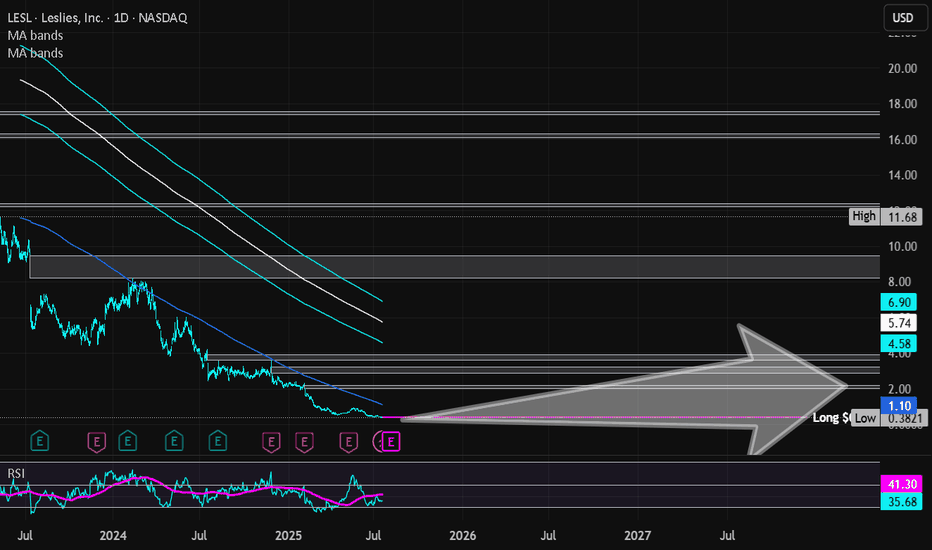

Leslies Inc | LESL | Long at $0.41**VERY risky trade - 25% or more risk of bankruptcy**

Leslies NASDAQ:LESL is a direct-to-consumer pool and spa care brand in the U.S., selling chemicals, equipment, and services. The stock dropped 88.86% last year due to weak demand, flat revenue, shrinking gross margins from stock write-downs, higher rent, shipping costs, and an earnings miss (-$0.25 vs. -$0.244). High debt, market share losses to e-commerce, and a competitive pool supply market also contributed.

On a positive note, the company generated $1.33 billion in revenue for fiscal year 2024. New leadership has entered the picture, cost-cutting is starting to happen, and summer season may boost pool sales. While 2025 is still projected to be a rough year, revenue is forecasted to grow 6.4% in 2026 and 2027 and earnings are likely to turn positive (based on company statements). While this is a *highly risky* play and there are absolutely better companies out there, I think there is a chance this ticker may get some steam in the near future. 7% short interest, 176 million float.

Thus, at $0.41, NASDAQ:LESL is in a personal buy zone.

Targets into 2027:

$1.00 (+143.9%)

$2.00 (+387.8%)

POOL

(RPL) rocketpool "ICO"Early funding for rocket pool came in the form of ICO, crunchbase.com metrics.

Initial coin offerings give a chance for people to buy the token before it is available for public trade on markets. Less decentralized than if the token had made no sales before being pushed to market.

POOL potential Buy setup (Weekly outlook)Reasons for bullish bias:

- Price respecting rising trendline

- Price bounced from horizontal support

- Strong weekly bullish candle closing

- No divergence

Here are the recommended trading levels:

Entry Level(CMP): 336.90

Stop Loss Level: 283.44

Take Profit Level 1: 390.36

Take Profit Level 2: 469.75

Take Profit Level 3: Open

RUNE - Huge Downtrend Breakout ! THORChain (RUNE) has been entrenched in a substantial downtrend since May 2021, consistently forming lower lows. Recent price action, including a retest of the downtrend line, suggests a potential shift in market dynamics. The expectation is for a retracement to the support zone, coinciding with the 0.5 Fibonacci level, before a potential upward move.

🔄 Prolonged Downtrend Analysis:

The extended duration of the downtrend indicates persistent bearish sentiment in the RUNE market. Lower lows have been a consistent feature, reflecting the dominance of sellers. Each attempt to rally has been met with resistance, leaving a trail of lower highs.

📉 Retesting the Downtrend Line:

The recent retest of the downtrend line signifies an important technical event. The fact that the downtrend line held as resistance suggests its continued relevance. This event highlights the importance of the downtrend line in influencing price movements.

🔍 Anticipating a Reversal:

The expectation of a retracement to the support zone aligns with the broader technical analysis. A move towards the 0.5 Fibonacci level, coinciding with a key support area, could serve as a crucial juncture. The convergence of these factors increases the likelihood of a potential reversal.

📈 Potential Scenarios:

Retracement to Support: A retracement to the support zone, especially the 0.5 Fibonacci level, would align with historical patterns and provide a potential springboard for a bullish reversal.

Confirmation of Support: Traders should closely monitor the price action in the support zone for signs of confirmation. Increased buying interest, reduced selling pressure, and the establishment of higher lows would be positive indicators.

Upside Momentum: A successful bounce off the support zone could signal the beginning of an upward move. Confirmation of a break above the downtrend line and higher highs would strengthen the bullish case.

💡 Trading Strategy:

Traders considering RUNE should exercise caution and await confirmation of a potential reversal. Entering a position at or near the support zone, with a clear risk management strategy in place, can help mitigate potential losses. Stop-loss orders below key support levels are advisable.

🔮 Future Outlook:

While the technical analysis suggests the possibility of a reversal, traders should remain vigilant and adapt their strategies based on real-time market data. The cryptocurrency market is known for its dynamic nature, and unexpected developments can influence price movements. A successful reversal would require sustained buying interest and a break above key resistance levels to validate a new bullish trend in THORChain.

Possible BTC movement for the next hours/daysEnglish

The price is currently in a zone with some difficulty to break and by now, is not confirming a HH yet (but let`s have in mind we are bullish in a general scenario) so, we could have a short movement to 38K where there is a liquidity pool that I believe is going to get before going to 50K.

*THIS IT NOT INVESTMENT RECOMMENDATION OR SOMETHING LIKE THAT, THIS IS ONLY FOR ANALYSIS AND EDUCATION PURPOSE*

Español

El precio està actualmente en una zona con cierta dificultad para romperla, no està confirmando un alto màs alto (pero debemos tener en cuenta que estamos alcistas), podríamos tener un posible movimiento hacia los 38K donde hay un pool de liquidez, el cual creo que irá a tomar, antes de irse a los 50K.

*ESTO NO ES RECOMENDACIÓN DE INVERSIÓN NI NADA QUE SE LE PAREZCA, ESTO ES SOLO PARA ANÁLISIS Y EDUCACIÓN*

Liquidity Pools EURUSDHi,

I can see at least two Liquidity Pools on Medium/Higher Time Frame for EURUSD,

and price is likely to seek these. The question is if it will go first below or first up. Instinctively, I usually want to trade upwards or the reversal, but since price short term is already downwards, and thus closer to the lower Liquidity Pool, then perhaps that is the wiser choice, to do a small short if anything.

But there are liquidity pools to the upside, which can give a great reward if it reaches there, and you have traded near these lows.

Have a great day in Jesus' name!

-ThomChris

POOL Corporation Options Ahead of EarningsAnalyzing the options chain of POOL Corporation prior to the earnings report this week,

I would consider purchasing the 350usd strike price Puts with

an expiration date of 2023-8-18,

for a premium of approximately $12.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

SWIM - Breaking OutSwim is positioned nicely to take advantage of the rise in interest rates as clients are moving away from the inflated prices of concrete swimming pools and downsizing to the speed and lower cost of fiberglass pools. They have made multiple moves to handle capacity issues they dealt with in the covid boom and will continue to see growth in the vinyl replacement & safety cover business. Not to mention we have a downtrend break out and it appears the bottom has been put in. The sky is the limit for this stock and there is no better season to get into a beat up pool stock than pre-summer. I see massive potential - Don't sleep on this one

How can traders make money on the asset tokenization trend?Asset tokenization is one of the most understandable applications for crypto technology. Various consulting and analytical companies estimate that the capitalization of tokenized assets will be around $3-4 billion by 2030.

Tokenized assets have no value and have no use without products that utilize these assets to create financial relationships and opportunities. Products that use tokenized assets in their operations are called Real World Assets (RWA). The essence of RWAs is to create a method for tokenization and a financial mechanism within the product that all participants will get value from.

How to make money?

Every RWA product has or will have its own native token. The project token will be the easiest way to earn. In fact, any trader knows how to trade tokens, so we will not give any recommendations, you already know everything very well.

We will highlight the most interesting projects, where tokens can give the most profit, so you don't have to spend much time searching and researching.

Top RWA narrative projects with a token

1. $CPOOl – loans to institutions

2. $GFI – RealFi lending protocol

3. $MPL – corporate lending protocol

4. $RBN – market maker lending

5. $TRU – lending protocol

6. $ONDO – U.S. Treasury bond trading

Top RWA narrative projects without a token

1. Backed Finance – derivative tokens of real world assets (S&P500, T-bills, TSLA, AAPL, etc.)

2. Carapace Finance – marketplace for crypto loan default risks

3. Florence Finance – European SME lending protocol

4. HomeCoin – mortgage secured lending

5. Jia – small and medium business lending in Africa and Asia

6. LandX – lending to farmers in exchange for a portion of their future harvest

7. Parcl – real estate trading around the world

8. Sapling – lending to banks in developing countries

What can you do now?

Add tokenized projects to the watchlist on TradingView and keep an eye out for trading opportunities

Keep up with news and changes in RWA and tokenization

Look for promising new projects

Read our idea about ZK Narrative

Check links below and start trading with us

Thanks for reading! Waiting for your comments about RWA projects

POOL (Elliot Wave Analysis) Shows a clear impulse down, similar to many other stocks like netflix. I think it will be do for a rally up in 3 waves and I will expect it to fail and start another leg of 5 wave move down.

It just so happens to match the 200MA on the Weekly chart at close to $330-$350 range. Time frame would be during this year and as long as beginning of 2023 for completion of the correction.

not a financial advice

PancakeSwap financegood&strong coin on BSC where u can buy and earn with good APY/ APR with farms or pools

when ppl see this coin price in such dips they start buying

for example , you can buy this coin and put it in a pool with 68% APR at the same time it will start growing and at the exit you will get a really big profit or just buy&hold this

Binance: CAKE-USDT Buy / Long D1Binance: CAKE-USDT Buy / Long D1

Entry: 14.2$

Stoploss: D1 close below 11.5$

Target: 26$ and hold longtern 40$

Pancakeswap is a diverse product set that turns Pancakeswap into a true DeFi station on the Binance Smart Chain ecosystem.

Trade: Trade and generate LP tokens to provide liquidity.

Farms: Yield Farming with an extremely large number of pools (the liquidity center of the BSC system).

Pools: Stake CAKE to receive CAKE or other tokens in the BSC system.

Predictions: A mechanism that predicts the rise and fall of asset pairs over a certain period of time.

Lottery: Lottery game on Pancakeswap.

Collectibles: Collect NFT items.

Team Battle: A program to participate in trading between groups and ranked based on trading volume.

IFO: Initial Farm Offering is the IDO Platform for new projects on the BSC system.

Frosting on the Cake…..This is not financial advice always do your own due diligence

Cake has been moving sideways after hitting the lower $12 mark it went back up to $25 now it’s on $15 looking for entry levels below the $14 to stack up some and throw into the pool.

Thank you please follow share and subscribe peace out

What do you do in this situation ?One company is a global player with solid records but the skyhigh price is deterring you to enter the market. It's closest competitor is a newly launched IPO that is still down and has yet to proven itself.

What will you do in this situation ? Please share your views ......

FIS Stafi (Staking Finance)

Good project, good team.

And good chart, we have a nice consolidation now

Low cap ~70m cap.

pooltogether ready to rumblePool is a new entry, one interesting project worth keeping an eye on.

It's a decentralized lottery with no loss. Won't discuss the fundamentals here but it's a solid project backed by coinbase.

Let alone the fundamentals, let's focus on the technicals.

The chart shows a bottoming formation:

on small tf 4h: there is a clear inverse head and shoulders, which should bring us at 0.0318 eth.

At this price tho, it would complete an adam and eve reversal:

If this was the case, then it's likely we are in wave 3 right now, possibly this kind of scenario:

As usual this post is for educational purpose only

POOL is set to x10 gainsJust airdropped 1.5M tokens to early users, with a max supply of 10M this gem is trading at less than 50$ and is SO UNDERVALUED . Could easily reach 500$ the market cap is under 100M and for a gorvenance token in the Defi Space is unbelievably low.

Next to be listed on CEX's like COINBASE and Binance.

TRUE GEM.

Pancake Swap TrendThe last month has been quite a ride for the easily accessible swaping and staking platform "PancakeSwap". Here we can see in a 4 day cycle they have had a steady increase of 78% up to a maximun 123%. Since the platform hasnt reach its full potential and if it keeps following this trend. It will pass by uniswap in the following month to come. Give it atleast 3 more cycles and we could see the price increase anywhere from $10 to $25. Since the platform burns excess coins by lotery and has an easy to understand platform. They also have pools with 100%+ APY with extremely low fees that help increase value.

If your new to the crypto world, do not jump quickly into a swap. First dip your toes with simple exchanges and once you feel you have a firm understanding, concentrate your attention to platforms like PancakeSwap. BINANCE:CAKEBUSD

Air my swapAST.

All is bullish. 9 february news coming with Consensys.

=> twitter.com/airswap/status/1355223372104396804

DEFI

DEX

20 Millions cap...

Talking about Transaction fees.A comparison between DéFi farming on the Ethereum blockchain or the since this year introduced Binance Smart Chain (BNB).

Take your time going over it, it will save you some money.

docs.binance.org