Comparative Analysis of US and UK EconomiesDear Traders,

I would like to offer my perspective on the major economic drivers for USD and GBP. Like the famous investor John Bogle says, "The market may be crazy, but it's not entirely insane. Fundamentals matter." This analysis compares key economic indicators of both countries in order to explore potential impacts on the GBP/USD currency pair in the long term. Examining GDP, growth rates, interest rates, inflation, jobless rates, government finances, external balances, and population dynamics displayed above, I intend to provide insights into the relative strengths and challenges of each economy.

ECONOMIC PERSPECTIVE

USD exhibits a larger GDP and higher growth rate , implying a more robust economy. They both have similar interest rates, but USD's higher growth puts it in a position of advantage.

INFLATION, JOBLESS RATE, AND GOV. FINANCES

GBP faces higher inflation, which affects it purchasing power against USD.

Both nations show low jobless rates; the UK maintains a lower debt-to-GDP ratio (good for GBP).

EXTERNAL BALANCES AND POPULATION DYNAMICS

Both countries have current account deficits, but the UK's larger deficit may affect its currency negatively. USD represents a significantly larger population, influencing economic scale.

MY TAKE

Understanding the economic dynamics of USD and GBP is crucial for interpreting potential influences on the GBP/USD pair in the long term. From the economic data and analysis presented above, it is evident that USD shows economic strength , while GBP shows stability . In the light of this, I expect a stronger USD (DXY) in the coming weeks or months. The currency pair may see fluctuations as institutions assess these strengths and challenges, but my bias on the GBPUSD pair is BEARISH.

A break below 1.2451 will likely send the pair to 1.2207 price region or even lower.

Population

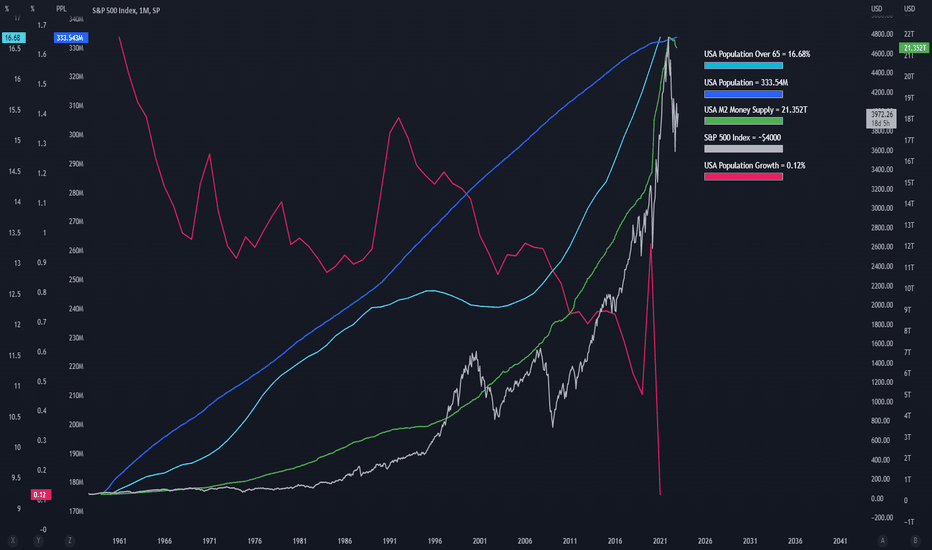

The M2 Money Supply, Population Statistics and The S&P 500This is the first time since the M2 Money supply has been tracked that there has been a contraction.

The population over 65 is increasing at an alarming rate.

Population growth is decreasing at an alarming rate.

This seemingly indicates that there is going to be a shortage of workers and consumers in the US market.

What does this mean for the constituents of the S&P 500 Index?

In my opinion, these are unprecedented times.

Back to normal! Hurray!130 years ago the USA became the world largest economy, and roughly 60 years ago they were the most far ahead. Today their lead is the smallest it has been in generations. Also, the share of the world GDP that the west makes keeps getting smaller. On top of that the US is pulling out of Afghanistan and reducing their world presence if I got that correctly, and France is pulling out of Mali and losing influence in Africa. Centrafrique recently made a movie praising Russia and apparently mocking France called "tourists" and fired their prime minister that was friends with France which as a result of Russia presence is pulling away. The relevance of the "big 4" has faded so much that each time I talk about France someone asks me "why?". No one ever asked me why I speak of China. Here's your proof. France is even expected to not be in the top 10 economies by 2050.

China share of world GDP peaked in the early 1800s with 33%, and India centuries earlier.

France+UK+Germany share of world GDP peaked in 1900 with close to 25% (probably 30-35% nominal).

And the USA share of world GDP peaked in 1950 with a little above 25% (nearly 40% in nominal).

The peak of the middle east share of world GDP probably peaked 3000 years ago, and the persian empire is still to this day the largest ever in % of world population, nearly half of the entire planet lived in it. I just thought that was interesting, and shows nothing lasts forever.

The "big 4" populations are getting older, with boomers getting close to retirement and a third of the cohort 5 to 15 years away from the life expectancy number.

They also reached their working age population peaks:

- USA: in 2019, sucking in millions of migrants to make up for bad demographics,

- Germany: in 2019, same thing as the USA, "migrants welcome", they try so hard to attract them at any cost,

- France: in 2018, it's more than a covid slump here

- The UK: No peak, people still breed there, weird place

If the US and Germany have not yet peaked, and the drop (500 thousand in Germany and 2 million in the USA) was not from the very top, the top is not far.

It is not possible to entirely replace a population, and if they did that it would be entirely different countries. At some point there are just too many boomers to replace.

For reference, Greece had a double top between 2004 and 2010, and Russia it's hard to say but it dropped violently in 1990.

And let me tell you, the 90s were not happy days in the east 🙃 Not happy days at all.

The entire world labor force peaked in 2019. Between 2019 and 2020 the labor force of Mexico collapsed from 58 million to only 54, much of it was probably sucked by the USA. Trust me, this is a gigantic drop, enough for a big fat depression. Not sure if their GDP has jumped out of the window yet. The US have a labor force of 165 million. And Mexico if you translate 5 years forward really have 50 million at best. Even if the US sucked in half of all Mexico they'd fail to replace their boomers. Birth control and abortions worked really well.

As you can see the economy of Spain which is already bad will collapse. If everything goes well it will contract 50%!

Of course, everything will not go well and bad things will compound!

Similarly, using the Euromomo bulletin and population numbers (there are twice as many 70-75 year old boomers today than 70-75 year olds 5 years ago!),

it is trivial to figure out the 10% covid spike in max weekly death will be a TENTH of what is too come... IF NOTHING GOES WRONG. BEST CASE SCENARIO.

And as Russia has shown, things go wrong. So I think they spike won't reach only 180k but way more.

Negatives will compound as ALWAYS. EVERY SINGLE TIME. I'm not saying a miracle is impossible, but you know it.

Twice as less doctors, twice as many seniors to take care of. Taxes are already enormous. The west spends about 50% of the GDP.

You literally can not keep the same standard of living even if you taxed all workers 100% and they magically were able to live with $0.

Ah, and let's not forget "IQ points have declined by 7 points a generation since 1970". And let's not forget old people vote.

Ye, lockdowns, mass panic, and more. It will not end. You can vaccinate against a coronavirus variant, you can not vaccinate against death.

You stop 1 virus, 10 other infectious disease will come, and heart disease, and cancer, and more.

Ah, and it is well known that economic contraction leads to a decline in life expectancy.

And don't get me started with depressions and alcoholism. Russia men over 50 are all MIA.

Women have more endurance, they are more resistant (not just to disease). Even with physical strength, men's is more explosive, short term.

Men are not good at sucking it up and being humble. LOL I'd rather be dead than not be a winner. Better luck next time.

If I wasn't overconfident (I see myself as an all powerful Poseidon) I don't think I'd see life as worth living. I'd just go next.

But wait there is more. I will avoid politics, so I'll skip the best part. But let me just mention that Vladimir Putin explained that empires all had the same problem.

They ignored problems. They think they are so powerful they can crush problems. Soviet Union did it, Romans did it, Persians did it. And so on.

Putin only mentions the USSR, but it always works the same way. Empire make little mistakes, and find quick fixes, "bully these opponents", "give necklaces to these", "print some money for those", and so on. But problems accumulate, and there comes a time when they cannot be dealt with.

"The US, with great determination, is following straight in the Soviet Union footsteps".

The USD rallied after a FED announcement, probably a really short term rally, funny to think of the suckers that got scammed here.

I wonder if Japanese investors are not pulling out from the US stock market. Might be the case.

I think now is the time Gold will shine. This is it. The poor suckers selling are the same poor suckers that sold in 2008:

They will buy only if it gets to 3000. What was the elected demagogue mastermind that sold gold reserves very recently?

Last bull market had the brown bottom, this one has the whatever his name was bottom.

Let the cowards wait for 3000, and the braindead incompetent elected demagogues with a stupid smiley look on their faces sell to me.

I'll take all that risk, and I'll charge a huge premium for it. If the price keeps going up like 2008 I will buy on every single pullback.