Bitcoin AccumulationPresenting a wyckoff accumulation for Bitcoin

The main area of focus on this chart is the JAC (jumping above creek) that we see near the bottom of the trading range.

Price displayed a change in/of character by jumping over the dynamically forming resistance (made by connecting the peaks of the highs) on noticeably higher volume. This illustrates the market absorbing supply.

After this JAC, price entered an uptrend illustrated by the demand line and the supply lines. Price has reacted very nicely to these boundaries.

We're currently facing the top of the trading range that happens to coincide with the upper creek. The appropriate course of action is to wait for another JAC and observe the volume. If the volume is markedly higher, then we accept bullish momentum and seek to enter long positions during a retracement...most likely @ the top of the TR/upper creek itself.

( It is worth noting that crypto doesn't always provide textbook retracements, so a pullback of any sort should be seen as an opportunity if the volume supports an entry. )

Lastly, the target range is taken by using a horizontal count and a point and figure chart of BTC. A reversal of 3 and a box size of 50 was used. TF's of the 1D and the 15min were used. As BTC has a lot of intraday volatility, each TF gave different results. I used the min and max for each resulting in a large target zone. However, the bearish order block (indicated by the red dotted lines) can be used to narrow down targets and observe reactions.

Pointandfigure

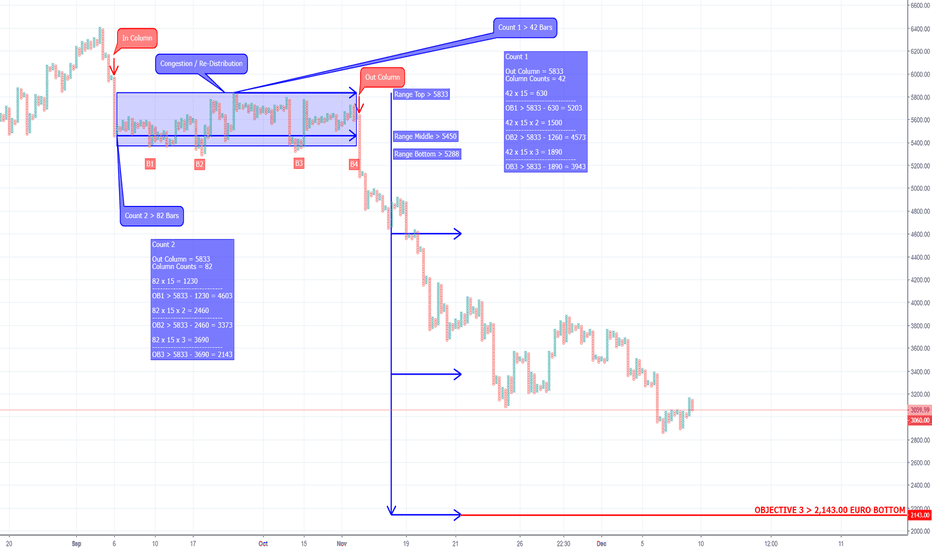

S&P500 outlook using Point & Figure chartingThis is a corrective/bearish outlook on S&P500 Index based on Point & Figure charting.

The Index managed to breach below the first uptrend line around the 2,550 level. Based on P&F charting (which is, arguably, one of the oldest charting techniques used in the western hemisphere), I expect the Index to dip to the second major uptrend line @ 2,200 points (-12% from 2,500 level) as a first target. My second expected target is around the peak of the first consolidation seen on the chart @ 2,100 points (-16% from 2,500). The third expected target, albeit far-fetched but remains a possibility, has been derived from the horizontal-counting and not shown on the chart, is 1,750 points (-30% from 2,500) points.

It should be noted that the P&F chart used has been setup as 25x3

*Always remember; this is an opinion, not a recommendation*

NPXS / BTC - Binance - Point and Figure Counts - ObjectivesJust a quick update on what I am seeing. Will update accordingly.

This would be the minimum count in terms of objectives.

Keeping busy during this final capitulation phase.

Not an expert :-).

Was this a false break?The point and figure chart suggests the upside break was false.

Now we have two key short term levels to keep an eye on.

Twitter users keep ramping up the stock so look out for official RNS's

This may be some kind of pull back before a break higher so do not discount that point of view

Bullish Divergence on Bitcoin Daily RSIBullish divergence on the daily RSI confirmed 20 minutes ago:

Here is a cheat sheet on divergence: i.imgur.com

Here is a historical look at daily divergence since we reached ATH 6 months ago: As you can see, they all played out at least for the short term giving bulls some relief.

Point and Figure Chart i.imgur.com Yesterday we confirmed a column of 14 O's. Just now we confirmed a column of 6 X's, retracing yesterday's long pole. A pullback to $4,499 would complete unresolved long pole dating back over 8 months ago and is our next likely long-term target. Short term, we have a recent unresolved long pole of 16 O's from 6/10, a move above 7,040 would resolve 50% of the pole.

Here is a look at Major trendlines since bull market ended. Right now we are in the green channel down. Relief if we break out up or max pain if we break down. Part of me wishes we could break down because we would probably get a good strong bounce off the 4k range. But following today's bull div we will probably edge up out of the channel and resolve our most recent long pole by reaching 7,040.

Learning Wyckoff methods -2.8 Bulls on Roids?There is a wonderful base formation in a lower time frame, which is very convincing to me that down side might be capped from here ...

here is the link to that cart....

tvc-invdn-com.akamaized.net

Although this is a bullish projection before confirmation of a reversal of trend, if the base slides lower, i will update the charts here ..

Remember the point and figure chart is a 1D chart with out any time axis...

This was used by Wyckoffians in addition to a Vertical Bar chart in those days..

Disclaimer.. not invested/ not trading.. no cryptocurrency in possession right now..

Not an investing/trading recommendation

I am new to Point and figure charting and presently learning the same from HM gartley- Profits in stock market and Charting the stock market Wyckoff methods by Jack K Hutson

(4/7/18) BTSUSDQuad bottom formation will be confirmed at 0.115. Could possibly also fail to meet that price point and develop into a Bearish Reversal.

(4/4/18) BTS catapult formingThe spread Triple top is technically in play even though I would have sold when it failed to yield higher lows. However, a bullish catapult seems to be forming. I would enter into a trade at 2280 - the point at which that signal is locked.

(4/4/18) EOSBTC P&F - AN ANALYSIS OF MARCHMarch ended with aproximatly a zero net gain/loss. we saw the Febuary decline terminate in the first half of the month followed by a shakey but consistent uptrend. EOS on correction during the upward leg is consistently testing support suggesting an inclination towards the bearish side.

However, this is counteracted by broken resistance levels that suggest a more bullish outlook on termination of this rising triangle.

Currently (4/4/18 18:45 UTC), a spread Triple Top may be forming and strong support would lead me to suggest this will be the case. However an aternate less likley pattern might unfold - A bull trap followed by a Spread Quad / Tripple Bottom formation and a movment in a downwards direction.

Historically though, when presented with ambiguous direction over a ichimoku support cloud the price bounced.

Please, suscribe to my Steemit Blog if you like these posts!

steemit.com

(4/3/18) EOSBTC - CONGESTIONA horizontal count from the previous congestion yielded a projection to 0.00076 that has not been met.

EOS has congested between 0.000792 and 0.000832. Resistance seems to be stronger than support.

A bigger picture:

We can see over the past month EOS has been generally moving in an upward trend making newer highs.

BTS (4/2/18) Triple top formationBullish Divergence indicator Triple Top forming on BTS.

The last Triple top failed (failure to make new highs), however, if an entry was made at 0.134 or 0.136 (on signal confirmation) then the trade could still be active with a generous stop loss. A Spread Triple Top has formed and a preliminary horizontal count gives us a preliminary target between 0.182 and 0.194

We seem to be in the clear and out of resistance but as a rule, I will wait for the signal to be confirmed before making a trade.