EURUSD Macro UpdateThe Euro has sunk and moved in line with our last market update however our models are now signalling signs of greater downside risk than a short/medium risk reversal.

Macro view

Options

- A bearish shift in market sentiment with put options (bearish bets) now claiming the highest premium in nearly four months

- One-month risk reversals (EUR1MRR) (higher volatility put premiums), crossed below zero on the 10th February and fell to -0.425 last Friday, the lowest level seen since 29th October 2019

Futures

- Hedge funds (leveraged funds) substantially increasing EUR short positions

Thematics

- Dollar bid remain supported under risk aversion

Technicals

- Symmetrical swing into 1.07xx institutional floor likely before any meaningful correction

Our last update

Politics

Hypothetical UK Election Trade ...Election results come in...

(for which party will be in government). which results in a rise or fall in GBP

due to it's significance (in this instance it was seen as a good result and GBP rose).

-We know there is going to be volatility, so we can profit regardless of whether the

price goes up or down as when the price reaches certain points (A if price rises and

B if price falls) it will trigger a trade which will cancel the other one

-Can be executed on many pairs/ stocks if large results are due.

-Eliminates bias with OCO order.

--(DISCLAIMER) Set TP and Trigger point on major support resistance,

you don't want to trigger then go the opposite direction!!

Straddle Trades can be good for profiting regardless on where the price goes (in times of high volatility) and you could have made some good profits here, this could be replicated for trades such as EUR/GBP, Non farm payroll, US Elections etc... and are also known as OCO (One Cancels the Other) orders

Technicals versus PolicitiansWIth Warren and Bernie fading a bit, Bio/health have jumped nicely. Too much too soon IMO, at the minimum a short term pull back is coming. I am hoping we can become more range bound in the technicals and return to cyclical trading between 78 and 87, this type of cycle is great IBB and XBI, however getting caught when it breaks down can hurt! I use XBI has my measure, but trade LABU and LABD.

**Short XBI via LABD

GBPCAD : POTENTIAL REVERSAL ?The GBP is still at the top of the Daily strength meter v CAD which has dropped below the zero line the past 3 days indicating a push up for GBP.

The problem here is that GBP has been attempting the move the past month and keeps being restricted in its advance.

A break and close above 1.7100 should provide clarity to the upside for the time being.

Should GBP start declining on the strength & weakness meter a reversal could be more favourable.

POLITICS !!!!

SPX S&P500 Breakout or Top Out? Either way, The Bull Continues!Euphoria would have to take hold with major progress in China Trade, Brexit, improving earnings and guidance, etc, for the overall market to continue this pace without a consolidation.

I expect a return to 2,950 around EoY 2019, but a rhythmic bounce up to 3,300 by May 2020.

Election based volatility will have a major impact. If Warren gets the nomination, expect another $2,850 test. If Biden or Buttigeg get it, expect to hold a similar upward rhythm.

Either way, the Great Bull will continue to run through 2020.

S&P 500 - A Bearish Outlook Heading Into 2020Here is my thought process behind why I have a bearish outlook heading into 2020 - please note that this is the second time that I have ever published analysis and this is just me synthesizing a bunch of ideas. I'm going to start off with the lighter ideas before moving on to the heavier ideas...

1) We are in the late stage of the economic cycle... this is the longest expansion of the US economy since records began. Common sense dictates that we will enter a recession soon.

2) Keeping this in mind, let's look at the state of politics around the world. We have protests and riots in HK (recently a protestor was shot for the first time), we have Brexit which has both Germany and the UK on the brink of recession. The US and China trade war has not improved at all and is constantly seeing tit-for-tats. Finally, literally the other day the US was given the go-ahead by the WTO for $7.5 billion in tariffs on the EU in response to their 15-year long row over the subsidizing of the rival aircraft companies Boeing and Airbus.

3) In recent surveys, over half of economists in the US believe that a recession will hit the US in 2020. The market has also seen the yield curve invert, providing a stark warning (although this usually takes at least 12 months to materialize, this is a bad indicator).

4) There is a ridiculous bearish RSI divergence on the charts, with Fibonacci Time Zones pointing towards significant price action at the start or end of 2020. I believe this is because this cycle was pumped and overrated, running on the crack cocaine of financial markets: Quantitative Easing.

5) Recessions usually occur when there is a sharp fall in liquidity in the cash markets (referring to bank deposits and not trade execution liquidity). In recent times we have seen a bipartisan deal passed through in the US which mandated the US Treasury to "aggressively build up" cash reserves. After lowering the debt ceiling the Treasury plans on borrowing an additional $433 billion during this quarter (about $275 billion more than it had previously estimated) which is roughly ten times (1,000%) more than what the Treasury borrowed last quarter ($40 billion). This would cause global dollar liquidity to dry up fast (foreign nations and banks use excess deposits and reserves to purchase these meaning dollars flow out of the economy into the Treasury).

6) Continuing on from the last point, not only do we have dollar liquidity vanishing in the global economy but we have negative dollar swap spread (those lending USD via currency swaps want higher premiums). This is only getting deeper and deeper. Interestingly, the Bank of International Settlements found that cross-currency swap spreads act as a more accurate measure of struggle in the financial markets than the VIX. This shortage of dollars (highlighted by the premium being charged to lend dollars in swaps) comes at a time when the global economy is already weakening thus is making financial markets more fragile (turning to IMF reports on muted inflation and weaker final demand for goods and services) also referring to previous points

Seeing and analyzing all these factors, the future doesn't look too bright. Disappointing economic data continues to plague our minds. As the Fed continues to cut interest rates they are only giving debt-laden companies one more sigh of relief which will only knock the inevitable crash further down the road when neither corporations nor the government can cope with it (they're throwing away all their ammunition and shooting themselves before the battle has even started). The drop to come will be harder and more brutal than 2008 because asset prices are currently inflated at incomprehensible levels due to quantitative easing as well as the Fed having little headroom to cut rates further. You could only imagine what is to come in countries with much less head-room for monetary policy than the US... What's next? Helicopter money!?

Disclosure: I hold shares in: XSPS IGLT O IBTM

Gold collapse and dollar surge due to impeachment proceedingsUsually gold moves opposite the dollar. Recently, however, both gold and the dollar index have been moving up. Gold has moved up largely because we got a rate cut and because there are war and recession fears. The dollar has moved up partly because of Chinese and European currency devaluation, and partly because no rate cut is expected later this year. There was bound to be a reckoning at some point as gold and the dollar sorted out which one would prevail. This morning, that reckoning came when the dollar index broke out upward and gold broke out downward.

What's driving this breakout? I've found surprisingly little analysis to explain it so far, but here's what I can figure out. First of all, today's breakout is genuinely driven by dollar strength, not by the weakness of other currencies. The dollar is up against a broad range of currencies, not just the Euro and Yuan. Secondly, markets are more forward looking than backward looking, so they're perhaps going to weigh future rate cuts more heavily than past ones. Thirdly, gold is up so far this year that perhaps the bulls got a little fatigued. We've been overbought on the weekly chart for a while now and forming a bearish divergence, so this could be partly a technical pullback in gold.

But I think what's really driving this morning's breakout is the Trump call transcript and the initiation of impeachment proceedings. Trump has broadly favored weakening the dollar, so it would be bullish for the dollar if he were removed from office.

Healthcare volatility could be good for swing tradersA recent survey of analysts by FactSet revealed that we're in an "earnings recession" right now and that it's expected to get worse in the next quarter. Certain sectors have been particularly hard hit, namely mining and semiconductors. The sectors that are expected to report the best earnings this quarter are healthcare, utilities, real estate, and gold. These are defensive sectors that usually do pretty well when the rest of the market is down. Utilities and gold are priced a bit high right now, but could be good for an entry if they pull back. Real estate stocks are a slightly better value, but would also be better after a pullback. Healthcare stocks are cheaper, but they face a lot more political risk, especially with Elizabeth Warren leading the Democratic pack. Health insurance and pharmaceutical companies are at particular risk from "Medicare for All."

Given the extremely mixed outlook for health care right now-- its bullish fundamentals and bearish political risks-- I expect to see a lot of volatility in this sector. Direxion's and ProShares' leveraged funds are great for playing that volatility. For upward moves you want CURE, and for downward moves you want RXD. Alternatively you could play the pharmaceutical equivalents, LABU and LABD. Look to buy and sell oscillations between critical support and resistance or overbought and oversold levels. Roughly speaking, I'd guess that healthcare outperforms through earnings season but pulls further back as the election heats up. You can see from CURE's chart that this sector has been downtrending overall. I expect that to continue until at least the primary. (If a market Democrat like Biden gets nominated or if Trump gets re-elected, that would be hugely bullish for this sector. Hugely discounted healthcare stocks could surge overnight.)

Long position on Gold above 1,358 on possible bearish FOMC min.

Good morning,

I would like to trade gold at this moment, but I am not willing to take a massive risk prior to FOMC minutes that will be released later on today! As shown in the graph (4 hr time frame), gold is priced on the higher bound of a 1.5 year old wedge.

While the US-China-Mexico fumble is still on the bounce, twisted with brexit rumble and global economical slowdown has forced Mario Draghi's yesterday's comment on possible rate cuts, which has given more fuel for the yellow metal.

The only napalm arsenal required for gold to hit towards 1,400 only if the feds decide to throw in a rate cut as well.

A part of my conscience is telling me that this is highly improbable, however, I shall place a buy stop order @ 1,358 targeting 1,390. This order will expire tomorrow.

Good luck

Short USDJPY on the daily chartIts been over a year where the prices have ranged between 114 to 104.5, giving no clear indications. Might as well take advantage of this big range and check out the daily close below the fibo retracement of 50% @ 109.58 to give a clear path for the 61% @ 108.4. Prices currently @ 109.3, got to make a move , placing a stop @ 110.

Good luck

Macroeconomic and Political Long term effect on the EURUSD pairMay 9th 2019

EUR/USD

This is a time where the macroeconomics of the U.S are influencing this pair in conjunction with the technical analysis seen on the chart. However, the macroeconomics are having an 80% influence over the price movement at this time, while 20% of the movement is still attributed to the technical.

The EUR/USD has reacted inversely to the movement of the S&P500 over the last 4 days as President Trump warns more trade tariffs on Chinese goods and a potential trade war between the two Powerhouses. (Compare EURUSD to SP500 )

This threat has had negative outcomes for the S&P500, Dow, Nasdaq and virtually all major U.S stock indexes. This movement has trickled over into the currency markets, showing a devaluation of the U.S dollar causing the EUR/USD pair to rise to break through its weekly resistance on high volume pushing it to intraday new highs of 1.1250.

Since the initial push, the price seems to have consolidated in a textbook flag pattern, slowly sinking below the weekly resistance. While the price is consolidating, this is the perfect time for a trader to speculate on the direction of the next big move over the next week or coming months.

Macroeconomic & Political factors at play

There are a lot of macroeconomic factors at play with this currency pair over the next month and coming months which will make deciphering movements difficult but that is why trading isn't for everyone. This will be hard. And most likely won't be fun or a get rich quick scheme.

Here are the major events that are looming over the price movement of this currency pair this week/month.

1. Potential Trade War with US&China -

President Trump finds himself in a peculiar spot, boxed in between his 2016 campaign promises to be tough on China, and his self proclaimed measurement of presidential success being the S&P500. President Trump sees that if he continues to be tough on China, the S&P500 will react negatively which it has done for the last 3 times he has beefed up tough talks against China. Investors believe that if Trump pushes forward with more tariffs on Chinese goods this will spark retaliation from China which will hurt U.S businesses that rely on a good working relationship with China, and competitive pricing. When the tariffs were first introduced the S&P500 reacted negatively to it and U.S businesses felt the brute of the iron curtain of tariffs. Early in January, President Trump promised trade negotiations with China, and since then there was only good news of favorable outcomes from the negotiations. However, over the weekend President Trump tweeted that negotiations were not going as well as planned which caused the S&P500 to plummeted. If these negotiations aren't going as planned president Trump may decide to be tougher on China with increased tariffs which will spark a retaliatory trade war as China has already begun doing.

2. Brexit Looms - Let's not forget that Brexit still isn't done, and it is basically making the UK more and more confusing to be an investor. Brexit, which was supposed to happen in March 2019, has been delayed by Theresa May to ensure she can create a road map forward for the country. Brexit is now scheduled to happen in October to give the government more time to prepare the country. However, the uncertainty of what will happen next is hurting British businesses. A weak housing market, slumping autos production, declining investment and downbeat executives all suggest that continued confusion over Brexit has caused the UK economy to stagnate. As more news about Brexit is released throughout the month it will inevitably affect this currency pair.

BREXIT UNCERTAINTY

Original deadline: March 29, 2019

First delay: April 12, 2019

New extension: October 31, 2019

3. US Election Cycle - There is no doubt U.S Election cycles affect the stock markets and the currency markets. Most of the presidential candidates have already launched their campaigns and as respectable contenders slam the sitting president and gain polling numbers, investor begins to think what would what happen if this candidate wins. For example, during the 2016 presidential elections, investors believed Clinton would be the victor and her push to lower drug prices were going to inevitably hurt the pharma industry. Therefore investors began pulling out before the ballots were even cast. This month in the election cycle is something to watch out for not because of what the candidates will say, but because what President Trump may respond to. If Trump begins responding to candidate promises associated to the economy, this may be an insight into what he will campaign on and moreover, what he will do in the coming month with China.

4. US Unemployment Rate - The U.S recorded a record-breaking low unemployment rate last month of 3.6%. This will no doubt be one of President Trump's talking points during his 2020 campaign. This is important because of two things, 1. historically low unemployment proceeds a market crash and correction and 2. maintaining this low unemployment rate will be the main focus for President Trump to ensure his re-election in 2020. In President Trump's mind, he is winning and succeeding with the U.S economy. He is doing what he said he will do during his 2016 campaign. But now his problem is that he is in a lead way too early, he will have to try to maintain low unemployment rates through to his campaign trail so it can stay relevant in the voter's minds.

5. Trump's Stock Market - After being elected President, the stock markets rallied for the business-centric president Trump. Investors gained confidence that Trump will do what's best for the Economy, and for the most part he has done just that. Until of course, you start to look more recently. With a tweet, he sent over the weekend the stock markets each lost 1 to 2% of their value. This is not what President Trump wants, especially if he ends up reversing all the gains the market has had over his presidency.

President Trump does not want to have a weak stock market going into the Presidential Election Cycle, but he also doesn't want to be weak on China. The Vice Premier of China is flying into the U.S to complete trade negotiations with the U.S and we should expect a result within the next week.

With Brexit not scheduled to happen until October, I think that is far enough outside of the realm of affecting this currency pair this month. In my opinion, I believe President Trump will increase tariffs, even if for a while on China to show China that there are consequences to crossing this administration. But I believe those tariffs will be lessened in time before the presidential elections to give the markets time to recover and be in a growing state by the time he is on the campaign trail. I think his game plan will be to have the markets growing strong while on the campaign trail so that he can get re-elected and be tougher on China at a later date.

If these events play out the way I believe they will, May will see an increase in tariffs causing a 1-4% decrease in market indices over the May-July period resulting in an increase in the currency pair EUR/USD.

Companies affected by the tariff increase will report lower earnings through the August-October period. Causing an additional decline in the major US market indices. Further increasing the currency pair.

Lower earnings will result in some companies closing their doors or laying off workers. If this is done at a favorable rate this could actually curb the market crash theories and reverse the historical pattern. Or it can be a catalyst to the market crashing in November-January.

Lower earnings reported during the Aug-October months coupled with Brexit in October can result in a major shake-up of the EUR/USD pair. However, if the two forces are of equal size they may cancel each other out and we may so no real change to the EUR/USD pair in October-November.

These are thoughts that may affect the currency pair in the way presented, investing is a risk and this should not serve as a recommendation to invest but rather educational material.

BULL DRAGON! Hyper Bullish Scenario (LONG)Wassup guys

this is bull dragon! we are back again!

as you can see from my last TA. i Hit the 1st Hyper Bullish Scenario.

Bitcoin is already gainging strong mementum!

but not yet! we are not going to the moon not just yet!

we are having a yet another Correction! dont worry its a healthy one!

it will be very dangerous if we aproach 6k in this early stage of bitcoin correction, we might face $2k area!

but as you can see the market price action are very healthy and its according to our Bull Dragon Scenario.

we are going back to .618! make sure to buy that area! for a long position.

Target Sell Around 6.5k-7k (FINEX) or even HODL it! :D

actually we might even go higher now up to the MA 50 resistance from 1 week chart. around 5550 at binance and 5700 at FINEX

Be sure to Short it! :D

GoodLuck on Trading!

SPX (S&P 500), Daily Chart Analysis Feb 23Technical Analysis and Outlook

The index is continuously moving steadily to higher towards our Next Index Rally 2840 , while a significant Key Res 2814 will act as a major barrier. In near-term, on the downside, there is an intermediate Mean Sup 2747 , and Key Sup 2706 . (For latest Market Commentary, please visit the TradingSig_dot_com).

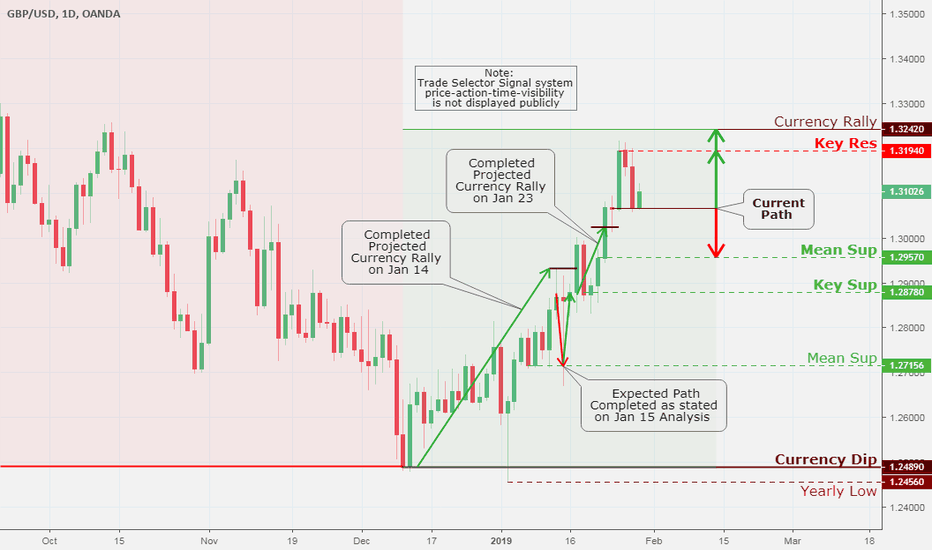

British Pound (GBP/USD), Daily Chart Analysis Jan 30Technical Analysis and Outlook

The currency has created a new Key Res 1.3194 just shy of completing our Currency Rally 1.3242 , therefore, expect a retest of this significant development in the intermediate time-frame. On the downside, there is a possibility of a pullback to Mean Sup 1.2957 before the up-movement. (For more Market Commentary, please visit the TradingSig_dot_com).

USDMXN AMLO or Ressesion?Here is a scary thought for the average Mexican. With the leftist inclination of Mexican President Andres Manuel Lopez Obrador (AMLO), Mexico could near an inflation streak for the following months or years to come. Uncertainty has risen in Mexico about whether AMLO's leftist policies will mean the printing of money to pay for public services and goods or weather he will be reallocating resources from other government agencies. The action of relocation for the time being is what is likely to happen given the President's short time in office. Time will tell weather or not the policies of the Mexican President will include the printing of money to pay to improve the community, weather he'll borrow such money or only reallocate funds. On the other hand with the United Sates being in a correction we could begin to see the price of the dollar and peso stalemate for some time with what I believe to be slight upward if the actions taken by the President become inflatory.

Bitcoin Price Will be $1114 Hi people!

after my previous prediction came true(),i wrote a new idea for u about btc price!!

btc price will be around $1114 and it's all politics!!!

yes!politics!

they want to make u afraid and sell ur bitcoins and they are selling even their miners and get ready to buy all of your bitcoins!

they will filling your pockets with usd and their pockets with btc!

BE AWAKE!!!!

US Election Effect on Bitcoin PriceHOWDY!! - Sticky Joe

Sup Peeps,

Ok so I have been looking at the charts today because I wanted to make a new TV idea, and I noticed something. WE HAVE BEEN IN A BULL MARKET SINCE JUNE 29!!!! Every single one of those waves up that we have had since June 29 has been actively price-suppressed by the whales (those magnificent b@stards). Bitcoin and the alts have had weak hands sloughed away every month for half a year now. If you have been selling bitcoin at these prices for anything non-essential YOU ARE A FOOL. OK now for the analysis:

I said in my last idea that what we are waiting for is a new catalyst. Something to demonstrate that Bitcoin is in a new cycle (not something to bring about the new cycle; we have been in BULL since late JUNE). Something to tell the lemmings in the regular world "maybe I shouldn't have my retirement money in Facebook stock" and to get them into thinking about bitcoin.

I believe that that day has come. It is the US Election Day people! It is looking like the democrats have a reasonable chance to take The House (they are not taking The Senate no way in hell lol). The democrats have said that they will focus on attacking business, and the stock market has been bleeding out in anticipation. People are jumping out of stocks and conventional investments all over the world like rats off of a sinking ship.

Whether or not the democrats actually will attack business is a moot point. Investors think they will, and Wall Street is preparing for a "Red Dawn" situation (lol the soviets are in the streets!!! lols SELL SELL SELL!!!) All the smart money will go into bitcoin. THERE ARE VERY FEW OTHER SAFE INVESTMENTS. If you disagree ask Tether people. They can try to put their money into dollar stores and canned food companies, but there is only so much money you can put into dollar stores and canned food lolz.

I truly believe this is the last moments before the blowup. I truly believe this is what the whales have been waiting for. I truly believe this is what all of us bitcoin investors have been waiting for all year. Global market collapse, rising inflation, distrust of conventional investments. This is where we see if Bitcoin has the minerals.

Current Portfolio Composition:

BTC 19,4 %

ETH 27,8 %

BCH 14,7 %

LTC 11,2 %

XRP 20,9 %

BAT 6,0 %

I'm not kidding people. The stock market will crash this week. Smart money goes to CRYPTO.

Perfect setup to short the S&P 500As described in my previous note on the S&P 500 there have been two major market corrections since the end of the Great Recession. They were periods of high volatility and a lot of repricing of stocks for 140 days or more.

In both cases they started with:

1. A complete reset of the RSI ( Relative Strength Index below 20)

2. The S&P 500 holds below the 200 day MA

3. The 50bar EMA passes below the 100bar EMA

They end when:

1. The S&P 500 0.54% holds above the 200 day MA

2. The RSI holds above 50

3. The 50bar EMA passes above the 100bar EMA

We are clearly not in a recession in the US however there will likely be many months of turmoil in the markets if the Dems take the House. From the TA angle we have a strong reset of the RSI currently retesting the trend-line just below 50. The S&P 500 is just below the 200 day MA and the 50 day EMA just death crossed the 100 day EMA.

When I first posted this I said "I think we will have our answers in the next 10 days. If this is for real, we will see all 3 conditions met and people will be talking doomsday talk all the way through March."

I now have a more bearish outlook, I will be looking for cheap stock prices to buy in when the S&P 500 reaches 2500 to 2400. We should also see higher trading volume of course.

Gold miners should do well in the short term since all of this is based on inflation fears. Common sense dictates however that gold will not rise for any reason other than short-term fear and that higher bond yields will keep gold down once fear subsides.

The TTW (Trump Trade War) is good for the dollar, bad for the developing world, bad for retail stocks if it continues into the holiday season. It is also bad for exporters since the dollar is going up. Tech stocks will bottom faster and recover faster than anything, the TTW does little to hurt their profits.

EUR/USD mid term election thoughts. I will not pretend to be an expert in politics, all I can say is this is the data that I have found. You may make your own prediction. The evidence leads me to believe that if the Republicans win than the value of our USD will remain strong, and our price line shall either stay at current levels, or likely dip further. If the Democrats have a sweeping victory... Well, I don't plan to trade much in a bear market. Please feel free to comment your thoughts. We are looking at a weekly chart in the long term.