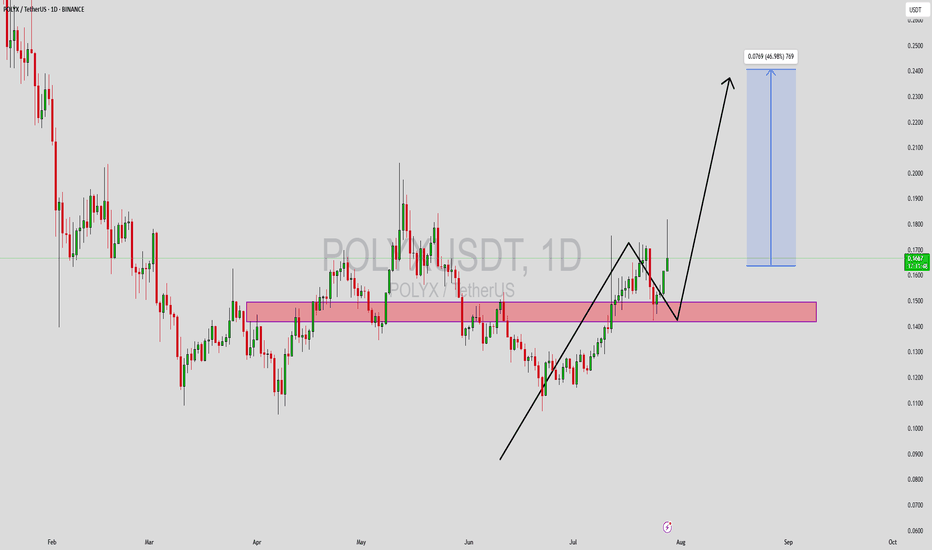

POLYXUSDT Forming Falling WedgePOLYXUSDT is currently showcasing a falling wedge pattern, a well-known bullish reversal setup that typically precedes a strong upward breakout. The chart structure reflects tightening price action with lower highs and lower lows, forming a wedge that has now broken to the upside. This pattern, coupled with a good spike in trading volume, supports the probability of a trend reversal. Price action has also respected the previous demand zone, reinforcing the likelihood of a sustained bullish movement.

Traders are increasingly turning their attention to POLYXUSDT due to its historical tendency to rally after consolidation phases like this. With a potential gain of 30% to 40% projected from the current levels, it offers an attractive setup for swing traders aiming to catch early entries before broader market participation. The chart also suggests that the token has reclaimed key support-turned-resistance zones, a critical bullish indicator in technical analysis.

The sentiment surrounding POLYX is improving as the broader altcoin market shows signs of recovery. As regulatory clarity improves and blockchain adoption expands, projects like Polymesh—which POLYX is native to—gain stronger traction. The falling wedge breakout, along with healthy volume and favorable macro signals, indicates that POLYX could be poised for a solid mid-term rally. It remains important for traders to watch retests of the breakout zone as confirmation before scaling in.

This technical opportunity could evolve into a strong move if bullish momentum continues to build across the market. Monitor volume surges and daily candle confirmations as catalysts to further validate this potential breakout trade.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

POLYXUSDT

POLYX: Primed for a Bounce? Long Opportunity at Channel Support.Greetings, fellow traders,

An interesting setup is forming on the BINANCE:POLYXUSDT chart. The price is currently situated near the lower boundary of an established ascending channel, suggesting a potential support zone.

We are identifying a potential long entry under the following conditions:

A confirmed close on the 1-hour (or 30-minute for more aggressive entries) timeframe within the confines of the delineated blue triangle on the chart.

Alternatively, a decisive close above the $0.1830 resistance level.

Should either of these conditions be met, a long position could be initiated with a primary price target of $0.2150.

Best of luck with your trades.

Trade with discipline and manage risk accordingly.

POLYXUSDT | Critical Decision Zones!POLYXUSDT has shown clear signs of distribution, and unfortunately, there is no bullish confirmation at the moment. The price failed to gain strength during this process, signaling potential weakness.

🔴 Short Opportunities at Resistance:

Red boxes mark key resistance zones where sellers are likely to step in.

Short entries should only be taken with confirmation—waiting for low time frame breakouts, CDV divergences, and volume footprint validation.

🟢 What Would Change My View?

If we see a strong recovery with volume and a successful retest of resistance levels as support, I may consider long setups.

However, without these signals, there is no reason to take unnecessary risks on the long side.

📌 Why You Should Trust This Analysis?

I don’t just mark random levels—every zone is carefully selected using volume footprint and time price opportunities. Most traders don’t understand these advanced concepts, which is why my success rate is so high.

🚨 This is a highly professional approach—those who follow emotional trading will always be at the mercy of the market. Trade like a professional, wait for confirmations, and don’t rush into bad positions.

👉 Follow closely to avoid costly mistakes.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Polymesh: Revolutionizing Regulated Asset TokenizationThe digital transformation in finance has led to a significant paradigm shift, especially with the emergence of real world assets (RWAs) on blockchain. This evolution not only increases liquidity but also democratizes access to investment opportunities. To understand the scale, an infographic is provided below.

Polymesh is a blockchain platform specifically designed to manage and trade regulated assets digitally. The project aims to create an infrastructure for tokenization of Real World Assets (RWA), such as securities, real estate, artwork and more. Polymesh is designed to tokenize assets that are subject to regulation, making it attractive to financial institutions and companies dealing with securities or other regulated assets. The Polymesh team developed the ERC-1400 standard for Ethereum, which went further in terms of providing compliance standards for tokenized assets, but Polymesh is extending that concept for its native blockchain.

Team

Bill Papp - Chief Executive Officer: Joined Polymesh Association from Arival Bank, where he was CEO and board member. Extensive experience in financial services, including stints at BankProv, Pacific Premier Trust, MEFA, Mizuho Americas, Pacific Crest Securities, Prudential Securities, and Lehman Brothers. He holds a bachelor's degree in business from Michigan State University and a master's degree from Tufts University.

Adam Dossa - Chief Technology Officer: He moved from Polymath to Polymesh Association in 2022. He has experience at Morgan Stanley where he worked on trading and regulatory infrastructure development. At Polymesh, he is responsible for technical strategy and blockchain technology development.

Nick Cafaro - Head of Product: Responsible for the development of new products and solutions based on Polymesh.

Will Vaz-Jones - Head of Partnerships: He is responsible for the education, implementation and management of key partnerships. Moved to Polymath in early 2019 after working in the traditional financial sector where he was an analyst and then held roles in corporate and business development.

Graeme Moore - Head of Tokenization: Author of “B is for Bitcoin”. Prior to Polymesh, he was the first employee at Polymath, worked as Creative Director at Spartan Race, and was an associate at Canada's largest independent investment firm.

Francis O'Brien (FOB) - Head of Developer Relations: He joined Polymesh after actively participating in the Polymath community since 2017. He has become a key advocate for Polymesh due to his ability to explain the complex technical aspects of blockchain. Prior to that, he worked as an engineer in the oil and gas industry.

Robert Gabriel Jakabosky - Head of Applied Blockchain Research: He started programming in high school and then worked at AlphaTrade, a financial services company. At Polymesh, his work is related to blockchain research.

Amirreza Sarencheh - Cryptography and Blockchain Architect: His role involves working in cryptography and blockchain architecture.

The Polymesh team is a unique combination of experience, expertise and innovative approach, making it exceptionally strong in blockchain technology and financial innovation. It's a really cool team where each member brings their unique contribution, creating synergies towards a common goal of revolutionizing financial services through blockchain. With such a diverse and talented team, Polymesh is at the forefront of innovation, making it one of the most exciting asset tokenization projects to date.

Architecture

Most general purpose blockchains have a limited set of primitives, forcing functions such as security tokens and their management to be implemented via smart contracts, leading to scalability and performance issues. In Polymesh, financial primitives are integrated at the core of the blockchain, allowing users to operate the network with low predefined costs and enabling developers to build innovative decentralized applications (dApps).

Regulated Assets: These are the cornerstone of Polymesh. Leveraging Polymath's experience in creating the ERC-1400 standard, Polymesh aims to balance openness and transparency with compliance with jurisdictional requirements.

Identity: Crucial for all actions involving regulated securities. Polymesh makes identity a core element where all actions are performed through an identity rather than a public key. Identities are universal and permissioned, collecting a set of claims or attestations from network-approved or issuer-specific authorities. These claims are used for managing asset ownership, transfer, and other restrictions.

Record Keeping: Polymesh records all primary and secondary transfers of security tokens, ensuring that ownership data is transparently captured on the blockchain, which reduces information asymmetry between the issuer and token holders.

Capital Distribution: Polymesh allows issuers to distribute cash flows associated with assets by capturing ownership distribution data at fixed times. Distribution can occur on-chain using stablecoins, via external payment receipts, or through a combination of both.

Corporate Governance: Polymesh provides tools for corporate actions leveraging blockchain technology, combining transparency with the ability to vote privately, thus reducing the risk of vote manipulation.

Stablecoins: Polymesh supports stablecoins to facilitate on-chain activities like cash distributions at a fraction of traditional costs. Stablecoins can be pegged to any currency and issued by adequately licensed and capitalized third parties.

Economy

Enabling Economy:

Nominated Proof-of-Stake (NPoS): This consensus mechanism involves Validators, who are regulated entities responsible for running nodes and processing transactions, and Nominators, who stake POLYX on validators. Validators produce blocks, while Nominators stake on them to enhance network security.

Block Rewards: Distributed equally among Validators adhering to protocol rules, with a portion kept by Validators and the remainder distributed to Nominators based on their stake.

Bonding Period: Time during which staked POLYX is locked after a withdrawal request, adjustable via governance.

Finality: Achieved when more than two-thirds of Validators vote in favor of a block, ensuring quick and trusted finalization.

Internal Economy:

Network Reserve Funding: Sources include a transfer from Polymath's Ethereum-held reserve, protocol usage fees, and transaction fees.

Governance: Managed by the Polymesh Governing Council, with potential future governance by POLYX tokenholders.

POLYX Supply: No fixed supply; increases through block rewards, which are also funded by network fees, to support the NPoS mechanism.

Enabled Economy:

Fee Structure:

Transaction Fees: Charged based on transaction size and complexity.

Protocol Fees: For specific blockchain functions, set by the Governing Council.

Developer Fees: Set by developers for smart contracts/extensions, aiding in ecosystem development.

POLYX Utility:

Acts as gas for transactions, similar to ETH on Ethereum.

Encourages participation in blockchain security through staking.

Prevents spam by costing each transaction.

Funds ecosystem growth through grants.

Facilitates governance decisions by allowing staking for votes.

POLY to POLYX Upgrade:

A one-way bridge allows POLY token holders to upgrade to POLYX at a 1:1 ratio, with a requirement for identity validation to transact with POLYX.

This token economy structure aims to ensure the sustainability, security, and utility of the Polymesh blockchain, tailored specifically for regulated assets with an emphasis on compliance and governance.

Polymesh Private

Polymesh Private is a private blockchain infrastructure solution from Polymesh designed for institutions that require increased levels of privacy, control and compliance in their blockchain operations. With Polymesh Private, you can restrict access to the network, making it completely private, where only authorized participants have access to data and transactions. Suitable for companies and institutions that want to take advantage of blockchain technology for internal processes while maximizing privacy and control. This can be useful for testing new financial instruments or for transactions that require strict confidentiality.

Polymesh's Strategic Partnerships and Innovations

1. Institutional and Regulatory Compliance:

Fortuna Digital Custody Ltd.:

Fortuna, an esteemed institutional-grade digital asset custodian based in Ireland, has been approved as a node operator for the Polymesh blockchain. This partnership not only extends Polymesh's network into new European markets but also strengthens the blockchain's security and compliance framework by ensuring all node operators are known and regulated entities. This move aligns with Polymesh's commitment to regulated assets and institutional-grade operations.

2. Expanding Utility Across Sectors:

TokenTraxx's Music NFTs:

TokenTraxx has pioneered the issuance of music NFTs on Polymesh, marking a revolutionary step in the music industry. By leveraging Polymesh's infrastructure, TokenTraxx enables artists like Evan Malamud to directly monetize and distribute their music through NFTs. This initiative not only reduces dependency on intermediaries but also introduces new revenue streams for artists, showcasing Polymesh's versatility beyond traditional financial assets.

AlphaPoint's Integration for Asset Tokenization:

AlphaPoint, a global leader in digital asset infrastructure, has integrated Polymesh into its platforms for tokenization. This partnership simplifies the process of asset tokenization, offering enhanced security, compliance, and efficiency, particularly suited for regulated financial products.

On Chain Listings (OCL) for Real Estate:

OCL is transforming real estate transactions in Florida by integrating with Polymesh. This partnership leverages blockchain for AI-driven title verification and monitoring, aiming to reduce fraud and enhance transaction transparency and efficiency.

REtokens' Real Estate Tokenization:

REtokens has utilized Polymesh to tokenize $30 million in real estate assets, making property investment more accessible and liquid. This initiative demonstrates how Polymesh's features like governance, compliance, and secure settlement can revolutionize real estate investment by allowing fractional ownership and increasing market liquidity.

3. Interoperability and Ecosystem Expansion:

ZenCrypto UAB's Equinox Bridge:

The launch of the Equinox bridge by ZenCrypto facilitates interoperability between Polymesh and Ethereum, allowing for the seamless transfer and wrapping of assets. This bridge not only enhances the utility of POLYX, Polymesh's native token, but also broadens the network's reach by integrating with one of the largest blockchain ecosystems.

4. Strategic Alliances for Global Influence:

Global Blockchain Business Council (GBBC) Membership:

Joining the GBBC positions Polymesh at the forefront of policy-making and standard-setting in the blockchain industry, particularly in the realm of tokenized securities and real-world assets (RWAs), fostering greater institutional adoption and regulatory clarity.

5. Enhancing User Experience:

Talisman Wallet with Ledger Support:

The integration of Polymesh into the popular multi-chain Talisman Wallet, now compatible with Ledger hardware wallets, enhances the security and user experience for managing digital assets on Polymesh, reflecting the growing demand for secure, multi-chain wallet solutions.

These developments collectively highlight Polymesh's strategic focus on:

Compliance and Security: By partnering with regulated entities and focusing on regulated assets.

Innovation: Applying blockchain technology to new sectors like music and real estate.

Interoperability: Ensuring Polymesh assets can interact with other major blockchains.

Accessibility: Making investment opportunities in regulated assets more accessible to a broader audience.

Polymesh is not only expanding its technological capabilities but also its market presence, reinforcing its position as a leader in the tokenization of real-world assets.

Conclusion

Polymesh has significant prospects for growth, particularly in the context of growing interest in asset tokenization and the need for regulatory compliance. Its specialization in regulated assets, technological innovation and strategic partnerships create a sustainable foundation for future growth and adoption in the global financial market. At the moment, the project looks like Ethereum in its nascent stage. Get ready, tokenization is here, billion dollar companies are getting ready to tokenize via Polymesh!

Horban Brothers.

#POLYX Ready For a Major Bullish Move or Not? Key Levels Yello, Paradisers! Is #POLYXUSDT about to break free, or could we see a deeper dive into bearish territory? Let’s break it all down for #Polymesh setup:

💎#POLYX is forming a Descending Broadening Wedge—a classic pattern known for signaling potential trend reversals. The price is currently going to test the upper descending resistance, sitting around $0.3156. A decisive breakout here could trigger a strong bullish move.

💎If #POLYXUSD breaks above $0.3156 with a solid 4H or daily close, the next target zone lies between $0.4000 and $0.4500, where sellers are likely to re-enter aggressively. You need to watch for increased volume and momentum to confirm this breakout.

💎On the downside, we have a reliable demand zone around $0.2314, with major support at $0.1933. These levels have provided significant liquidity for buyers in the past and are key for maintaining the bullish structure. The Bulls will definitely buy #Polymesh here and it will likely bounce back.

💎A breakdown below $0.1933 with a 4H or daily candle close would invalidate the bullish setup. This could lead to a steep drop, targeting $0.1500 or lower, potentially indicating a bearish market sentiment shift.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#POLYX (SPOT) entry range(0.1930- 0.2430) T.(0.4500) SL(0.1891)BINANCE:POLYXUSDT

entry range (0.1930- 0.2430)

Target1 (0.3140) - Target2 (0.3940)- Target3 (0.4500)

SL .1D close below (0.1891)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #POLYX ****

POLYX looks bullish (1D)It seems that POLYX is within a large Diametric pattern, and wave D appears to be nearing completion.

If it reaches the green zone, we will look for buy/long positions.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#POLYXUSDT: Is Breakout Brewing or Will Sellers Regain Control?Yello, Paradisers! Are you ready for the next big move in #POLYXUSDT? Let's discuss the latest analysis of #Polymesh and see what's happening:

💎Right now, #POLYX is sitting at a pivotal level, hinting at a potential bullish continuation from the crucial demand zone at $0.215. But the big question remains: will the momentum hold, or are we about to see a fakeout?

💎The key demand zone at $0.215 has already shown resilience twice, acting as a significant support level. If POLYX can maintain its footing here, it could pave the way for a breakout above the ongoing channel's descending resistance.

💎However, the real challenge lies in sustaining momentum; strong buying pressure is essential to confirm the bullish case. Look for signs like decisive bullish candles, which can indicate that the bulls are in control. Without these, any attempt to break out could quickly reverse.

💎To validate the bullish scenario, we need a clear break above the descending trendline and a retest of that level. This confirmation is crucial, as engulfing candles and continued momentum in this area will signal that the breakout is genuine. Until we see these signs, it’s wise to stay cautious and avoid jumping in too early.

💎If buyers struggle to push #Polymesh above the trendline, the momentum could shift back toward the sellers. Should this happen, the critical level to watch remains $0.215. A rebound here would keep the bullish outlook alive and could lead to another attempt to move higher.

💎On the other hand, if the $0.215 demand fails to hold, prepare for a drop toward the major support zone around $0.156-$0.177. A fall into this range would suggest that the bullish scenario is off the table, making it crucial to adjust your strategy accordingly.

The market is full of opportunities for those who stay disciplined and focused.

MyCryptoParadise

iFeel the success🌴

POLYXUSDT - 1h - About to take off...POLYXUSDT - 1h - About to take off...

If you like my AT, and you agree with the approaches, please FOLLOW ME and press BOOST so we can share it with more people. We are working on an automated trading tool so that everyone can apply their strategies VISUALLY and PROFESSIONALLY, as we present in the analysis.

Thank you!

_______________________________________________________

POLYXUSDT - 1h - About to take off...

Simple analysis. We just have to look at the levels:

SL: 0.2333

TP1: 0.28

TP2: 0.32

Always keep above the Dynamic Stop Loss (Base of the bullish channel) + a reasonable margin in case it crosses it to hunt some ducks.

______________________________________________________

Automated Cryptocurrency Trading Bots: All these strategic alternatives can be configured with TradeX BoT, as it will allow you to position in both directions without having to block any amount per position. It will only be necessary for the conditions to be met, either downward or upward, for the orders to be executed in one direction or the other, taking the necessary deposits from your portfolio.

TradeX BoT (in development): Tool to automate trading strategies designed in TradingView. It works with both indicators and technical drawing tools: parallel channels, trend lines, supports, resistances... It allows you to easily establish SL (%), TP (%), SL Trailing... multiple strategies in different values, simultaneous BUY-SELL orders, conditional orders.

This tool is in the process of development and the BETA will soon be ready for testing.

FOLLOW ME and I will keep you informed of the progress we make.

I share with you my technical analysis assessments on certain stocks that I follow as part of the strategies I design for my portfolio, but I do not recommend anyone to operate based on these indicators. Get informed, train yourself and build your own strategies when it comes to investing. I only hope that my comments help you on your own path :)

#POLYX/USDT#POLYX

The price is moving in an ascending channel on a 1-day frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.2130

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2400

First target 0.2991

Second target 0.3507

Third target 0.4109

POLYX USDT Spot trade | 350% Potential or ATH in 2025 Bull markePOLYX/USDT is showing strong upside potential, with a possible 350% gain or a new ATH in the 2025 bull market. As the Polymesh ecosystem grows, this could be a key player in the next crypto cycle. Watch for breakout opportunities! 🚀 #POLYX #Crypto #BullMarket

Buy and hold in spot.

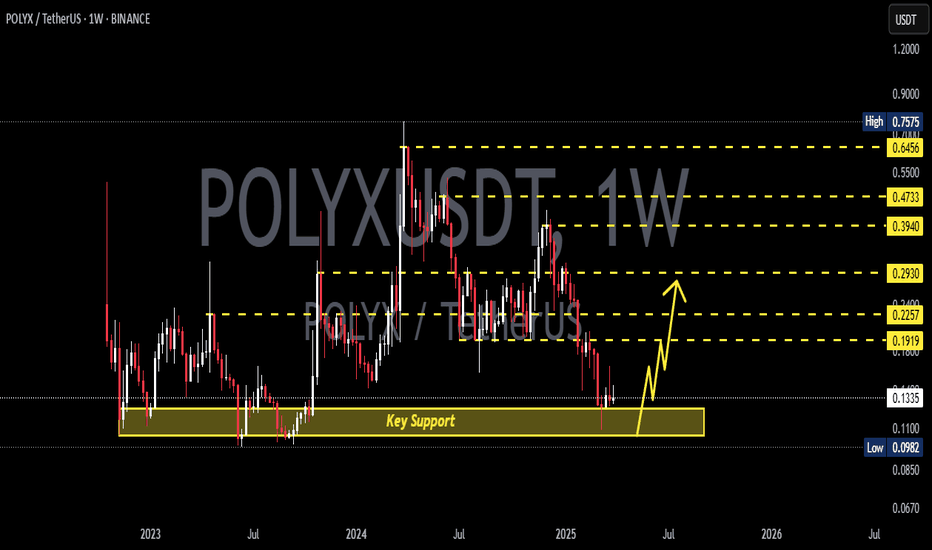

$POLYX Weekly Entry Plan & Technical Analysis Checkout 1DAY TF Entry plan :

-

$POLYX has good support at 0.17, if this support breaks it will go dip more!

Next Weekly strong support at $0.14 & $0.081

For Long term investment you can DCA at weekly support & Target : $0.28-0.42-0.56

Weekly TA :

- Trend & S/R

- Liquidity below weekly Lows

- Elliot 5th Wave

- Double Bottom

Please hit the LIKE button to support my work and share your thoughts in the comment section.

Thanks

@cnb006

$POLYX Entry Plan & 1DAY TF Technical Analysis $POLYX short/mid term trade entry : $0.201 & $0.171

Target : $0.259-0.329-0.409

Must use Stoploss at $0.1391 & follow proper risk management!

$POLYX 1Day chart is showing some bullish structures, Like :

- Inverse HnS

- PO3

- S/R

- OB

- Gartley, 3Drive patterns

Please hit the LIKE button to support my work and share your thoughts in the comment section.

Thanks

@cnb006

POLYXUSDT.P LONG IDEAhi everyone, as you see on chart, it seems that there is a clear support line around 0.21550 . Also funding rate on binance is negative. it means short positions more than longs. thats why i want to set up long position. i will use 50x leverage in this set up.

entry : 0.21790

stop : 0.21469

take profit : 0.23834

remember that all the ideas belong me is only my idea and it is not financial advice.DYOR.

hope this idea usefull for you. have a nice day.

POLYX ( RWA ) project macro analysis ⏰Expecting potential 15x from here 📌+1500%

📌 Not expecting weekend candle close below the red box ☑️

>< Present price $0.48 :-: but :-: anything below $1 is gift 🎁 from God 💟

" No logic ❌ only magic ✨ bcs " RWA " sector hype goon take this more than OKX:RIOUSDT

👉🏾 Follow and save article with boosting 🚀 for future updates 🚨

💰 Returns calculated from present price

POLYX looks bearishIt looks like a big triangle is forming.

Wave C looks like a triangle and now it looks like we are in wave e of C

If the price reaches the red box, we look for sell/short positions in the red box

We will also look for buy/long positions in the green box.

Closing a daily candle above the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

POLYXUSDT | Testing the New Trading SystemMarket Context

Exciting times as we put our new trading system to the test with POLYXUSDT!

Strategy: Buy the Dip

We spotted a trendline break on the 5M chart and used adjusted Fibonacci levels to set up our limit orders. Here's the plan:

LIMIT Order 1: 0.5169 | TP: 0.5415

LIMIT Order 2: 0.5080 | TP: 0.5163

LIMIT Order 3: 0.5000 | TP: 0.5078

Results

We hit LIMIT #3 and secured a solid 2.53% gain! 🎉

This system is showing promise—let’s see how it continues to perform. Stay tuned for more updates and trades!

#POLYX/USDT#POLYX

The price is moving within an ascending channel pattern on a 1-day frame, which is a retracement pattern

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 0.4973

The first target is 0.5900

The second target is 0.6757

The third goal is 0.7885

POLYX/USDT Has Successfully Broken out of Symmetrical Triangle💎#POLYXUSDT has successfully broken out from a Symmetrical Triangle, positioning it for a potential bullish rally. Currently, with robust momentum at the $0.40 support, there's a high probability for #POLYX to challenge and potentially overcome the resistance level ahead.

💎However, if #Polymesh cannot sustain this momentum and dips below the $0.40 mark, we might see a reversal into a bearish trend. The next critical demand zone at $0.354, renowned for its liquidity and historical upward movements, will be the area to watch.

💎In contrast, if $POLYX revisit this demand zone, it's imperative for the price to achieve a rebound to uphold its support structure. Failure to do so could heighten bearish pressures, worsen market sentiment, and perhaps trigger additional declines in its price.

💎Stay focused and adaptable, Paradisers. Your ParadiseTeam is diligently monitoring the market and ready to guide you through any shifts in the dynamics of #Polymesh.

MyCryptoParadise

iFeel the success🌴