial data releases this week and the following, the Euro may remain under pressure as the yield gap between the US and the Eurozone widens.

This widening of the yield gap in turn comes in light of the divergence in economic performance and concerns about the continued high interest rates in the US, as well as the rising geopolitical tensions in Europe.

Today’s weaker-than-expected Ifo Business Climate Index for November in Germany also reinforced the narrative of economic divergence, which could keep the Euro’s gains fragile. The headline reading fell more than expected to 85.7.

The report said that the German economy is floundering amid declining business sentiment, both in terms of the current situation and future expectations. Pessimism has also increased among companies about the future in the manufacturing, services and construction sectors.

However, the assessment of the current situation varied between improvement in manufacturing, retail and wholesale trade, and the most pessimistic in services, larger trade companies and construction.

Today's Ifo data adds to the shocking reports of the PMI reports for November for the eurozone, Germany and France from S&P Global, which we saw last Friday and deepened concerns and highlighted pessimism about the health of the region's economy. Services activities in the region contracted unexpectedly, and manufacturing activities deepened their contraction, in addition to the lowest levels of sentiment since September 2023.

This comes in contrast to the acceleration of service activity growth in the United States more than expected, and sentiment rebounded and reached its highest level since May 2022, which may indicate further economic expansion in the coming months, according to S&P Global.

In addition, the latest set of data from the US has heightened concerns about the pace of rate cuts next year. After the expected cut in December, markets are now pricing in only a 12% chance that the Fed will cut rates in January, according to the CME FedWatch Tool.

A higher-for-longer interest rates in the US and accelerating growth could add pressure on the euro as the European Central Bank may need to cut borrowing costs more given the continued weakness in economic activity. This disparity in potential interest rate paths could also keep the yield gap between US and eurozone Treasuries on the widening trend.

The gap between 10-year Treasury yield and their German bund counterparts hit its highest level since April last Friday at 2.149% before narrowing slightly today.

In addition, real inflation-adjusted yields on 10-year US Treasuries are near their highest levels since 2015, around 1.85%. This could also increase the appeal of US Treasuries, as the real yield gap between them and their German counterparts is also more than 1.5%, which is the highest level since last February.

The escalation of geopolitical tensions could also increase pressure on the euro, following a series of mutual escalations on the Russian-Ukrainian front and concerns about the possibility of it getting out of control.

Both sides of the war are putting more pressure on each other in an attempt to extract gains ahead of any potential negotiations under the next US Republican administration. These concerns are already starting to return to the forefront and were evident in the rise in European natural gas futures (TTF) today to their highest levels this year.

GBPUSD Short and Longs (News) Scenario 1: Both PMIs Better than Forecast

Actual Manufacturing PMI: 49.5 (Better than 48.8 forecast)

Actual Services PMI: 56.0 (Better than 55.2 forecast)

EUR/USD: Down - If both sectors perform better than expected, this might signal a stronger US economy, potentially leading to a stronger Dollar.

GBP/USD: Down - Similar to EUR/USD, a stronger US economic outlook could weaken GBP against USD.

USD/JPY: Up - Improved US PMI data might strengthen USD against JPY, especially if this leads to expectations of a tighter Fed policy.

Scenario 2: Both PMIs Worse than Forecast

Actual Manufacturing PMI: 48.0 (Worse than 48.8 forecast)

Actual Services PMI: 54.0 (Worse than 55.2 forecast)

EUR/USD: Up - If both sectors disappoint, this could indicate economic weakness in the US, leading to a weaker USD.

GBP/USD: Up - Weaker US data might make GBP relatively stronger, especially if UK economic indicators are not as disappointing.

USD/JPY: Down - A disappointing PMI might lead investors to question the US economic recovery, potentially weakening USD against JPY.

The Fib is just an example if we was to see a sell off it may come into play. If we not seeing a sell off the Fib will be non existent.

NAS100 - Nasdaq will reach above 21,000?!The index is located between EMA200 and EMA50 in the 4H timeframe and is trading in its ascending channel. If the index rises towards the two specified supply zones, you can look for NASDAQ sell positions with the appropriate risk reward. Nasdaq's buying position is in the demand zone after the continuation of the corrective movement, and considering the downward sentiment at the end of the week, it should be saved quickly.

China’s Export Restrictions and Their Impact on Global Supply Chains

• China Tightens Export Controls:

Starting December 1, China will implement new regulations to tighten export restrictions on critical metals and raw materials, including tungsten, graphite, magnesium, and aluminum alloys, essential for the technology sector.

• China’s Objectives:

These measures are part of a broader strategy to manage sensitive exports and protect national interests.

• Global Market Impact:

The new restrictions are expected to disrupt global technology supply chains and introduce volatility in related markets.

Zelensky’s Perspective on Trump’s Presidency

• Zelensky’s Comments:

Ukrainian President Volodymyr Zelensky stated that the war in Ukraine could end sooner if Donald Trump returns to the White House.

• Constructive Interaction with Trump:

Zelensky emphasized that Ukraine successfully communicated its vision for peace to Trump, and he observed no opposition from Trump regarding Ukraine’s stance.

• Implications of Zelensky’s Remarks:

These comments reflect Ukraine’s hope for continued international support to expedite the resolution of the conflict.

US Economic Forecasts

• Q3 Earnings Reports from Major Companies:

This week, companies such as NVIDIA and TARGET will release their third-quarter (Q3) earnings reports.

• Federal Reserve Rate Cuts:

Rick Rieder, Chief Investment Officer at BlackRock, predicts that the Federal Open Market Committee (FOMC) will cut interest rates by 25 basis points in December.

• The current Federal Funds rate range is 4.5% to 4.75%, which Rieder considers restrictive.

• Following the December cut, the Fed is expected to pause temporarily to reassess future adjustments.

Jerome Powell’s Statements and Market Reactions

• Powell on a Strong US Economy:

Federal Reserve Chair Jerome Powell highlighted the robust performance of the US economy, stating there is no urgency to lower interest rates.

• Cautious Approach to Rate Cuts:

Powell stressed that decisions should be made carefully due to uncertainties surrounding the neutral rate level.

• Market Reaction:

These statements reduced market expectations for a rate cut in December.

EURJPY | MarketoutlookThe policy divergence between the US Fed and SNB supports the pair at lower levels.

Jobless claims dropped to 227,000 for the week ending October 19, down from 242,000 the week before, suggesting some stability in the labor market. The four-week moving average rose by 6,750, reaching 231,000, which indicates that jobless claims are still showing fluctuations despite the recent decline.

The S&P Global Flash U.S. Manufacturing PMI increased slightly to 47.8 in October, up from 47.3 in September. However, this still shows that manufacturing activity is contracting for the fourth month in a row. On the other hand, the Flash Services PMI rose to 51.5, indicating modest growth in the services sector, which is important since it makes up a large part of the U.S. economy.