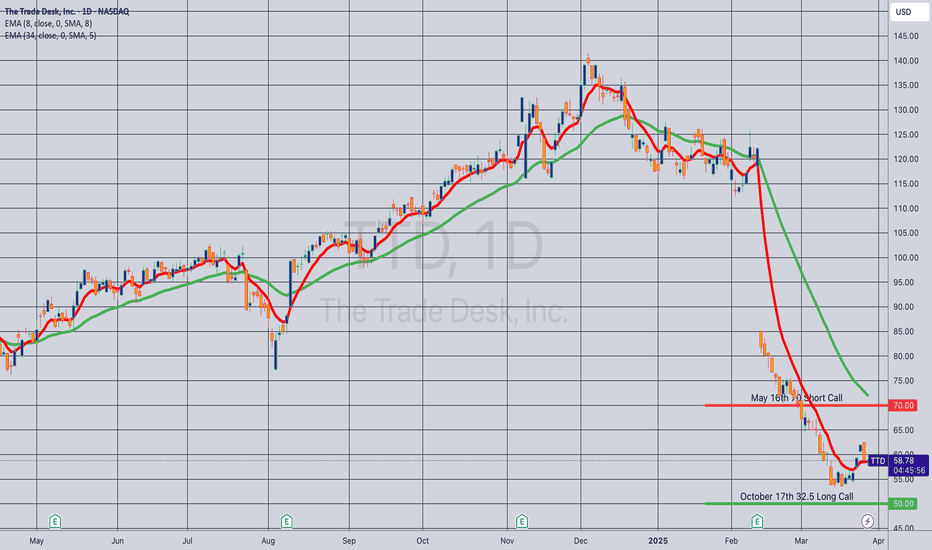

Opening (IRA): TTD May 16th -70C/October 17th 32.5C LCD*... for a 26.10 debit.

Comments: At or near 52-week lows. Buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The October 17th 32.5C is shown at the 50 strike to fit it on the chart).

Metrics:

Buying Power Effect: 26.10 debit

Break Even: 58.60/share

Max Profit: 11.40

ROC at Max: 43.7%

10% Max: 2.61

ROC at 10% Max: 10.0%

In this particular case, I'll look to take profit at 110% of what I put it on for and/or roll out the short call if it hits 50% max. Earnings are on 5/14, so my preference would be to take it off before then ... .

* -- Long Call Diagonal.

Poormanscoveredcall

Opening (IRA): TGT April 17th -108C/October 17th 75C LCD*... for a 30.05 debit.

Comments: At or near a 52-week low. Buying the back month 90 delta and selling the front month strike that pays for all of the extrinsic in the long. (The 75C is shown at the 100 strike so that it fits on the chart).

Metrics:

Buying Power Effect: 30.05

Break Even: 105.05

Max Profit: 2.95

ROC at Max: 9.82%

50% Max: 1.48

ROC at 50% Max: 4.91%

Will generally look to take profit at 50% max and/or roll the short call at 50% max to lower my downside break even.

* -- Long Call Diagonal.

Opening (IRA): XRT April 17th 70/Sept 19th 50 LCD*... for a 17.57 debit.

Comments: And back into XRT, which is at/near 52 week lows with a long call diagaonl/Poor Man's Covered Call, buying the back month 90 and selling the front month that pays for all the extrinsic in the long.

Metrics:

Buying Power Effect: 17.57

Break Even: 67.57

Max Profit: 2.43

ROC at Max: 13.83%

50% Max: 1.22

ROC at 50% Max: 6.92%

Will generally look to take profit on the setup as a unit at 50% max and/or roll out the short call when it is at 50% max.

Opening (IRA): SPXL April 17th 148/October 17th 85 LCD*... for a 56.84 debit.

Comments: Looking to be a little bit more buying power efficient here ... . Buying the back month 90 delta and selling the front month that pays for all the extrinsic of the long.

Metrics:

Buying Power Effect: 56.84

Break Even: 141.84

Max Profit: 6.16

ROC at Max: 10.84%

50% Max: 3.08

ROC at 50% Max: 5.42%

Will generally look to take profit on the setup as a unit at 50% max, roll short call out at 50% max.

* -- Long Call Diagonal.

Opening (IRA): XRT April 17th -71C/Sept 19th 50C LCD*... for a 17.91 debit.

Comments: At or near 52 week lows. Buying the back month 90 delta and selling the front month such that it pays for all the extrinsic in the long, with a resulting break even that is at or below where the underlying is currently trading. The Sept 19th 50C is shown at the 65 strike so that it appears on the chart.

Metrics:

Buying Power Effect: 17.91

Break Even: 67.91

Max Profit: 2.09

ROC at Max: 11.67%

50% Max: 1.05

ROC at 50% Max: 5.83%

Will generally look to take profit at 50% max, roll short call out and/or down and out at 50% max.

* -- Long call diagonal a/k/a a Poor Man's Covered Call.

Opening (IRA): EWY July 18th 35C/February 21st -55C PMCC*... for an 18.17 debit.

Comments: Back into EWY, after missing out on the dividend due to my shares being called away. Since there is no longer a dividend to be had, going with a Poor Man's Covered Call/long call diagonal, buying the longer-dated 90 delta strike and selling a shorter-dated call that pays for all of the extrinsic in the long, resulting in a setup that has a break even slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 18.17

Break Even: 53.17

Max Profit: 1.83

ROC at Max: 10.07%

50% Max: .92

ROC at 50% Max: 5.04%

Delta/Theta: 46.50/.751

Will look to money/take/run at 50% max.

Rolling: EWZ December 17th 32 Short Call to January... for a .25 credit.

Comments: With only 14 days to go in the short call aspect of my long call diagonal/Poor Man's Covered Call, rolling it out on this little bounce here to reduce cost basis in the setup further.

My cost basis in the diagonal is now 5.72 with the resulting diagonal spread being the June 25 long call/January 21st 32 short call.

The Poor Man’s Covered Call ExplainedWhat Is The Poor Man’s Covered Call?

Questions we’ll answer in this discussion:

- What is it?

- Who is it for?

- When to use it?

The Poor Man’s Covered Call is a very specific type of spread. As you know, we’ve been covering option spreads for several Coffee With Markus Sessions.

We’ve also covered the Covered Call’s strategy in-depth on our YouTube Channel.

In this article, we’re discussing the difference between trading stocks, covered calls, and the Poor Man’s Covered Call.

Trading Stocks

Let’s take a look at trading stocks first. Let’s say that you’re bullish on a stock like Boeing BA . If you were bullish on this stock, you might purchase a decent amount of stock, let’s say 100 shares.

At the time of the original writing of this article, this stock’s strike price was $180. If you purchased 100 shares of BA , at $180 dollars each, this would require $18,000 in purchasing power.

If the stock increases by $10, to $190, you stand to earn $1,000 in net profit.

So you’ve risked $18,000 to earn $1,000. If the stock price increases to $200, you’ll earn $2,000 and so on.

This is pretty basic and you probably understand this concept.

A profit picture is a sliding scale that moves to the right as the stock price increased.

It is a visual representation of your profits. or losses depending on the movement of the stock.

In this example, the price of the stock is increasing so the scale is moving to the right.

Selling Covered Calls

In this example, let’s say that you’re still bullish on BA . And in the short term, you expect an upward movement in price.

Since you already own the 100 shares of BA stock, you can sell a $200 Call Option against these shares (again, this is based on the price of BA at the time of writing this article).

If the stock price increases to $190 like you expect, you’ll earn an additional $450 on top of the $1,000 you’ve already earned.

If we see a decrease in stock price, the covered call acts as a hedge.

In this example, if we saw a downward movement to $170 you would lose $1,000.

But because you sold a $200 Call option contract and received a premium of $450, your net loss would only be $550.

Covered Calls VS Poor Man’s Covered Call

Poor Man’s Covered Call

When would you trade a Poor Man’s Covered Call?

That’s easy! When you don’t have the $18,000 to buy 100 BA shares!

And When do you trade a covered call?

When you expect the stock to stay above the current price and move slightly higher.

Instead of buying a stock, you would purchase a deep in the money call option at a later expiration.

When looking for a call option deeper in the money, we’re trying to find one with a Delta of 0.95.

his means for every dollar the stock moves, the call option is gaining .95 cents in value.

Deep “In The Money” Calls

For this example, We’re buying a deep ITM call at $71 which means the capital required to take this position is only $7,100.

As you can see this is a fraction of the price to purchase the stock outright.

At the same time, we will sell the $200 Call option. Similar to the covered call.

But instead of owning the stock at a price of $18,000, we purchased the ITM call option and sold a $200 call option.

if the underlying stock price moves from $180 to $190 you would make $1335 because the Delta is 0.95, which means it’s only increasing 95% of the value.

The profit on this type of position isn’t as high as a covered call, but it’s much more than owning the stock outright, with much less risk and less capital.

This sounds too good to be true right? The perfect strategy! BUT… there’s a downside associated with this strategy.

Your profit is limited. If you see a huge movement in the underlying stock, you’ll only benefit from a portion of the total gains.

In this example, if the underlying strike price gained $40, the stockholder would earn $4,000.

The covered call would earn $2450, and the Poor Man’s Covered Call would earn $2,320.

Many traders use this strategy because of the limited capital involved with taking on a position, and the limited risk associated with a potential downward movement of this stock.

EDUCATION: BACK MONTH DURATION SELECTION FOR SYNTHETICSI have on occasion highlighted the benefits of using various options strategies instead of getting into stock, not the least amongst them being buying power effect. Pictured here is a 98.35 delta long call in SPY in the December 16th '22 (896 Days Until Expiration) cycle costing 183.35 ($18,335) to put on versus 312.23 spot (i.e., it would cost $31,233 to get into a full, uncovered one lot of SPY here). Although even this highly delta'd long call is "dynamic" (i.e., its delta will change in response to movement in the underlying, decreasing as price moves into the strike and increasing as it moves away), it is -- at least at the outset -- near being equivalent to being in long SPY stock at the strike price (130) plus its value (183.35) or 313.35.*

Such deeply monied longs generally stand in for stock, which are then covered with a short call to emulate a covered call without paying covered call prices. This is particularly important in a cash secured setting where buying power is limited or in small accounts where getting into a full one lot of certain underlyings is prohibitive. Naturally, even getting into this particular long call will be beyond the reach of some smaller accounts, but I'm using SPY here as an exemplar; the same delta and duration considerations apply with any underlying.

Generally speaking, my rule as to duration with the back month long has been to "go as long-dated as you can afford to go," since having a longer back month duration allows for a maximal number of opportunities to reduce cost basis via short call. However, if your go-to strike to buy as your stock substitute is, for example, something around the 100 delta strike,** then going longer-dated usually means that you'll have to go deeper and deeper in the money to buy that strike, and that usually gets more and more expensive as you go out in time. But does it?

Here's a look at SPY long calls around the 100 delta and their cost over time:

October 16th 155 (105 days) 158.15

January 15th 130 (196 days) 183.20

March 19th 130 (258 days) 183.50

June 18th 130 (350 days) 183.35

September 17th 130 (441 days) 183.35

December 17th 130 (532 days) 183.30

March 18th '22 130 (623 days) 183.30

June 17th '22 130 (714 days) 183.30

December 16th '22 130 (896 days) 183.35

Interesting, huh? You basically don't pay more by going longer-dated between January of '21 and December of '22. Naturally, this might not always be the case; currently, expiry implied volatility slopes away somewhat from shorter duration implied in SPY, with all of '22 being between 22.6 and 22.9%, and we've had substantial periods of time where it is the exact opposite: implied slopes upward from short to longer duration. Put another way, you'll probably have to look at whether going longer duration makes sense each time you get ready to set one of these up.

Just for kicks, I also looked at QQQ:

October 16th 130: 122.95

January 15th 112: 141.00

March 19th 105: 148.05

June 18th 92 (lowest strike available): 160.05

September 17th 92 (lowest strike available): 161.00

June 17th '22 92 (lowest strike available): 161.00

December 16th '22 92 (lowest strike available): 161.50

Not much difference between going June of '21 versus December of '22.

And EFA (albeit with fewer available expiries to look at):

December 18th 25 (lowest strike): 37.02

March 19th 25 (lowest strike): 37.02

June 18th 25 (lowest strike): 37.00

January '22 25 (lowest strike): 36.88

No significant difference between December of '21 and January of '22.

And TLT:

October 16th 95: 68.55

December 18th 95: 68.55

January 15th 95: 68.55

January 21st '22 95: 68.55

December 16th '22 95: 68.60

No significant difference between October of this year and December of '22.

In a nutshell: where there isn't a significant difference in price between shorter and longer duration of the same delta, go with the longer duration. It'll afford you with more time to reduce cost basis and/or generate cash flow via short call premium.

* -- That particular strike is bid 181.90/mid 188.35/ask 184.75, but would to get filled somewhere closer to spot (312.33) minus the strike price (130) or 182.33. In all likelihood, you're going to pay some small amount of extrinsic, but would start price discovery there, since a strike near the 100 delta should be almost all intrinsic value.

** -- My general go-to in the past has been to buy the back month 90, sell the front month 30 to obtain a net delta metric of +60. Buying a slightly lower delta'd long will obviously cost less (e.g., the 90-delta December 16th '22 is at the 205 strike and would cost 114.25 to put on versus the near 100 delta 130's cost of 183.35), but will also have more extrinsic in it.

TRADING IDEA: TWO BULLISH ASSUMPTION PLAYS IN DISHDISH announces earnings on Tuesday before market open and is a state of high volatility (>50%). While you can naturally go with the plain Jane volatility contraction play around earnings (short strangle), there might be an opportunity here to catch it at significant lows while simultaneously taking advantage of risk premium present here which will lower your cost basis out of the gate.

The "Wheel of Fortune" Short Put

Sell the June 15th 32.5 Put (Neutral to Bullish Assumption)

Metrics:

Probability of Profit: 64%

Max Profit: 1.60/contract

Buying Power Effect: 30.90 (cash secured); 6.18 (on margin)

Break Even: 30.90

Notes: Look to either take profit at 50% max or run the contract all the way to expiry. If assigned, immediately proceed to cover at or above your cost basis (i.e., sell calls with strikes above 30.90). Proceed to work it as you would any other covered call. To bring in buying power effect somewhat, you can buy the throwaway 25 long for .15, which reduces the buying power effect to 6.05 in a cash secured environment (and reduces the credit received to 1.45 and changes your break even to 31.05); there isn't much advantage to doing that if on margin.

The natural alternative is to roll the broken short put out "as is" for duration and additional credit before taking assignment. Assuming you can get a decent credit to do that, this is usually to your advantage somewhat, since taking on stock is more buying power intensive than naked short putting on margin or uber wide long put vertical in a cash secured environment. In the latter case, you'll have to re-up on buying a throwaway long before rolling out the short to keep the buying power effect in check.

Synthetic Covered Call (Neutral to Bullish Assumption, But More Bullish than the Wheel of Fortune)

Sell the June 15th 35 put

Probability of Profit: 56%

Max Profit: 2.95/contract

Max Loss/Buying Power Effect: 32.05 (cash secured); 6.41 (on margin).

Break Even: 32.05

Notes: Look to take profit at 50% max or do the same thing as you would with the Wheel of Fortune trade, albeit with a less favorable break even. Consequently, it's a slightly more bullish play since you need price to stay above your break even (32.05). Buying the 25 strike throwaway long brings in the buying power effect to 7.07 in a cash secured environment.

* * *

I also looked at doing a Poor Man's Covered Call, but it doesn't look like that would be a more capital efficient setup (at least when I priced it out during off hours) than naked short putting on margin or going uber wide short put vert to bring in buying power effect in cash secured. Preliminarily, a 90/30 June/Sept Poor Man's, which would involve buying the Sept 20 long and selling the June 15th 37.5 short, would cost 13.40 to put on.

OPENING: XLU JULY 20TH 47 LONG/MAY 18TH 51 SHORT CALL... for a 3.02/contract debit.

This is a "properly" set up split month Poor Man's Covered Call where the credit received for the short exceeds the extrinsic in the long and has a neutral to bullish assumption. It's neutral because price can stay right here, and I can reduce cost basis further by rolling the short call out in time and/or it's bullish, because it will also benefit from movement of the underlying toward the short call strike.

Metrics:

Max Profit on Setup*: .82/contract

Max Loss on Setup: 3.02/contract

Break Even on Setup: 50.02

Price/Spread Width Ratio: 75.5%**

Profit Target: 20% of debit paid or .60/contract

* -- These metrics are only good at setup. When you roll the short call, the potential max profit and max loss metrics change because you've received additional credit and therefore reduce cost basis further.

** -- I generally like to see less than 75%, but this is in that neighborhood.

Notes: Previously, most of my posts have involved directionally neutral setups like short strangles/straddles and iron condors/flies. These setups don't represent a change in tack over my traditionally agnostic approach to the market, but rather another tool in the tool box for those who want to take a longer-term, directional position in underlyings without ponying up for a full on covered call and/or want to reduce cost basis "up front" before exercising the long for shares.

TRADE IDEA: RSX AUG 17TH 17 LONG/MAY 25TH 21.5 SHORT PUTFading the down move here with a put diagonal ... .

Metrics:

Max Loss on Setup: $350/contract

Max Profit on Setup: $100/contract

Break Even: 20.50

Notes: The natural alternatives would be to sell the 30 delta short put or go synthetic covered call via a 70 delta shortie ... . I'm looking for a 3.50 fill, but the setup may need some adjustment at NY open, since after hours quotes are showing a wide bid/ask ... .

TRADE IDEA: GE JULY 20TH 13 LONG/MAY 18TH 15 SHORT CALLThis is a neutral to bullish assumption "skip month" call diagonal that very nearly approaches the metrics of a "proper" Poor Man's Covered Call where the credit received for the short call is equal to or greater than the extrinsic in the long option, the break even on setup is at or below where the stock is trading, and where the price paid is less than 75% of the width of the spread.

Currently, the setup is bid 1.33/mid 1.40/ask 1.47. Spot sits at 14.31 with a mid price fill yielding a break even of 14.40 (.09 above where the underlying is trading), a potential max profit (assuming no rolls) of .60/contract, and a price/spread width ratio of 70%.

Alternatively, you can widen the setup to a 12/15 to relieve yourself of additional extrinsic in the long such that the credit received on the short call end of the stick exceeds what's in the long. The 12/15's currently bid 2.15/mid 2.20/ask 2.25, a mid price fill would yield a break even of 14.20 (.11 below where the stock is trading), a max profit of .80, and a price/spread width ratio of 73.3%.

I'd look to take profit at 20% of what you put these setups on for, which would yield a .28 profit for the 13/15 (20% ROC), .44 for the 12/15 (20% ROC), keeping in mind that earnings come out in 35 ... .

Notes: We're kind of in between where the April monthly is too near in time and the May monthly -- too far out -- for setups, but I'm willing to roll the dice on a cheap setup on the notion that there might be some speculative bullish interest in this beaten down stock running into earnings, particularly since it's trundled down further from where it was a few weeks ago on an analyst downgrade. Neither setup requires a particularly huge amount of upward movement, particularly if you're shooting for 20% versus max profit (which would basically require a finish above the 15 shortie).

TRADE IDEA: OIH JULY 20TH 19 LONG/APRIL 20TH 26 SHORT CALLThis is a Poor Man's Covered Call, with the 90 delta July long call standing in as your stock, and the April 20th 26 short call functioning as it would in a covered call situation. Your max loss is the difference between what you paid for the long (currently 6.28 at the mid) minus what you received for the short call (currently .69 at the mid). Consequently, you pay a debit for this setup: 6.28 minus .69 or 5.59/contract. 5.59 is the max you can lose if you (a) do nothing with the setup; and (b) both the short and longs go to worthless on a finish of the underlying below the long strike at 19. 5.59 is also your cost basis in the long option.

Look to exit the trade at 10-20% of what you put it on for (i.e., for a $56-$112 profit). This will occur along a neutral to bullish spectrum if either (a) price doesn't move much from here such that the intrinsic value in the long does not change appreciably over time and the short call value dwindles to worthless to (b) price shooting up and through your short call, at which point further increases in value of the long are offset by further increases in the value of the short, thus capping out further gains in the same fashion as would occur with a covered call. On break of the short call, wait toward expiry for the most of the extrinsic to bleed out of the short and then exit the trade as opposed to attempting to roll out the short call and/or strike improve. If the setup still has a "good look," re-up with a totally new Poor Man's.

Intratrade, generally roll the short call out for duration and "as is" or to a similarly delta'd strike as the original short call on significant decrease in value (ordinarily, at 50% max). In the unfortunate event that this is no longer productive because price has pulled away from the short call too much, consider rolling the short call down to a reasonably delta'd strike (i.e., between the 20 and 30) while keeping an eye on your cost basis in the long in an attempt to ensure that it is always less than its current value.

OPENING: GDX MARCH 16TH 18.5/DEC 15TH 23.5 POOR MAN'S... for a 3.85/contract debit.

Here, I'm going with the deep in the money 90 delta long, the out of the money 30 delta short. The long functions as a stand in for the stock with the short providing cost basis reduction.

I'll look to roll the short call at significant loss of value to reduce cost basis and take profit at anywhere north of 10% of what I put the setup on for ... .

TRADE IDEA: XLE SEPT 15TH 57/JULY 21ST 67 PMCC** -- Poor Man's Covered Call.

One of the few sectors that hasn't benefited from the post- November election run-up is XLE, so I'm looking to get into a bullish play here where price of the underlying is comparatively low.

Here, I'm basically looking to emulate a full-on covered call using a deep in the money call in September to stand in for stock, 100 shares of which would be somewhat pricey here, comparatively speaking. A covered call with the same short call would cost 64.56 to put on; the Poor Man's shown here is far less than that. Additionally, if you're looking to acquire XLE shares at some point, the setup gives you the flexibility to reduce some cost basis up front before acquiring the shares, after which you can exercise the long call instead of being stuck with shares with a cost basis of 64.56/share here, as you would be with a covered call here.

Unfortunately, as a form of diagonal, there aren't many metrics to look at, but this is what we do know about the setup:

Max Loss/Buying Power Effect: 7.21

Delta: 61.59

Theta: .75

Generally, you work it like a covered call, rolling the short call out to reduce cost basis in the long aspect of the position. However, on break of the short call, your long call won't be subject to "call away" as it would be with stock; in that event, look to exit the trade profitably and redeploy or roll the short call up and out for a credit if you want to continue to reduce cost basis in the long through expiry.

Notes: The pricing of the setup will probably be different during the regular NY session. I'm working with off hours quotes here, and the bid/ask on the back month is particularly wide here, so overall pricing of the setup may be inaccurate.

TRADE IDEA: A SNAP POOR MAN'SOne thing I'm certain about, and that's that I don't want to buy SNAP stock here with its having whipsawed between 29+ and 19 in the short time since its IPO. But I might want to acquire it later once it settles down -- as with all things, preferably at a lower price than 22.74. A Poor Man's Covered Call gives me the flexibility to play SNAP, give me the option to buy it later by exercising the 15 long call before expiry, as well as to reduce cost basis in that long call while I'm waiting for it to figure out where it's going.

Consequently, here I'm thinking a Poor Man's Covered Call where the long-dated, back month, long option takes the place of long stock and (as with any covered call), the short call looks to reduce cost basis in the long option, while protecting the position from some downside. As with a covered call, you look to roll out the short option for duration, ideally keeping it clear of your cost basis, and you exit the trade for a credit that exceeds what you paid to put it on minus any credits collected due to rolling.

Metrics:

Max Loss/Buying Power Effect: $725/contract

Theta: 2.23/contract

Delta: 50.38

As with any diagonal (that's what this is, basically), we don't know much else about the setup in terms of potential profit, but I generally look to exit these north of 10% of what I paid to put them on.

Naturally, this is likely to continue to be somewhat of a roller coaster, so you need to be prepared for somewhat of a bumpy ride, particularly as price moves toward the long call side of the setup (since its delta long).

Notes: There is some piddling that needs to be done with these to ensure that the credit received for the short call exceeds any extrinsic value in the long option. The extrinsic value in the long option can be calculated by subtracting the difference between current price and the long call strike from what you will be paying for the long option 8.20 - (22.74 - 15) = .46. The April 21st 24 short call brings in .95 in credit at the mid, which is greater than the extrinsic value in the long.

Currently, the long option is bid 7.80/ask 8.60, so some further adjustment may be required during regular market hours to recalculate whether the extrinsic value received for the short exceeds that in the long and/or to get a fill.

OPTIONS TIP: "CHEAP CALLS" HERE MAY NOT BE "SMART" ... DEPENDINGBad advice in part; good advice in part; hiding the ball in part. finance.yahoo.com

The good part: cover your stock/equity positions with short calls. This will smooth out your P&L somewhat and protect you -- albeit not completely -- from down side risk while reducing cost basis in your shares. Unfortunately, they don't want to "share their secrets" right up front about "where" to sell those short calls (strike, expiry), so do some research as to where you should sell those (I generally sell the 20 delta short call to cover in the monthlies; others are slightly more aggressive and sell the 30; to a certain extent, it depends on what you're doing with an individual position (i.e., are you looking to reduce cost basis over the long-term or looking to get called away)).

(To be somewhat nit-picky here, though, selling short calls in this environment isn't quite as productive as in a high implied volatility environment. You'll get less than you would were implied volatility were higher. Nevertheless, staying "covered" the vast majority of the time is fairly good advice.)

The bad part, depending on what they're saying: buy calls here because they're "cheap." One of their recommendations is to liquidate a portion of your shares and buy long calls instead. As I've repeatedly said here, buying and holding shares is extremely capital intensive as compared to an options position that "synthetically" represents long stock. When I do a play like this article appears to be recommending (but doesn't come out and say directly), I buy deep in-the-money calls somewhat far out in time (>180 DTE). I buy deep and long-dated because I'm looking for calls with as little extrinsic value/premium in them as possible, because I just don't want to pay for premium in an option that will just decay over time. Even when I do this, I "cover" this "synthetic" long stock position with short calls nearer in time (the options lingo for this setup is a "Poor Man's Covered Call.").

If that's what they're recommending that people do here in this article, then come right out and say it, for goodness sake. Merely saying: "buy calls" is stupid, uninformative, and potentially destructive.

If the article is suggesting that readers buy out-of-the-money calls here just because they're "cheaper" (i.e., made up of less extrinsic value) than usual, well, that's just plain ass stupid advice. The vast majority of OTM calls expire worthless, so you would be throwing your money away on these if you do not get the required movement you need to "make them pay."

Long calls may be comparatively cheap here in this low volatility environment; it doesn't mean they're a "smart" play, depending what you're buying and where ... .

TRADE IDEA: GDX JUNE 16TH 18/FEB 17TH 25.5 POOR MAN'S ...I'm not going to take this trade at the moment, because I'm trying to wind up current trades to move over to TastyWorks (formerly Dough). However, once I finish up that process, this is one of the trades I'm looking at, although certainly putting this on here isn't necessarily the best in terms of timing, since price has come bounced quite dramatically off that sub-$19 mark. In any event ...

Here, the long-dated, fairly deep in-the-money long call stands in for what would ordinarily be stock in a covered call situation. As with a covered call, a short call is sold against the stock position not only to reduce downside risk, but to reduce cost basis in the long option (currently priced at 5.98). However, the poor man's covered call is put on for much cheaper than a "rich man's" covered call; if you initiated one here, you'd buy 100 shares at 23.20 ($2320 and sell the same 30 delta short call against for a $63 credit, so you'd be tieing up around $2250 in buying power to go that route). In comparison, the buying power effect of this particular setup would be $535 as of the writing of this post -- about a quarter of what you'd pay to do the "standard fare" covered call.

The notion here is to roll the short call month to month (each time to the next month's 30 delta short strike) and then exit the position for at least 10-20% of what you put the play on for.

Notes: Ordinarily, I do these using a the 70 delta long in the "back month" and the 30 delta short in the "front month." Here, however, I'm tweaking the play somewhat to use obvious horizontal support around 18 as a guide for the back month strike.

BUYING POWER EFFICIENCY: "POOR MAN'S" VS. TRAD COVERED CALLSThere is more than one way to skin a cat. But some ways are more buying power efficient than others ... .

Here, I'm looking at a covered call in X. The implied volatility is >50%, so I can get a bit of premium on the call side to reduce my cost basis in any stock I buy here. For example, if I buy shares at 20.38, and sell the Sept 30th 20.5 call against (for a 1.50 ($150) credit at the mid), I can get into the whole package for a 19.03 debit ($1903), my cost basis in the shares will be $19.03 per share, and my max profit is $147 if called away at 23. However, for some, that $1903 stick price can be hefty, especially if they're working with a smaller account. The drawback is that I'm (a) stuck with stock I bought at 20.38 per share; and (b) the buying power effect may be larger than I'd like.

In comparison, I can also do a PWCC or poor man's covered call. Traditionally, this is set up using a long-dated, deep ITM long call option to stand in for the stock and -- like the covered call -- a call sold 30-45 DTE. Most of the time, I set these up using the 70 delta strike for the long option and the 30 delta strike for the short. As with the traditional covered call, I'm looking to reduce my cost basis in my "synthetic stock" (here, the long option) by selling calls against. Compared to the traditional covered call, the PWCC has a smaller price tag -- $361 (which is also my max loss for the setup, assuming I do nothing at all), and I look to exit the setup as a whole at 10-20% of what I paid for the setup which, in this case, isn't as attractive as the $147 max profit of the covered call. However, there is one other aspect of the setup worth noting -- my buying the Jan 20th 18 call gives me the right to exercise for shares at $18. With the covered call, I'm locked in with 20.38 shares; with the PWCC, I'm not.