Peanut the Squirrel 1315% Profits Potential · Technical AnalysisI noticed that most of the memecoins have a strong growth potential. Here we have PNUTUSDT and the potential goes easily beyond 1,300%. An easy target is set to 467% so you can imagine. The chart looks strong and you know we focus only on TA.

Good evening my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Peanut the Squirrel. Who am I to judge? RWA, Layer 1, POW, Gaming, DeFi, Infrastructure, NFT, AI... The choice is yours.

Here we have the classic and more than classic higher low. The bottom low and the bullish breakout ending its retrace higher is as easy and simple as it goes. The beauty of TA. You can know where the market is headed based on how the candles behave.

And then, we are back to the EMAs. Notice the blue one because it is the main one I'll be using on the daily timeframe. The huge big candle happens to break above this level. Once this level is conquered as resistance we know the bulls are on. Now the market can rest but it can also move ahead. We have a higher low, PNUTUSDT, and the action happening above EMA89, EMA55 and EMA13; in short, the bulls win.

The next higher high and first target is $1.03. This is followed by $1.59, 467% potential for growth and then the market can continue higher, easily, because we are entering the strongest ever Cryptocurrency bull market.

Namaste.

Pnut

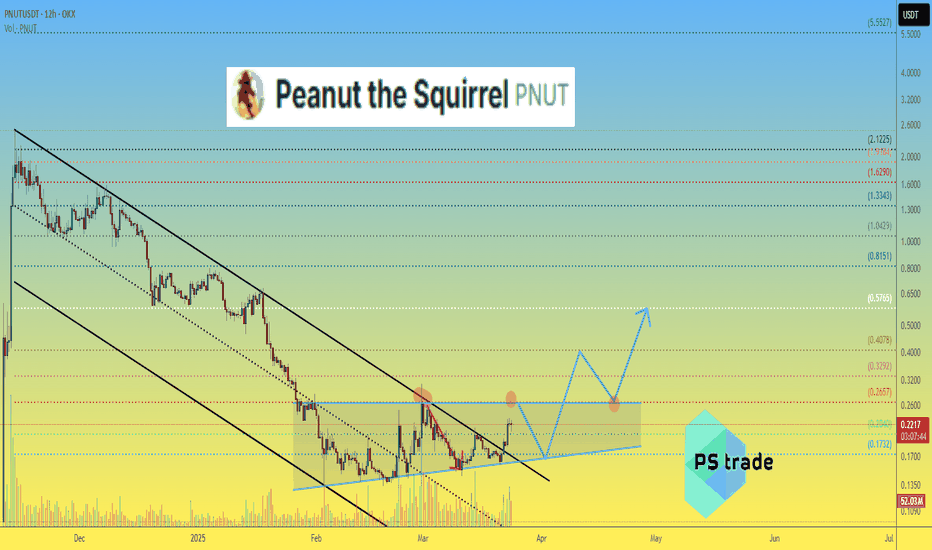

Falling Channel Breakout on PNUT/USDT – Next Stop: $0.76?📊 Pattern Analysis:

Falling Channel (Descending Channel): PNUT formed a clear falling channel from early May to late June 2025. This pattern typically signals a potential bullish reversal once a breakout occurs.

Confirmed Breakout: The price has successfully broken above the upper boundary of the falling channel, which is an early sign of a potential bullish trend.

Strong Support Zone: The horizontal zone around $0.20 – $0.26 USDT has acted as a solid demand base, as seen multiple times from March to June.

✅ Bullish Scenario:

If the breakout continues with momentum, the price could move upward gradually, aiming for the following resistance levels:

1. Target 1: $0.2986 – Minor resistance

2. Target 2: $0.3774 – Previous consolidation area

3. Target 3: $0.4403 – Major historical resistance

4. Target 4: $0.5951 to $0.7674 – Recovery zone from the falling channel

5. Extended Target (Long-Term): $1.0797 to $1.7957 (if a full rally occurs with strong bullish sentiment)

❌ Bearish Scenario:

If the price fails to hold the breakout and re-enters the channel:

Potential drop back to the support zone of $0.2000 - $0.1600

A breakdown below this range may lead to further downside toward $0.1300 to $0.1000 (previous historical low)

🔍 Summary:

The chart displays a classic bullish reversal pattern with a confirmed breakout from the falling channel.

The $0.26–$0.29 area now acts as a key confirmation zone. If the price holds above it and completes a successful retest, the bullish continuation is likely.

However, traders should stay cautious of false breakouts.

#PNUTUSDT #CryptoBreakout #AltcoinSeason #ChartAnalysis #BullishReversal #TechnicalAnalysis #BreakoutTrading #CryptoSignals #DescendingChannel

PNUT/USDT – Bullish Breakout from Falling Channel!PNUT Breakout Alert – 200% Potential on the Table

Hey Traders — if you're into high-conviction setups with real momentum, this one’s for you.

PNUT has officially broken out of a textbook falling channel after a healthy consolidation. This pattern often signals trend reversal and renewed bullish momentum — and PNUT looks ready to move.

🔹 Pattern: Falling Channel

🔹 Breakout Confirmation: Clear candle close above resistance

🔹 Previous Move: +204% before entering the channel

🔹 Current Setup: Long entry with defined risk-to-reward

🔹 Target: ~0.85

🔹 Stop: Just below the breakout zone

🧠 Technical Perspective:

Volume uptick during breakout confirms buyer strength

Strong support retest zone around 0.28–0.29

Holding above this range could fuel a significant leg higher

📌 This setup offers a clean structure with a high R:R potential. PNUT has proven it can move fast — now it’s about following the breakout with tight risk management.

📥 Add to your watchlist and let price action lead the way.

PNUTUSDT – Breakout Brewing from Bullish Pennant!PNUT Bullish pennant Formation – 200%+ Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver!

PNUT is consolidating inside a bull pennant after a massive 200%+ rally earlier this month. Currently, it's sitting near the lower support zone, forming higher lows—a sign of growing pressure for an upside move.

🔍 Setup Highlights:

Bull Pennant forming

Strong bounce zone (green box)

Potential breakout path marked in projection

📌 Trade Idea:

Entry: $0.31–$0.28 support zone

Targets: $0.39 / $0.46 / $0.55 / $0.72

SL: Below $0.27

Leverage: 5x–10x (only for experienced traders)

Keep a close eye—once PNUT clears the triangle resistance, things could move fast.

What are your thoughts?

PNUT Reversal Arc: From Panic Low to 120% Rebound Potentia

The PNUT/TetherUS daily chart from May 10, 2025, presents a compelling case for a powerful recovery rally, despite today's sharp correction (-12.87% on 364.19M volume). While current price action appears bearish at first glance, the broader technical structure reveals an exceptional buying opportunity forming.

--- The Macro Technical Framework ---

The chart shows PNUT has been trading within a well-defined ascending channel (white boundaries) since the January 2025 low. What makes this pattern particularly significant is the recent development:

1. Major Breakout + Pullback Scenario - After breaking out from months of consolidation, PNUT has experienced a sharp pullback, creating the classic "shakeout before the breakout" pattern that often precedes major moves

2. Historical Supply/Demand Zone (purple rectangle) - The 0.55-0.60 region that previously acted as strong support before the late 2024 breakdown

3. Structural Support Level (gray horizontal line) - Additional confirmation of support around the 0.22 level

--- Technical Analysis: The Pendulum Swing Setup ---

The recent price action follows a textbook reversal pattern:

Phase 1: Accumulation & Breakout - The extended consolidation from January through April 2025, followed by the explosive green candle breaking above the channel's midline

Phase 2: Current Shakeout - Today's sharp 12.87% decline represents a classic shakeout move, designed to clear out weak hands before the next leg up

Phase 3: Projected Recovery (blue pathway) - The anticipated price movement shows:

- Pullback to the 0.2213 entry zone (confluence of channel support and horizontal support)

- Series of higher lows and higher highs as the pattern develops

- Ultimate target at 0.4671, representing a 111% gain from the projected entry

--- Why This Pattern Is Particularly Compelling ---

Three key factors make this setup exceptionally attractive:

1. Volume Profile Analysis - Despite today's negative price action, the volume signature shows characteristics of a selling climax rather than distribution, indicating potential exhaustion of sellers

2. Channel Integrity - The lower boundary of the ascending channel has held on multiple tests since January, establishing its significance as structural support

3. Historical Precedent - Similar pattern formations in PNUT during 2024 resulted in significant rallies after comparable shakeout moves

--- Strategic Entry Approach ---

The optimal strategy for this opportunity involves:

1. Waiting for the projected pullback to the 0.22 level, which provides both technical confluence and an excellent risk-reward ratio

2. Using a stop loss below the channel boundary (approximately 0.19) for clear invalidation

3. Taking partial profits at the mid-channel area (around 0.33) before allowing the remainder to run toward the 0.46 target

4H VIEW HERE

This technical setup suggests PNUT is preparing for a significant recovery rally over the coming weeks, offering a well-defined opportunity with precise entry, target, and invalidation levels.

HELP US WITH LIKE AND FOLLOW GUYS .. THANK YOU

#PNUT/USDT#PNUT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1595.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1633

First target: 0.1700

Second target: 0.1771

Third target: 0.1916

PNUT/USDT: FALLING WEDGE BREAKOUT ALERT!!🚀 PNUT Breakout Alert – 100%+ Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

PNUT has officially broken out of a falling wedge structure — a bullish reversal pattern we've been eyeing for weeks! After weeks of consolidation and pressure along the wedge resistance, the price has now made a clean breakout with increasing volume.

🔹 Last time it broke out from this zone, we witnessed a massive 109% move.

🔹 Currently, it’s showing a similar breakout structure with room for a big upside move.

🔵 Entry Zone: $0.158–$0.162

🎯 Targets:

• Target 1: $0.21

• Target 2: $0.27

• Target 3: $0.31+

🛑 Stop-loss: $0.142

📊 Leverage: 3x–5x (low to moderate risk)

⚠️ As always, manage your risk and don’t chase pumps. Setup looks strong as long as the breakout holds and we don’t see a fakeout candle back inside the wedge.

📍Let me know what you think — will PNUT fly again?

FIO is ready for the trendLarge-cap coins showed growth yesterday following the tops, and memcoin bullying is subsiding today, followed by a high probability of bullying in the remaining altcoin market. I expect the main day of growth tomorrow until Sunday afternoon, then the probability of a major pullback prevails until the middle of the new week.

Today, fio, which I considered for work in the first place, continues to accelerate growth. The main goal is to retest the key level of 0.025, which will open the way up to 0.50-75. We can see a repeated breakdown and consolidation above today. If the second half of the month opens above the level by June, the fio may move into the range of 0.045-60. With sufficient volatility, a test of this range is likely tomorrow.

After working fio and chess up to 60-90% from current levels as the most undervalued assets in finance today, quick adx pivx can be additionally considered for scalping. There is also a high probability of a new blizzard on atm city acm fantokens with new hays.

Strong rebuy setup for PNUT (8H)Note: This is not a sell/short setup | it is a buy/long setup.

After clearing resistance order blocks and a strong bullish move, buyers seem to have exhausted their momentum and may need a retracement for price to return to their base.

We are looking for a rebuy within the green zone. The price is likely to move from this area toward the red box.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

PNUTUSDT Ready to Rally!PNUTUSDT Technical analysis update

PNUTUSDT is breaking out of a wedge pattern on the daily chart after three months of formation. We also observed a bullish RSI divergence in the daily timeframe, along with a MACD bullish crossover a few days ago. A 50–100% move could be seen in the mid-term.

PNUT / USDT – Daily AnalysisBullish divergence spotted!

Price is printing lower lows, but RSI is making higher lows — a classic bullish divergence pattern. This signals potential trend exhaustion on the downside.

#PNUT is holding above a horizontal support level around 0.12–0.13 USDT, aligning with the divergence signal.

Volume is tapering off, indicating decreasing selling pressure.

RSI is currently around 37–38 and showing a higher low structure.

Key levels to watch:

Support: 0.1220–0.1300 USDT (current demand zone).

Resistance: 0.1650 USDT (local high), followed by stronger resistance at 0.2000–0.2200 USDT.

Scenario ideas:

If PNUT can hold above support and RSI continues climbing, we might see a relief rally towards the next resistance zones.

A breakdown below 0.1220 would invalidate this bullish setup and could lead to continuation of the downtrend. Still... bullish divergence then will become even more obvious....

Bias:

bullish short-term, watching for confirmation.

⚠️ Not financial advice. Always manage your risk!

#PNUT #Crypto #Altcoins #BullishDivergence #RSI #TradingView

Peanut the Squirrel PNUT price analysis🐿 For #PNUT holders, there is good news and a little bit of "not so good" news)

🟢 Good - the formation of a reversal pattern continues

🟡 Not so good - so far, buyers have not managed to gain a foothold above $0.26

As soon as this happens, OKX:PNUTUSDT price will go up to at least $0.40 and $0.57

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

PNUT looks bearish (4H)It appears to be completing a triangle, currently in Wave E.

From the red zone, it may move downward.

Below the chart, there is a liquidity pool, which could be the price target for a sweep.

The invalidation level is slightly far, so proper risk management and position sizing should be maintained

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

PNUT Sell/Short Setup (2H)A large liquidity pool has formed below the price.

We have not yet seen a bearish CH on the chart, but in the supply zone, considering the invalidation level as a stop, we can enter a sell/short position.

If the invalidation level is touched, it will invalidate this setup.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you