Popcatlong

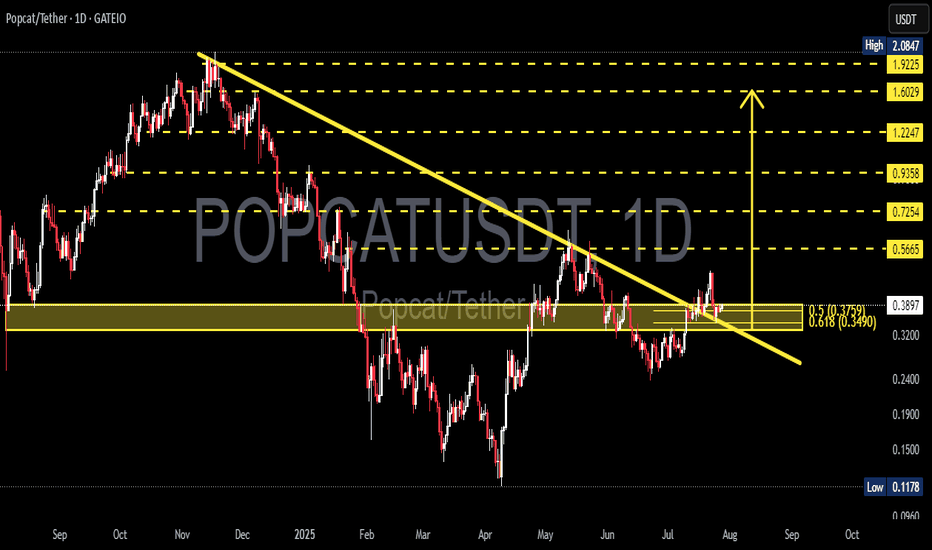

POPCATUSDT – Breakout Confirmation or False Signal?On the daily chart of POPCATUSDT, the price has recently broken out of a descending trendline that has been acting as resistance since December 2024. This breakout signals a potential trend reversal from bearish to bullish.

Currently, the price is in a retest phase, revisiting the breakout zone, which also aligns with a strong support and Fibonacci retracement area:

Support zone: $0.34 – $0.38

Fibonacci 0.618: $0.3490 (major technical support)

Fibonacci 0.5: $0.3759 (typical retest level after breakout)

If the price holds above this zone and forms a bullish confirmation candle, it strengthens the case for continued upward momentum.

---

Pattern and Market Structure:

Descending Triangle Breakout: The price has broken out of a long-standing descending triangle pattern, which is typically a bullish reversal signal — especially if supported by volume (not shown in chart but crucial).

Neckline Retest: The current move is retesting the breakout zone, a common behavior after significant breakouts.

---

Bullish Scenario:

If the price holds above the $0.34–$0.38 zone and forms bullish price action:

Potential targets based on Fibonacci levels:

Target 1: $0.5665

Target 2: $0.7254

Target 3: $0.9358

Major targets: $1.2247 and possibly $1.6029 if bullish momentum sustains

---

Bearish Scenario:

If the price fails to hold above $0.34 and breaks down below the support:

Potential downside towards $0.26 – $0.20 zone

If selling pressure intensifies, it may revisit the key support low around $0.1178

---

Conclusion:

POPCATUSDT is at a critical decision point. The breakout from the descending trendline is an early bullish signal, but confirmation from the $0.34–$0.38 retest zone is essential. If it holds, a strong bullish rally may follow. However, a failure to hold could signal a false breakout and resume the bearish trend.

#POPCAT #POPCATUSDT #CryptoBreakout #AltcoinAnalysis #ChartPatterns #TechnicalAnalysis #FibonacciLevels #CryptoTrading #BullishSetup #BearishScenario

$POPCAT - Chance of Seeing $1 in Q3

Haven’t posted much about Solana coins lately, but they’re starting to show signs of life again.

$POPCAT had a clear entry right at the weekly FVG below 33c. From here, it either retests the Monthly Open or begins a slow grind higher.

It performed exceptionally well last year, so there’s a good chance to offload some around the $1 mark if momentum picks up. BYBIT:POPCATUSDT

POPCAT/USDT — Major Reversal in Play? Strong Bounce

📌 Quick Summary:

Altcoins are starting to show signs of life, and POPCAT/USDT is now sitting at a critical price structure. After a long and painful downtrend since November 2024, the price is consolidating near a powerful support zone — potentially signaling the start of a reversal phase. Is this the calm before a major breakout? Let’s dive into the technical setup.

🔍 Pattern & Market Structure:

🟨 Descending Triangle Pattern – with Signs of Accumulation:

A clear descending triangle has formed, typically a continuation pattern — but in this context, paired with strong demand at the base, it can signal a reversal.

The horizontal support ($0.27–$0.30) has been tested multiple times, holding firm, which suggests large-scale accumulation by smart money.

A breakout above the descending trendline would invalidate the bearish bias and open the door to a bullish surge.

📐 Descending Trendline (Yellow Line):

This line has been acting as resistance since November 2024.

A clean breakout from this line would serve as a strong bullish signal, likely attracting new buyers and triggering FOMO.

🟩 Bullish Scenario (Reversal Potential):

If the price successfully breaks above the descending trendline and holds above the breakout level, the following targets are in play:

1. 🎯 Target 1: $0.4067 – Minor horizontal resistance

2. 🎯 Target 2: $0.5714 – Previous support turned resistance

3. 🎯 Target 3: $0.8874 – Strong psychological and structural zone

4. 🎯 Target 4: $1.5238 to $1.9510 – Possible macro target if the crypto cycle enters full bullish mode

🧠 Market Psychology Insight: This type of breakout from a long-term downtrend often leads to high-momentum moves, especially if backed by volume. Swing traders and mid-term holders may see this as a golden entry.

🟥 Bearish Scenario (Continuation Risk):

If the price fails to reclaim the descending trendline and breaks below the demand zone:

1. ❌ A breakdown below $0.27 opens room for:

Minor support: $0.20

Long-term low: $0.0869

2. 📉 This would confirm extended bearish control and possibly a deeper retracement phase.

🧭 Strategy Tips for Traders:

✅ Aggressive Approach: Begin accumulating around the $0.27–$0.30 zone with tight stop-losses below $0.26

✅ Conservative Approach: Wait for a confirmed breakout and successful retest before entering toward the next key resistance levels

⚠️ Always combine technical setups with proper risk management and volume confirmation

💬 Final Thoughts:

POPCAT/USDT is at a key decision point. The current support zone shows signs of strength and accumulation by buyers, offering a potential launchpad for a powerful breakout. If the descending triangle breaks to the upside, this could mark the beginning of a trend reversal — with potential gains of 100%+ on the horizon.

The chart is setting up for something big. Are you ready?

#POPCAT #CryptoBreakout #AltcoinReversal #POPCATUSDT #DescendingTriangle #CryptoTrading #ChartAnalysis #BullishSetup #CryptoSignals #BuyTheDip #CryptoTechnicalAnalysis

POPCAT/USDT Analysis – Trend Reversal

The short-term downtrend on this coin has shifted into a strong bullish trend.

During the rally, we broke through the sell zone at $0.182–$0.195 without any significant reaction, forming a mirrored zone as a result.

At this point, entry opportunities could be considered on a pullback to the $0.195–$0.18 zone , or from the lower support area at $0.173–$0.16 .

POPCAT ideaGreetings, fellow traders!

My analysis suggests a developing potential for a bullish move in POPCAT/USDT. I'm observing a possible breakout scenario, and I'll outline a potential long trade setup.

Entry Rationale:

A long entry is suggested above the $0.2135 level, contingent upon a confirmed breakout from the currently established neutral-bullish channel. This breakout would serve as confirmation of increasing bullish momentum.

Trade Setup:

Entry: Above $0.2135 (post-breakout confirmation)

Target 1: $0.2435

Target 2: $0.2650

Stop-Loss: $0.1910 (This provides a risk management level below a recent swing low, it's just an idea.)

Risk Management:

A stop-loss order placed around $0.1910 is recommended to mitigate potential losses should the trade move against the anticipated direction.

Disclaimer and Call to Action:

I welcome your constructive feedback and alternative perspectives on this analysis. Please conduct your own independent research and due diligence, including thorough risk assessment, before making any trading decisions. This analysis is for informational purposes only and does not constitute financial advice.

#POPCATUSDT Expecting further bullish continuation📈 LONG BYBIT:POPCATUSDT.P from $0.2850

🛡 Stop Loss: $0.2760

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:POPCATUSDT.P is showing strong bullish movement, breaking above key resistance at $0.2778, confirming buying interest.

➡️ The $0.2778 - $0.2850 zone now acts as a support, and if the price holds above it, further upside is likely.

➡️ The first major resistance level is at $0.2900, followed by $0.2989 and $0.3100 if the momentum continues.

➡️ Volume remains high, indicating strong liquidity and potential for further growth.

⚡ Plan:

➡️ Enter LONG after confirming a breakout above $0.2850, reinforcing bullish momentum.

➡️ Risk management with Stop-Loss at $0.2760, below key support.

➡️ Key upside targets:

🎯 TP Targets:

💎 TP1: $0.2900 — first take-profit level.

🔥 TP2: $0.2989 — potential resistance.

⚡ TP3: $0.3100 — major upside target.

🚀 BYBIT:POPCATUSDT.P - Expecting further bullish continuation!

━━━━━━━━━━━━━━━━━━━━━━

📢 BYBIT:POPCATUSDT.P is maintaining bullish momentum, and a breakout above $0.2850 could confirm further upside movement.

📢 Watch for price action at $0.2900, as this level might act as short-term resistance.

📢 If the price holds above $0.2989, a strong push towards $0.3100 is possible. However, a drop below $0.2760 would invalidate the bullish setup.

POPCAT - LONG - Good opportunityPOPCAT is now ready to give us a chance. Despite being a little late it is still in a good place for daily timeframe. This is a risky trade because the stop loss is tight; you can use an extended stop (SL 2 or SL 3), i will move it if I see a lot volatility. These currencies are also very volatile and high leverage should not be used.

TP 1: 1.15

TP 2: 1.25

TP 3: 1.55

SL 1: 0.7099 (risky)

SL 2: 0.68 (good)

SL 3: 0.62 (best)

POPCAT - Bullish Reversal - LONG - (Re-entry)We are at an excellent entry point. Little possibility of it reaching 0.88 in the short term. The stop loss is somewhat tight, so be careful. If you want more security, increase the stop by covering up to that point.

T1: 1.27

T2: 1.40

T3: 1.45

T4: 1.60

Stop loss:

1) 0.98

2) 0.88

*This is a re-entry from my last POPCAT idea

POPCAT - Bullish Reversal - LONGWe are at an excellent entry point. Little possibility of it reaching 0.88 in the short term. The stop loss is somewhat tight, so be careful. If you want more security, increase the stop by covering up to that point.

T1: 1.27

T2: 1.40

T3: 1.45

T4: 1.60

Stop loss:

1) 0.98

2) 0.88

POPCATUSDT Buy Zone IdentifiedThe broader cryptocurrency market faces uncertainty, with a possibility of no recovery by year-end. In light of this, I’ve adjusted my buy positions lower to reflect a more cautious approach.

For POPCATUSDT.P, the blue box highlights a key buy zone where I anticipate strong support. I plan to join as a buyer within this area, looking for a favorable entry point aligned with current market sentiment.

Key Points:

Buy Zone: Blue box region

Risk Management: Stop loss placed below the box

Potential Target: Await confirmation of a bounce for upside momentum

Remaining patient and disciplined will be crucial in navigating the current market conditions.

Disclaimer: This is not financial advice.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

Popcat meme coin potential targetsI'm not a fan of meme tokens, but here is potential targets for Popcat on Sol

GATEIO:POPCATUSDT

Possible Targets and explanation idea

➡️Marked W fvg will be like a target for correction and from that level we can wait bounce

➡️Under marked green main support block

➡️On D timeframe got Sell signal from TradeOn indicator, no new buy signals

➡️After bounce first will be buy side liquidity sweep

➡️Money Power indicator no new money inflow, only fixation profit

➡️Market Mood indicator, the same story, coin still overbought.

➡️ Top for this one at least for middle term I can see around 1.25 B market cap

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

POPCAT's Rise: Can This Meme Go the Distance?It certainly looks like $POPCAT will continue to be the leading cat #meme. Others (already listed on exchanges) have tried to take the spot but lack the momentum behind it.

As for this one, it just keeps grinding higher and is most likely to hit $2.3 before the end of the year.

This post is mainly to track the price action of this particular coin, as entries were obviously much lower. One could enter here, as there is an active weekly and daily trend, but I prefer to snipe my entries instead of buying after expansion.

Let’s follow the price together and see how much actionable data we can extract from its movements.

I’ll wrap up this thread at the end of December.