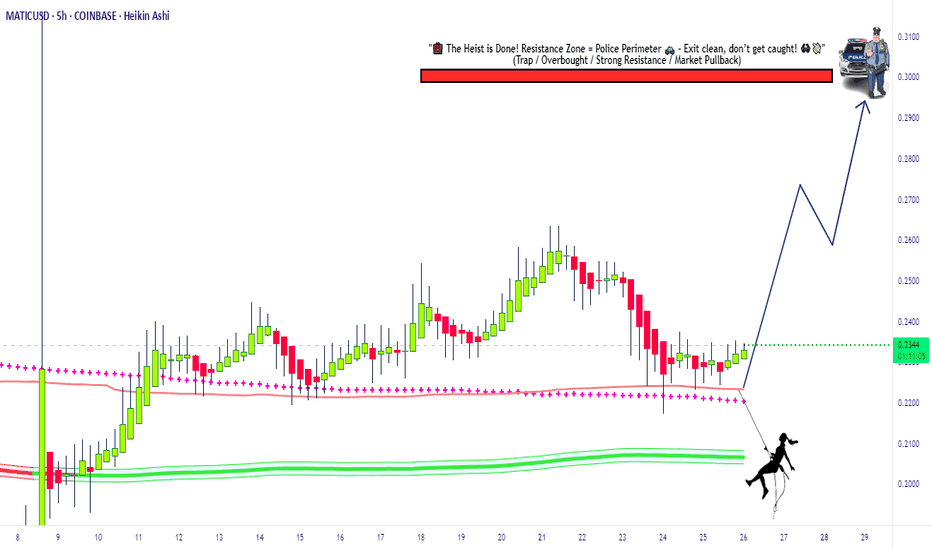

Swipe the Polygon Vault MATIC/USDT Bullish Heist Strategy🔥 MATIC/USDT Heist Plan: Swipe the Loot Before the Cops Clock In! 🏴☠️💸

🌍 Oi! Hola! Bonjour! Hallo! Marhaba!

💼 Welcome back, Money Makers & Market Bandits!

The Polygon (MATIC) vs Tether vault is wide open! Based on our 🔍 Thief Trading Style Analysis, it's time to plan the ultimate crypto chart robbery with a long-side assault on this bullish breakout. 📈💥

💣 Robbery Blueprint – The MATIC/USDT Master Plan

🚪 ENTRY STRATEGY: Get In, Get Rich, Get Out!

⚡ Vault Breach: Enter LONG at market price if you're bold & fast.

🎯 Smart Entry: Wait for price pullbacks on 15m/30m swing lows/highs.

💎 Use layered DCA-style orders for clean risk-controlled entries.

Thieves don’t rush—they snipe the perfect price levels.

🛑 ESCAPE PLAN: Stop Loss Strategy

📍 SL placed at: 0.2000 (based on 4H candle wick zone).

💡 Adjust SL to your loot capacity (risk, lot size, number of orders).

⚠️ If price dips near SL, that’s the cops knocking—bail fast or go down swingin’.

🎯 TARGETS: Stack Your Bags Before the Alarm Rings

🚀 Primary Target: 0.3000

🧲 Scalpers: Grab & Go! Stick to long bias only. Use trailing SL to protect the gains.

🎩 Swing Robbers: Hold strong. Watch for resistance traps & trailing stops near key zones.

📊 Market Intel: Why This Heist Has High Odds 🎯

🔋 Bullish pressure building with growing momentum.

📡 Supporting Data:

🔍 On-chain metrics signaling accumulation

💼 Macro sentiment favoring risk assets

🧠 COT reports + intermarket analysis leaning bullish

Just don’t get comfy—this is a heist, not a honeymoon!

🚨 Trade Warning – Don’t Get Caught!

📢 Major News Releases = High Volatility.

🚫 Avoid fresh trades during key announcements.

🔒 Use trailing SL to lock in profits & escape clean.

💥 Like, Follow & Power Up the Robbery Squad 💥

💬 Support the crew. Hit BOOST to keep these trade ideas flying.

Your thumbs-up fuels the next chart breach. 💪

📡 Stay locked in—more heist setups coming soon!

🎯 Trade Sharp. Swipe Smart. Escape Fast. 🏴☠️

Thief Trader Out. 🐱👤💰

Polygonusdt

POLUSDT Bullish🔍 BINANCE:POLUSDT Technical Outlook – May 16 🔍

Bulls are watching the key $0.2390 level! 🔼

If broken, we could see a rally towards $0.2620, then $0.2940, and even $0.3200 if momentum stays strong 🚀

But if price gets rejected... 👀

Watch support at $0.2150 – and if that fails, $0.1900 could be next 🛑

📊 Current zones to watch:

🔴 Resistance: $0.2620 | $0.2940 | $0.3200

🟢 Support: $0.2390 | $0.2150 | $0.1900

#POL/USDT#POL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 2270.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2270

First target: 0.2322

Second target: 0.2374

Third target: 0.2430

POL Breaks Out of Monthly Downtrend, Ending Consolidation Phase.POL has recently emerged from a significant downtrend following an extended period of consolidation. It has successfully surpassed the 0.2200 resistance level that defined this consolidation range and is now working to maintain its position above this threshold. This presents a potential opportunity to enter a long position, with price targets set between the 0.2400 and 0.2500 levels.

pol pol usdt daily analyses

time frame daily

risk rewards ratio > 5 ( incredibly )

look at the chart

this analyse is base on price action and support and resistance

pol has 2 resistance boxes above its price

the weak one ( red ) and the strong one (blue)

pol broke the weak resistance and price came down little and moved up and broke again.

now it pass the first box and will move to strong one.

if pol can break second resistance ( blue ) we will reach our valuable target and 500% benefit

it is not out of reach

Polygon (POL) AKA "MATIC" - Long Key LevelsPolygon (POL) or "MATIC" has experienced a strong rally recently, climbing from its monthly low of $0.40 to its current price of $0.70. This implosive move has brought the bulls to push POL to a critical descending trendline resistance level that the bears have held in a long-term downtrend since 2022.

The key level to watch is the $0.76 mark, where the neckline and trend line meet with previous resistance zones. A breakout above $0.76 could potentially surge POL to it's 1st target which is around a resistance level of: $0.89. If momentum continues, then price action will retest between: $1.23 - $1.48 representing a potential upside of +100% from the breakout at this current point

Polygon (POL ex-MATIC) gets increased accumulation: $1 soon?The Polygon token has reclaimed its position in the top 30 cryptocurrencies with a weekly price surge of ~50%. With this, this Ethereum-based Layer-2 altcoin is regaining momentum and preparing itself to achieve a multi-year high this bull run. We at CoinPedia have created an in-depth Polygon price analysis and possible short-term price targets.

After recording a new yearly low, the Polygon price has experienced a strong bullish reversal. This has resulted in this altcoin reclaiming an 8-month high. Moreover, the altcoin is on the verge of possibly breaching the resistance level of the channel pattern, highlighting increased bullish sentiment.

Moreover, with a surge of 143.36% during November, this altcoin has breached its resistance trendline of the descending channel pattern and has further formed an ascending channel pattern. Notably, this altcoin continues trading within it with a constant bullish price action.

The Moving Average Convergence Divergence (MACD) displays a constant green histogram in the 1D time frame. Moreover, with its averages recording a constant uptrend, the Polygon price may continue gaining momentum this week.

Maintaining the price above its support level of $0.690 could set the stage for this altcoin to prepare to retest its resistance level of $0.890. Furthermore, if the bullish momentum sustains at that point, this could result in it retesting its target price of $1.

Conversely, if the crypto market experiences an increase in liquidations, the POL coin price could retest its support level. Furthermore, if the bears dominate the crypto space, the MATIC price could retest its low of $0.50.

POL/USDT: The Perfect Short-Term Play?POL/USDT – Demand Zone Opportunity with Caution

Polygon Ecosystem Token (POL) is approaching a demand zone that aligns with a Fibonacci retracement level, offering a potential short-term bounce. However, since this is not a high-timeframe (HTF) level , traders must exercise caution and manage their risk effectively.

Buyer Activity : The demand zone reflects a lower timeframe area where buyers have stepped in previously, indicating potential short-term interest.

Fibonacci Confluence : This zone aligns with a key Fibonacci retracement level (e.g., 0.618 or 0.786), which could enhance its strength for a short-term reaction.

Why Traders Must Be Careful

LTF Nature : This is a lower timeframe (LTF) level, making it more vulnerable to volatility and false breakouts compared to HTF zones.

Limited Strength : Since it lacks the institutional significance of HTF zones, the level may not hold as strongly.

Breakdown Risk : LTF zones are more prone to invalidation, so risk management is crucial.

How to Trade POL/USDT Safely

Wait for Confirmation : Only enter after bullish signals like candlestick patterns (e.g., hammer, bullish engulfing) or volume spikes indicate buyer strength.

Set Tight Stop-Losses : Place a stop-loss just below the demand zone to minimize potential losses.

Monitor HTF Context : Align your trade with the HTF trend. If the overall structure is bearish, this LTF zone may not hold.

Use Smaller Position Sizes : Reduce position size compared to HTF levels to account for the increased risk.

Summary :

The POL/USDT demand zone and Fibonacci retracement setup present a short-term trading opportunity. However, the lack of HTF validation means traders should proceed with caution, use tight risk management, and wait for strong confirmation signals.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

My Previous Hits

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

Bullish Momentum in Demand ZoneI’ve market bought POLUSDT as it’s showing strong bullish momentum and is currently sitting in a well-defined demand zone. The price action indicates significant buying pressure in this area, aligning perfectly with my analysis.

This setup reflects a high-confidence trade for me, as the combination of bullish sentiment and a key demand zone often signals a potential upward move. As always, proper risk management is essential, let’s see how this plays out!

I don't overcomplicate things and add a ton of dirty crap to my charts, but you can check out the success of my analysis below.

I approach trading with confidence backed by experience and past success in identifying high-probability setups.

While I don’t claim to be the best, my track record speaks for itself, and I strive to let my analysis and results do the talking. Watch these levels closely—markets can confirm what charts already whisper. Let’s see how this plays out together.

My Previous Hits

🐶 DOGEUSDT.P | 4 Reward for 1 Risk (or more if you’re bold).

DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P | HTF Sniper Precision

RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P | Buyer Zone So Accurate You’ll Double Check

ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P | Buyer Zone Mastery (CZ vibes).

BNBUSDT.P: Potential Surge

📊 Bitcoin Dominance | Called it Like a Pro

BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P | The Blue Box: A Demand Zone with Potential

WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P | Long-Term Trade

UNIUSDT.P: Long-Term Trade

Now sit back, relax, and watch the market do its thing. Or don’t, FOMO is real. 😉

POL 1$ TargetLike I said earlier, any rebranding is a green flag for investors and an indicator to buy the asset. POL was no exception. 1$ is exactly the target that big investors are waiting for. I think it's no secret that along with Bitcoin, Ethereum and Solana, a major market maker was accumulating POLYGON, which eventually became POL. Bullish!

Horban brothers.

MATIC (Polygon) Down Channel BreakBreak of the down channel on this 4hr timeframe with an added support of the 200MA in white.

I think this could be the start of a reversal for MATIC as the market is beginning to heat up.

Very cheap still right now.

Bullish on 4Hr and Daily, Weekly so on, timeframes.

MATIC/USD "Polygon vs US Dollar" Bullish Side Robbery Plan.Hallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist MATIC/USD "Polygon vs US Dollar" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Pink Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

FULL TECHNICAL ANALYSIS FOR CRYPTO PAIR MATICUSDTHello my wonderful community !

I’m back again

I really appreciate you guys for reviewing my charts

Kindly like and comment on how you feel the market will go , I’m open to learn and communicate with other hardworking traders on here.

The colors for each line/zone

Monthly - Yellow

Weekly - Orange

Daily - Green

4H - Red

1H - Purple

My Monthly chart view:

Ever since 2022, price has been in a downtrend by making Lower highs and Lower lows.

Price breaks a major Support area and turns it to a dynamic resisitance areas.

Take note as price is in a range and respecting the newly formed monthly resistance line (1.2300 ) and support line (0.3600) in yellow

My Weekly chart view:

Going into the weekly TimeFrame, it is truly clear that bears has been in full control of price from mid 2022 until last quarter of 2024,Price is currently not making lower lows and has been ranging

Last week price has reached a strong support area that has been respected for years after being in a downtrend for weeks

My Daily chart view:

Price is in a downtrend after breaking the daily dynamic S/R in green (0.7400) and has approached the Monthly resistance line in yellow.

Looking for buy setups as price has respected that monthly support zone for a stipulated period.

My 4H chart view:

As we move into the smaller timeframe of the 4H period, the market seems to be clearer as we can see another formation of a dynamic S/R zone in red (0.4350) which i will set as my target when we go down further

My 1H chart view:

So I’ll go down into a smaller 1H timeframe and look for buy Setups as bulls seems to be coming in slowing and the formation of an inverse heads and shoulders pattern

To play safe, for me to feel comfortable in capturing a buy setup ,I’m looking for the break of the neckline of the inverse heads and shoulders pattern , cross of the EMAs and volume of bulls coming into the market to put the odds in my favor.

Avoid entry of any trade during any major news that will affect price and this is not financial advise -

NEWSCHOOLTRADER

Polygon's MATIC transforms into POL: will POL rise back?A couple of days ago, the Polygon chain accomplished its much-awaited migration, wherein POL replaced MATIC as the native gas and staking token. While the newly launched POL is expected to play a crucial role in AggLayer, the community could decide to expand the utility of POL in subsequent phases. While the MATIC on the Polygon zkEVM will be automatically swapped to POL on a 1:1 basis, the tokens on Ethereum and other chains require a manual migration.

Meanwhile, the POL price remained stuck under $0.4 until the traders jumped in with a massive influx of buying volume. The POL price experienced a quick upswing after the volume soared. above $70 million, halting the ongoing descending trend. The technicals have turned in a bullish favour, which revives the possibility of reclaiming $0.5. The bulls are trying hard to materialize a parabolic recovery and a bullish close above $0.44 may keep up the probability of a bullish continuation for the next few days.

The price is trying to set a parabolic curve, which appears to be more likely as the RSI is ascending with the MACD close to undergoing a parabolic crossover. Besides, the steep rise in volume suggests an immense rise in the trader’s confidence. Therefore, the POL price is believed to maintain a steep upswing and rise above $0.57. However, the token may face a pullback before reaching the pivotal $0.6 zone, which may exhaust the selling pressure.

The upcoming quarter is believed to retain a strong bullish momentum within the markets and hence the POL price is also believed to demonstrate some strength. Therefore, as the market dynamics change, the token is expected to reclaim the $1 milestone, validating a move above the bearish influence. Although forming a new ATH remains a tedious job, the Polygon (MATIC) price or the POL price is believed to maintain a slow and steady upswing in the days ahead.

Will dormant wallets trigger MATIC uptrend?The MATIC market opened this year with a green candlestick. On the first day of the year, it closed at $1.0171. Later, for a short period, the market weakened. But in late January, the buyers of the market took control of the market. They took the price as high as $1.2711 in mid-March. Post that, the market situation overturned in favour of the sellers of the market. Post a sharp decline, the market emerged a sideways trend.

This month, on 16th, the buyers attempted to regain control of the market. They dominated the market for at least 9 consecutive days, taking the price from $0.4010 to $0.5716. For the last couple of days, the market saw consecutive red candlesticks, indicating the return of the selling pressure. It is important to see whether the mark of $0.4010 will act as a support or not.

In a recent X post, Santiment revealed about a surge in activity on Polygoin, with dormant wallets. There are chances that this increased activity would influence the price of MATIC positively. Often, a spike in activity leads to either a price reversal.

As conclusion, it is fair to say that something important is likely to happen in the MATIC market. The unexpected activation of dormant wallets can be seen as an early signal. Anyway, it is too early to make a market move based on what we know right now. It is better to wait until we see a clear signal in the chart.

Polygon (MATIC) grows amidst new token introduction. What's nextPolygon (MATIC) has been among the top five outliers on the daily and weekly price charts. Since last Friday, MATIC has risen by nearly 20%, while the rest of the market has remained sideways.

That’s not all though as in what is now a new update, Polygon will change its native token from ‘MATIC’ to ‘POL’ on 4 September. The exchange ratio will be 1:1 for MATIC to POL. According to the Polygon team, the transition aims to make POL the gas and staking token for the ecosystem. It could be expanded to cater to Polygon’s aggregation platform (AggLayer).

On the daily chart, MATIC was bullish as it mounted above the $0.42-level. Since 16 August (last Friday), MATIC has embarked on an extended recovery that netted almost 20% gains, at the time of writing. This reversed most of its August losses.

MATIC was trading at $0.47, at press time, and had to clear two key resistance levels to hit the supply area at $0.55. The immediate hurdles were at $0.49 and $0.51. Given the massive buying pressure shown by the RSI (Relative Strength Index) cruising above its average level, these targets could be hit.

At the same time, the Stochastic RSI was overheated as it was in the overbought territory. Hence, a cool-off couldn’t be overruled for MATIC’s rally. Also, the $0.46 and $0.42 levels were key short-term supports to consider if the rally cooled off.

So, MATIC’s extended recovery could face headwinds at $0.51 or $0.55, key resistance levels which could attract sell pressure.

POLYGON (Crypto) BUY TF H4 TP = 0.4564On the H4 chart the trend started on Aug. 05 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 0.4564

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading